As far as I'm concerned, a card swiper is a card swiper—I'm not paying attention to the specific logo on the device when I'm making a purchase. But what might be a pretty inconsequential difference to consumers like me will have a big impact on sellers.

You need to make sure the processor you choose can integrate with your selling platform, that it supports the transaction types you use, and that it has the features you need. And when it comes to fees, choosing the wrong payment processor can cost you hundreds—or more, if you're selling at scale.

Two of the most popular payment processors are Stripe and PayPal—but which is better for your business? Here's what you need to know to decide between using Stripe vs. PayPal for your sales needs.

Stripe vs. PayPal at a glance

I'm just going to put the bottom line up front: Stripe is the better choice in most situations. Having said that, you can't put a price on the value of PayPal's universal brand recognition. Here's how those factors weigh against each other at a bird's-eye view.

PayPal has a seriously complicated fee schedule that adds up quickly, and even basics like a virtual terminal or a recurring payment tool require a subscription plan plus an added fee. Also, many of the premium features PayPal charges for are either free with Stripe or come at a flat rate per transaction.

If your customer demographic skews a little less tech-forward, customers may be more willing to input financial information via a platform they're already familiar with, which is usually PayPal.

Keep in mind that I'm evaluating these platforms strictly as payment processors in the vein of merchant solution competitors like Shopify and Square—not for personal money transfers or even for particularly large invoicing projects (though both platforms do have invoicing tools, which I'll get to later on).

Here's a comparison table with the main differences, but keep reading for details.

| Stripe | PayPal |

|---|---|---|

Ease of use | ⭐⭐⭐ A little trickier to set up, since Stripe's checkout gateway must be integrated with your site | ⭐⭐⭐⭐ Very easy off-page checkout setup; customizable gateways available with upgrades are just as tricky to integrate as Stripe |

Costs and fees | ⭐⭐⭐⭐⭐ Simple "% + fixed cost" fee schedule with uncomplicated pricing for add-ons like recurring payments and invoice management; offers a custom plan for bigger businesses | ⭐⭐ Complicated pricing with different "% + fixed cost" fees for each type of transaction; difficult-to-parse fees for upgrade services that are required in order to access key features that can also cost an additional fee |

Recurring payments | ⭐⭐⭐⭐⭐ Recurring payment setup is included at no extra charge; users can gain access to advanced billing tools like recurring invoices for a low additional per-transaction fee | ⭐⭐⭐⭐ PayPal Business merchants can set up recurring payments with no additional monthly fee, but the per-transaction fee is higher than Stripe's |

Pay later options | ⭐⭐ Available via third-party integrations with high per-transaction fees | ⭐⭐⭐⭐⭐ PayPal Pay option included with no additional fees |

International payments | ⭐⭐⭐⭐⭐ Simple, low-cost added fee for international transactions and currency conversions | ⭐⭐ Higher added fee for international transactions and currency conversions, plus base "% + fixed cost" fees have different fixed costs by country |

Customizability | ⭐⭐⭐⭐ Fully customizable checkout gateway included at no extra cost | ⭐⭐⭐ Customizable checkout gateway and on-site checkout options require Payments Pro ($30/month) or Payflow Pro ($25/month) accounts |

Currencies/transfer types supported | ⭐⭐⭐⭐ All major credit cards, 135+ international currencies, crypto, and ACH debit and credit transfers; Venmo transfers not supported | ⭐⭐⭐⭐ All major credit cards, 25 international currencies, Venmo transfers, crypto, and ACH |

Trustworthiness and brand familiarity | ⭐⭐⭐⭐ Stripe doesn't have PayPal's name recognition yet, but it has similar security and a growing market presence | ⭐⭐⭐⭐⭐ PayPal stands as a very trusted payment processor with a high level of trust and security across demographics |

AI | ⭐⭐⭐ Uses AI to enhance checkout and offers additional AI-powered fraud protection | ⭐⭐ Has announced eventual rollout of modest AI-powered features |

What's not different?

If you're torn between Stripe and PayPal for your business, disregard these factors—they're (more or less) the same on both sides.

Credit cards accepted: Both Stripe and PayPal can accept all major credit cards.

Varied transaction types: Whichever app you choose, you'll be able to check out customers online, in person, or via manual credit card input (though both slightly upcharge for manually entered transactions).

Chargebacks: Both platforms' chargeback fees are pretty similar ($15 for Stripe, $20 for PayPal).

Security: You'll get similar security quality from either processor, including safeguards like data encryption, 2FA, fraud detection, etc., though the prices will vary (more on that later).

Report building: PayPal might be a tiny bit more capable of the two, but either will allow you to build simple reports from past transactions.

Learn more about how to automate post-purchase marketing with PayPal and how to automate your payments with Stripe.

PayPal is easy to set up and use, but Stripe allows on-site checkouts that you can customize to your brand

If you've ever made a PayPal purchase before, you're familiar with the standard off-page checkout process that takes place on the PayPal site. It's absurdly easy for the buyer—and the brand name is enough for people to trust it—but it takes you off the page you were purchasing from.

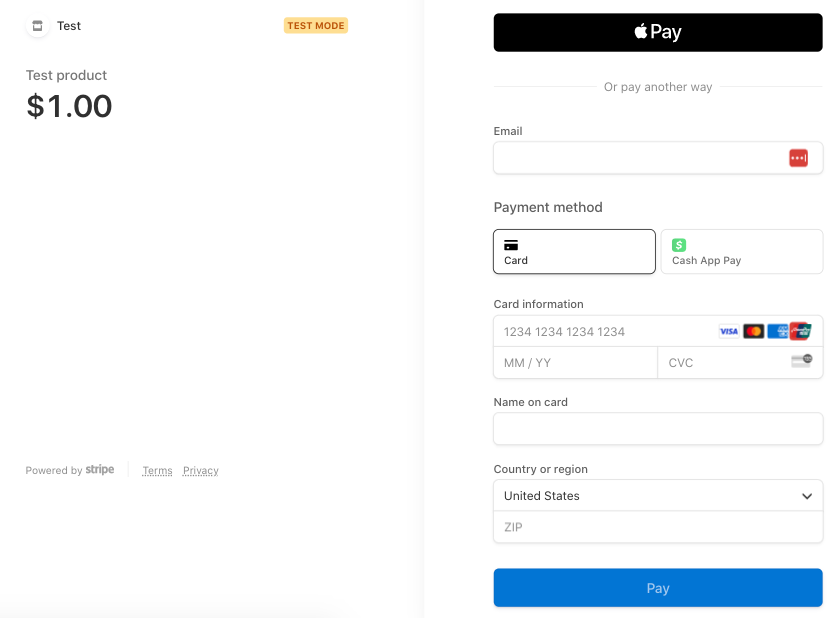

Stripe is designed to be integrated directly with your shop, so that the customer remains on your website throughout the entire checkout process. It also allows you to customize the checkout gateway to match your shop's brand and aesthetic. PayPal users have to pay up for Payflow Pro to fully customize their checkout pages; otherwise, branding options are limited to just adding a logo.

But here's the rub: setting up an integrated checkout gateway is a little tricky in both cases, and requires some basic programming knowledge (or the patience and technological aptitude to follow a how-to video really, really closely). So if you don't care about having a branded on-page checkout page and just want something easy, PayPal has an option for that. Stripe Checkout implementation is described as "low-code," but it's still not quite as simple.

That said, you can hire a freelance programmer on Fiverr to set up a checkout gateway for as little as $20. So if you couldn't code your way out of a paper bag but you still want the nicer checkout experience, paying someone else to do it isn't going to bankrupt you.

Nearly every type of transaction is cheaper with Stripe (and you won't have to worry about hidden fees)

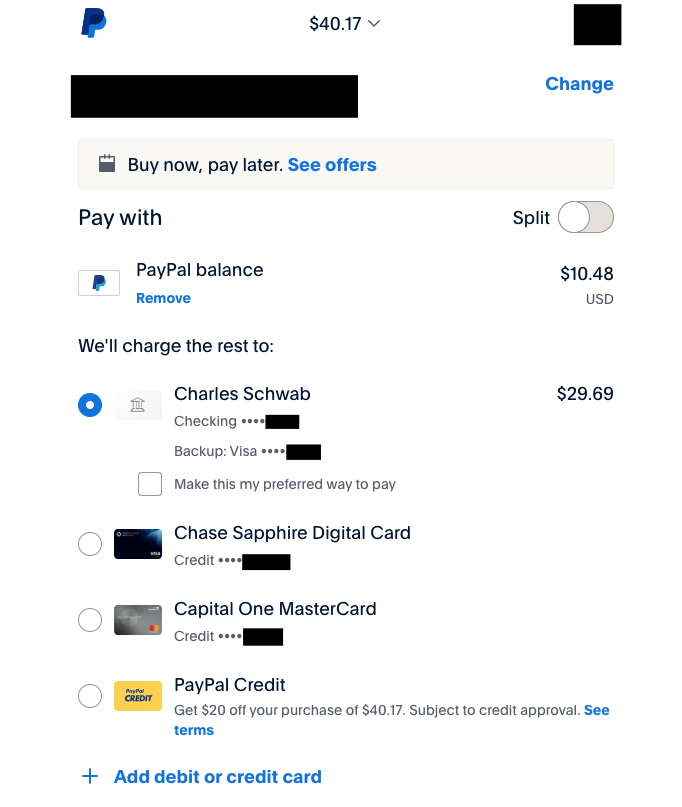

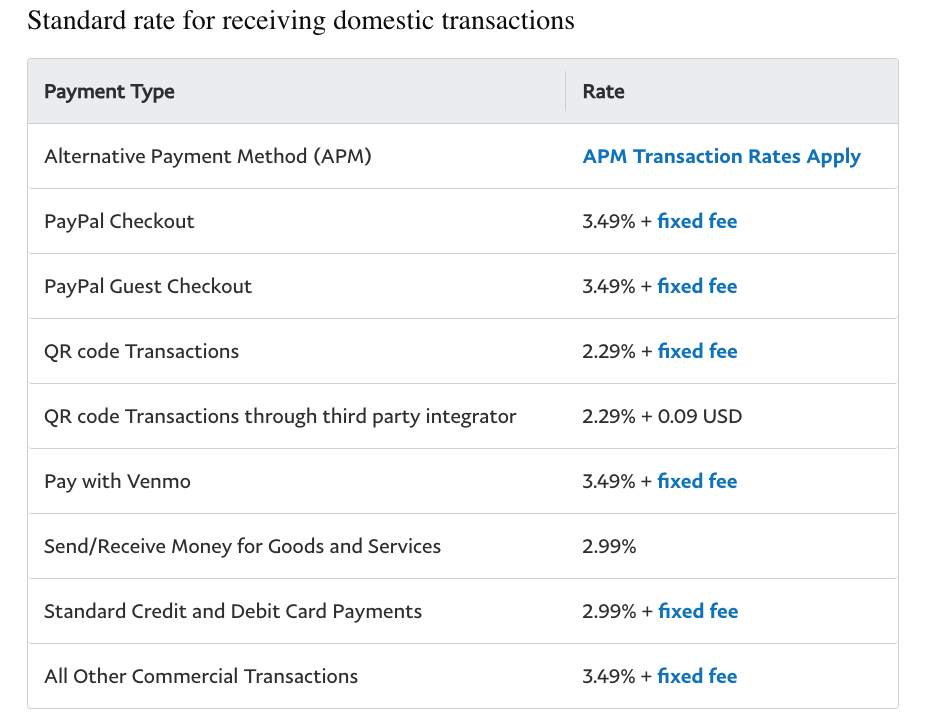

There's no other way to put this: PayPal's pricing structure is a nightmare. It took me, without exaggeration, hours to figure out PayPal's fees, and that was just so I could write this post. Not only is the percentage fee different for each type of transaction, but you need to consult a different table to find the fixed fee that applies to each different payment type as well.

The specificity of the payment types PayPal lists is bananas, and there's a different fee for almost every one.

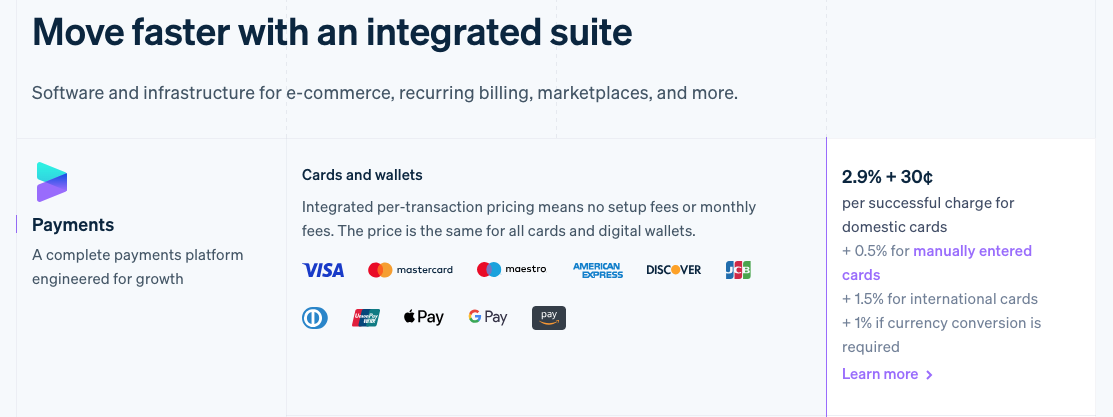

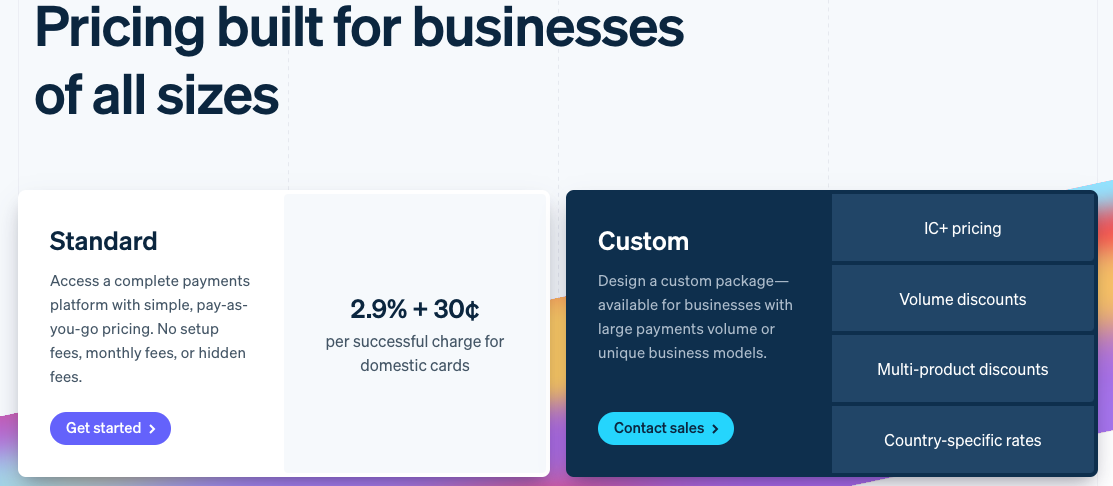

Meanwhile, Stripe decided on a fee and mostly just sticks to it, charging 2.9% plus $0.30 for online sales. Sure, there are plenty of separate fees for optional services and specific scenarios, like ACH transfers and wire payments, but for the vast majority of sales, you'll know what fees to expect. In addition to its blissful simplicity, Stripe fees are also cheaper than most PayPal fees.

That said, PayPal does have three pricing advantages. First, it has a fee-free pay-later service (though the Pay Monthly option is subject to 9.99% to 35.99% APR for approved customers). Stripe doesn't offer a native pay-later option, but integrates with third-party platforms like Affirm, Afterpay, and Klarna instead—each of which charges its own fee of around 6% plus $0.30 per installment.

Second, PayPal charges only its standard transaction fees for invoicing. Invoicing with Stripe, however, costs an additional 0.4% per transaction for Starter and 0.5% for Plus plans per paid invoice. Given Stripe's typically lower transaction fees, that still may be cheaper than PayPal depending on the transaction type and amount.

Third, PayPal's point-of-sale (POS) setup can be cheaper. PayPal POS transaction fees are only 2.29% plus $0.09. Its terminal starts at $199 and can be upgraded with a barcode scanner ($239) and printer/dock bundle ($269), while its card readers cost only $29 for the first and $79 apiece thereafter. Stripe isn't too far off, with its two terminals priced at $249 and $349 and its card reader coming in at $59. Its terminal fees are 2.7% plus $0.05 per transaction, meaning the percentage rate is a tad higher but the tag-on rate is nearly half of PayPal's. It probably evens out pretty closely for most sellers, but at massive volumes, it could make a difference.

One last thing worth noting: For both Stripe refunds and PayPal refunds, sellers are no longer reimbursed for transaction fees.

PayPal's add-on fees are confusing and require users to pay extra for features that are included with Stripe

Stripe collects its fees primarily on a per-transaction basis, and those features that are considered "extras" (like tax configuration, audit tools, and data pipelines) cost a small additional per-transaction fee—usually a few cents or a few tenths of a percentage point. And for high-volume sellers that need a more dynamic pricing structure, Stripe does offer custom fee packages.

As I mentioned earlier, users who want to create a custom integrated checkout gateway with PayPal need to pay to be able to do so. The Payflow Pro plan allows merchants to fully customize their shopping flows, and costs $25/month plus an added $0.10 fee per transaction. Stripe offers this same service for free.

The other paid PayPal plan is Payments Pro ($30/month). This subscription allows eCommerce businesses to not only customize their checkout screens, but also accept all major cards as well as payments over phone, fax, and snail mail. For other perks like account monitoring, fraud protection, and buyer authentication, you'll need to add monthly fees and possibly still more per-transaction fees—plus PayPal can deem that your account comes with additional risk factors and stick you with an additional 5% per transaction.

Rather than incurring monthly premiums for access to advanced features like these, Stripe charges a small per-transaction fee with no premium subscription required.

PayPal has more brand recognition, but that may be less impactful as its competition grows

Payment processors should be like the pipes in your house—completely unnoticed as they move things along.

For businesses whose customers may be a little more sensitive to name recognition when it comes to providing online payment information, PayPal has the advantage of being deeply entrenched as a trusted payment processor. And it's a big advantage—PayPal still dominates the payment processing landscape, with 45.4% of the global market share. (Stripe is second, with a mere 18.2%.) If there's a chance your customers will be reluctant to finalize payment if they don't recognize the company handling your checkouts, there's always a chance they'll take their business elsewhere.

But this is becoming less common these days. Most of us have open accounts with a slew of companies, and one more isn't likely to scare many of us off. If people do think Stripe seems a little sus, a quick Google search will show it's becoming very trusted in online marketplaces.

Both apps integrate with Zapier

Whichever solution you choose, both Stripe and PayPal integrate with Zapier to help you connect your checkout page to thousands of other apps. That way, you can automate your post-purchase marketing, add new sales to a spreadsheet, or anything in between.

Learn more about how to automate Stripe and how to automate PayPal, or get started with one of these pre-made workflows.

Add rows to Google Sheets spreadsheets for new PayPal sales

Zapier is a no-code automation tool that lets you connect your apps into automated workflows, so that every person and every business can move forward at growth speed. Learn more about how it works.

Neither is doing a lot with AI, but Stripe has slightly more actionable AI features

Admittedly, payment processors aren't exactly the most fertile software ground for AI features since so much of what they do depends on end users taking physical actions. But that hasn't stopped these two from using artificial intelligence to enhance backend user experience with features their customers aren't likely to notice.

Stripe's AI initiatives are useful but pretty modest, centering on smarter checkouts and security. Stripe's Optimized Checkout Suite uses AI to suggest the most likely payment methods to customers from their massive pool of over 100 options. If Stripe's reporting can be believed, users who migrate to the Optimized Checkout Suite see over 11% more conversions thanks to these suggestions.

For an extra $0.05 per screened transaction, Stripe users can also enroll in Radar, its fraud management service. Users can enter natural language processing prompts to describe fraud details, and Radar will set up rules to monitor accordingly. It's potentially a way of using AI police to detect AI fraud, which feels kind of Asimovian, but it's a compelling offering for those who need a little more protection against bad actors.

While PayPal doesn't currently have user-facing AI features of note, the company stated in a press release that they've got a handful of new (and notably vague) ones cooking. Those include an enhanced checkout experience that'll use AI to (somehow) keep checkouts faster and safer, suggest future purchase options to past customers, leverage purchase data into insights for sellers, and suggest cashback opportunities to potential customers on the new CashPass app.

So really, AI probably isn't moving the needle toward one option or the other for most users. PayPal seems to be investing more in AI, but Stripe's existing features are a little more accessible and tangible as of now.

Stripe or PayPal: Which makes sense for you?

To put it bluntly: you'll get essentially the same thing from each of these payment processors. But that doesn't mean they're totally equal. Here's how I'd summarize all the above into which I'd recommend:

If you want to leverage the more familiar brand with more built-in trustworthiness and more out-of-the-box simplicity—and don't mind higher fees and more complicated pricing—PayPal is the winner.

If you want to keep fees low at scale, are comfortable with light coding or outsourcing some implementation, and don't mind less ingrained brand recognition for your payment pathway, Stripe is the one.

If you're only making a handful of sales per month and you aren't selling big-ticket items, the fee difference for Stripe vs. PayPal will be manageably small. But once you start selling at scale, in almost all scenarios, PayPal is going to cost you a few hundred dollars more than Stripe per month—savings that will more than make up for hiring a freelancer to set up Stripe payments if needed.

Related reading:

This article was originally published in August 2018 by Daniel Brame and has had contributions from Amanda Pell and Bryce Emley. The most recent update was in May 2024.