When I hear the word "invoice," my gut reaction is anxiety. The bold, usually all-caps document title means I'm about to have to pay someone for something that already happened. It feels kind of like getting hustled by a time traveler.

But for those who are on the fruitful end of the billing table, an invoice is how you get paid for your products or work. To the uninitiated, it can sound like a complicated, legally-binding contract, but in reality, it's an easily customizable, simple document that clearly outlines what your client or customer needs to pay you, what they're paying for, and when you need to be paid.

To cover all your bases, we've designed a dozen simple invoice templates you can download and edit to fit your exact billing needs.

12 free invoice templates

Not every industry handles payments the same, so my team and I made a dozen template options you can access on Google Docs to help you set just the right foundation for requesting payment.

The first template below should work great for just about any industry and product or service type, and you'll notice many of these templates have only slight variations on it. Remember, each of these is completely customizable, so if your use case isn't represented below, you can pick the template that comes closest and then tailor it to your needs.

1. Standard business invoice template

This is a standard invoice for small businesses and freelancers, meaning you use it when you want to get paid for your goods and services. It works well for general invoicing, but not so much for a specialized invoice like a credit or debit invoice.

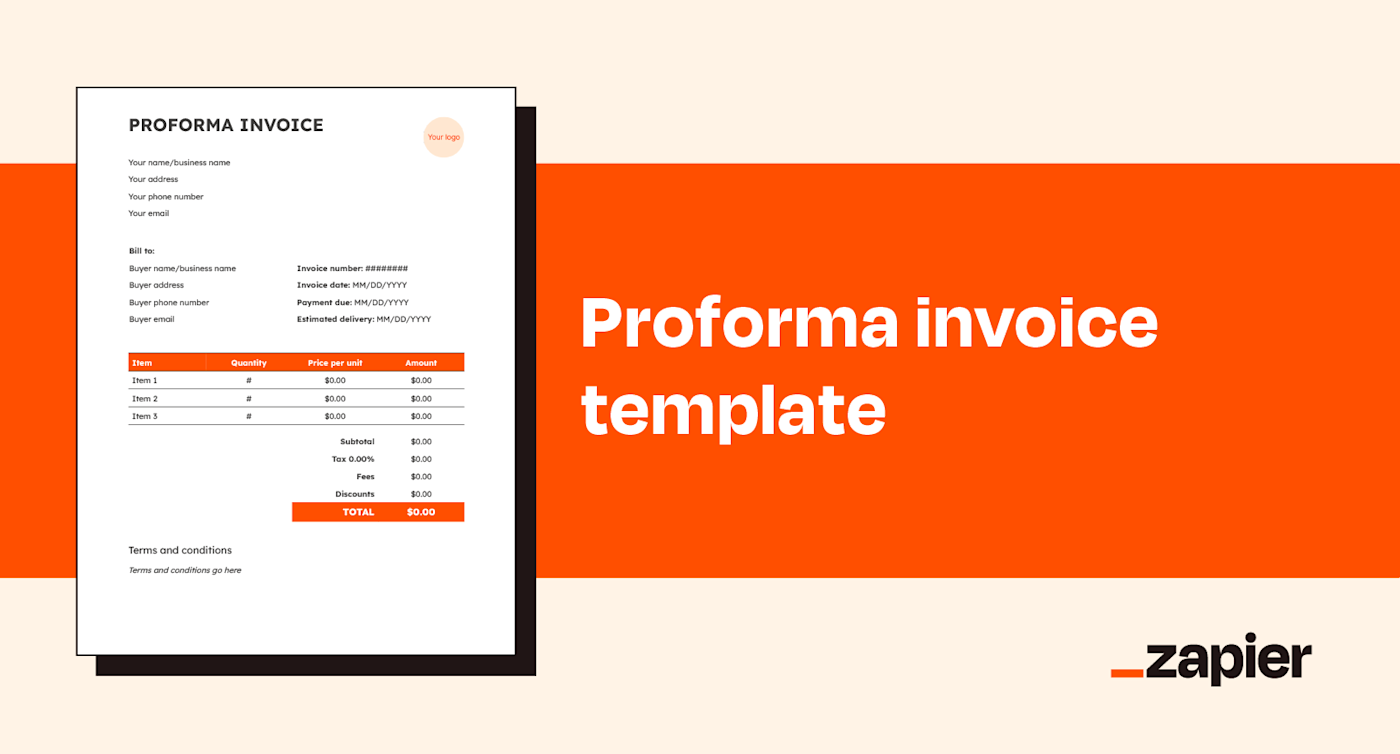

2. Proforma invoice template

A proforma invoice is an invoice for goods or services that the client needs to pay before you deliver. This is very similar to the standard invoice, but it's important for proforma invoices to be marked as such and to include the estimated delivery date—both of which have been added here. It's also a good idea to include estimates about timelines.

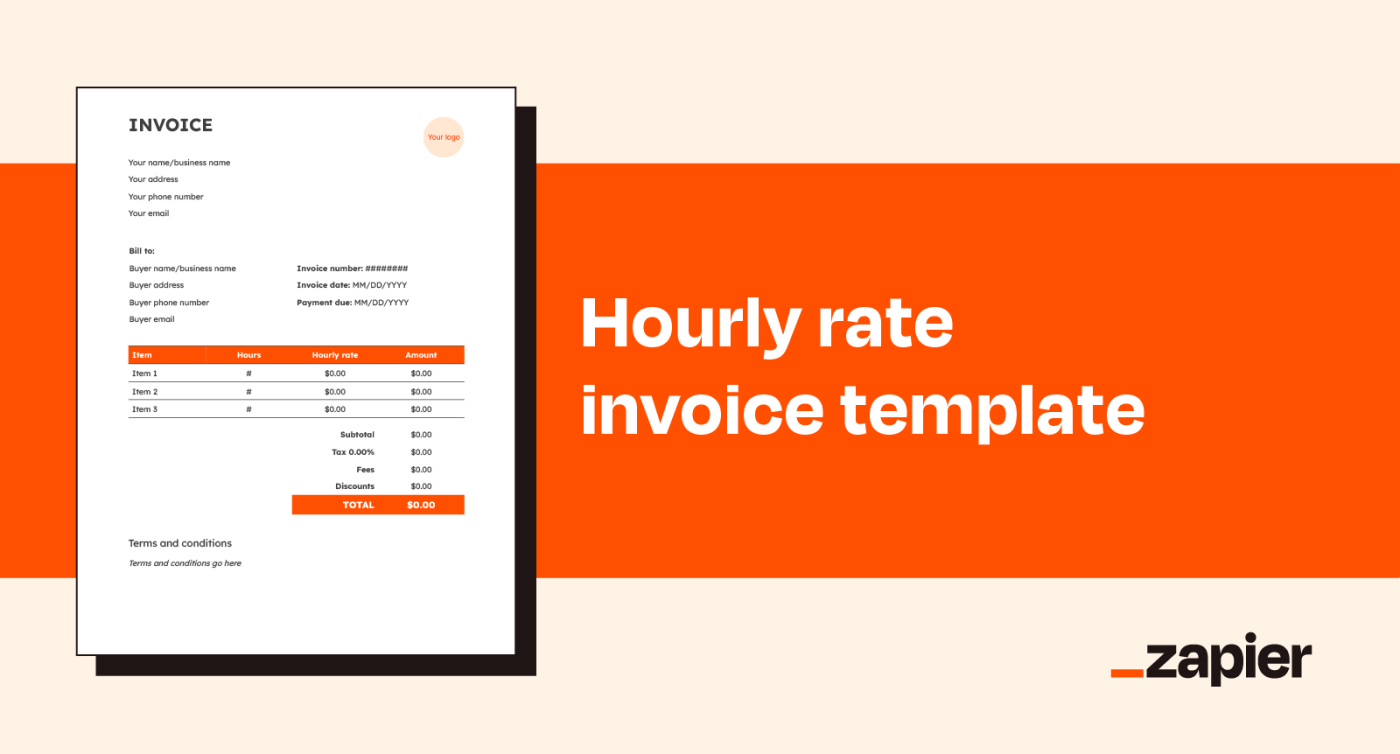

3. Hourly rate invoice template

This variation on the standard invoice is structured for charging hourly rates rather than product quantities. Hourly rate invoices can be used the same way standard invoices are, except you'll enter hours and price per hour instead of quantity and price per unit.

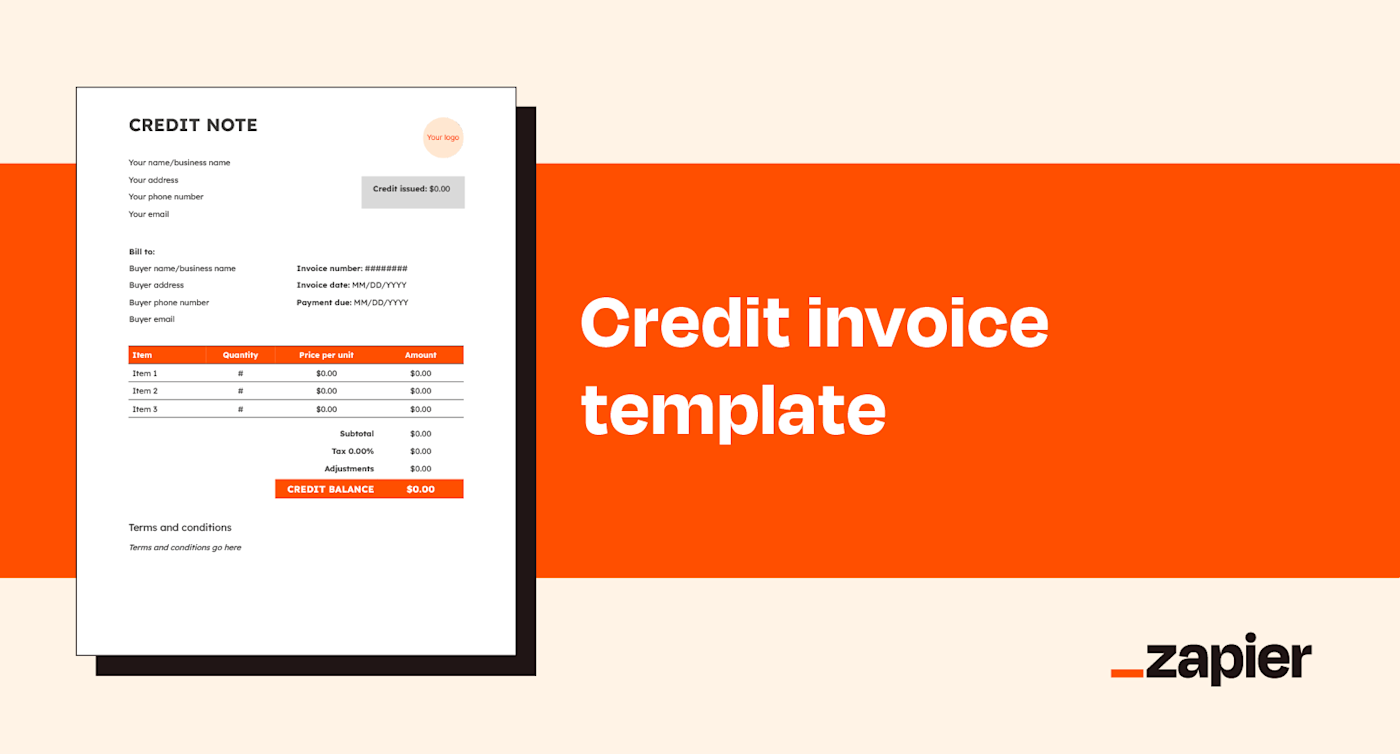

4. Credit invoice template

Usually, you use an invoice to request funds from a client. But if you owe your client money for any reason, you may find yourself using an invoice to pay your customer. A credit invoice (or credit note) is a way to communicate returns to a client due to things like previous payment overages, rebates, accidental charges, or refunds.

5. Debit invoice template

You'll need to use a debit invoice (or debit note) if you have to bump up the amount your client owes you for an existing (but otherwise unchanged) order. This allows you to maintain a paper trail of charges if the scope of the project grows, your rates increase, there was an error in your original invoice, or your estimate proves to be too low.

6. Mixed invoice template

Sometimes, updating invoiced fees isn't as easy as adding or subtracting. When you've got to amend your original invoice with both positive and negative adjustments, you need a mixed invoice. Think of it like a combination of credit and debit invoices.

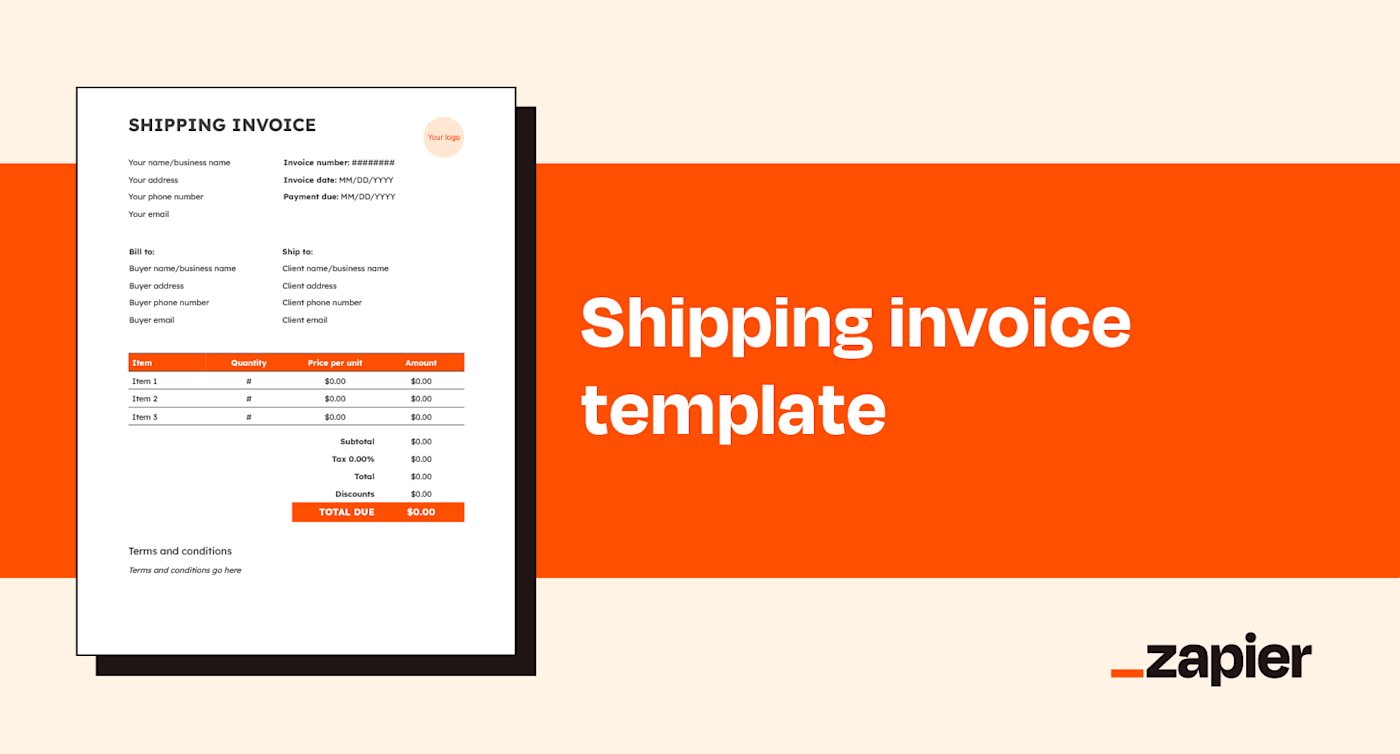

7. Shipping invoice template

If you deal in physical goods that need to be shipped to your customers, it's a good idea to have a separate "ship to" section for your customers in case this address is different from their billing address.

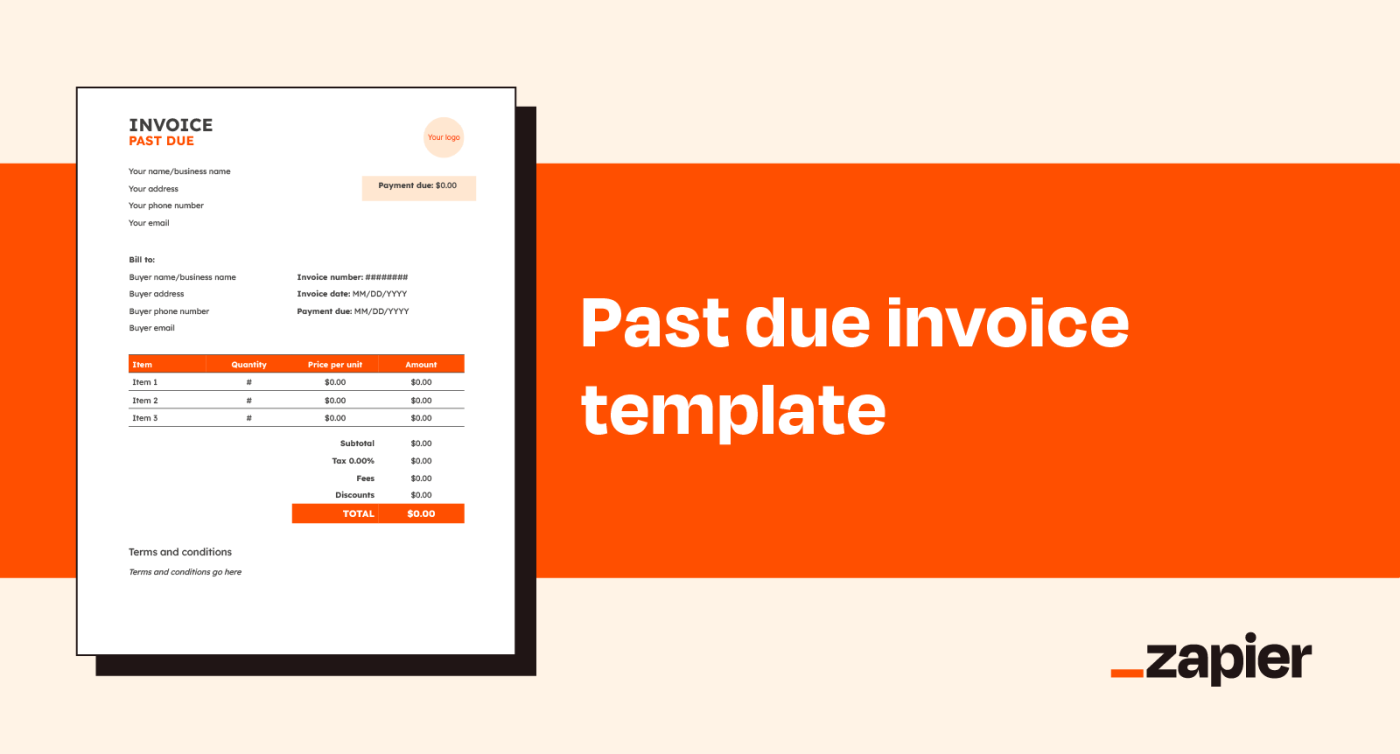

8. Past due invoice template

Unfortunately, even perfectly executed invoices don't always lead to on-time payments. This past due invoice is a variation on the standard invoice but includes a bold "past due" notice. To mark a specific invoice type as past due, you can combine this with any of our other templates by copying the notice text and pasting it into another template doc.

9. Timesheet invoice template

Similar to an hourly rate invoice, a timesheet invoice is used to request payment based on time rather than quantity. The difference is, timesheet invoices also document time delegation with clock-in/clock-out fields. This invoice type gives the client a greater amount of transparency to see how the work they're paying for breaks down.

10. Freelancer/contractor invoice template

Though many of these templates will be useful for freelancers and contractors, this dedicated invoice template is ideal for those who need to request payment on multiple one-off projects within a single invoice. Rather than breaking line items into specific hourly rates or quantities, this simple invoice allows you to list individual tasks or projects as their own billable items.

11. Project-based invoice template

For some projects, it can be useful to itemize specific tasks that fall under a single project umbrella. This can be useful for adding a layer of transparency around billing for complex projects that contain multiple tasks and deadlines.

12. Commercial invoice template

In the realm of invoices, commercial invoices are completely different animals. These are used for international shipping, so they call for a lot more information than any other invoice in this article because they deal with the intricacies of customs, import taxes, and foreign currency exchange. Our template was adapted from the International Trade Administration.

How to create an invoice using an invoice template

To create an invoice, start by making a copy of one of these editable templates. (You'll be prompted to do this when you click their download links.) We made each template a Google Doc, so you can easily edit them and then download them in your preferred format, including PDF.

Ready to start filling yours out? Here are some tips on what to enter into each invoice field.

Invoice title and logo

When creating an invoice, it should include a clear "Invoice" title in case you need to use it for legal documentation. It'll help you keep your invoices separate from other documents, too.

You can also include a logo if you want, but it's not necessary. Place your logo under the "Invoice" title or create a borderless table to put it on the right of the header.

Your business name and contact information

Make sure your invoice includes your full business name—or your name if you're a contractor. Add your contact information, including your address, email address, and phone number. Include these details for your and your client's accounting and legal documentation.

Buyer's name and contact information

Enter your client's name and contact information here. Include as much contact information as you have, and don't be afraid to ask your client if you need more details. If you're billing a specific person at a company, you can list the business name, then the person's name.

Invoice number

Each of your invoices should have a unique identifying number for easier tracking. It doesn't have to be anything profound if you have a simple billing system.

For example, you might use the date of the invoice bill and the order of the invoices you send that day. The first invoice sent on 9/6/2024 would have the number "09062401," and the second would have "09062402." Find a numbering system that works for you.

Invoice date

Add the date that you send the invoice. (Keep this in mind especially when you create invoices in advance.)

If you're billing a client in another country, use a date format that makes sense for both of you. The template has the American MM/DD/YYYY format, but feel free to write out the month in the date for clarity. In other words, you could enter the date as "September 6, 2024" instead of "9/6/2023."

Payment due date

Here's where you list when your client's payment is due. Payment terms vary among industries, but here are some common ones:

Net 30/60/90: "Net" followed by a number means that the buyer should pay within that number of days, regardless of business days or holidays. A net 30 invoice sent on February 28 would have payment due on March 30.

End of month (EOM): Some businesses combine net payment terms with "EOM," meaning payment is due that many days after the last day of the month. A net 30 EOM invoice sent on March 15 would have payment due on April 30.

On receipt: The buyer should pay the invoice as soon as they receive it.

If you aren't sure what payment terms to use for your invoice, ask a fellow freelancer or business owner in your industry. Still building connections? Join an online community for your profession and ask around.

Line items

In this section, you describe and quantify the products and services you're billing for. If you deal in services, there's some leeway in how you create line items. You could make one for each project, project component, or add-on service.

Each line item on the template includes these sections:

Item: A quick description of the product or service you're billing for

Quantity: The number of that item you provided

Price per unit: The price per individual item

Amount: The total amount per item, calculated by multiplying price per unit by quantity

Subtotal

This is the total amount of your line item charges before taxes, discounts, or additional fees.

Taxes

Depending on the nature of your work, you may have to include taxes in your transaction. List the percentage tax you're adding and how much that percentage adds up to. Feel free to delete this table row if you never charge taxes.

Fees and discounts

Put any fees and discounts into these fields, such as a late fee or early payment discount.

Total

Here's where you add up your subtotal, taxes, fees, and discounts to calculate the total your client owes you.

Terms and conditions

Note any additional terms and conditions here. Some examples include:

Payment terms, including net 30/60/90, EOM, payment on receipt, and payment in advance

Terms of sale, such as who covers taxes and duties

Warranty terms

Return policy

Late payment fees

Discounts for early payment

Accepted payment methods

When do you need to send an invoice?

You should send an invoice after you complete a billable project (which comes after completing a sales order). Depending on your and your client's preferences, you might send one right after completion, every two weeks, or every month.

With invoice timing varying based on client and project, don't let yourself forget to send one. Use Zapier to automatically fill out an invoice when you mark a task done in your favorite project management app.

Tips for how to write an invoice that works

Once you finish filling out your template, there's more you can do to ensure a smooth invoicing process. Here's how to do an invoice in a way that raises your chance of getting paid on time:

Get on the same page: Outline your preferred payment terms with your client at the beginning of your working relationship. Include them in your contract or statement of work.

Stay organized: Designate a digital or real-life folder for invoices with sub-folders for each client. Within each folder, organize your invoices by invoice number or date.

Decide how you'll take payment: Talk to your client about payment methods that will work best for both of you. Payment services like PayPal and card payments often have extra fees for the seller. Meanwhile, electronic bank payments don't charge the seller, but they take extra work on the client's end.

Use in the right format: PDF is usually the agreed-upon format for online invoicing. In Google Docs, go to File > Download > PDF Document (.pdf) to download your invoice as a PDF.

Follow up: Don't be afraid to follow up with a client if they don't pay within your agreed-upon payment period. You aren't being pushy for asking for the money you're owed.

How to automate invoicing

Want to make receiving client payments even easier? Just automate your invoicing process. If you find yourself creating a lot of invoices from a Google Docs invoice template (like the 12 in this article), you can use Zapier to supercharge them. Try autopopulating a Google Doc template, or use a single template to automatically create new documents.

And when it's time to use a purpose-built invoicing app (there are free options, too), you can do even more to automate your invoicing workflows, so you spend less time on invoices and more time doing the work that gets you paid. With Zapier, you can connect your invoicing apps to all the other apps you use, so you can do things like automatically create and log invoices, add contacts to your invoicing tool, and get payday notifications.

Learn more about how to automate your invoicing, or try one of these pre-made workflows:

Add new QuickBooks Online invoices to Google Sheets spreadsheet rows

Create Wave customers from new changes to properties of HubSpot contacts

Create new QuickBooks Online customers from newly won Proposify proposals

Update Pipedrive deals when new Quickbooks invoices are paid

Invoice creation FAQ

How do I create my own invoice?

To create your own invoice, start with a template (like the 12 in this post) or a blank Google Doc. Enter your name or business name and contact information on the top-left, then add your company logo if you have one on the top-right. Below your information, add your buyer's name and contact information. To the right of this, add invoice number, invoice data, and payment due date. Below this, add a table with enough rows for each line item you're billing for, and columns labeled Item, Quantity, Price per unit, and Amount. Below the table justified to the right, add fields for subtotal, tax, fees, discounts, and total. Finally, add applicable terms and conditions below that.

How can I get a free invoice template?

You can get a free invoice template by downloading any of the 12 options on this very page. You're welcome. You should also be able to access a variety of template options built into Microsoft and Google Workspace.

Does Excel have invoice templates?

Microsoft has several generic invoice templates you can load into Excel and Word.

How do you write a simple invoice?

To write a simple invoice, create a document that includes your and your buyer's name and contact information, an invoice number and date, payment due date, descriptions of the items/services you're providing along with costs and quantities, a subtotal of those fees, applicable taxes and fees/discounts, and a total amount due.

Related reading:

This article was originally published in April 2022 by Melissa King. The most recent update was in December 2023.