We independently review every app we recommend in our best apps lists. When you click some of the links on this page, we may earn a commission. Learn more.

You've curated the perfect product lineup, got your online store running, and the traffic's coming in. Then someone tries to check out, and your payment form throws an error. That's a customer walking away.

This is why you need a reliable payment processing platform. One that accepts whatever payment method your customer prefers, processes transactions without drama, and stays fair with fees so you can keep your margins.

I researched and tested 120+ payment gateways and payment processors to find the seven best.

The best payment gateway services

PayPal for first-time users

Stripe for rich analytics

Shopify Payments for eCommerce stores

Square for selling both online and offline

HubSpot Payments for B2B sales

Helcim for interchange pricing and volume savings

Airwallex for cross-border businesses

What is a payment gateway?

A payment gateway lets you accept electronic payments (online or in-person) by securely connecting your customer, your business, and the banks involved. It's the bridge that makes it possible for your customers to actually pay you.

Here's how it works: when someone checks out, the gateway captures their payment information, encrypts it, and sends it to your acquiring bank for authorization—then returns an approve or decline result to the checkout. It's like the digital equivalent of a card terminal at a physical store, but designed for websites, apps, and modern payment methods like digital wallets.

Payment gateways often get mentioned alongside payment processors, but they're not identical. The gateway securely transmits payment data and enables the checkout experience, while the processor handles the broader back-end movement of the transaction. That said, many providers bundle both services into one product.

There are tons of niche concepts tied to payment processing, so I've also created a hefty FAQ that you'll find at the end of this article. Click here to jump to it.

What makes the best eCommerce payment gateway service?

How we evaluate and test apps

Our best apps roundups are written by humans who've spent much of their careers using, testing, and writing about software. Unless explicitly stated, we spend dozens of hours researching and testing apps, using each app as it's intended to be used and evaluating it against the criteria we set for the category. We're never paid for placement in our articles from any app or for links to any site—we value the trust readers put in us to offer authentic evaluations of the categories and apps we review. For more details on our process, read the full rundown of how we select apps to feature on the Zapier blog.

As I was researching and testing eCommerce payment processors, here's what I was looking for:

Accepted payment methods. At minimum, these credit card processing companies needed to accept all major credit card brands.

Ease of integration. You shouldn't have to know how to code to implement a payment solution from start to finish. These apps have either a fully no-code setup or a detailed guide if you have to tinker a bit.

Security. Every payment processor listed here is PCI DSS-compliant, so you don't need to implement any additional security measures on your shop.

Checkout experience. It should be easy for customers to buy products and services at your eCommerce shop, so I looked out for the platforms that offer the best customer checkout experience.

Extra features. Having a toolkit at your disposal—including subscription support, invoicing, payment links, or card readers—can be useful, so I kept tabs on all those extras as well.

I tested these platforms using two different strategies. For the platforms that offered self-service sign-up, I went in, configured everything needed to start accepting payments, and integrated that into a page on my website. For others that required talking to sales, I sent out emails to set up a test environment, so I could see how it worked.

What to avoid when looking for a payment gateway

Payment setup directly affects revenue, cash flow, and customer trust. Picking a poor fit may lead to serious disruptions, so here are some red flags you should look for when evaluating which one is the best for your business:

Hidden fees. Fee pages can be confusing to read, with too many exceptions and small print. Effective rates can shift by payment methods, region, and sales channels. The areas where these fees lie are usually in chargebacks, cross-border/FX markups, refunds, withdrawal fees, and monthly minimums—check them out so you're not surprised later.

Unclear security posture. At a minimum, a payment provider should clearly state its security and compliance commitments. PCI DSS compliance is essential, as it sets the baseline requirements for environments storing, processing, and transmitting card data. Credible providers can explain what they're doing to protect your payment flows at a high level. Be sure to check PCI scope (yours vs. theirs), encryption, and incident response policies.

Poor customer support. Payment issues can grind your business to a halt. If you don't have a dedicated engineering team, weak support can make you lose money. Check which support channels exist, response-time SLAs, escalation paths for urgent outages, and public status pages.

Concerning reviews. A few 1-star reviews are normal; dozens of reviews criticizing the same issues are not. The important topics to screen for are complaints about payout delays, sudden holds, surprise account closures, and poor dispute handling.

The best payment gateways at a glance

Best for | Standout feature | Pricing | |

|---|---|---|---|

First-time users | Extremely simple setup | Fees vary by transaction type and currency; 3.49% + $0.49 per transaction for U.S. credit cards | |

Accessible analytics | Flexible, with a wide range of tools and plugins | Fees vary by transaction type; 2.9% + $0.30 per online credit card transaction | |

eCommerce stores | All-in-one eCommerce solution | Processing starts at 2.9% + $0.30 per transaction; active Shopify plan required, starting at $39/month | |

Selling online and offline | Includes a basic website builder | Fees vary by transaction type; 3.3% + $0.30 for online credit card transactions | |

B2B sales | Simplifies billing with payment links | 2.9% per transaction; active HubSpot CRM Starter subscription required, starting at $20/month | |

Interchange pricing and volume savings | Lower fees for high-volume sellers | Interchange Plus averages at 2.27% + $0.25 per transaction; discounts available for high-volume sellers | |

Cross-border businesses | Virtual cards | Fees vary by transaction type; 2.80% + $0.30 for domestic card transactions |

Best online credit card processing system for first-time users

PayPal (Web, Android, iOS)

PayPal pros:

Trusted, well-known name might make customers more likely to click buy

Extremely simple (for you and your customers)

PayPal cons:

Very confusing pricing structure

PayPal has been in the payments industry for a long, long while. In that time, it built an experience that's really easy for first-time users, taking most of the complexity out of the equation. This means little to no coding and zero developer lingo.

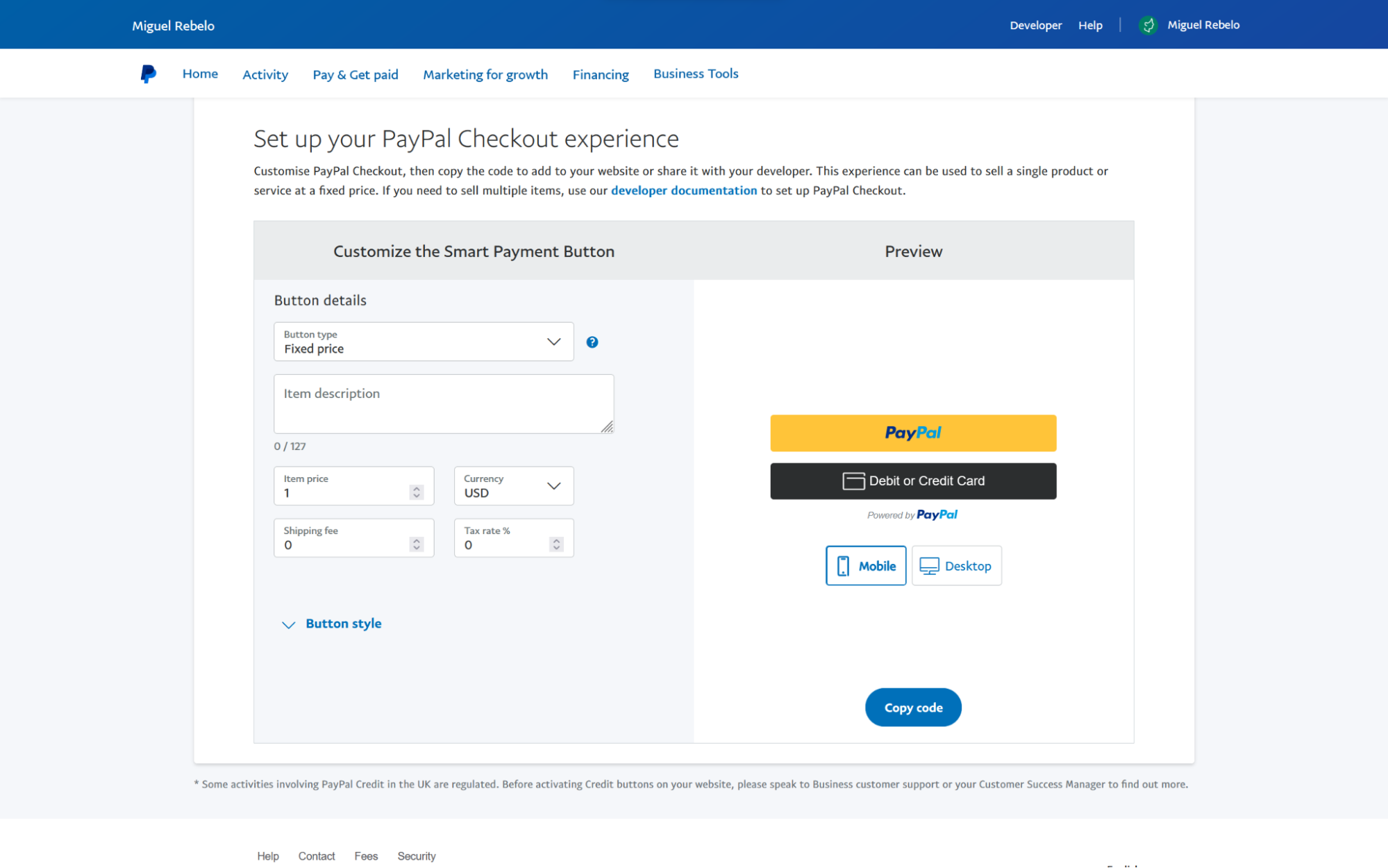

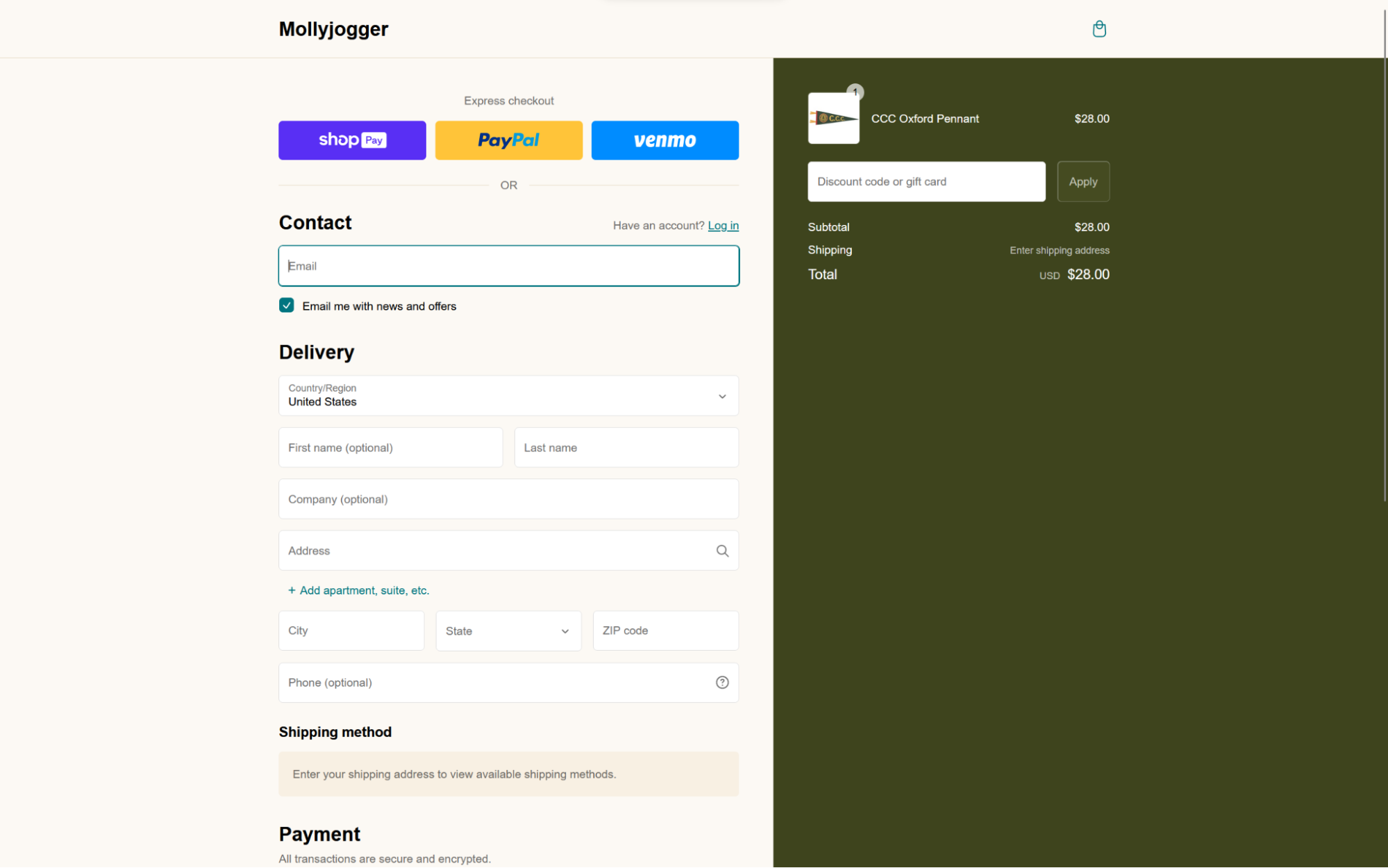

When you have a small product or service line, you can use the Smart Payment Button, as you can see in the screenshot above. It comes stock with PayPal branding for added trust, so you only need to copy the embed code and paste it on a landing page and guide your customers there. For eCommerce shops, PayPal integrates with major platforms to process the payments: your shop passes the cart's total at checkout, and PayPal takes care of the rest.

One advantage is that your customers can pay with their PayPal balance if they choose. If not, they can check out by entering their credit card details (all data is handled securely by the platform in both cases). Added security measures include fraud protection, which keeps your store safe from credit card fraud, and also customer protection, which lets shoppers file claims if there's a mismatch between the products advertised and what they actually got.

One thing you'll hear from anyone using PayPal: the transaction fees are flat-out confusing. In general, PayPal charges a base fixed price for each transaction and then a percentage over the total amount. So the basic credit card fee is 3.49% + $0.49 for U.S. transactions, but this percentage/cents combo varies a lot depending on transaction type and currency, so be sure to read the fine print.

When you're set up and ready to sell, connect PayPal to Zapier to automatically add new customers to your email marketing tool, a spreadsheet, or anywhere else you store your data. Learn more about how to automate PayPal.

PayPal pricing: Fees vary by transaction type and currency; 3.49% + $0.49 per transaction for U.S. credit cards. Full pricing information here.

Is your sales volume growing? PayPal has another payment solution for you: Braintree. It has advanced analytics, better control in creating and implementing your checkout experience, and slightly lower payment processing fees. It also accepts a wider range of payment methods, including Venmo.

Best online payment processing system for rich analytics

Stripe (Web, Android, iOS)

Stripe pros:

Extremely flexible with loads of features

A huge ecosystem of plugins and integrations

Stripe cons:

Steep learning curve

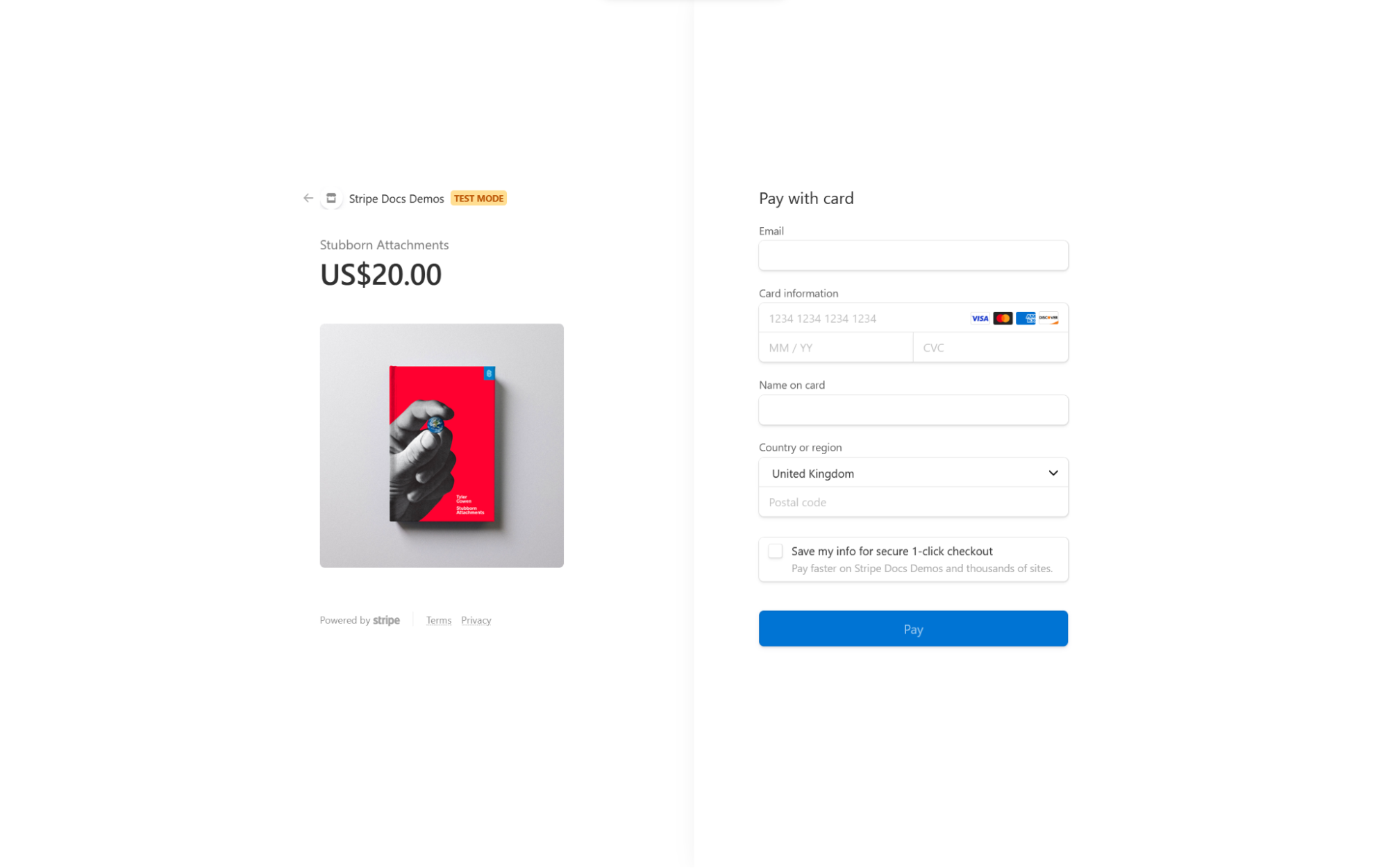

Looking at the total transaction value at the end of a quarter doesn't mean much: how much did you lose in refunds? Are there adjustments buried in the numbers? Which chargebacks were decided in favor of the customer—and how much did each cost? For all these questions and more, Stripe has a collection of dashboards, reports, and drill-downs to help you make better decisions in the long run.

What does this look like in practice? Using Stripe's analytics, you can improve payment performance, turning a checkout flow into a funnel you can optimize. Dive into payment success/acceptance, authorization rates, and where/why payments usually fail. With this data, you can, for example, tune the tradeoff between conversion and risk, adjusting fraud controls to reduce false declines and bump approvals, keeping disputes in check.

Speaking of disputes, Stripe offers the full picture on everything related to volume, dispute rates, and outcomes over time. It's more than a list: you can filter them by reason, so you can identify spikes tied to a product, customer segment, or a time window. This is useful for troubleshooting issues with your offer or deciding which disputes to fight vs the ones you should refund immediately—you can't afford to waste time on unwinnable cases.

While Stripe is great for businesses on an optimization path, it's still accessible if you're just starting out. The integration processes have good documentation and easy setup flows, especially for the major eCommerce platforms. And when your volume starts growing, diving into the analytics will feel like you're seeing your business from new angles, useful to brainstorm new approaches in terms of ops, product, or marketing.

You can go even further by connecting Stripe to Zapier. Automatically get Slack notifications for new Stripe sales, create QuickBooks customers for new Stripe payments, and connect Stripe to your entire tech stack. Read more about how to automate your payments with Stripe.

Stripe pricing: Fees vary by transaction type; 2.9% + $0.30 per online credit card transaction. Full pricing information here.

Best eCommerce payment processing system for online stores

Shopify Payments

Shopify Payments pros:

All-in-one eCommerce solution

Very easy to set up and use

Shopify Payments cons:

Limited freedom to use another payment provider

Shopify is becoming a synonym of eCommerce. Starting at $39 per month, you get the starter toolkit to sell online: website, marketing tools, and payments, all in one place. To be clear, you can't use it to process payments if your store is hosted on another platform—its main power lies in how payments are deeply integrated into the Shopify ecosystem.

If this is your first time running an eCommerce website, Shopify is a beginner's haven, offering plenty of high quality help to get you started. You don't have to be a technical expert or coding wizard: just bring time and curiosity, and you'll be able to build your store. If there's any extra functionality you need, you can browse add-ons that extend your shop in any direction you'd like.

The paid plans are designed to unlock more features as you need them, with a nice side bonus: as you go up the tiers, the payment processing fees come down slightly, down to a minimum of 2.4% and $0.30 per transaction. This is nice to both improve your infrastructure and keep more of what you're charging.

Going with Shopify makes sense if you only need eCommerce payments, removing integration headaches from the equation. The platform handles the thorny technical parts so you can focus on selling, not on troubleshooting. Even if you decide to sell via other channels—for example, a custom-made app—you can route the checkout flow via Shopify with a bit of extra configuration, even if it's not as flexible as a solution like Stripe.

You can also integrate Shopify with Zapier to connect your eCommerce apps and automate the boring stuff. For example, you can automatically send new Shopify orders or customer details to your email marketing tool, CRM, or fulfillment system. Here are more ideas for how to automate your Shopify store.

Shopify Payments price: Processing starts at 2.9% + $0.30 per transaction. Active Shopify plan required, starting at $39/month.

Using WordPress with WooCommerce instead? WooCommerce also has a native payment system, WooPayments, upgrading your WordPress installation to a fully-fledged eCommerce solution. Each transaction goes for 2.9% plus $0.30, too, with tools similar to those Shopify offers.

Best payment gateway for selling online and offline

Square (Web, Android, iOS)

Square pros:

Easy combination of in-person and online sales

Includes a basic website builder

Square cons:

Not quite as feature-rich as Stripe

Do you run a brick-and-mortar shop? Not accepting card payments at all yet? Square offers full support for physical card reader machines, and it lets you build your own online store with seamless payment processing. That means faster sales in person and online sales support too.

The interface is sleek and easy to use. The main dashboard gives you a snapshot of your business at a glance, and you can then use the left-side menu to access the wide range of features on offer. These include accepting payments online for all major card brands, as well as Google Pay, Apple Pay, and Samsung Pay.

After you set up your account and add your products, you can embed customizable buy buttons on your sales channels. The level of customization is great, but there are no payment method badges or a "processed securely by Square" note. Be sure to add those to your website to give your customers a sense that it's safe to shop with you.

Don't have a website? No problem. Square offers a website builder with beautiful themes, easy to set up and publish. It also offers basic email marketing features, so you can keep in touch with your customers, run campaigns to raise awareness about new products or services, or get some feedback on customers' experiences.

You can connect Square to all the other apps you use with Square's Zapier integrations: automatically create customers in Square, add transactions to your accounting app, and trigger workflows across your entire tech stack. Here are popular ways to automate Square.

Square pricing: Fees vary by transaction type; 3.3% + $0.30 for online credit card transactions while on the free plan. Square also offers subscription plans to unlock more features and reduce fees, starting at $29/month. Full pricing details here.

Best online payment processing system for B2B sales

HubSpot Payments (Web, iOS, Android)

HubSpot Payments pros:

Simplifies billing by turning deals into payment links

Easy to spread payment buttons anywhere you need

HubSpot Payments cons:

Very focused on the B2B sales use case

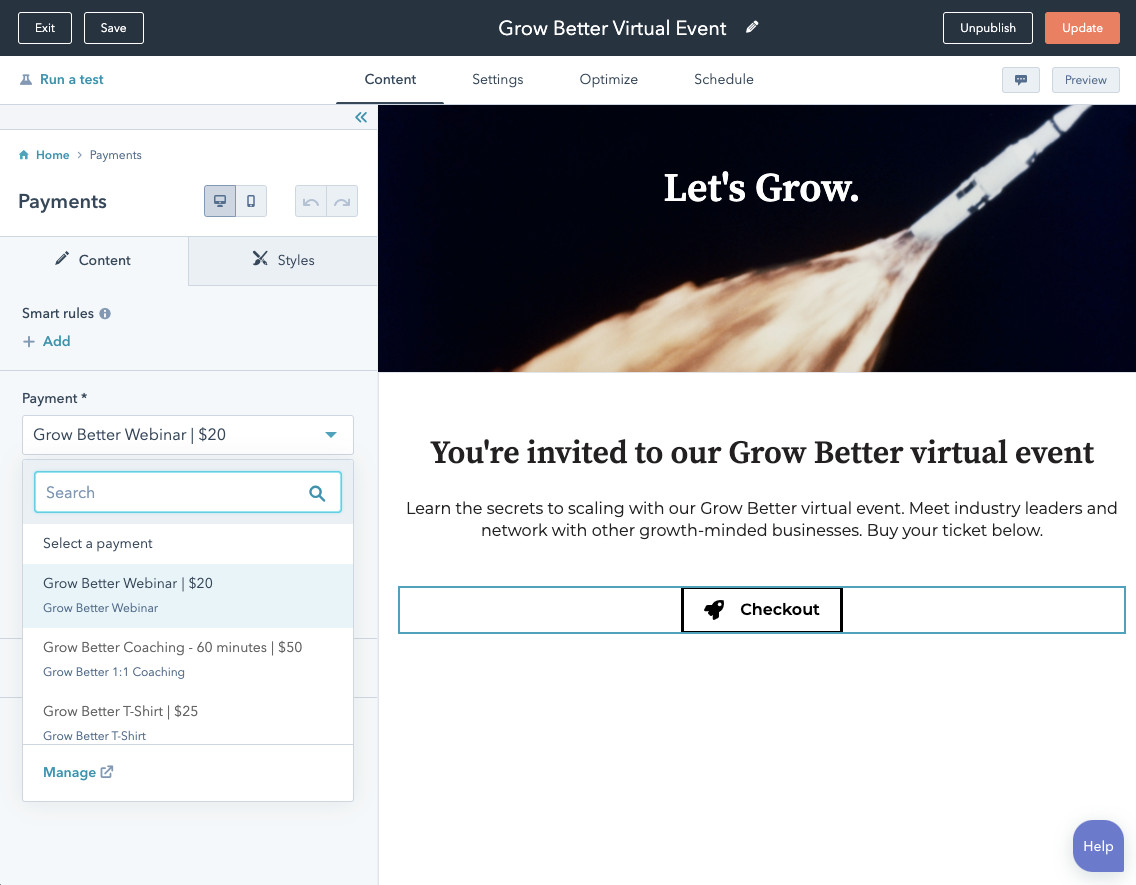

No one loves friction. When selling products or services to other businesses—say, you're doing consulting work or providing workshops—it's best to have a payment flow that's easy to use. HubSpot Payments exists to fill this gap: you can use it to quickly turn proposals into a payment link. Your customers can pay in a good-looking payment form, so you can lock in those dates or send those products right away.

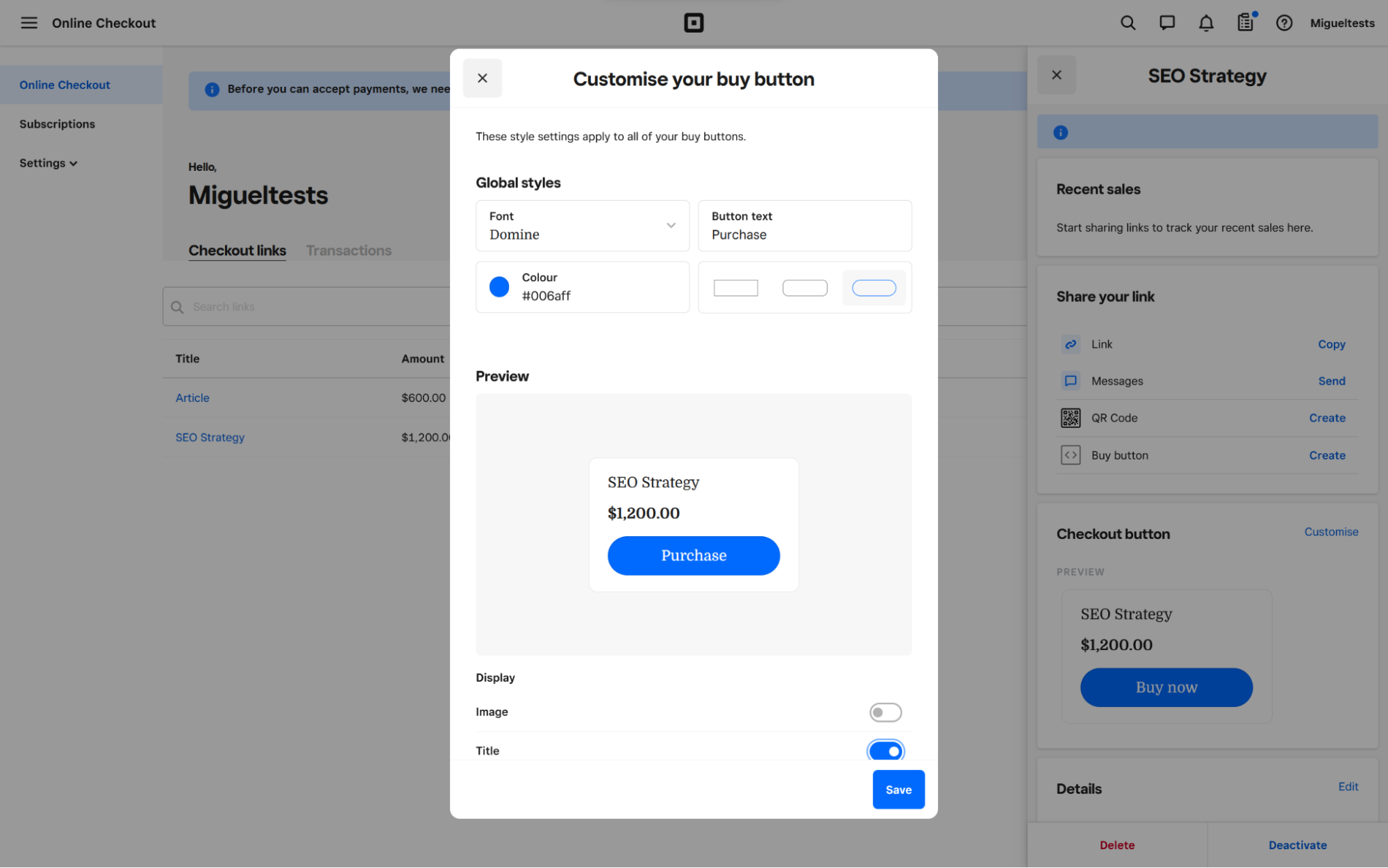

Part of the HubSpot Commerce Hub feature set, Payments adds payment processing on top of a mountain of possibilities. It's seamlessly connected to all other parts of this sales software, so you can manage your business relationships, marketing, website, content, and operations from the same place. The actual payment infrastructure belongs to Stripe, with HubSpot charging 2.9% (no extra fees) for each transaction. A piece of advice: don't connect your Stripe account to HubSpot for processing payments, otherwise you'll have to pay both apps' processing fees, bringing the total to 3.4% + $0.30 per transaction instead.

The major upside of Payments is that it's easy to use, offering the basic tools to send links and see the results. The connection with the CRM saves plenty of time since you don't have to create the payment request elsewhere and send it over. You can put the link inside a button and then embed it anywhere, be it your weekly newsletter, your blog, or the front page of your website. If you're curious about this possibility, check out HubSpot's guide on how to get it done.

Since this new product is all about streamlining your work and saving time, you can keep doing that by connecting HubSpot and Zapier and making your tech stack work as one. Take a look at the best ways to automate your business operations in HubSpot.

HubSpot Payments price: 2.9% per transaction. Active HubSpot CRM Starter subscription required starting at $20/month.

Best online payment processing service for interchange pricing and volume savings

Helcim (Web, iOS, Android)

Helcim pros:

Great user experience, for both you and your customers

Wide feature set

Helcim cons:

Potentially confusing fee structure

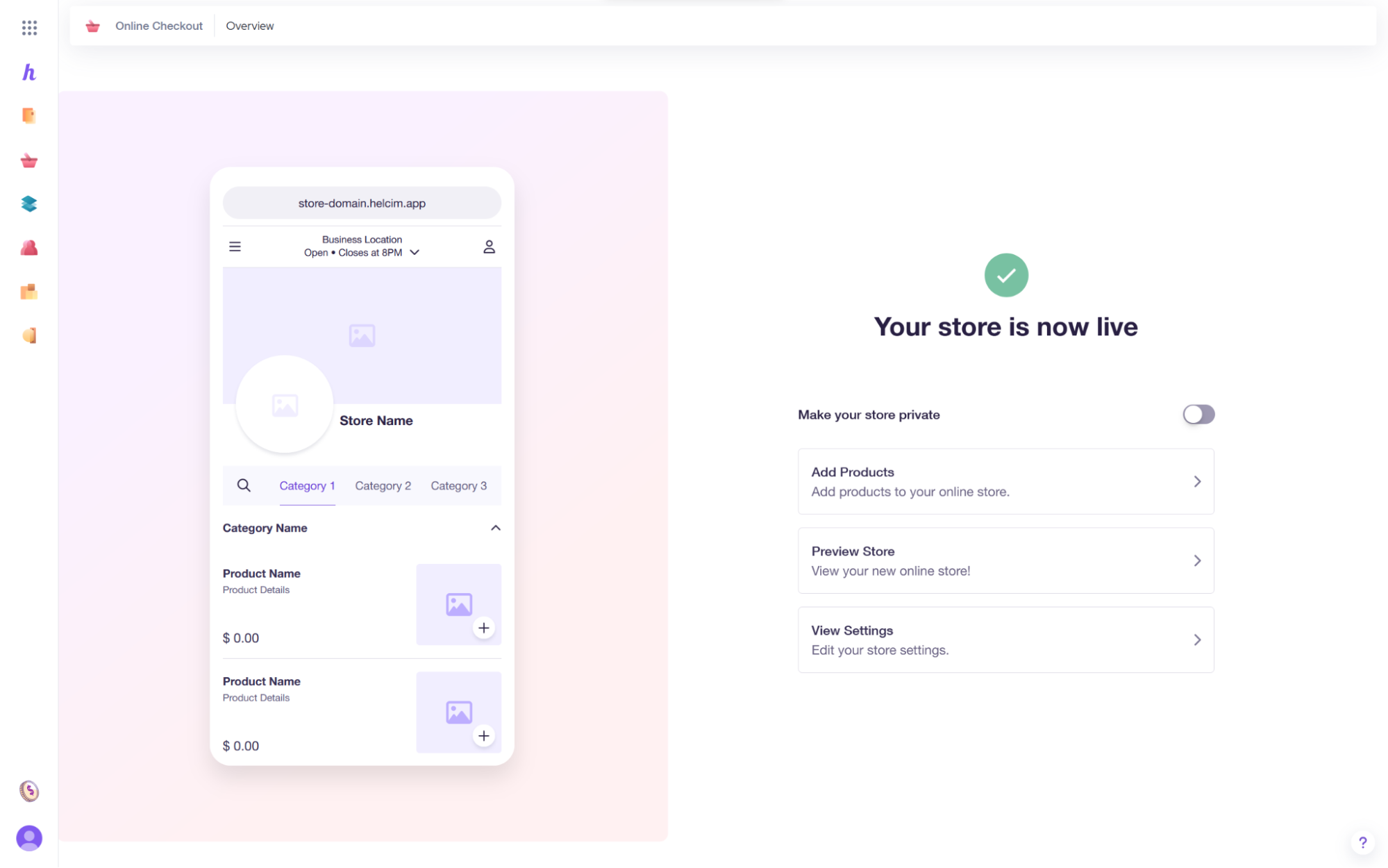

Most of Helcim's advantages lie in the math, so let's whip out our calculators. Instead of charging a fixed fee like most competitors, you're charged Interchange Plus fees. Here's what that means.

Interchange fees refer to the payment network in charge of processing. This can be Visa, Mastercard, or American Express, among others. Each of these networks puts its price on each processing action. Here are a few examples:

If one of your customers pays with a Visa International Corporate card, the interchange fee is 2.0%.

If, instead, they pay with a Mastercard International card, that'd be 1.1%.

If it's with an American Express card and you're a B2B merchant offering a service over $7,500, you'd pay 2.35% + $0.10.

Helcim passes the interchange fees directly to you. Upside? You may be able to save if your customers use the more inexpensive payment networks. Downside? Too many fees to familiarize yourself with. At the end of the year, you can expect the average fee to stand at 2.49% + $0.25 per transaction.

The second part of the "Interchange Plus" expression is "Plus." This is Helcim's cut, the profit they make with each of your transactions, added to the interchange fee. And here, the platform is generous for their bigger clients: if your monthly volume is below $50k, you'll be charged 0.50% + $0.25 a pop; if you rake in more than $1M, that comes down to 0.15% + $0.15.

Let's put the calculator away and reason a bit together. The variance of fees may feel risky or pointless for smaller businesses. But if you're running a bigger operation and have access to data on customer payment methods, you may be able to shave a few decimals off the transaction fee—which, for bigger bottom lines, can have a noticeable impact.

And if you want to destroy the calculator entirely, you can pass on these processing costs to your customers with surcharging—they pay these fees, not your company. There are mixed opinions here. Your marketing and sales teams won't like explaining why the final price was increased at the end of the payment flow. If you go this route, be sure to think about the checkout user experience.

Helcim price: Interchange Plus averages at 2.27% + $0.25 per transaction. Discounts available for high-volume sellers.

Best online payment processing system for cross-border businesses

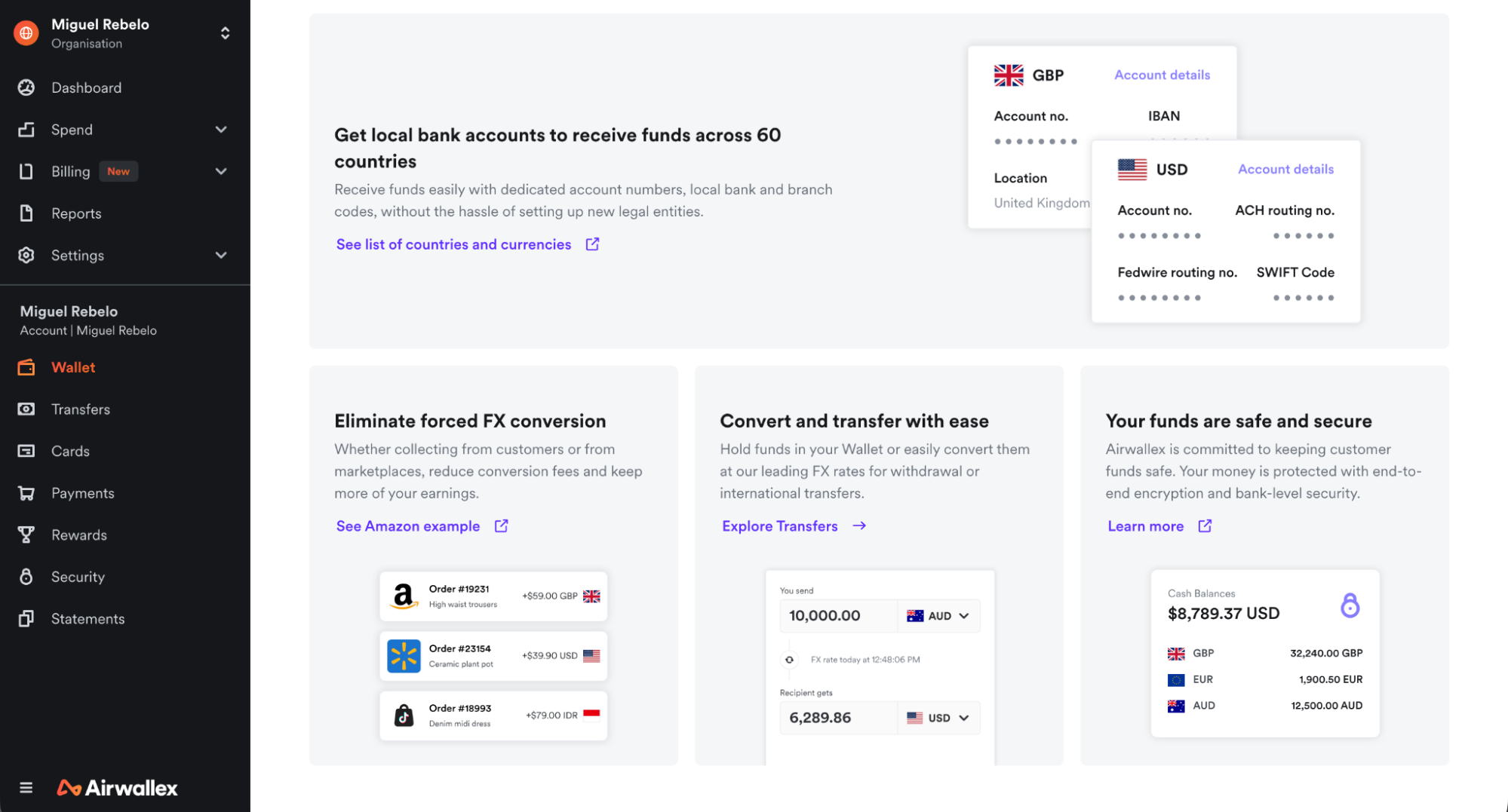

Airwallex (Web, iOS, Android)

Airwallex pros:

Clean, intuitive platform

Includes virtual cards for spending

Airwallex cons:

High friction during know-your-customer and compliance checks, sometimes leading to account restrictions

When you operate in multiple countries, every cross-border transaction can mean a ~3% loss when charging your customers. Airwallex helps you keep more of each sale, letting you work with multiple currencies and exchange them only when the rates and circumstances are in your favor.

You can hold up to 20 different currencies, get local bank details for more than 60 countries, and transfer internationally across 120. You can get paid and hold money like a local business, and then set up currency pair alerts in the platform so you can exchange when the high rates are best for you.

Spending money to make money is essential, and Airwallex opens up possibilities to being more efficient in this aspect. If you want to buy products and services in any of the regions you're operating in, just create virtual debit cards to purchase anything locally. The amount will be deducted from the corresponding currency account. No need for on-the-spot conversions: you can still get all the products and services you need to operate without dealing with currency market fluctuations.

And while I've been focusing mostly on FX advantages, Airwallex includes all the features of a modern online payment processor, with flexible implementation paths. It can be completely no-code with the hosted checkout pages, embedded in your shop's user experience with the low-code drop-in visual element, or seamless with the well-documented developer kit.

Automate your financial ops and prevent copy/paste errors by connecting Airwallex to Zapier. Set up what happens next when certain conditions are true, such as when a new transaction starts or a new cardholder is added.

Airwallex price: Fees vary by transaction type; 2.80% + $0.30 for domestic card transactions. Full pricing information here.

Payment gateway FAQ

What are interchange fees?

Interchange fees are per-transaction fees that the merchant pays to the customer's bank. The fee amount increases based on how risky the transaction is. It covers the costs of fraud prevention services run by the bank, credit card rewards programs to incentivize spending, and account maintenance.

Online transactions with credit cards command higher fees because these carry repayment risk (the cardholder may not pay their bill), and remote transactions lack the security of in-person verification.

Card networks like Visa and Mastercard set the interchange rate schedules that determine the fees, which are then paid to the customer's bank.

What is a merchant account?

A merchant account is a special bank account used for receiving funds from card payments, separate from your everyday checking account. It holds your funds until the payout date, when they're transferred to your business bank account—you can't use your money until that happens.

What is a payment gateway?

A payment gateway is a service that sits between your shop's payment form and the financial system. It collects the customer's payment details securely and sends them to the processor so the money can actually move from your customer to you.

What is a payment processor?

A payment processor sits behind the scenes to handle the actions needed to approve a card payment. When the customer pays through the payment gateway, the processor sends the transaction details to the card network, so the customer's bank can authorize (approve/decline) the purchase and send that decision back to the checkout quickly.

After the payment is approved, the processor also handles all the steps to help the merchant get paid—this is called clearing and settlement.

What is an issuing bank?

An issuing bank (or issuer) is the financial institution that provides a debit or credit card to a customer. The bank issues cards under major card networks like Visa or Mastercard, allowing customers to make purchases anywhere those networks are accepted.

When a customer pays by card, the network routes the transaction details back to the issuer. The bank runs its checks: Is the card valid? Does the customer have enough funds or credit? Is this a legitimate transaction? If so, they approve the transaction and release the funds.

How does credit card processing work?

After a customer hits the pay button on your site, the payment gateway sends the request to a payment processor. The processor contacts the card network so it can get authorization from the issuing bank. Once the bank approves the transaction, the decision comes back to the checkout page and the success message appears.

To the customer, the success message signals that the payment is complete. However, the money doesn't actually move until settlement—typically at the end of the business day or on a scheduled basis. This is when the customers' banks release funds and your payment processor collects them.

How do payment gateways handle refunds?

Payment gateways allow you to initiate refunds for completed transactions. When you do, the gateway sends a refund request to your payment processor, which then routes it through the card network to the customer's issuing bank. The refund goes through the same settlement process as a regular transaction, which is why it typically takes several business days. Once complete, the money is deducted from your merchant account and credited to the customer's card.

If a refund fails—for example, if the customer's card has expired or their account was closed—the funds may be returned to your merchant account. Keep in mind that processing fees from the original transaction are typically not refunded, and some payment platforms charge additional fees for processing refunds.

How do payment processing platforms handle disputes?

When a customer is unhappy with the product or service, they may file a dispute with their bank—this is a chargeback, a forced reversal of payment. Payment platforms typically notify you, pull out or lock the disputed amount from your balance, and give you a deadline to accept the chargeback or submit evidence that the customer doesn't have a right to it.

If you decide to challenge, the platform packages your evidence and sends it back through the card system. Based on the claims presented by both parties, the bank makes a decision in either your or the customer's favor.

Payment platforms may charge fees for chargebacks, even if you win the dispute.

Which gateways are the best for international transactions?

The best gateways for international transactions let you charge in multiple currencies, letting you settle in whichever one you need. They offer local payment methods that people actually use in each region, and provide tools to improve approval rates for transactions, such as smart payment routing.

PayPal, Stripe, Shopify Payments, and Airwallex support international transactions well.

Can I negotiate transaction fees for higher sales volumes?

Yes, especially once you have a high sales volume and/or if you have low fraud/chargeback rates. Many processors have custom and enterprise pricing where you can negotiate directly with their sales teams to lower per-transaction rates, switch to interchange-plus pricing, or secure volume discounts instead of the standard published rate.

What are buy-now-pay-later (BNPL) services?

Buy-now-pay-later services are a type of short-term consumer financing, where people can pay in interest-free installments. From a merchant's point of view, you need to enable the payment methods associated with BNPL services—such as Klarna or Clearpay—so customers can select them during checkout.

The BNPL provider will pay you in full for the product or service you're selling, but there may be higher fees associated with it. It's a nice-to-have in your shop, as it increases conversion rates and shoppers usually purchase more.

What's the best online payment gateway for eCommerce?

All these payment processing companies are solid choices to let your customers pay you securely. Take your time to explore their entire feature sets, as not all of them offer the same possibilities or have the same pricing model. It's also wise to try out the support team and ask some questions—I mostly interacted via chat and phone, but your experience may vary depending on your needs.

Once you're locked in on your favorite online credit card processing system, register for an account and familiarize yourself with the way payments are processed, the fees applicable to your business, and how chargebacks are handled. Happy selling!

Related reading:

This article was originally published in September 2016 by Matthew Guay, and has also had contributions from Hannah Herman. The most recent update was in January 2026.