When you start a business, one of the first pieces of advice you'll get is to find a good accountant, outsource your books, and focus on the parts of your business you're best at rather than fiddling with P&L statements. Is it good advice? Definitely. But after patchy experiences with accountants over the years, I'm one of those stubborn people who now insists on doing their own books—and user-friendly apps like Wave and QuickBooks make it easier than ever.

I've experimented with lots of accounting software over the years, including Wave, before ultimately settling on QuickBooks, which I've used for a few years now. Each app has a decidedly different target market. If you manage a large business with inventory and multiple employees, you can stop reading now—you probably want to go with QuickBooks.

But if you're a freelancer, solopreneur, contractor, or consultant, you could realistically go with either Wave or QuickBooks. In this article, I'll compare the strengths of each app and help you sort out which makes sense for you.

Table of contents:

Both apps make invoicing easy, but QuickBooks offers more advanced options

QuickBooks offers far more integrations, but both connect to Zapier

Wave vs. QuickBooks at a glance

Here's a quick summary of the key differences between these accounting apps.

Wave is best for US or Canadian freelancers needing a simple, low-cost invoicing and accounting solution. (Unfortunately, Wave is no longer available outside North America.)

QuickBooks is a better fit for medium to large businesses with more complex accounting needs and a higher budget.

Wave | QuickBooks | |

|---|---|---|

Pricing | ⭐⭐⭐⭐⭐ Solid free plan; Pro plan at $19/month for additional features like payment reminders, receipt tracking, and auto-importing bank transactions | ⭐⭐⭐ Much pricier. Starts at $38/month for Simple Start plan; Essentials at $75/month (3 users); Plus at $115/month (5 users); Advanced at $275/month (25 users) |

Ease of use | ⭐⭐⭐⭐⭐ Designed for simplicity; clean dashboard with intuitive navigation and menus that won't overwhelm beginners | ⭐⭐⭐ Clean and logical interface, but there are so many features it can get overwhelming; complex workflows and massive submenus can confuse beginners |

Invoicing | ⭐⭐⭐⭐ Easy invoice creation with templates and basic customization options; includes branding features like logos and accent colors | ⭐⭐⭐⭐⭐ Advanced invoicing with custom fields, SKU tracking, AI-powered autofill, granular payment options, late fees, and customer deposit handling |

Reporting | ⭐⭐⭐ Limited selection of report templates covering basic financial statements, taxes, and customer/vendor tracking | ⭐⭐⭐⭐⭐ Extensive reporting options like business overview, sales, expenses, and payroll; custom report builder functionality |

Inventory | ⭐⭐ No built-in inventory management; requires workarounds or third-party integrations | ⭐⭐⭐⭐⭐ Full inventory management (on the Plus plan and above) with product tracking, vendor info, purchase orders, and automatic updates from billing and invoicing |

Time tracking | ⭐⭐ No built-in time tracking; requires third-party app integrations | ⭐⭐⭐⭐⭐ Basic timesheet functionality included; advanced QuickBooks Time available for $20/month with real-time tracking, GPS mapping, and scheduling features |

Mileage tracking | ⭐⭐ No built-in mileage tracking; requires creative workarounds or third-party solutions | ⭐⭐⭐⭐⭐ Built-in mileage tracking with trip categorization, business/personal classification, and round-trip options |

AI features | ⭐ No AI features; focuses on budget-friendly simplicity over advanced technology | ⭐⭐⭐⭐⭐ Comprehensive Intuit Assist AI throughout platform with specialized agents for accounting, payments, customers, finance, and project management |

Integrations | ⭐⭐⭐⭐ Limited native integrations; connects with financial institutions and integrates with thousands of apps via Zapier | ⭐⭐⭐⭐⭐ 800+ native integrations including major eCommerce and payment platforms; robust third-party marketplace plus Zapier connectivity |

Wave is free; QuickBooks is decidedly not

If you're on a tight budget, it's a pretty easy choice between the two platforms, as you can use Wave for free. Wave recently updated its pricing plan, but its free invoicing and accounting software still comes with all the capabilities you need to get started, with additional paid services like payments, payroll, and bookkeepers. Meanwhile, Wave's $19/month Pro plan includes additional features that help businesses keep track of bank transactions, receipts, and payment reminders.

One important caveat: Wave is only available for US and Canadian users. Wave takes a blunt-force approach to enforcing this by blocking IP addresses outside North America from signing up, meaning that if you have a US or Canadian business but live elsewhere, you'll need a VPN.

QuickBooks is far more expensive than Wave. While it'll almost certainly meet all your small business's accounting needs, even the most basic plan, Simple Start, will set you back $38/month—twice as much as Wave's Pro plan.

If you need access for additional users, the $75/month Essentials plan gives you three users and adds recurring invoices, while the $115/month Plus plan increases the limit to five users, along with helpful AI workflow features like AI-powered reconciliation. For larger organizations, QuickBooks also has a $275/month Advanced plan offering access for 25 users with features like forecasting, custom user management and permissions, and even more AI goodies. QuickBooks also offers add-ons like payroll services, starting at $50/month, and time tracking, starting at $20/month.

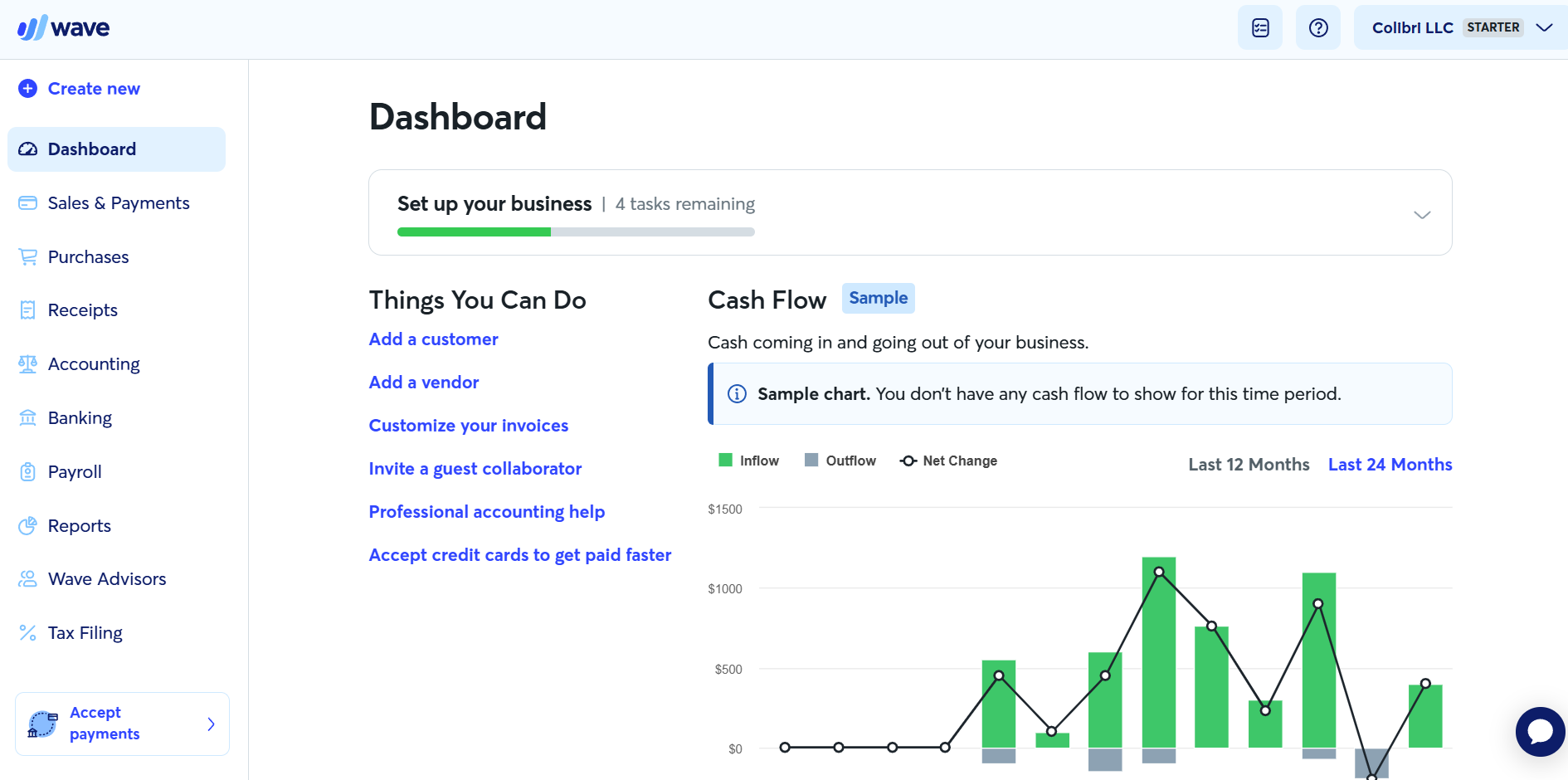

Wave is more user friendly

Apart from its affordable pricing, Wave has another big element going for it: ease of use. Accounting software is notorious for being complex, but Wave is built to be simple enough for business owners to navigate without getting overwhelmed.

As a freelancer or small business owner—even if you're not accounting-savvy—a quick look at Wave's dashboard and menu options will quickly tell you where you need to go. At a glance, you get shortcuts to common actions like Add a customer; useful reports for cash flow, profit and loss, and accounts payable; and self-descriptive menu items like Receipts and Purchases.

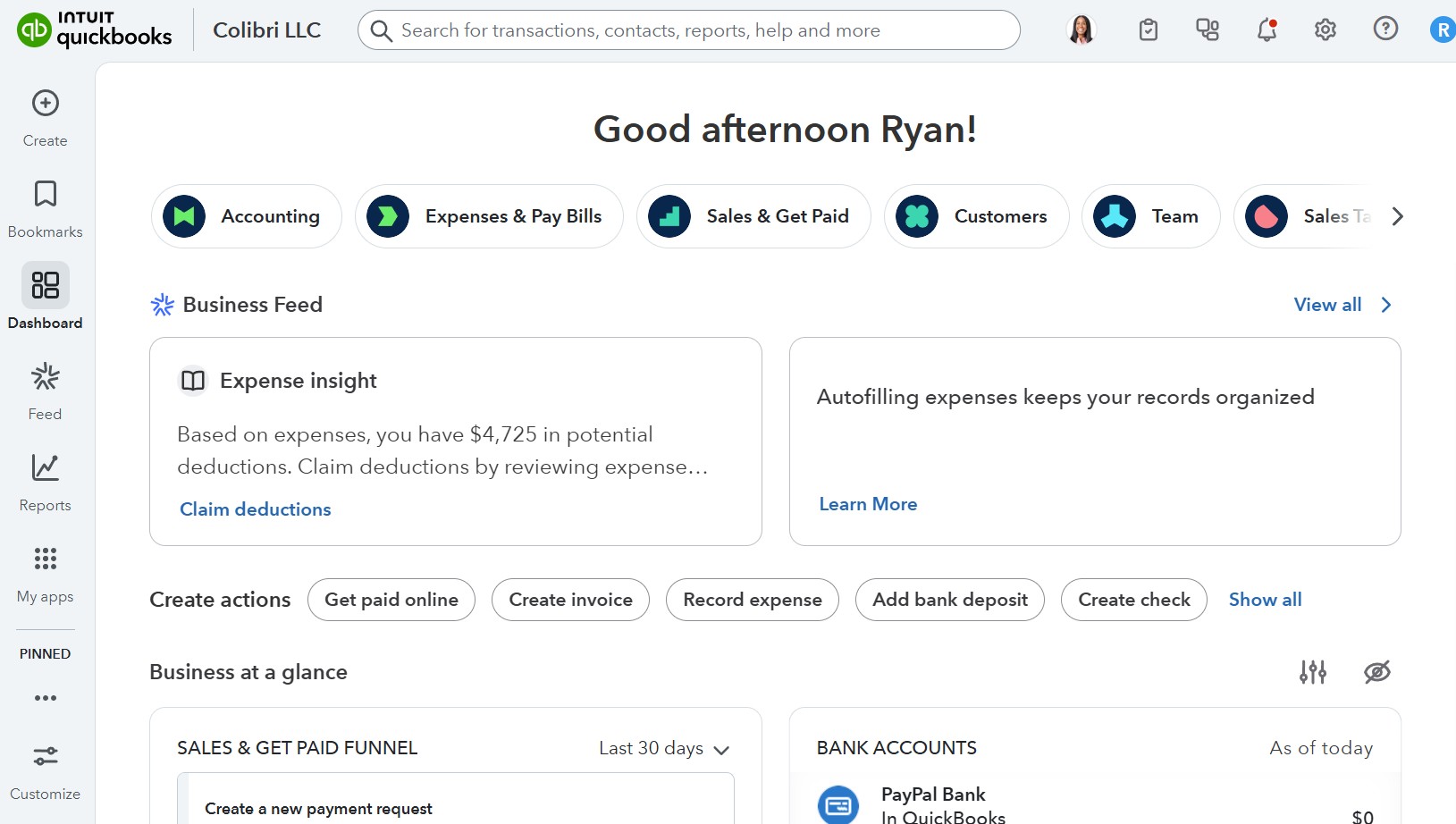

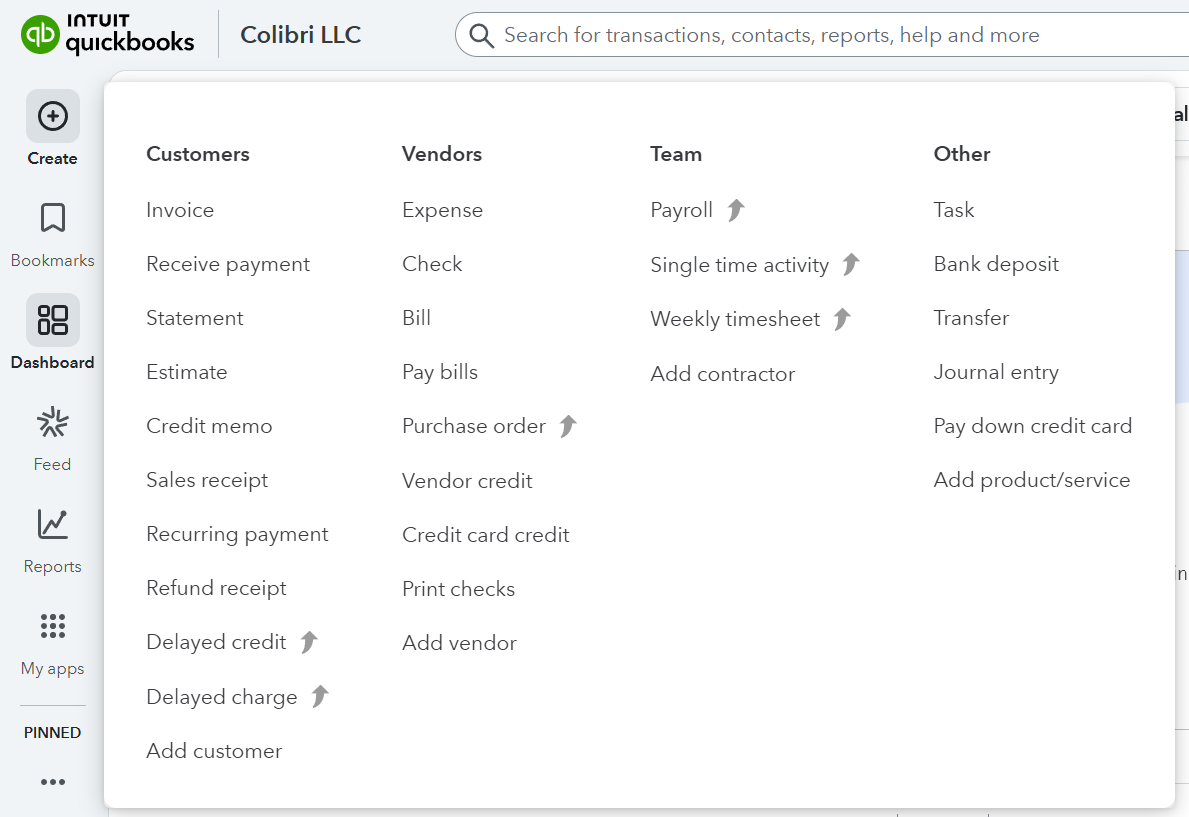

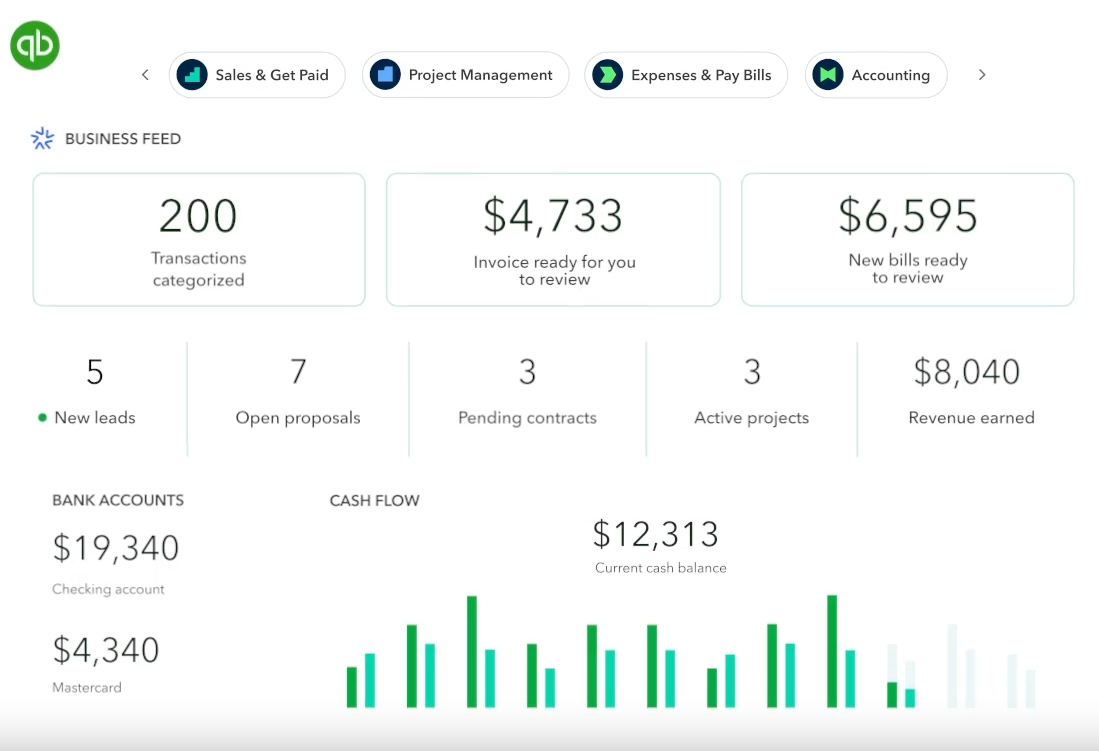

Despite a recent design update that's made it a lot cleaner to look at, QuickBooks is so jam-packed with features and data that, for accounting novices, there's really no way around the fact that it can still feel overwhelming. QuickBooks' dashboard, for example, starts with a friendly "Good morning!" before hitting you with AI insights, deposit trackers, and options to do everything from exploring lending options to tracking mileage.

QuickBooks has done a fine job of simplifying its menu and allowing you to customize what shows up there, but you still get hit with massive submenus like this one.

As a regular QuickBooks user, I've mostly figured out how to navigate all this, but there are still a few head-scratching choices that send me to Google or YouTube to figure out next steps.

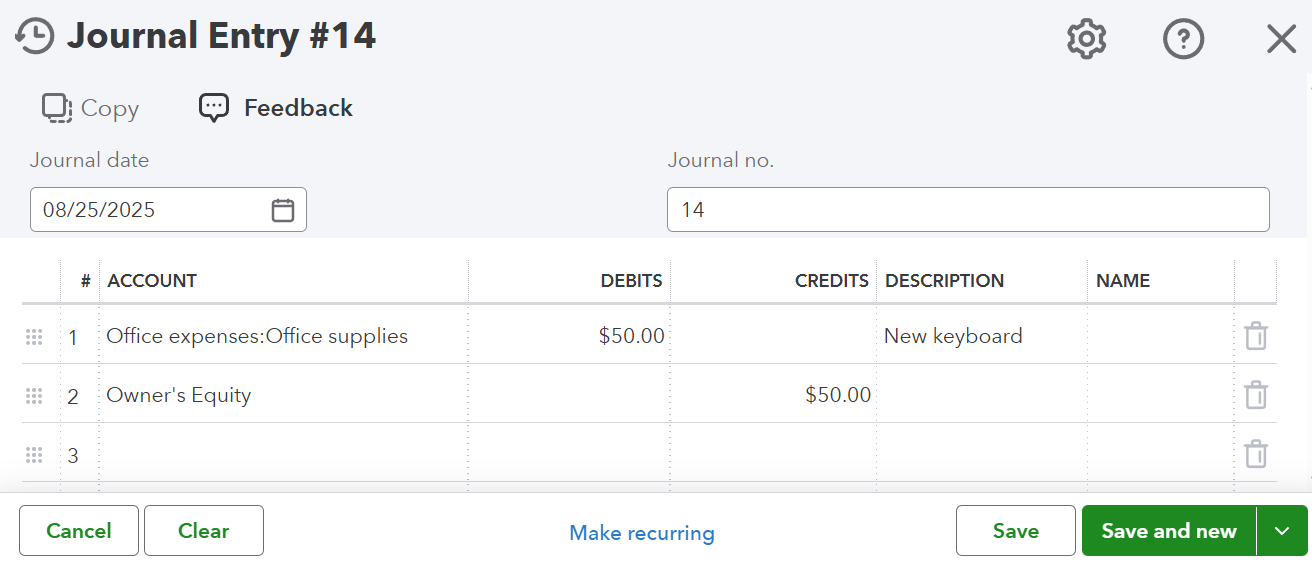

Here's one: as a business owner, I put all expenses on my business credit card, which is automatically pulled into QuickBooks for categorization. But occasionally, I need to retroactively add something as a business expense even though I paid for it with my personal card. It ought to be a simple matter of adding a new expense and setting the payment account as Owner's Equity, but instead, you have to follow an irregular journal entry process that uses owner's equity credits to cancel out personal expense debits. It probably makes sense to an actual accountant, but not to me.

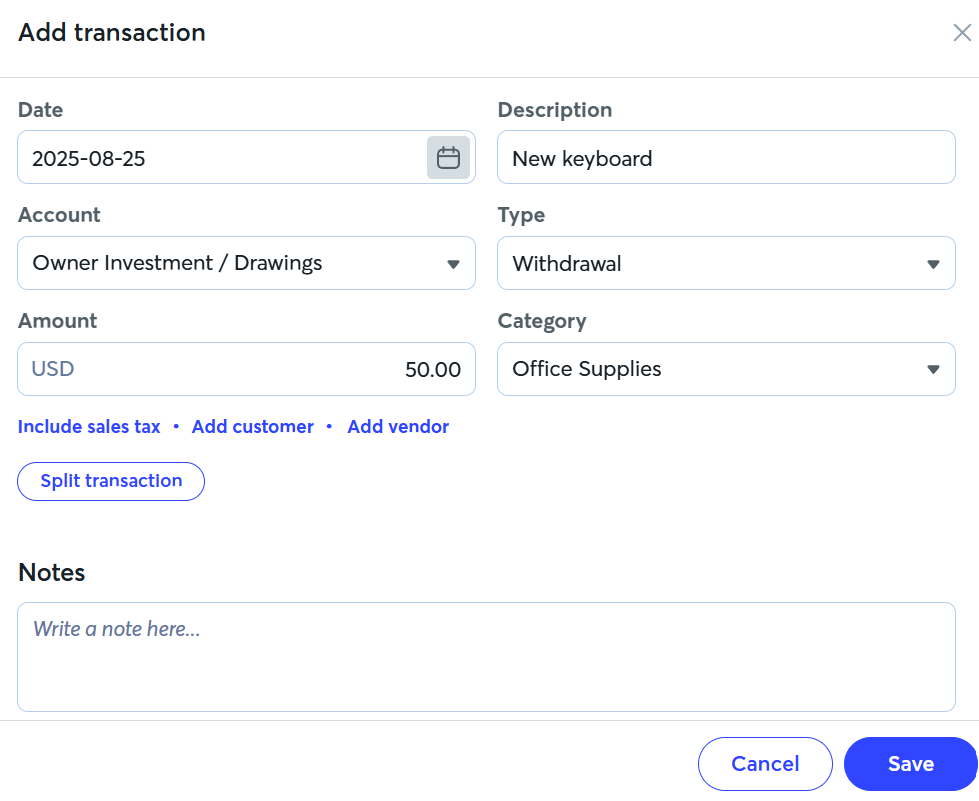

Wave makes this a whole lot simpler by just letting you follow the normal expense-recording process and tweaking the payment account.

Granted, apart from odd design choices like this one, QuickBooks is more complex than Wave because it's a lot more powerful. But if you don't have complex needs, why overcomplicate it?

Both apps make invoicing easy, but QuickBooks offers more advanced options

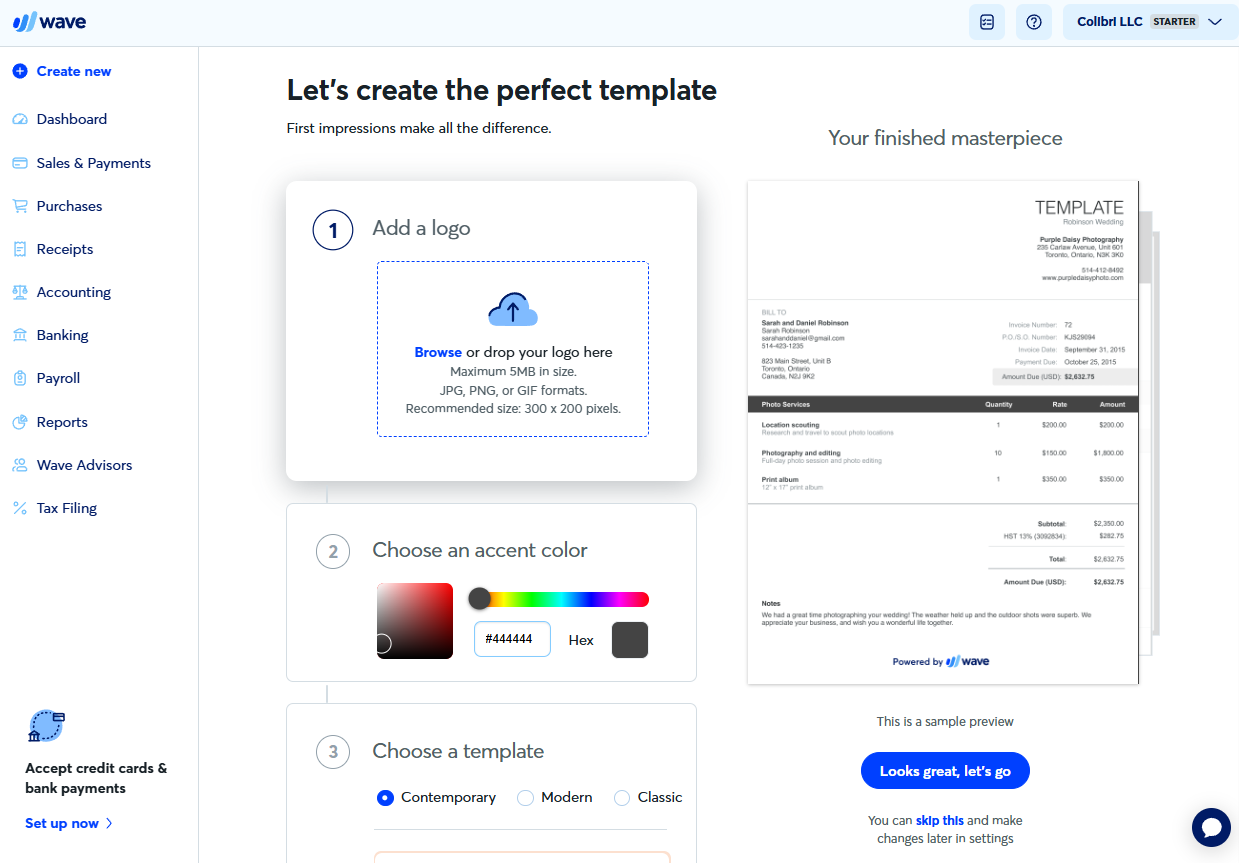

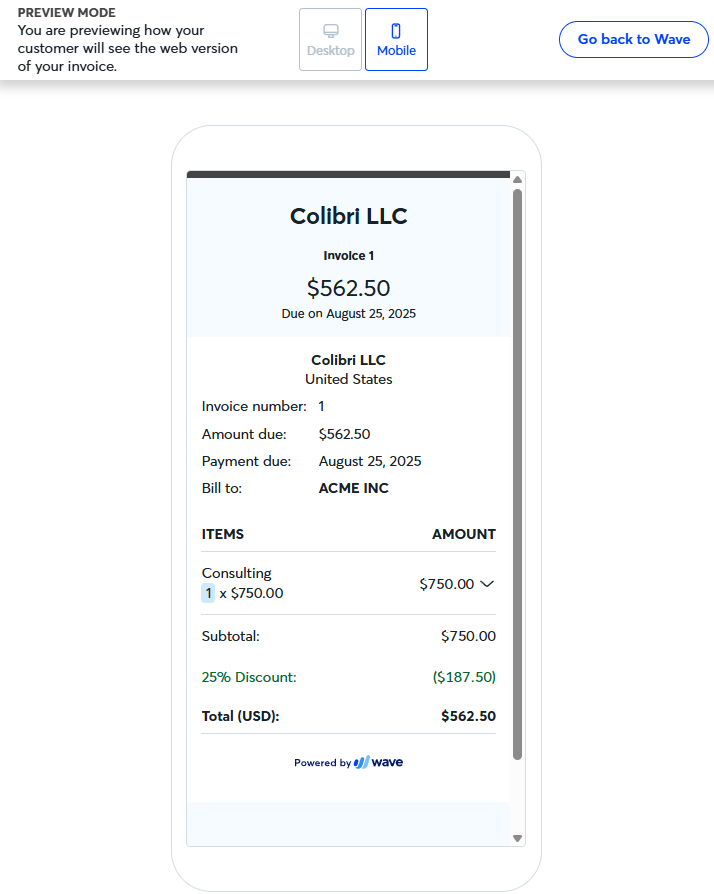

When you create your first invoice in Wave, you're guided to create a template first. The platform has a few template options to choose from, and even has the option to add branding like your logo and an accent color, which I thought was a nice touch.

It's super easy to create an invoice with Wave, and you get access to simple customization options like the ability to create discounts with a toggle for percentage or dollars. There's also a preview feature, so you can see how the invoice will look to your customers.

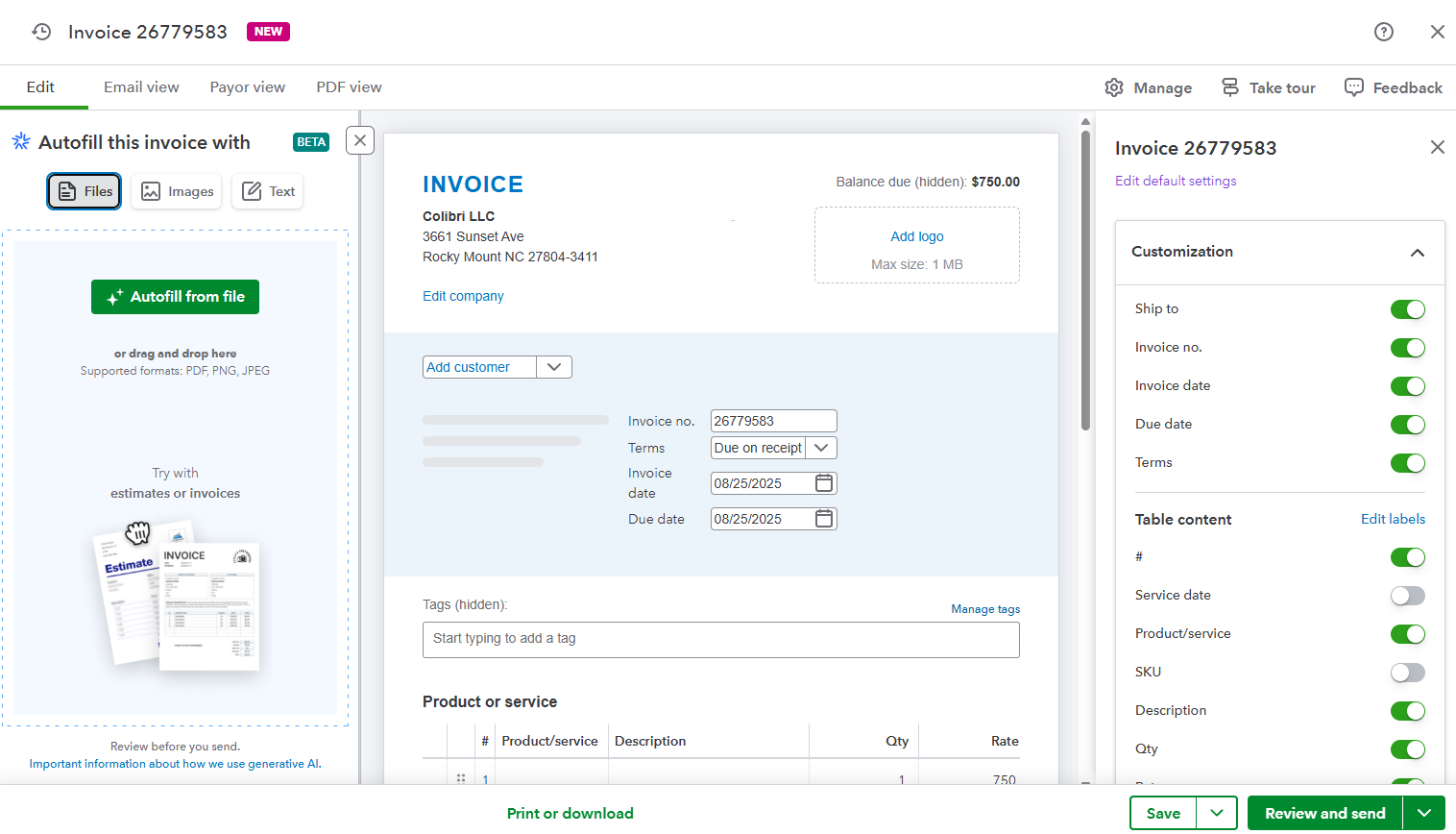

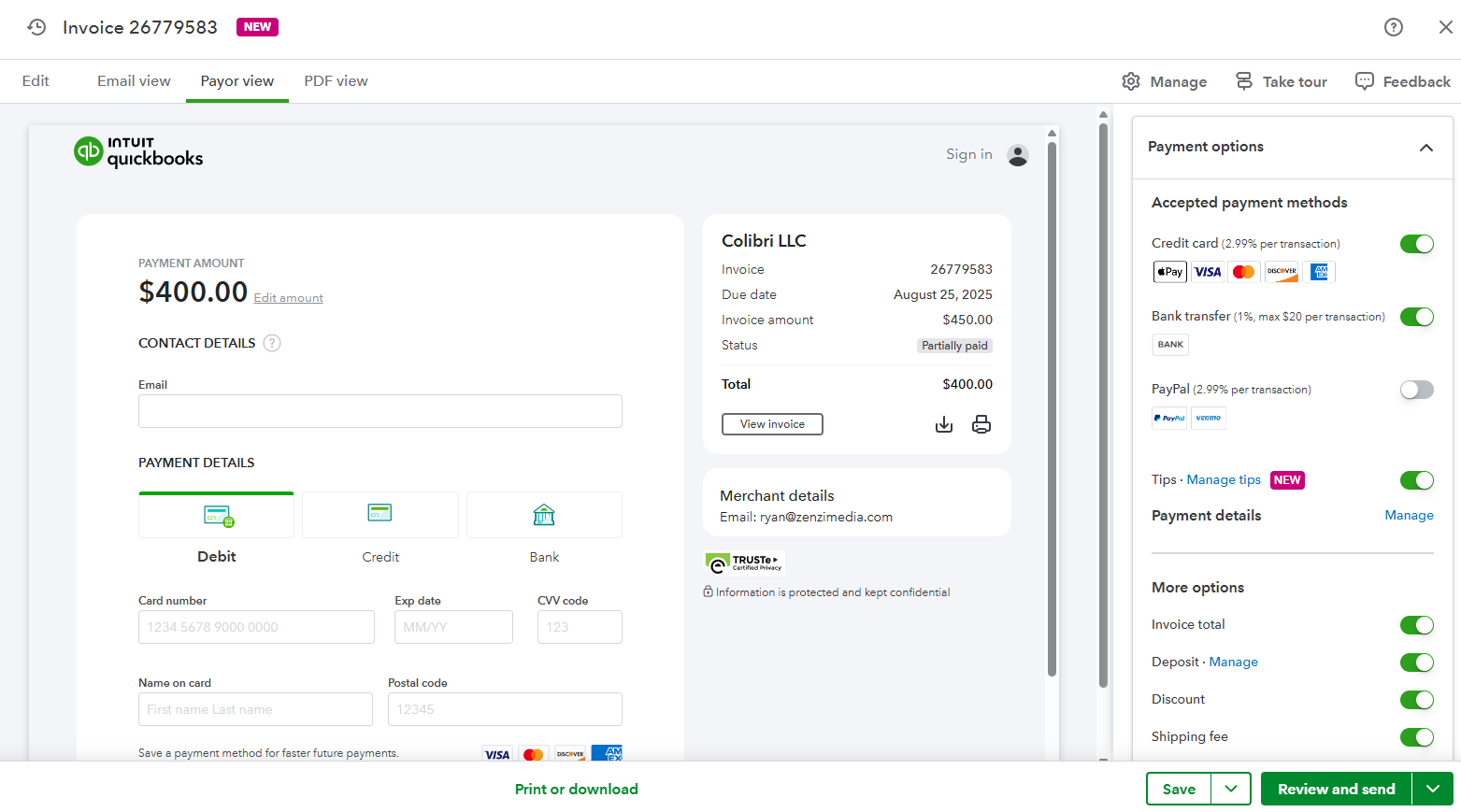

While Wave is fine for most freelancers sending invoices, QuickBooks has far more options for anyone with complex needs. Apart from standard fields like price, item description, and units, you can also add columns for SKU and service date, or create your own custom fields. QuickBooks also has an AI-powered autofill feature that lets you populate your invoice with data from files, images, or text.

With QuickBooks, you get especially granular control over payment options. Want to accept only PayPal and Venmo and let customers add tips to your invoice? No problem. You can easily handle edge cases, like tacking on extra shipping fees for far-away addresses or subtracting customer deposits from the final payable amount. If customers don't pay your invoice within the agreed upon time, you can even set up late fees and decide whether to offer a grace period.

QuickBooks boasts significantly more features than Wave

The extra cash you shell out for QuickBooks translates into a whole gamut of extra features. So not only do you get your money's worth, but these features also help support the complex needs of larger businesses.

Time tracking

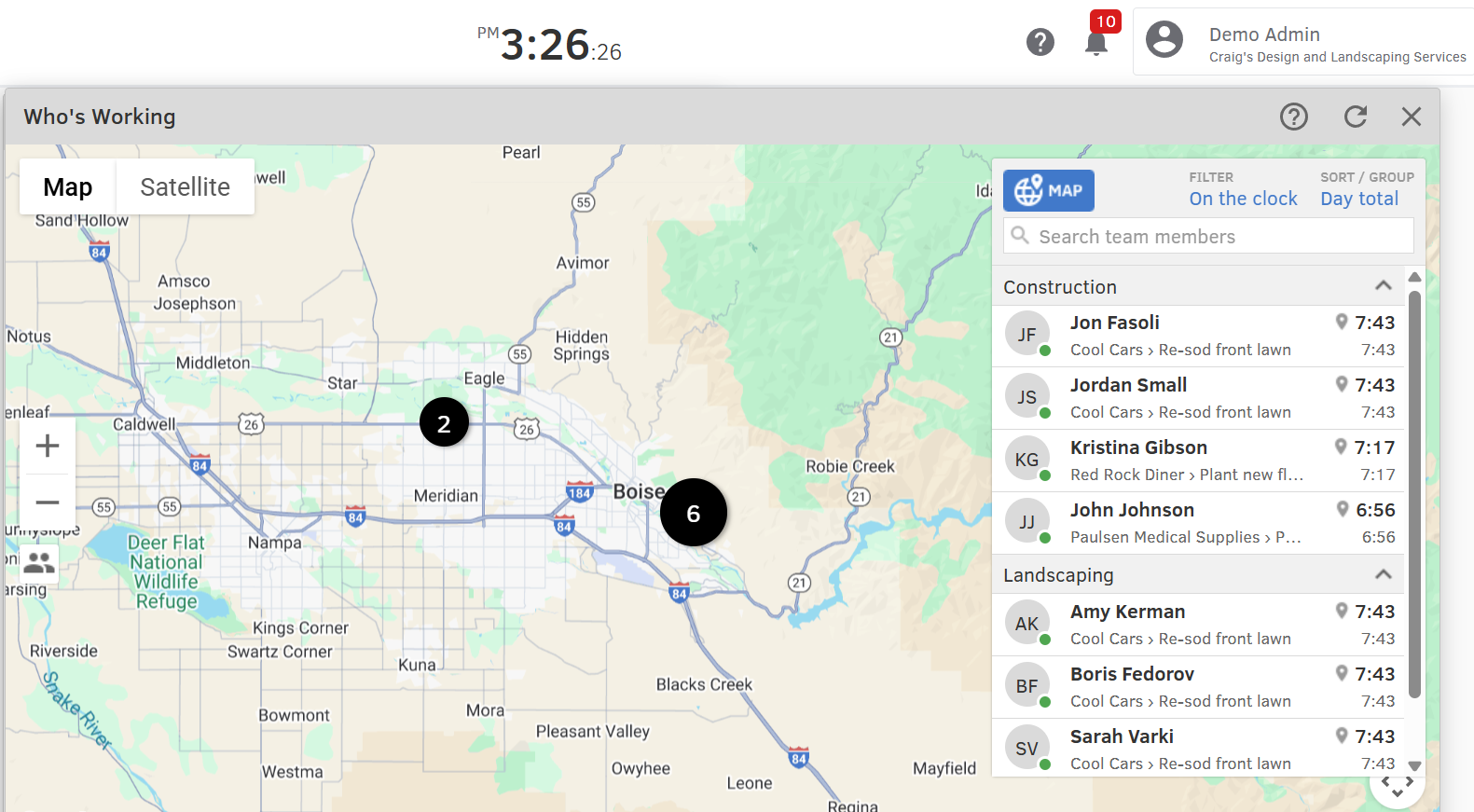

If you just want to add employee time records for invoicing purposes, you get access to a simplified version of time tracking on the QuickBooks Essentials plan and up. But if you're assigning shifts or managing employees in the field, you'll want to upgrade to QuickBooks Time, which starts at $20/month and carries an extra per-employee cost. While it's fairly pricey once you add everything up, if your goal is to centralize all your employee records, payroll, and accounting into a single system, QuickBooks offers a much better base of operations than Wave.

Employees can clock in and out for real-time tracking or retroactively add their time. There are also fields for billable hours to add specific customers and services. And if you have the mobile app installed on your team's phones, you can even get a bird's-eye map view of what job sites your employees are working on at any given time.

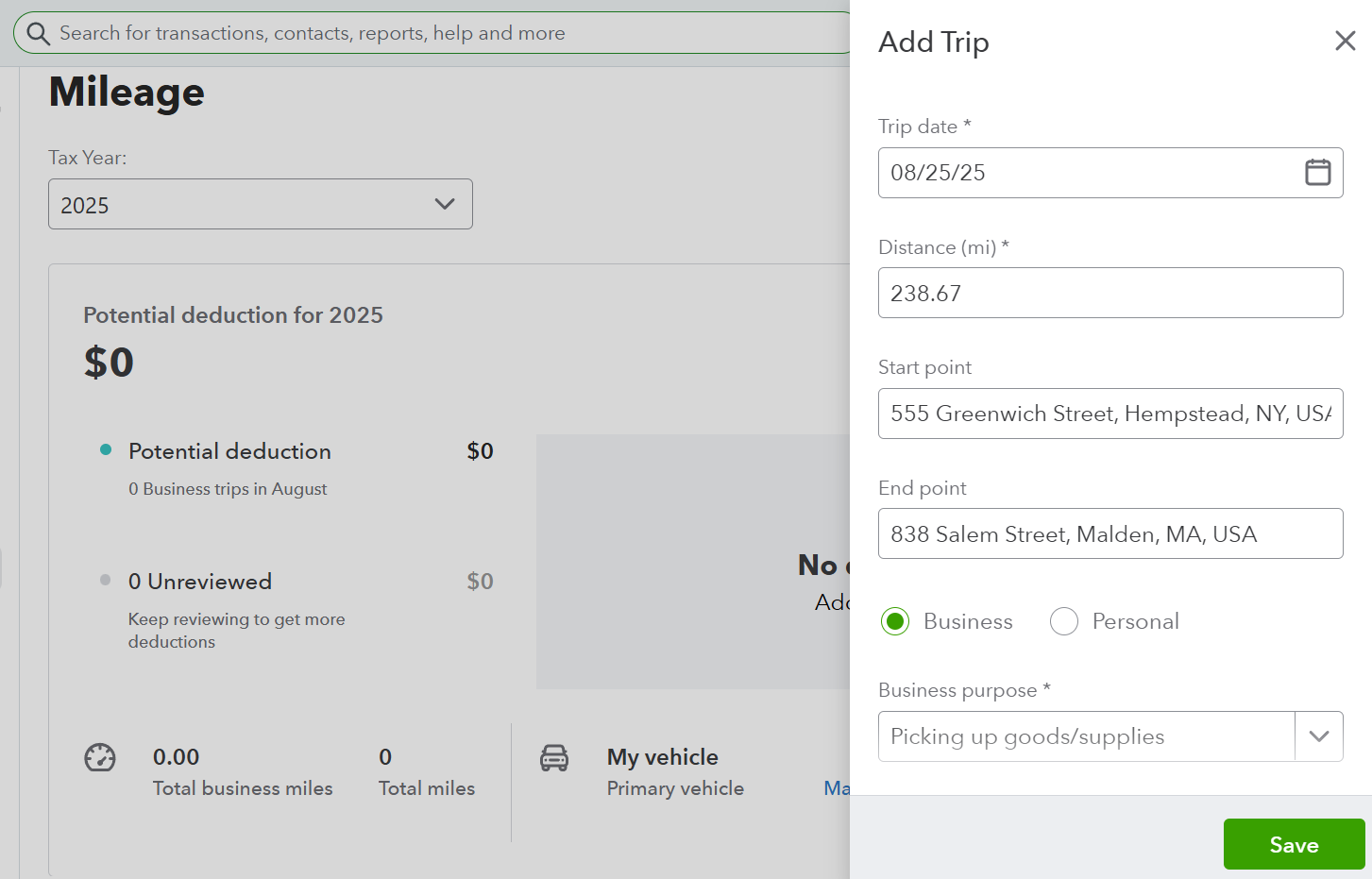

Mileage tracking

Mileage tracking is another feature built into QuickBooks that Wave doesn't have, unless you rely on a third-party integration. With this QuickBooks feature, your employees enter their trip information, and their trips then go into a bucket for your review, where you can confirm each trip as Business or Personal. There's also a convenient Round Trip toggle, so you don't have to manually enter two separate trips.

Complete with a dashboard displaying total miles, total business miles, potential deductions, vehicles, and mileage allowance, everything you need for employee compensation, tax deductions, and tracking mileage on business vehicles is there at a glance.

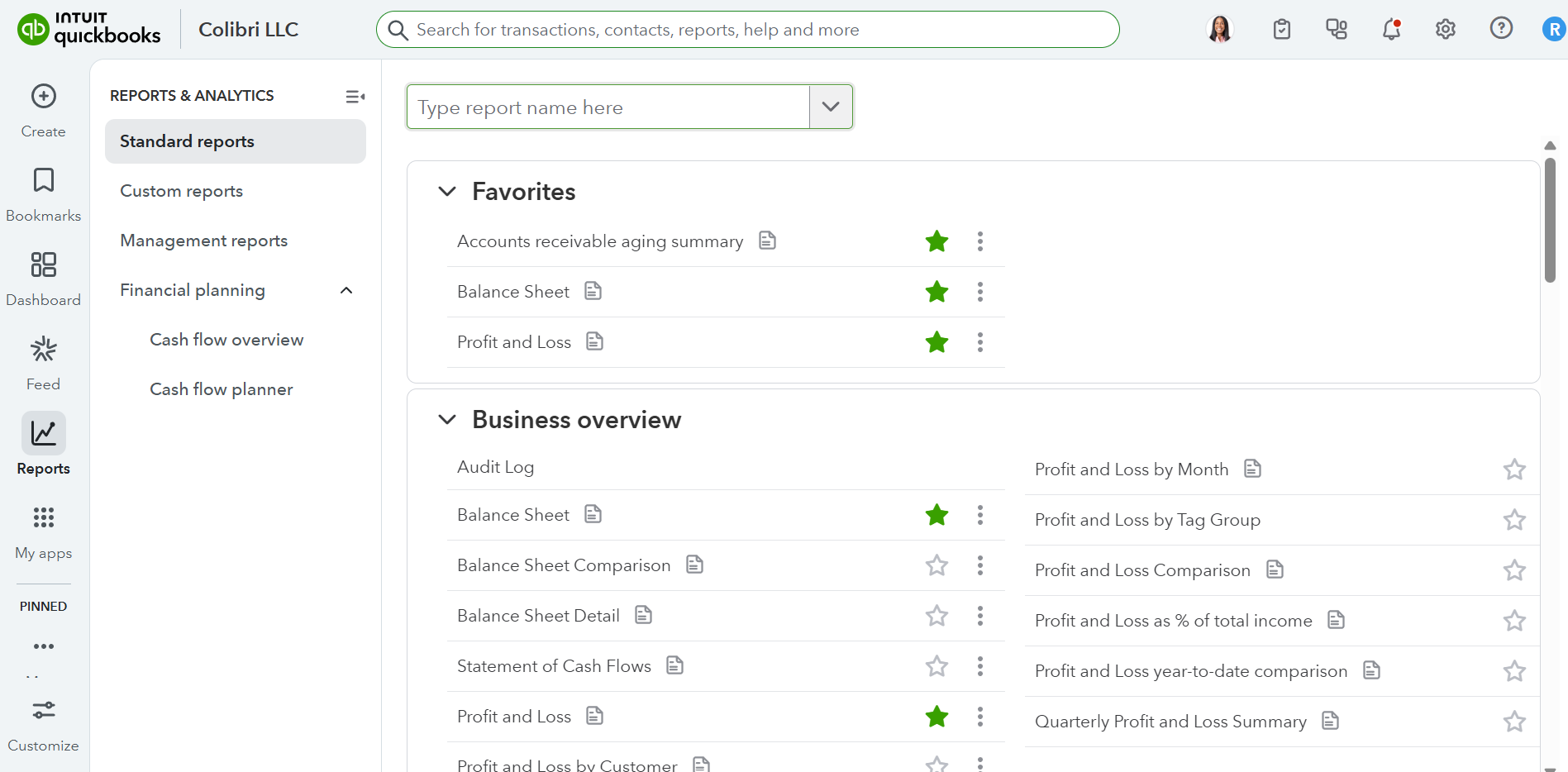

Advanced reporting

QuickBooks offers tons of report templates with categories for Business Overview, Who Owes You, Sales and Customers, What You Owe, Expenses and Vendors, Employees, For My Accountant, and Payroll. You can work off one of the many pre-made templates, or you can take one of those templates and customize it to meet your specific business needs.

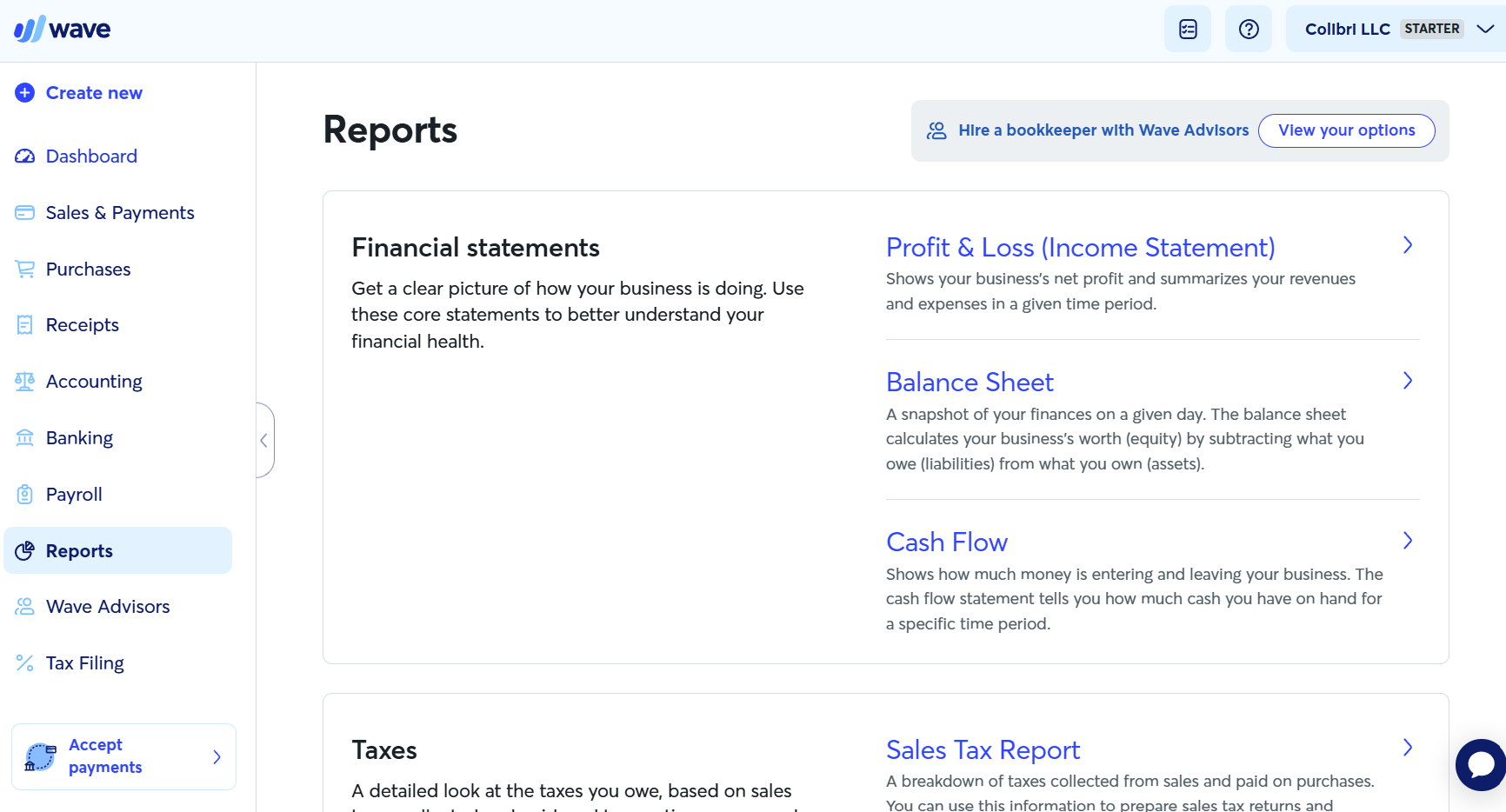

Wave offers its own set of report templates, but the list isn't nearly as extensive. You can still track financial statements, taxes, payroll, customers, and vendors, but the number of report templates is much more limited. And just like QuickBooks, payroll insights are only available with a paid add-on.

Inventory management

Inventory management is available in QuickBooks Plus and up and allows you to input all your products, with the option to add pictures, stock quantity, vendor information, and more.

You also have the ability to create categories with four levels of subcategories. Once you've set up your inventory, you can create purchase orders to send to vendors. The inventory tracker updates when vendors bill you for products and after you invoice customers. Again, with Wave, you have to use a workaround to track inventory.

Live chat support

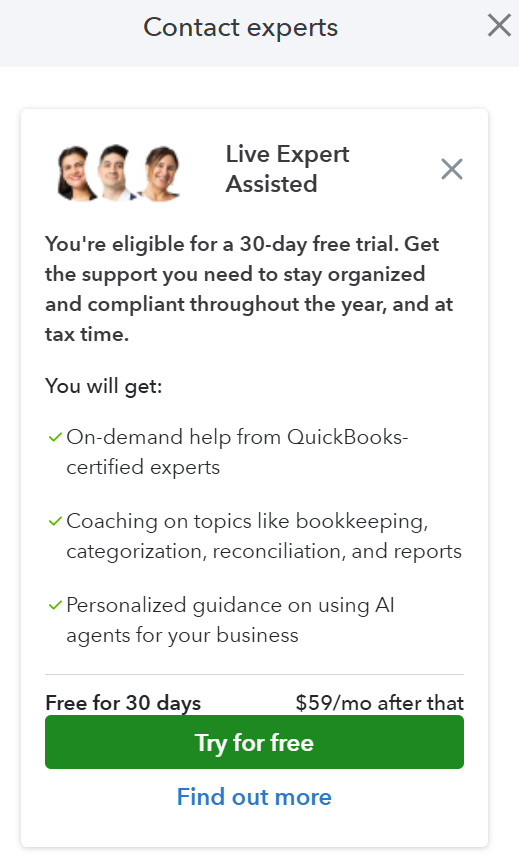

QuickBooks may be occasionally confusing, but it does have a live chat support feature to help you out of a pickle. You can get answers from a bot, guided tutorials, or actually chat with a real live human.

You can also pay for premium support if you're looking for a middle ground between doing your own books and hiring an accountant. QuickBooks Live, which costs $59/month, connects you to certified experts who can walk you through tricky accounting tasks like reconciliation.

Wave has a help chat, but it's restrictive. Users on the free plan can only access the automated chatbot and self-help resources, while those on the paid plan can access a human representative. But the only time you can talk to a human is Monday through Friday from 9:00 a.m. to 4:45 p.m. Eastern US time by chat or email. And when I happened to be testing Wave, those support hours were temporarily restricted even further to a mere three-hour window. Not ideal if you can't figure out how to process incoming payments over the weekend.

AI features

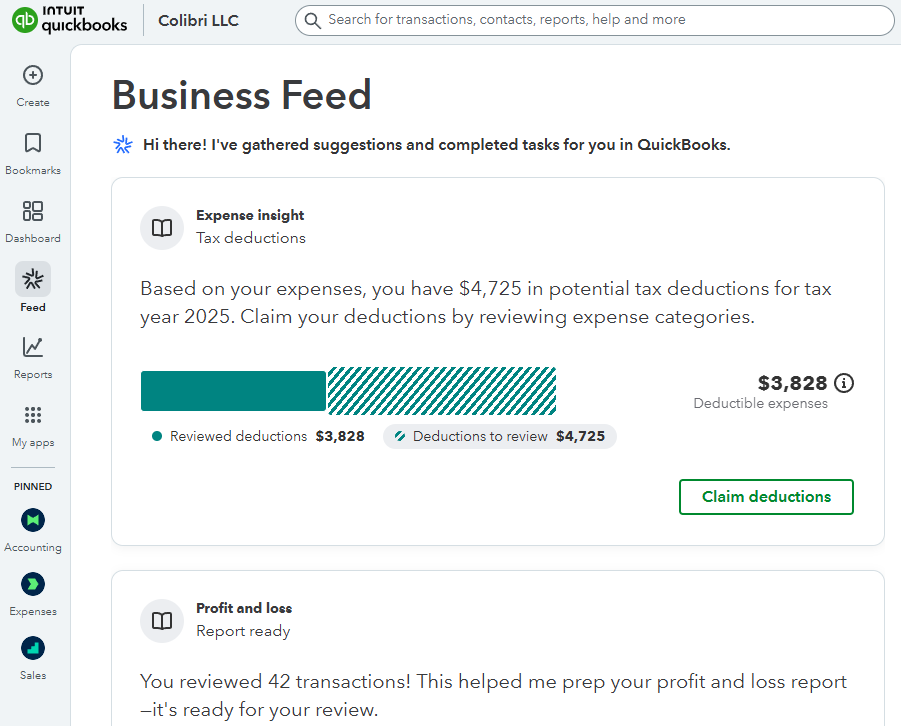

Earlier, I mentioned that QuickBooks has an AI-powered autofill feature for creating invoices quickly. That's just the start: QuickBooks has infused artificial intelligence throughout its platform via Intuit Assist, its AI-powered assistant. You can use AI for everything from reconciliation to reporting. (In fact, as you look through QuickBooks' feature comparison chart, it's hard to find something that's not influenced by AI.)

The central hub for AI insights is the Business Feed. When Intuit Assist completes activities—like suggesting tax deductions or preparing a P&L statement—they end up here for you to review and take action on.

Some of Intuit Assist's features are fairly indistinguishable from the automated accounting and machine learning features QuickBooks has had for a long time. Categorization and transaction matching are good examples: QuickBooks has automated these functions for years by learning from your manual activities or by following rules you set up proactively. Despite now being tagged as "AI" features, they still operate in pretty much the same way—personally, I haven't noticed any magical jumps in ability or accuracy.

Intuit Assist offers more disruptive AI features in the form of its Agents, which include:

Accounting Agent, which adds more context to your transactions and boosts categorization accuracy

Payments Agent, which manages your cash flow and helps you get paid faster

Customer Agent, which helps you follow up with leads and customers

Finance Agent, which provides AI-powered forecasts and financial planning

Project Management Agent, which helps you keep projects on time and within budget

Some of these features, like the customer agent and project management agent, demonstrate how QuickBooks is using its foothold in accounting to expand into other areas of business operations.

One drawback is that AI agents are only available on the pricier QuickBooks plans. You'll need to upgrade to the $75/month Essentials plan to try out the accounting and payments agents. And some of the most useful-sounding AI features, like AI-powered reconciliation, are only available on the $115/month Plus plan and above.

Unlike QuickBooks, Wave doesn't even try to compete in the AI arena. To a certain extent, this makes sense since Wave is focused on offering a budget-friendly solution. But it's still a little surprising given Wave's interest in making bookkeeping and accounting as simple as possible.

QuickBooks offers more integrations, but both connect with thousands of apps via Zapier

QuickBooks offers over 800 integrations, including direct connections with eCommerce apps like Shopify and payment apps like Square. Since QuickBooks has a bigger user base than Wave, there's a robust marketplace of third-party apps from independent developers that can help you manage accounting edge cases. For example, I use Stripe for recurring billing and invoicing, but syncing and reconciling those Stripe payouts manually—while also accounting for Stripe's transaction fees—is a pain. An app called Acodei helps me sync everything automatically.

Wave has a pretty limited selection of integrations. You'll probably be able to connect to any financial institutions you use, but for anything else, don't count on finding a native integration.

No matter which platform you choose, Wave and QuickBooks both integrate with Zapier, so you can create automations to spend less time on bookkeeping and more time growing your business. For example, you could use Zapier's AI orchestration to automatically categorize expenses as they come in and generate a weekly summary in Google Sheets or Slack, or extract key details from invoices and receipts and then log them directly into your accounting app.

Learn more about how to automate Wave or automate QuickBooks, or try one of these pre-made workflows.

Create QuickBooks Online customers with sales receipts for new Stripe payments

Zapier is the most connected AI orchestration platform—integrating with thousands of apps from partners like Google, Salesforce, and Microsoft. Use interfaces, data tables, and logic to build secure, automated, AI-powered systems for your business-critical workflows across your organization's technology stack. Learn more.

Wave vs. QuickBooks: Which should you choose?

Choose Wave if you're a US or Canadian freelancer looking for an easy-to-use accounting and invoicing app. If you just want to send invoices, get paid, and manage your books without a whole lot of extras, it's a great option, and you might even find that the free version of the software meets your needs. Unfortunately, if you're located outside North America, Wave isn't an option.

Choose QuickBooks if you have a medium or large business, or if you have a small business with more complex needs. For anything beyond simple invoicing and payments—like time tracking, inventory, advanced reporting, and automatic integrations with other platforms—QuickBooks is a better option. It's also the best choice for anyone located outside North America.

Wave vs. QuickBooks FAQ

Still stuck between the two accounting tools? Here are answers to the most common Wave vs. QuickBooks questions.

Does Wave connect to QuickBooks?

Wave doesn't natively integrate with QuickBooks, but you can use Zapier to connect Wave to QuickBooks. For example, you could automate workflows between the two platforms to create and send a QuickBooks invoice for every new Wave invoice—no code required.

Can you migrate from QuickBooks to Wave?

Yes, you can migrate from QuickBooks to Wave. You'll first need to delete your outstanding invoices and bills from QuickBooks. From there, you can merge your data by using the Add Journal Transaction functionality. It's important to note Wave won't have specific QuickBooks accounting history, so you should keep a copy of old transactions for your records.

What percentage does Wave invoicing take?

Wave charges a 2.9% + $0.60 fee for most credit card transactions, with a 3.4% + $0.60 fee for Amex transactions. The Pro plan waives that $0.60 fee for the first 10 transactions per month. In both plans, there's a 1% fee for each bank transaction and a $1 minimum fee for every invoice payment it processes.

On the other hand, QuickBooks charges fees based on how you process a transaction. It charges 1% for ACH bank transfers, 2.5% for using a credit card reader, 2.99% for online invoices, and 3.5% for keying in a credit card.

Related reading:

This article was originally published in July 2023 by Luke Strauss and has also had contributions from Ben Lyso. The most recent update was in August 2025.