Accounting automation is a process that lets you complete financial record-keeping work without human intervention. For example, if you're an accountant who tracks expenses for your team manually, with automation, you could connect the team’s expense management tool to its accounting tool to categorize and record spending on autopilot.

What did accountants do before computers? I'm just imagining someone in a poky, windowless room, hunched over a desk covered in towers of invoices, squinting at a paper ledger.

Record-keeping, is, of course, worlds easier now that the records are digital. And maybe you're keen on making that work even smoother by automating your financial workflows. If you don't know what to automate first—or how, or whether you even should—I've got you covered. Below are some need-to-know basics about accounting automation, popular accounting automation tools, and workflows you can build easily and securely on Zapier.

Zapier is the most connected AI orchestration platform—integrating with thousands of apps from partners like Google, Salesforce, and Microsoft. Use forms, data tables, and logic to build secure, automated, AI-powered systems for your business-critical workflows across your organization's technology stack. Learn more.

Table of contents

Zapier integrates with over 200 accounting apps—and we're always adding more. Browse our up-to-date integration list.

What is accounting automation?

Accounting automation uses software to handle routine, time-consuming financial tasks—things like tracking expenses, generating invoices, categorizing transactions, and reconciling accounts. Instead of manually entering numbers into spreadsheets or jumping between apps, automation pulls data from one tool to another and keeps everything in sync. It's like upgrading from a flip phone to a smartphone: same core function, way more power.

For example, when a customer makes a payment, your accounting automation software can automatically update their invoice, log the transaction in your ledger, and notify your team—no extra clicks required.

Accounting automation isn't about replacing human judgment—it's about removing repetitive work so you can focus on analysis, strategy, and growth. Think of it as clearing the noise so you can actually hear the signal.

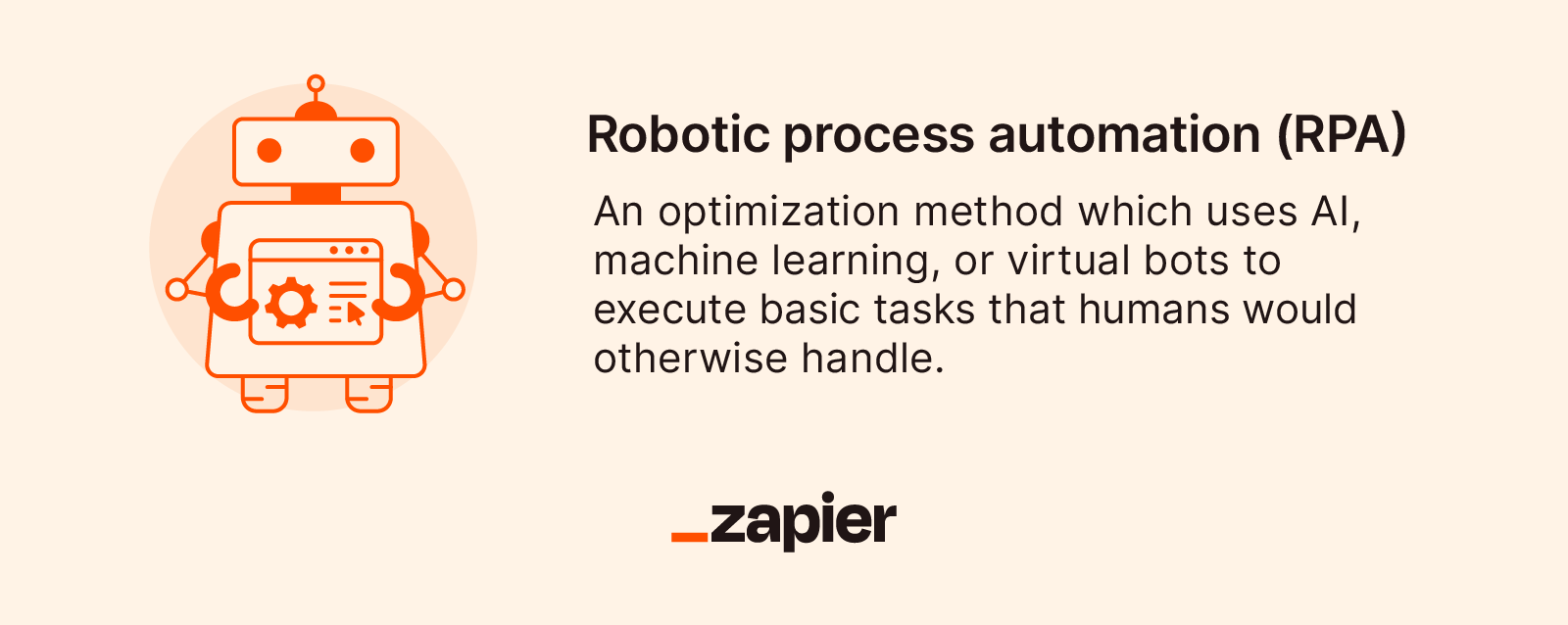

What is robotic process automation in accounting?

Robotic process automation (RPA) in accounting refers to using software "bots" to handle repetitive, rule-based tasks—like data entry, invoice processing, or reconciling accounts. These bots mimic the actions a human would take in a spreadsheet or app, but they do it faster, without taking breaks, and without making typos. RPA is especially useful for high-volume workflows, which helps finance teams save time and reduce errors without overhauling their entire system.

Read our full article on robotic process automation.

How does automation affect accounting workflows?

Automation saves you considerable time, reduces risk, improves accuracy, and opens up space for more valuable work. And once you set up an accounting workflow, the impact is immediate.

Here's what the benefits look like in practice:

Fewer errors. Automation eliminates manual data entry, which means fewer typos, mismatched numbers, or forgotten line items.

Faster month-end close. When your records update in real time, you're not scrambling to reconcile them later.

Improved visibility. Automatically categorized and synced data gives you clearer, more up-to-date financial reports.

More time for strategy. With the basics handled, you can focus on forecasting, budgeting, or helping your team make smarter decisions.

Better scalability. As your business grows, your accounting processes don't get messier—they just keep running.

Increased compliance. Automation helps you stay audit-ready by maintaining consistent, complete records.

Popular accounting software tools

There's no shortage of accounting software on the market, and the right one for you will depend on the size of your business, your industry, and how much time you want to spend tinkering with your books. But a few tools consistently show up at the top of the list.

QuickBooks Online is the go-to for many businesses. It offers robust features for invoicing, expense tracking, payroll, and reporting—all in a user-friendly interface. Xero is another favorite, especially for international teams, thanks to its strong multicurrency support and sleek design. If you're looking for something lightweight and intuitive, FreshBooks is great for freelancers and service-based businesses who need to send invoices and track time. And Wave is a solid free option for small businesses.

Accounting automation with Zapier

But choosing your accounting software is just the first step. The real magic happens when these tools talk to the rest of your tech stack—and that's where Zapier comes in.

Zapier's automated workflows—called Zaps—connect your accounting platform with apps like your CRM, eCommerce store, or email inbox, so you can automate the flow of financial data across your business. Whether it's sending invoices from one tool to the other, updating spreadsheets, or logging transactions, Zapier turns your accounting software into part of a bigger, smarter system.

To get started with a Zap template—what we call our pre-made workflows—just click on the button. It only takes a few minutes to set up. You can read more about setting up Zaps here.

Add transactions from your payment processing apps

Connecting your accounting software to your bank account will capture the net payments from your payment processing apps, but only the app itself contains the processing fees paid. To properly capture the gross sales and the amount of the fees, you'd need to adjust the bank transaction manually. The bank transaction also lacks other details, like the original date of the translation or individual transactions that might be included in a lump payout.

Instead, you can use Zapier to automatically send transactions from payment processors like Stripe, Square, and PayPal. By doing this, you'll have more accurate accounting records and better reporting of your sales.

Create QuickBooks Online customers with sales receipts for new Stripe payments

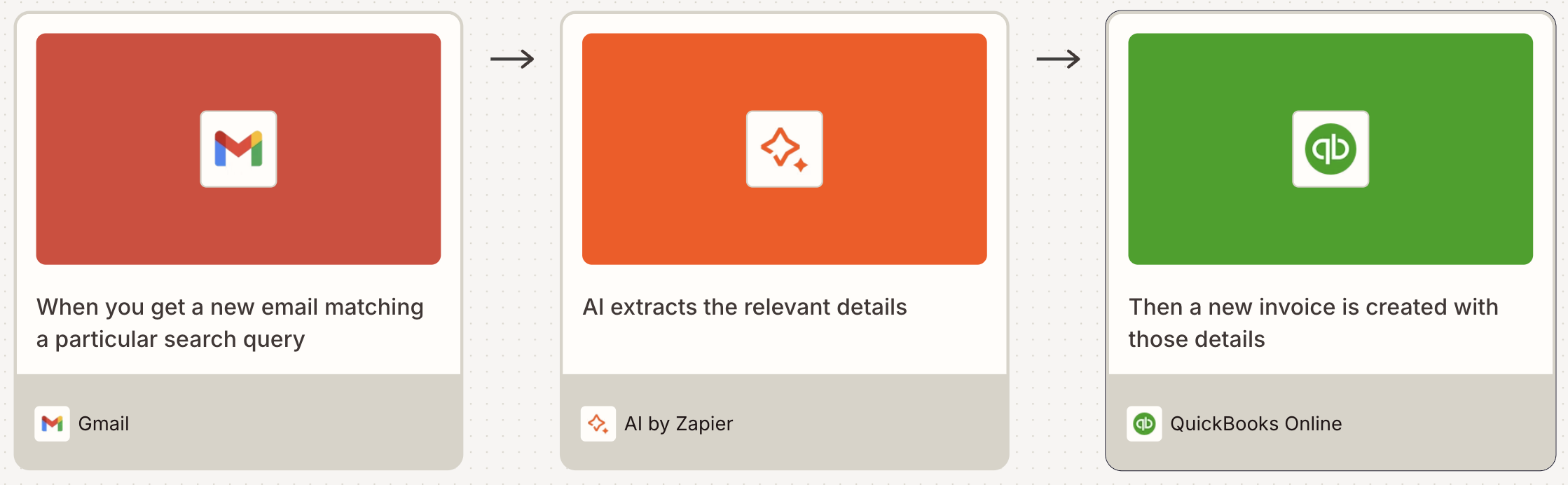

Create invoices based on emails

If you get an email notifying you that someone is interested in your services, your next step is probably to send an invoice. But how do you quickly and easily get that information from your email? Hopefully not by copying and pasting, which makes it very easy to accidentally grab incorrect or miss important information.

Instead, Zapier can use email notifications to create invoices. With Email Parser, one of Zapier's built-in tools, you can extract data from the email, like the person's name, the amount, and the services. This saves you time since you won't have to add the new customer to your accounting software manually, and ensures that invoices are sent promptly.

Upload documents for bookkeeping purposes in Lexware Office from new email attachments

Send QuickBooks Online invoices from new emails parsed by Zapier

Create new Xero invoices from parsed emails by Zapier

Note: Email Parser works best when emails follow a consistent format or template—like automated notifications from a form or booking system. If clients send you free-form emails with varying structures, use AI by Zapier instead. It can intelligently extract the info you need (even when every email looks different), and you don't need an API key to use it. Learn more about AI by Zapier.

Upload documents to your accounting software

You might store documents in an app like Google Drive, Dropbox, or OneDrive for record-keeping purposes, but you also need a copy in your accounting software. With accounting automation, you can send files from your cloud storage to your accounting software, rather than upload the file twice.

You can even have the uploaded files create and send invoices. Since Zapier's automation is based on using a specific folder as a trigger, you can have different folders trigger different workflows. For example, an upload to a designated folder might send an invoice to a specific client.

Upload documents for bookkeeping purposes from new files in Google Drive folders to Lexware Office

Upload new documents for bookkeeping purposes from new files in OneDrive to Lexware Office

Create sales receipts in QuickBooks Online for new Google Drive folders

Send updated Google Drive files as sales invoices by email with Xero

Add transactions to a spreadsheet or database

Spreadsheets are a frequent supplement to accounting software. Whether you need more robust reporting than your accounting software can provide or need a more detailed breakdown, spreadsheets fill the gaps.

While you can typically download transactions from your accounting software, this is usually for bulk actions (like a month-end review). With Zapier, you can send transactions to a spreadsheet as they occur. That way, you can review them in your spreadsheet immediately and don't have to export transactions from your accounting software constantly.

Add new QuickBooks Online invoices to Google Sheets spreadsheet rows

Create Google Sheet rows for new Splitwise expenses

You can even send transaction data to a database like Airtable for more complex or customizable use cases, especially if Airtable is your central hub for other parts of your business.

Create Airtable records for new QuickBooks Online invoices

Send notifications based on invoices and payments

Very often, sending an invoice or receiving a payment triggers another action in your company, whether it's reaching out to a customer or starting a new project. The people who need to be informed about those invoices and payments aren't necessarily the same as those working in your accounting software.

Whether your preferred method of communication is Slack or email (or both!), you can set up a Zap to automatically send notifications based on new invoices or received payments.

Send Slack messages for new invoices in QuickBooks Online

Send gmail emails for new QuickBooks Online payments

Send Slack channel messages for new payments in Xero

Send Gmail messages when new payments are received in Xero

Send channel messages in Slack for new payments in Quickbooks Online

Do you regularly share profit and loss (P&L) statements with your teammates? Use this P&L report generator template to build an AI agent that automates the process. Learn more about Zapier Agents.

Add new customers to your marketing apps

New customers often mean adding customer information to several different apps. If you're already adding customer contact information to your accounting software, why not save a step and add that customer to your marketing apps?

Whether you're using an email service provider like Mailchimp or a CRM like Salesforce, you can create new customer records based on adding new customers or creating invoices within your accounting software. Within these apps, you may have additional automation set up, such as adding tags to the customer or kicking off a welcome sequence.

Create Mailchimp subscribers from new Wave customers

Create Salesforce records for new QuickBooks Online invoices

Add new Mailchimp subscribers from new contacts in Xero

Subscribe new Zoho Books customers to a list on Mailchimp

Connect your accounting software to the apps you use every day

You're already using a heap of tools to balance the books. Squeeze all the value you can from those apps by having them talk to each other. That's the real benefit of setting up accounting automation, whether you have a high volume of transactions or a small team.

And there are so many different workflows you can orchestrate. What will you build first? Head to the Zap editor to see what's possible.

Related reading:

This article was originally published in April 2021, written by Joanna Rutter. It was most recently updated by Steph Spector in November 2025.