Technology companies have done exceptionally well over the past few years—experiencing huge gains during the pandemic as many companies and consumers turned to technology to provide contactless ways to communicate and do business. But now, rumors of a recession threaten those gains, and even big tech firms say they're bracing for tough times.

How likely do most technology companies feel a recession is—and are they prepared to weather the storm? Zapier surveyed over 500 technology founders, executives, and employees at tech companies to find out. We also explored whether venture capital (VC) funding, burn rates, and annual recurring revenue (ARR) impacted how well prepared or unprepared firms felt they were to survive a recession and what actions companies planned to take to survive.

Here's what we discovered.

Key findings

88% of technology companies think a recession will likely occur in the next year.

1 in 5 technology companies feel they are not well prepared for a recession.

1 in 4 technology companies don't think they'll be able to survive more than a year-long recession.

Over half of technology companies don't think they'll survive a 2+ year recession.

98% of tech companies will take action to help survive a recession.

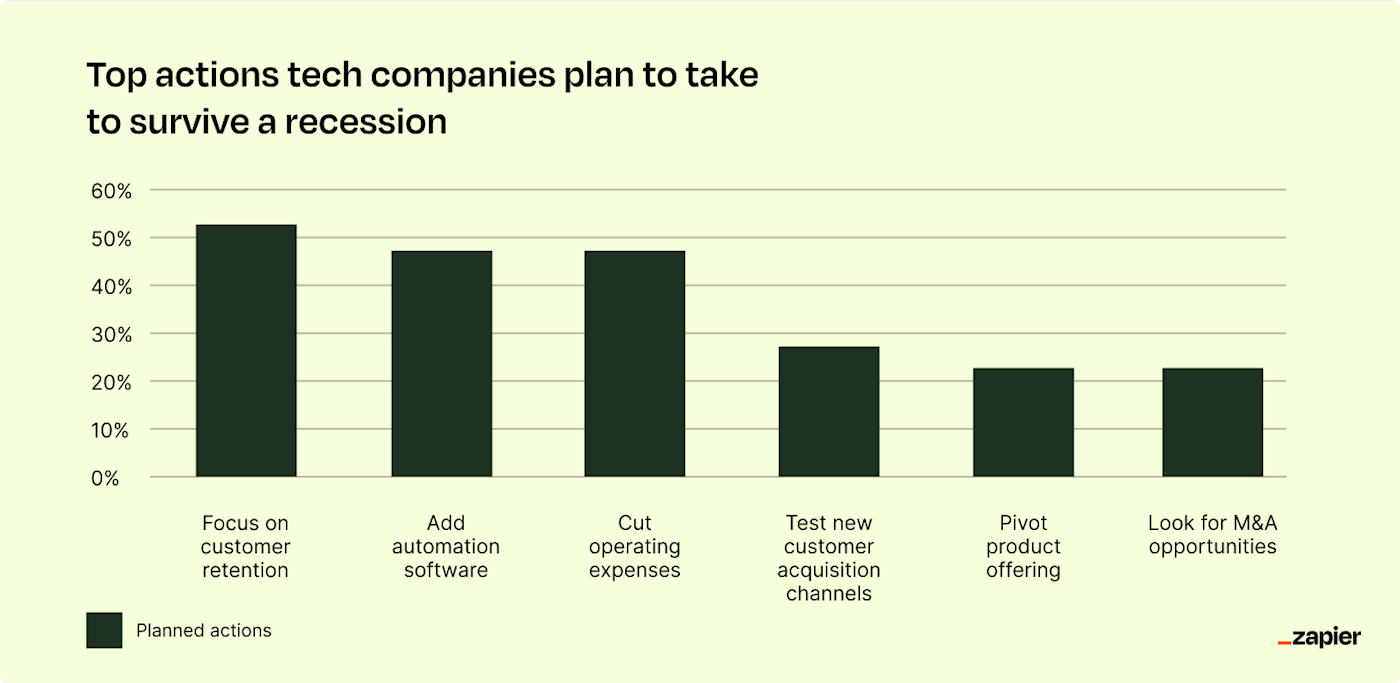

Automation, customer retention, and cutting operating expenses are the primary actions technology companies are taking or plan to take to help survive a recession.

Just how ready are tech companies for a recession?

While 88% of technology companies believe that a recession is likely in the next year, and 75% say they feel they are prepared, this still leaves a quarter of tech companies who are either not well prepared (21%) or unsure of how prepared they are (4%).

The amount of VC funding a company has received, when it last received funding, its burn rate (how much cash a company spends in excess of its income), and its ARR, can also influence how well prepared a tech company is and how long it is likely to survive a recession.

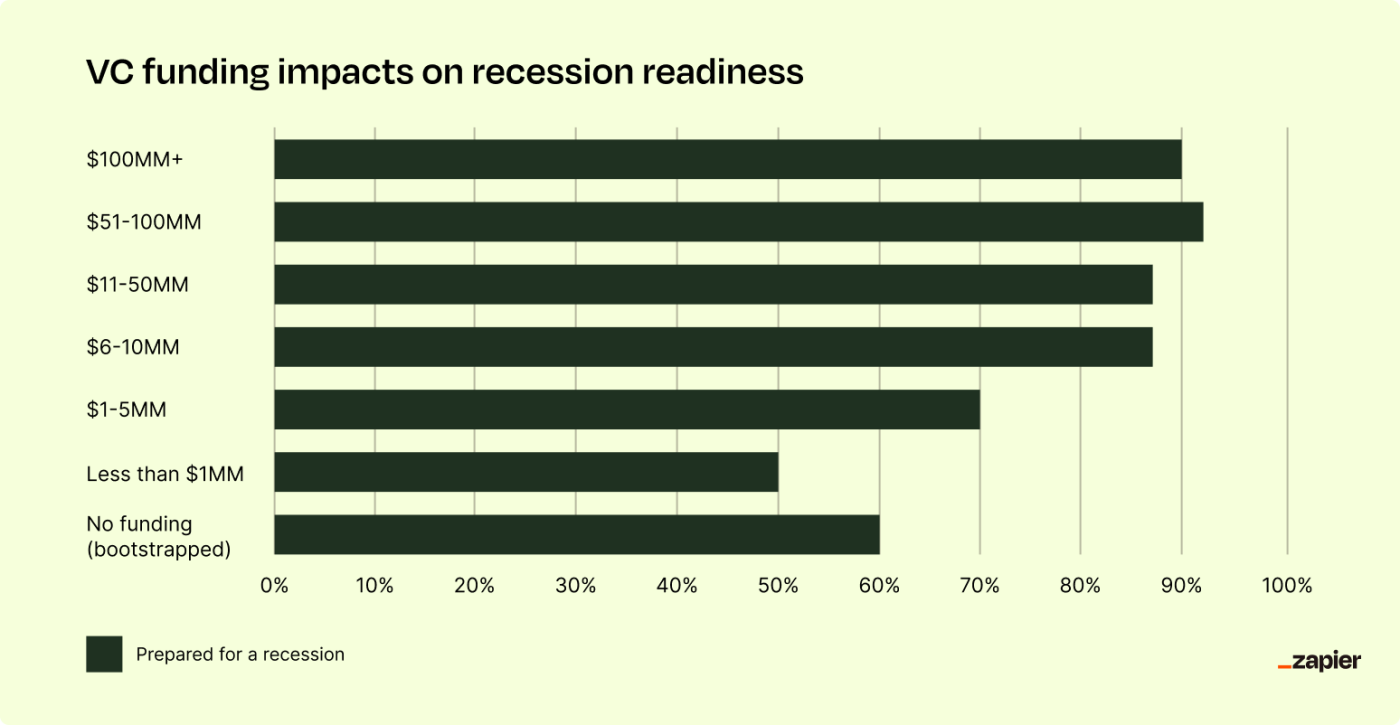

The impact of VC funding on recession readiness

Of the 87% of tech companies that say they've received some VC funding, those that have received the most funding ($50MM+) were most likely to say they felt very well prepared for a recession. Meanwhile, companies that had received less than $1MM in funding and bootstrapped companies (those that had not received any VC funding), were the least likely to feel well prepared for a recession.

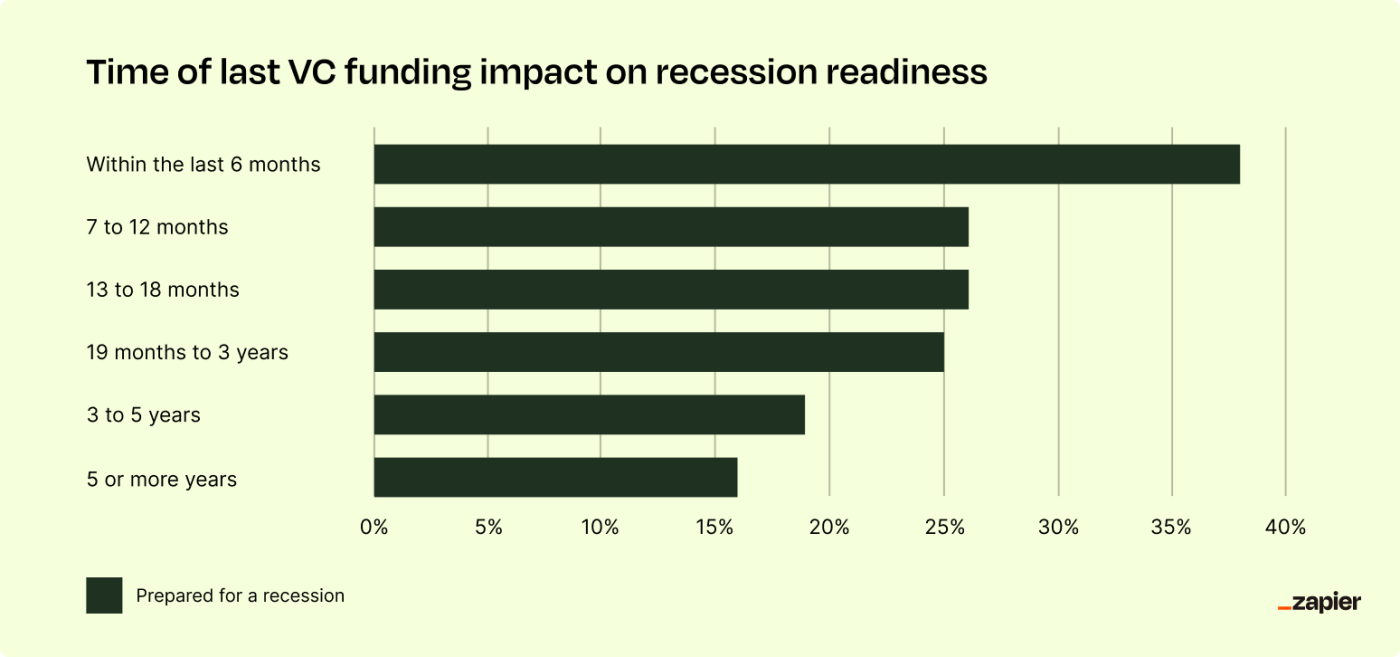

How recently a company received VC funding also influenced how well prepared respondents felt their company was for a recession. For instance, 38% of companies that have received VC funding in the last six months feel very well or well prepared, compared to only 16% of those who received VC funding five or more years ago.

How long companies felt they could survive also aligned with the amount of VC funding received. Companies that received the most funding ($100MM+) were the most likely to say they could survive a recession that lasted longer than two years, while companies with the least amount of funding (less than $5MM) were the least likely (21%) to say they could survive more than two years.

One reason tech companies with the most recent VC funding feel very well prepared may be that they're also the least likely to be worried about getting funding in the next 18 months. Tech companies that were VC funded within the last 12 months were 1.5 times more likely to be not worried about getting VC funding compared to those who hadn't received funding in 5 years or more.

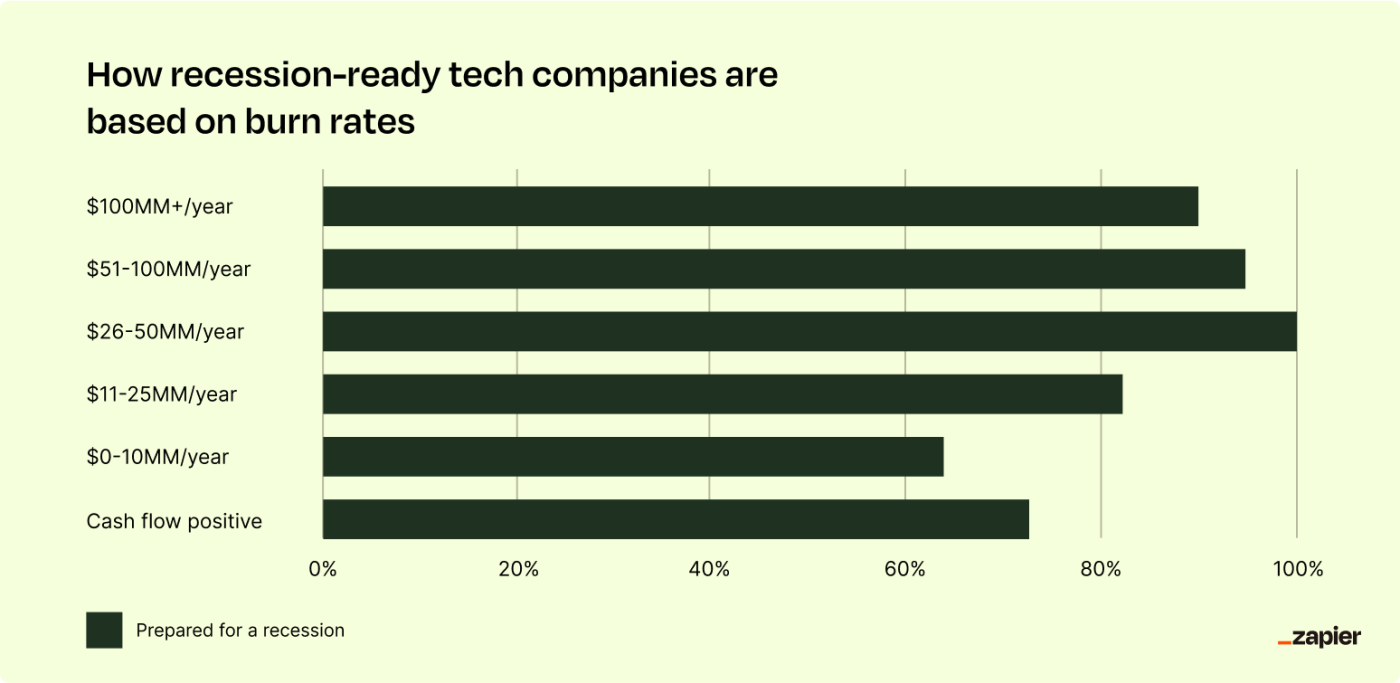

The impact of a company's burn rate on recession readiness

When asked about their burn rates, 34% of tech companies said their companies were cash flow positive, and 25% of tech companies said their burn rate was less than $10MM per year. Surprisingly, positive cash flows and lower burn rates don't necessarily correlate to a company being better prepared for a recession.

Companies with the highest burn rate ($100 MM+/year) are also the most likely (40%) to say they can survive a 2+ year recession. While this may seem surprising, companies with that high burn rate are also likely to be well-established and well-funded, giving them more confidence and more cushion to survive.

In all other instances, the lower a company's burn rate, the longer respondents believed their company could survive. Cash flow positive companies were second most likely to say they could survive a two-year or longer recession, while companies with a $51-100MM/year burn rate were least likely to say they could survive beyond a two-year recession.

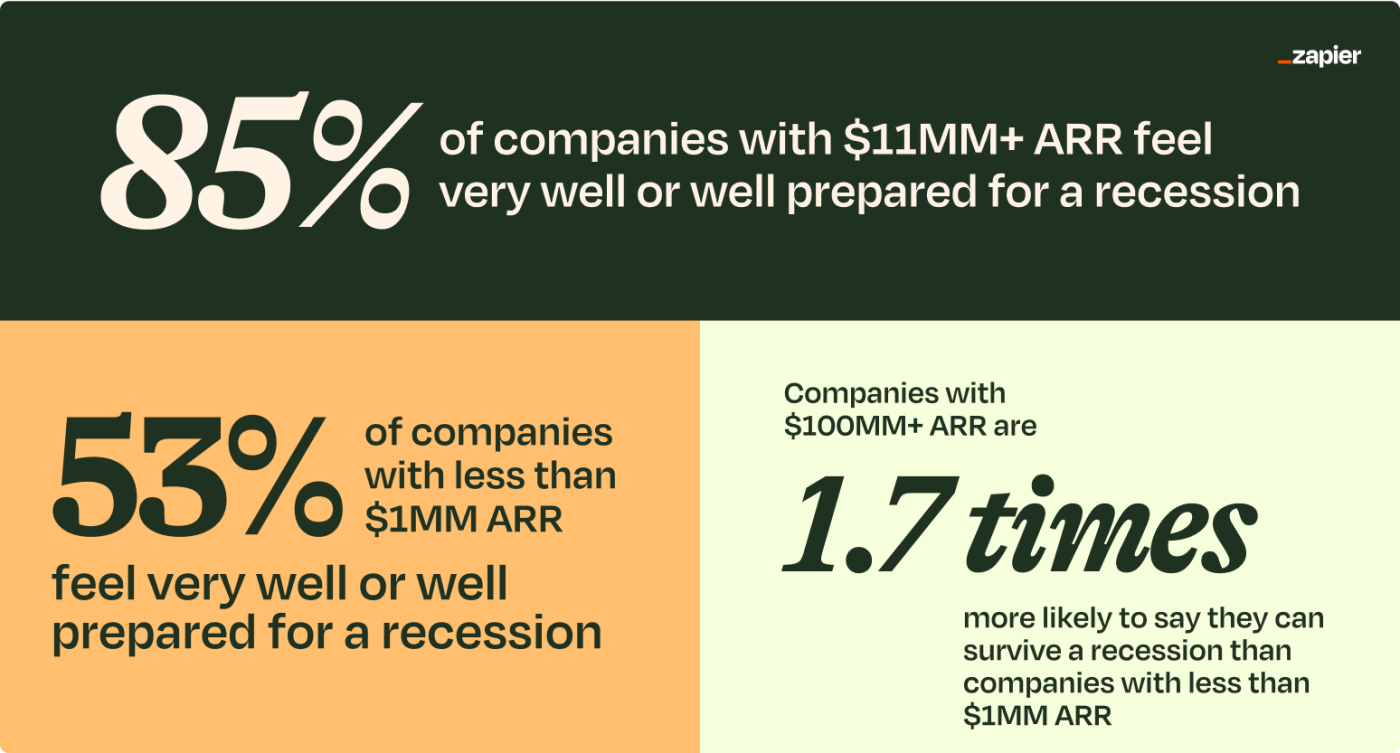

The impact of annual recurring revenue on recession readiness

Not surprisingly, the higher a company's ARR, the more likely they were to say they were very prepared to survive a recession. Companies with $11MM or more ARR were at least 85% confident they were very well or well prepared for a recession. On the other hand, of companies with an ARR of less than $1MM, only 53% of respondents felt their company was well prepared for a recession.

Tech companies with an ARR of over $100MM+ were 1.7 times more likely to say they could survive a two-year or longer recession than companies with less than $1MM ARR.

Recession preparedness doesn't equal survival: over half of tech companies won't survive a 2+ year recession

Companies may say they feel very or well prepared for a recession, but the duration of a recession could significantly impact whether they survive. Almost a quarter (23%) say they wouldn't be able to survive more than a year, and over half (57%) of companies don't think they'll survive a recession longer than two years. However, a third (34%) of companies feel confident they can survive more than two years.

How long can tech companies survive a recession?

57% of companies say they won't survive more than 2 years

23% of companies say they won't survive more than 1 year

9% of companies say they don't know how long they'll last

7% of companies say they won't survive 6 months

Founders and employees feel differently about their company's recession readiness

Our study found that founders feel the least confident that their business is prepared for a recession (37%), while employees are much less worried (26%) that their company isn't prepared. Additionally, over a quarter of founders (26%) don't think their company can last a year in a recession, and only 27% believe they can last more than two years. Again, employees have much more confidence in their company weathering a recession. Over half of employees (56%) feel confident their company can last more than two years, and only 11% think their company won't survive a year-long recession.

Why the difference? It’s possible that employees don't have full insight into their company's actual financial standing. Another reason may be that founders feel more responsibility toward the business's ability to survive and justifiably worry more about whether they'll succeed when times are tough.

Tech companies plan to make changes to survive a recession

Regardless of how well prepared or how long they think they can survive a recession, 98% of all tech companies plan to make at least some changes to their business to help them survive.

The top three changes companies plan to make are:

52% will focus more on customer retention

47% will add automation software

47% will cut operating expenses

Job security remains high as tech companies look to automation and other actions before layoffs

Most tech companies considered layoffs as a last resort and unlikely to happen. Only 17% of tech companies said it was an action they planned to take, and layoffs were ranked the least likely action overall that tech companies would take to survive a recession.

Instead, using software automation in workflows can save tech companies time, clean up mistakes on repetitive tasks, and help companies be more productive overall, which can lower operating expenses and help increase customer retention. Additionally, companies are investing more in automation to help employees with their current and future workloads.

The impact of VC funding on the actions tech companies plan to take to survive

The amount of VC funding also impacted a tech company's potential actions. Those companies with less than $1MM in funding or those that don't rely on VC funding were most likely to cut operating expenses, whereas those with the highest funding levels ($51MM+) were most likely to look to automation for help.

A company with $11MM or greater in VC funding is 1.6 to 2.1 times more likely to use automation as its top action than companies without any VC funding.

While a company's last VC funding date didn't seem to significantly impact what actions a company would take to help it survive, how worried a company was about getting new VC funding within the next 18 months did. Those that are very worried were the most likely to say they would:

57% cut operating expenses

35% look for merger and acquisition opportunities

35% lay off employees

On the other hand, companies that were "not at all worried" or only "a little worried" about their ability to get funding over the next 18 months were most likely to focus on customer retention as their primary strategy and the least likely to consider laying off employees.

High ARR and the use of automation go hand-in-hand

Companies with the highest ARR also significantly turned to software automation to survive versus those with less than $10MM ARR. Automation was the number one action companies with an $11MM or higher ARR planned to take to help them survive a recession, while cutting operating expenses was the top action for those with less than a $1MM ARR.

One reason those companies with a higher ARR may be more likely to invest in automation during a recession is that they've already benefited from some investment in automation. As a result, they understand that software automation can help them remain competitive in the market even when needing to tighten budgetary belts. Scaling companies are the ones who will most benefit from automation. Incorporating automation into their processes will help streamline operations; it also helps increase speed-to-market, development, and getting products into customers' hands faster.

Tech companies believe they can successfully weather a recession successfully

While a looming recession is creating worry for technology companies, the good news is that most companies not only expect a recession but feel prepared for it. The biggest concern for most tech companies will be the length of the recession. If the recession is long-lasting, it could seriously impact tech companies, especially those that will need an infusion of VC funding or have a low ARR.

Because tech companies have had ample warning that a recession is imminent, they are at least in an offensive position rather than a defensive position. Regardless of a tech company's current level of preparedness, VC funding, burn rates, or ARR, they can begin to take actions now, such as focusing more on customer retention, automation, and cutting operating expenses to help them be even more ready should a recession hit soon.

Survey methodology. In order to determine how technology companies are feeling about a recession, how prepared they are to survive and what changes companies intend to make to survive, Zapier conducted an online survey of 522 founders (27%), executives (23%), managers (33%), and employees (18%) employed full time at technology companies in the U.S. between June 15 and June 28, 2022. The responses were random, voluntary, and completely anonymous.