Payment gateways and payment processors do more than just process transactions. They let you embed a payment form or button on your website, securely take in credit card details, and trigger all the necessary notifications to help you deliver your products or services on time. And then, every few days, the platform will pay out everything you've received.

I spent time researching and testing the best payment gateways, looking into nearly 100, spanning all sorts of sub-categories and use cases. After narrowing it down to a couple dozen to test in depth, I spent time with each app—and these are the six best.

The 6 best payment gateway services

PayPal for first-time users

Stripe for accessible analytics

Shopify Payments for eCommerce stores

Square for selling both online and offline

HubSpot Payments for B2B sales

Helcim for interchange pricing and volume savings

What is a payment gateway?

Payment gateways and credit card processors are critical components of an eCommerce shop. They enable secure online payments, exempting you from investing in costly security and compliance software.

The most basic credit card processor will do exactly that: stay compliant to PCI-DSS standards and provide simple integration options with your sales channels. But more advanced platforms offer features like recurring billing and subscription support, advanced analytics, or seamless integration with your website or eCommerce platform.

There are tons of niche concepts tied to payment processing, so I've also created a short FAQ that you'll find at the end of this article. Click here to jump to it.

What makes the best eCommerce payment gateway service?

How we evaluate and test apps

Our best apps roundups are written by humans who've spent much of their careers using, testing, and writing about software. Unless explicitly stated, we spend dozens of hours researching and testing apps, using each app as it's intended to be used and evaluating it against the criteria we set for the category. We're never paid for placement in our articles from any app or for links to any site—we value the trust readers put in us to offer authentic evaluations of the categories and apps we review. For more details on our process, read the full rundown of how we select apps to feature on the Zapier blog.

As I was researching and testing eCommerce payment processors, here's what I was looking for:

Accepted payment methods. At minimum, these credit card processing companies needed to accept all major credit card brands.

Ease of integration. You shouldn't have to know how to code to implement a payment solution from start to finish. These apps have either a fully no-code setup or a detailed guide if you have to tinker a bit.

Security. Every payment processor listed here is PCI-DSS-compliant, so you don't need to implement any additional security measures on your shop.

Checkout experience. It should be easy for customers to buy products and services at your eCommerce shop, so I looked out for the platforms that offer the best customer checkout experience.

Extra features. Having a toolkit at your disposal—including subscription support, invoicing, payment links, or card readers—can be useful, so I kept tabs on all those extras as well.

I tested these platforms using two different strategies. For the platforms that offered self-service sign-up, I went in, configured everything needed to start accepting payments, and integrated that into a page on my website. For others that required talking to sales, I sent out emails to set up a test environment, so I could see how it worked. Let's jump in.

The best payment gateways at a glance

Best for | Standout feature | Pricing | |

|---|---|---|---|

First-time users | Extremely simple setup | Fees vary by transaction type and currency; 3.5% + $0.49 per transaction for U.S. credit cards | |

Accessible analytics | Flexible, with a wide range of tools and plugins | Fees vary by transaction type; 2.9% + $0.30 per online credit card transaction | |

eCommerce stores | All-in-one eCommerce solution | Processing starts at 2.9% + $0.30 per transaction; active Shopify plan required, starting at $39/month | |

Selling online and offline | Includes a basic website builder | Fees vary by transaction type; 2.9% + $0.30 for online credit card transactions | |

B2B sales | Simplifies billing with payment links | 2.9% per transaction; active HubSpot CRM Starter subscription required, starting at $20/month | |

Interchange pricing and volume savings | Lower fees for high-volume sellers | Interchange Plus averages at 2.49% + $0.25 per transaction; discounts available for high-volume sellers |

Best online credit card processing system for first-time users

PayPal (Web, Android, iOS)

PayPal pros:

Trusted, well-known name might make customers more likely to click buy

Extremely simple (for you and your customers)

PayPal cons:

Very confusing pricing structure

PayPal has been in the payments industry for a long, long while. In that time, it's built an experience that's really easy for first-time users, taking most of the complexity out of the equation. This means little to no coding and zero developer lingo.

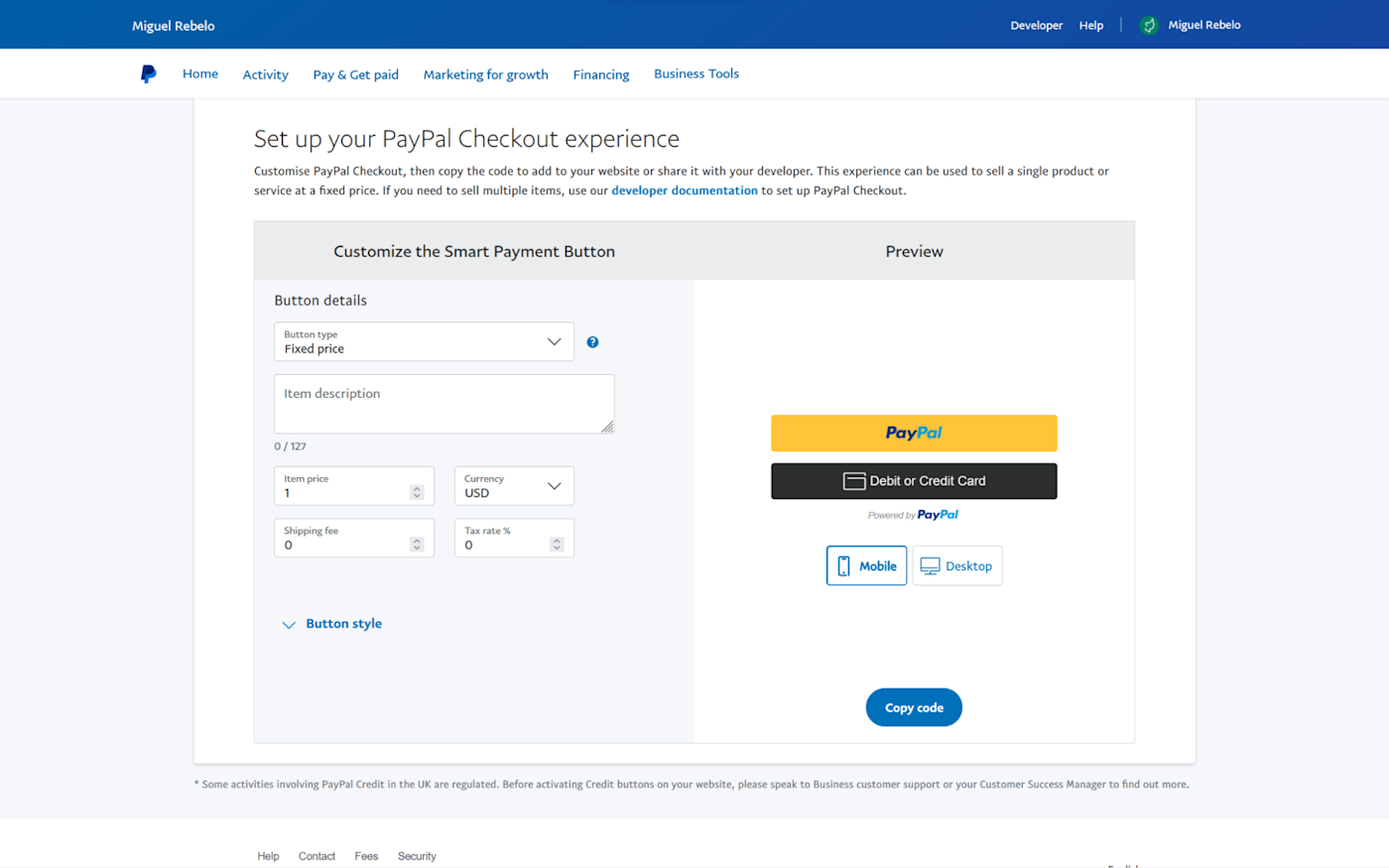

Once you add your products, you can customize the Smart Payment Button, as you can see in the screenshot above. The only thing you can't customize are the colors: you can change the shape, what logo appears on the PayPal button, and show/hide the Debit or Credit Card button. When you're done, simply click Copy code and paste it on your product page.

What happens on the customer side? When they visit your website, they'll see the button you've configured. They can then choose to pay with their PayPal balance or any saved payment method on their PayPal account. If they don't have PayPal, they can check out by entering their credit card details (all data is handled securely by PayPal in both cases). Added security measures include fraud protection, which keeps your store safe from credit card fraud, and also customer protection, which lets shoppers file claims if there's a mismatch between the products advertised and what they actually got.

One thing you'll hear from anyone using PayPal: the transaction fees are flat-out confusing. In general, PayPal charges a base fixed price for each transaction and then a percentage over the total amount. So the basic credit card fee is 3.49% + $0.49 for U.S. transactions, but this percentage/cents combo varies a lot depending on transaction type and currency, so be sure to read the fine print.

PayPal has some interesting extras to offer. You can create your PayPal.me profile page, which gives you a searchable profile, and generate individual payment links that you can share via email or in a text message. And if you're running a subscription-based business, there's also a lot of customization there, including setting up trial periods, one-time setup fees, and billing cycle length.

When you're set up and ready to sell, connect PayPal to Zapier to automatically add new customers to your email marketing tool, a spreadsheet, or anywhere else you store your data. Learn more about how to automate PayPal, or get started with one of these pre-made workflows.

Add rows to Google Sheets spreadsheets for new PayPal sales

PayPal pricing: Fees vary by transaction type and currency; 3.5% + $0.49 per transaction for U.S. credit cards. Full pricing information here.

Is your sales volume growing? PayPal has another payment solution for you: Braintree. It has advanced analytics, better control in creating and implementing your checkout experience, and slightly lower payment processing fees. It also accepts a wider range of payment methods, including Venmo.

Best online payment processing system for accessible analytics

Stripe (Web, Android, iOS)

Stripe pros:

Extremely flexible with loads of features

A huge ecosystem of plugins and integrations

Stripe cons:

A bit more complicated to set up

Stripe has become a kind of household name for online businesses, mostly because of how flexible it is and for the range of tools it offers. It brands itself as the financial infrastructure for the internet, and it's not wrong.

As soon as you land on the dashboard, you'll realize that Stripe has depth. That may make things a bit unintuitive at the start. Developers will feel right at home, but what about those of us that don't know how to make an API call? Stripe has an implementation wizard, where you can choose how you want to implement it in your shop by answering a few simple questions. The results come with a full guide to help you copy and paste code to the right place on your website.

When your shop is good to go, Stripe lets you look deep into what's happening with your payments. You can see sales volume, a report on fraud and disputes, spend-per-customer, and high-risk payments on the home dashboard. Want to take a deep dive? Head to the Reports section, and explore all the options available, including billing analytics that help you look into your MRR or revenue forecasts.

Another win: the fee structure is simple. It's 2.9% + $0.30 per transaction for credit cards, and while other payment methods have different costs, the pricing page is straightforward and clear about them.

There are three main ways you can embed Stripe on your shop:

You can set up an embedded payment form (this requires some coding to customize everything about it).

You can add a button that'll bring up a pop-up hosted by Stripe, where the customer can input their credit card details securely. Then, the payment button is unlocked on your shop, and the transaction can be processed from there (also involves some coding to implement).

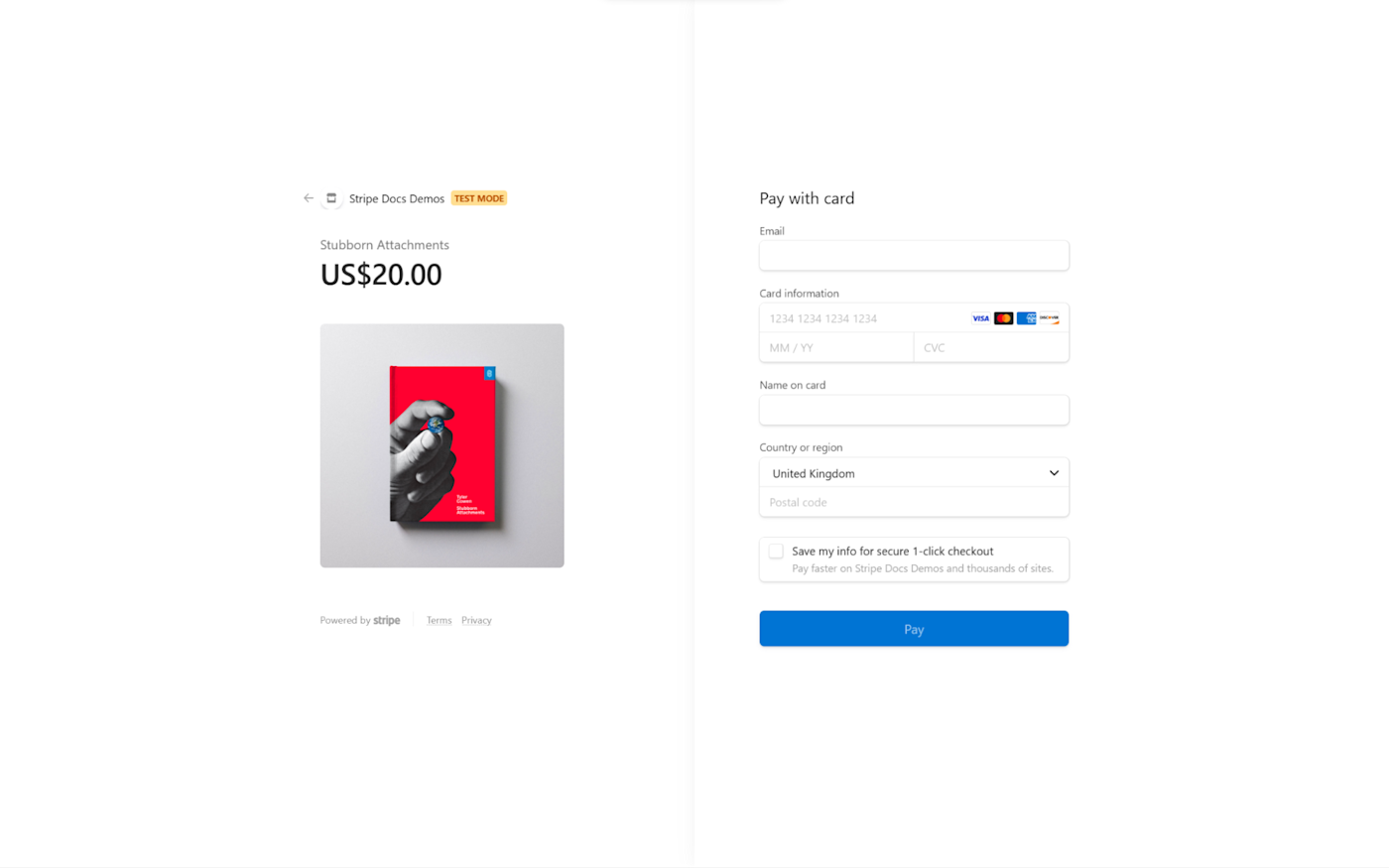

You can redirect your customer to a beautiful checkout page (pictured above), where the customer can input all their details. When they're done, they get redirected back to any part of your website.

Stripe has a bottomless pit of extras—there are so many things to explore, and for all levels of expertise too. I'll tease you the main ones: subscription features that support cross-selling, tax automation, incorporation of your own startup via Atlas, and native integrations with a range of website builders and eCommerce platforms.

It's a lot, and you can go even further by connecting Stripe to Zapier. Automatically get Slack notifications for new Stripe sales, create QuickBooks customers for new Stripe payments, and connect Stripe to your entire tech stack. Read more about how to automate your payments with Stripe, or get started with one of these pre-built workflows.

Create QuickBooks Online customers with sales receipts for new Stripe payments

Stripe pricing: Fees vary by transaction type; 2.9% + $0.30 per online credit card transaction. Full pricing information here.

Best eCommerce payment processing system for online stores

Shopify Payments

Shopify Payments pros:

All-in-one eCommerce solution

Very easy to set up and use

Shopify Payments cons:

Limited freedom to use another payment provider

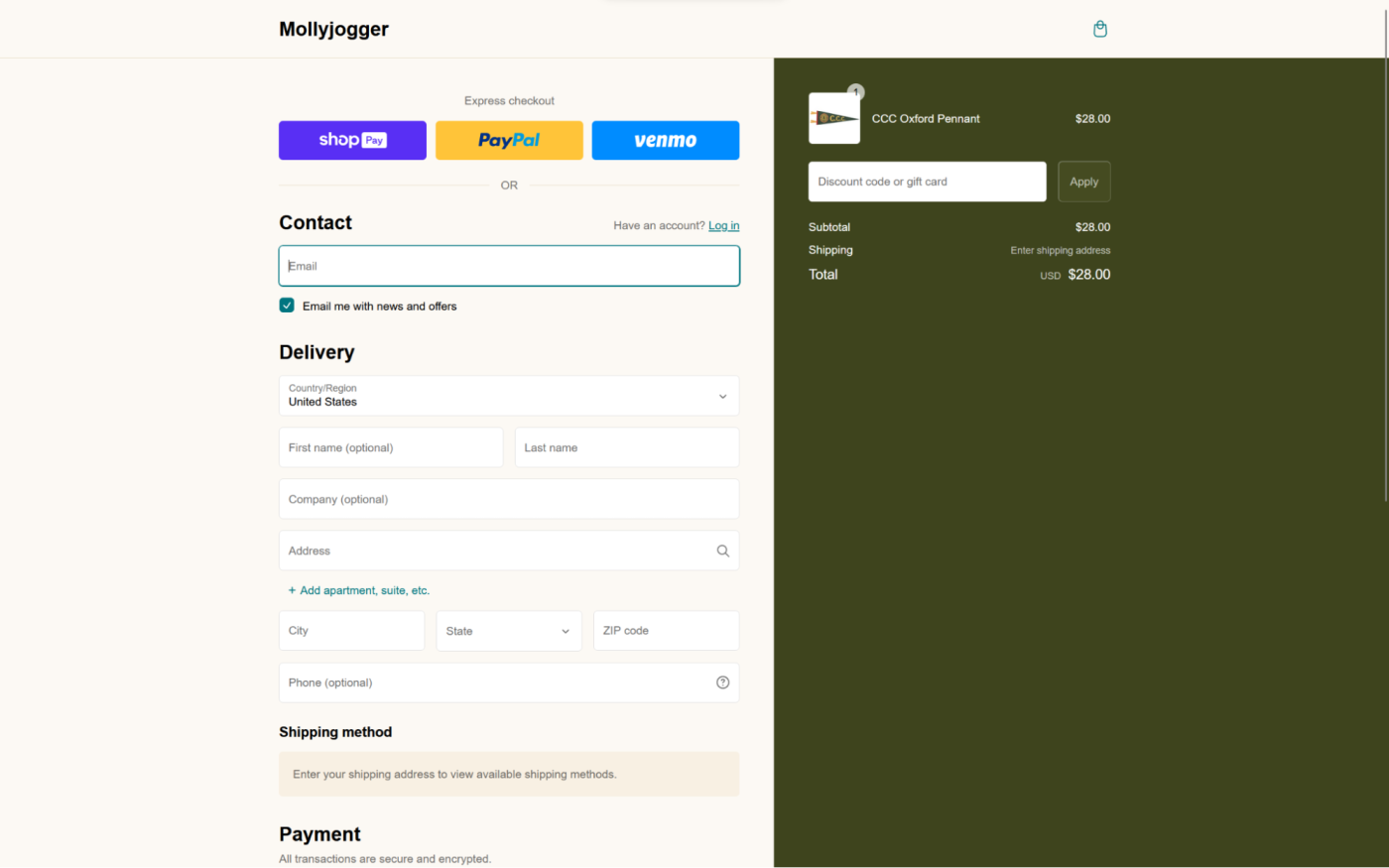

If you have an eCommerce store, you'll see you can either integrate an external platform or use a native one for payments. That's how Shopify handles it, making your life easier in the process.

You can only use Shopify Payments if you have a store hosted on the platform. The plans start at $39 per month, offering the starter toolkit for everything you need to sell online: website, marketing tools, and payments, all in one place. As you go up in the paid tiers, you unlock more features to increase the quality and reach of your shop, while also slightly reducing the payment processing fees, down to a minimum of 2.4% and $0.30 per transaction.

Shopify is a beginner's haven, offering plenty of high quality help to get you started. You don't have to be a technical expert, coding wizard, or eCommerce legend: just bring time and curiosity, and you'll be able to build your store. To activate the online payments, submit your business details, wait for confirmation, and that's that.

Using this native payment solution saves you the time—and potentially headache—of configuring and integrating a third-party platform, especially if your store's inventory rotates a lot. Updating dozens of payment links for your new clothing collection isn't the best way to pass the time. Shopify handles these thorny parts for you where other platforms would require either manual work or some tech savvy for coding a solution.

You can also integrate Shopify with Zapier to connect your eCommerce apps and automate the boring stuff. Here's how to automate your Shopify store, or you can take a look at these workflows for some inspiration.

Shopify Payments price: Processing starts at 2.9% + $0.30 per transaction. Active Shopify plan required, starting at $39/month.

Using WordPress with WooCommerce instead? WooCommerce also has a native payment system, WooCommerce Payments, upgrading your WordPress installation to a fully-fledged eCommerce solution. Each transaction goes for 2.9% plus $0.30, too, with tools similar to those Shopify offers.

Best payment gateway for selling online and offline

Square (Web, Android, iOS)

Square pros:

Easy combination of in-person and online sales

Includes a basic website builder

Square cons:

Not quite as feature-rich as Stripe

Do you run a brick-and-mortar shop? Not accepting card payments at all? Square is here to help. Besides offering full support for physical card reader machines, it also lets you build your own online store with seamless payment processing. That means faster sales in person and online sales support too.

The interface is sleek and easy to use. The main dashboard gives you a snapshot of your business at a glance, and you can then use the left-side menu to access the wide range of features on offer. These include accepting payments online for all major card brands, as well as Google Pay, Apple Pay, and Samsung Pay.

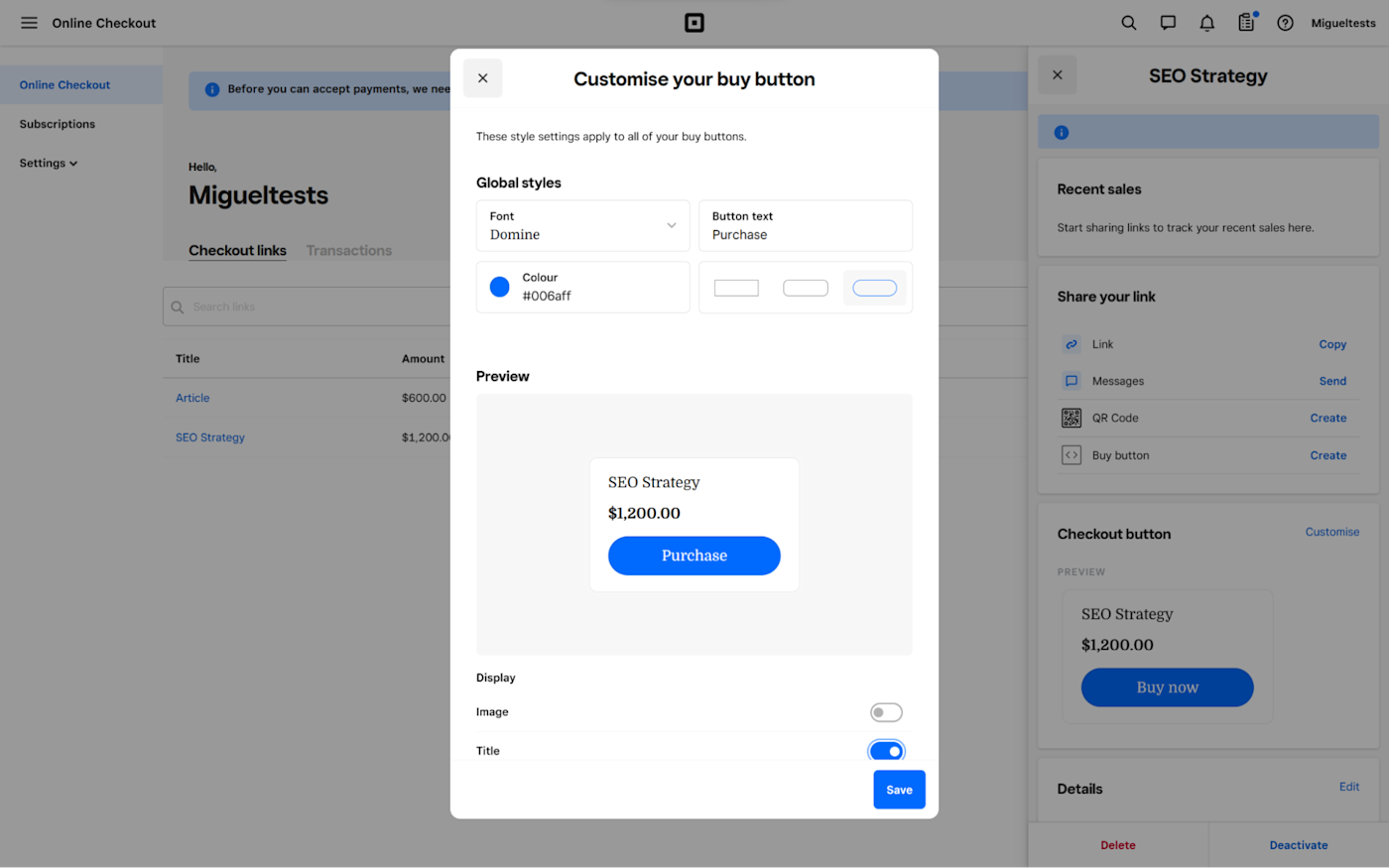

After you set up your account and add your products, you can embed customizable buy buttons on your sales channels. The level of customization is great, but there are no payment method badges or a "processed securely by Square" note. Be sure to add those to your website to give your customers a sense that it's safe to shop with you.

Don't have a website? No problem. Square offers a website builder with beautiful themes, easy to set up and publish. It also offers basic email marketing features, so you can keep in touch with your customers, run campaigns to raise awareness about new products or services, or get some feedback on customers' experiences.

Most of Square's features are free to use, but if you want to unlock more for your store and checkout experience, there are two subscription plans available. The highest one, Premium ($79/month), even lowers the transaction fee to 2.6% + $0.30 (from 2.9% + $0.30), so if you end up setting up shop with Square and start selling a lot, it may make sense to upgrade.

As for extras, Square has quite a bit to offer. You can open a checking account, letting you receive payments faster and make payments directly from there too. You can also keep your invoices organized, send estimates and contracts, and see filterable reports on everything from sales to disputes.

You can connect Square to all the other apps you use with Square's Zapier integrations. Here are popular ways to automate Square, plus some pre-made workflows to get you started.

Save new Square transactions to Google Sheets rows

Square pricing: Fees vary by transaction type; 2.9% + $0.30 for online credit card transactions. Square also offers subscription plans to unlock more features, starting at $29/month. Full pricing details here.

Best online payment processing system for B2B sales

HubSpot Payments (Web, iOS, Android)

HubSpot Payments pros:

Simplifies billing by turning deals into payment links

Easy to spread payment buttons anywhere you need

HubSpot Payments cons:

May lack flexibility

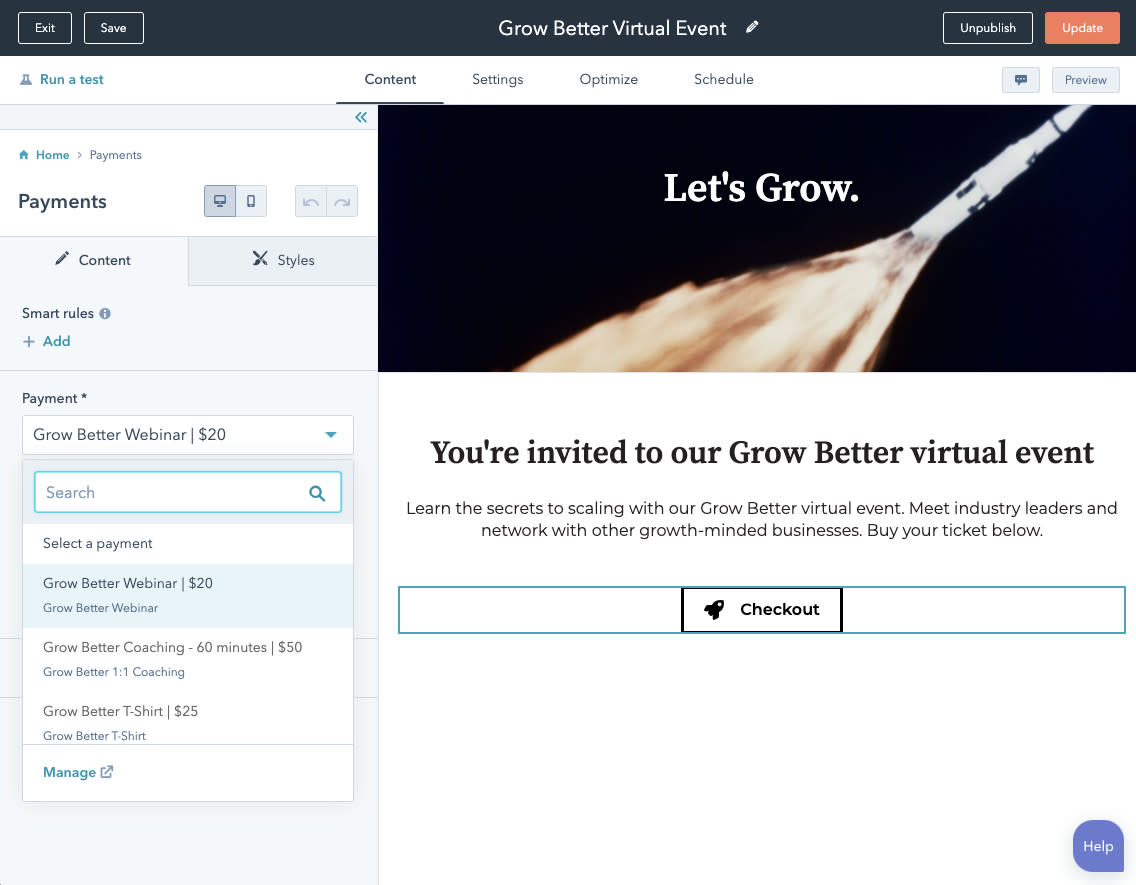

No one loves friction. When selling products or services to other businesses—say, you're doing consulting work or providing workshops—it's best to have a payment flow that's easy to use. HubSpot Payments exists to fill this gap: you can use it to quickly turn proposals into a payment link. Your customers can pay in a good-looking payment form, so you can lock in those dates or send those products right away.

Part of the HubSpot Commerce Hub feature set, Payments adds payment processing on top of a mountain of possibilities. It's seamlessly connected to all other parts of this sales software, so you can manage your business relationships, marketing, website, content, and operations from the same place. The actual payment infrastructure belongs to Stripe, with HubSpot charging 2.9% (no extra fees) for each transaction. A piece of advice: don't connect your Stripe account to HubSpot for processing payments, otherwise you'll have to pay both apps' processing fees, bringing the total to 3.4% + $0.30 per transaction instead.

The major upside of Payments is that it's easy to use, offering the basic tools to send links and see the results. The connection with the CRM saves plenty of time since you don't have to create the payment request elsewhere and send it over. You can put the link inside a button and then embed it anywhere, be it your weekly newsletter, your blog, or the front page of your website. If you're curious about this possibility, check out HubSpot's guide on how to get it done.

Since this new product is all about streamlining your work and saving time, you can keep doing that by connecting HubSpot and Zapier and making your tech stack work as one. Here are some ideas to get you started, or you can take a look at more ways to automate your business operations in HubSpot.

Save new HubSpot form submissions to Google Sheets rows

HubSpot Payments price: 2.9% per transaction. Active HubSpot CRM Starter subscription required starting at $20/month.

Best online payment processing service for interchange pricing and volume savings

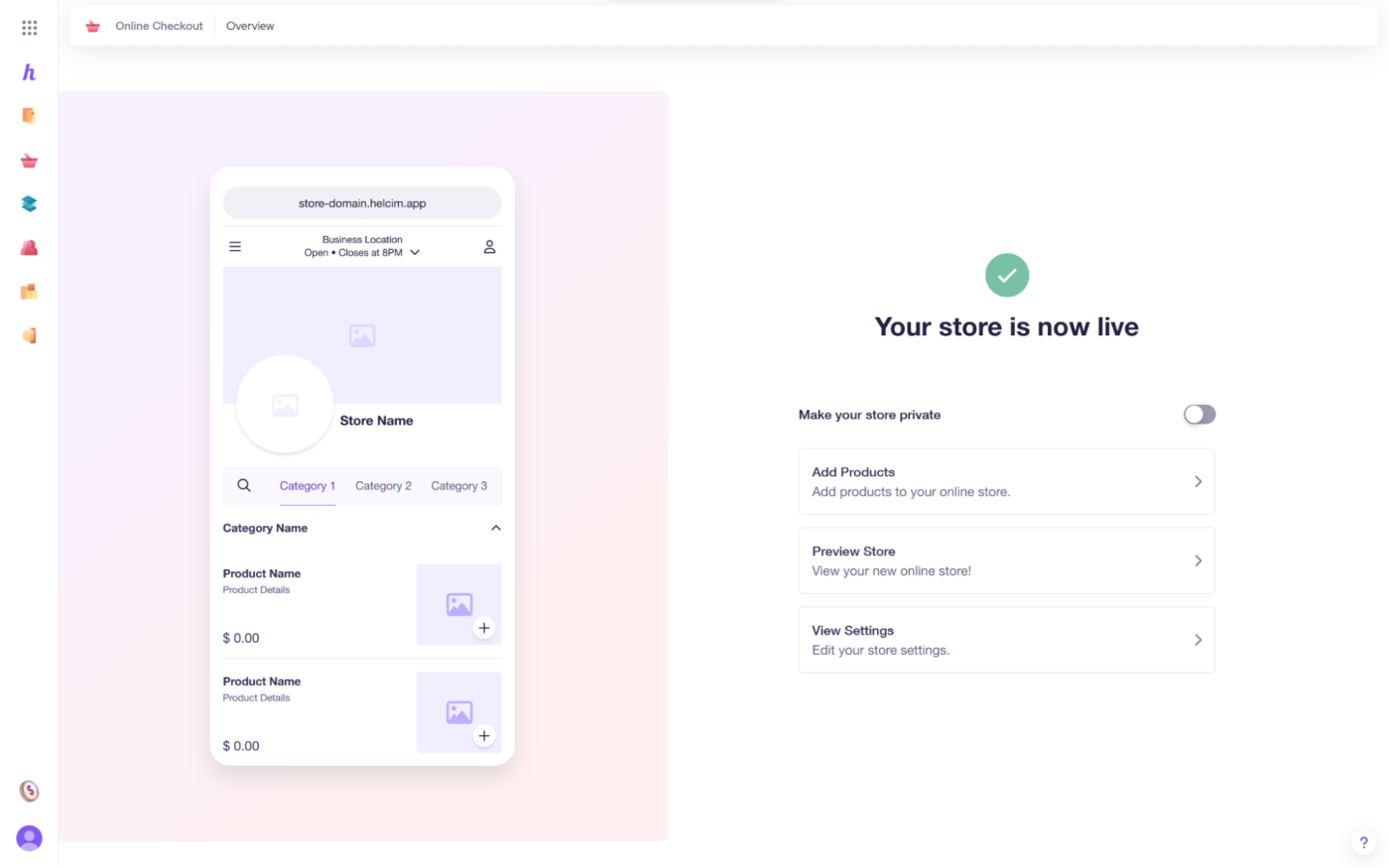

Helcim (Web, iOS, Android)

Helcim pros:

Great user experience, for both you and your customers

Wide feature set

Helcim cons:

Potentially confusing fee structure

Most of Helcim's advantages lie in the math, so let's whip out our calculators. Instead of charging a fixed fee like most of the competition, you're charged Interchange Plus fees. Here's what that means.

Interchange fees refer to the payment network in charge of processing. This can be Visa, Mastercard, or American Express, among others. Each of these networks puts its price on each processing action. Here are a few examples:

If one of your customers pays with a Visa International Corporate card, the interchange fee is 2.0%.

If, instead, they pay with a Mastercard International card, that'd be 1.1%.

If it's with an American Express card and you're a B2B merchant offering a service over $7,500, you'd pay 2.35% + $0.10.

Helcim passes the interchange fees directly to you. Upside? You may be able to save if your customers use the more inexpensive payment networks. Downside? Too many fees to familiarize yourself with. At the end of the year, you can expect the average fee to stand at 2.49% + $0.25 per transaction.

The second part of the "Interchange Plus" expression is "Plus." This is Helcim's cut, the profit they make with each of your transactions, added to the interchange fee. And here, the platform is generous for their bigger clients: if your monthly volume is below $50k, you'll be charged 0.50% + $0.25 a pop; if you rake in more than $1M, that comes down to 0.15% + $0.15.

Let's put the calculator away and reason a bit together. The variance of fees may feel a bit risky or pointless for smaller businesses. But if you're running a bigger operation and have access to data on customer payment methods, you may be able to shave a few decimals off the transaction fee—which, for bigger bottom lines, can have a noticeable impact.

And if you want to destroy the calculator entirely, you can pass on these processing costs to your customers with surcharging—they pay these fees, not your company. There are mixed opinions here. Your marketing and sales teams won't like explaining why the final price was increased at the end of the payment flow. If you go this route, be sure to think about the checkout user experience.

Helcim price: Interchange Plus averages at 2.49% + $0.25 per transaction. Discounts available for high-volume sellers.

Payment gateway FAQ

What are interchange fees?

Interchange fees are the percentage (and sometimes a fixed fee, usually cents) charged for each processed transaction. These are usually paid for by the merchant, but you can offload them to your customers using surcharging mechanisms.

Paying for anything is only easy because of card networks and similar payment systems. These ensure that the money travels from the people buying products and services to the merchants selling them.

What is a merchant account?

A merchant account is like a bank account where you receive the money your customers pay you. Unlike a bank account, you can't use this money freely: you'll have to wait for the payout date.

Some platforms only offer merchant accounts without a gateway or a processing system, so be sure to check it out if you're conducting your own research online.

What is a payment gateway?

A payment gateway used to be software that takes care of the legwork of online payments. Since some gateways also offer physical terminals, it now refers to platforms that handle the front-end portion of payments: the payment forms, checkout flow, online security, and initiating the transaction with a payment processor.

What is a payment processor?

A payment processor is a platform that connects banks, merchant accounts, card networks, and payment systems to initiate transactions. It handles authorization (making sure the card's credentials are valid and that the cardholder's account has enough funds) and settlement (moving the money from the cardholder's accounts to the merchant's accounts).

A payment processor is different from a gateway because it handles the back-end portion of payments, the invisible messages to secure authorization and settlement. Some platforms combine processing and gateway features, so don't be surprised if a platform claims to offer both.

What is an issuing bank?

If you pull out your bank card from your wallet, it's likely either a Visa or Mastercard. Your bank works with these card companies (or others) to provide you with a card you can use to make payments. This is the issuing bank: the bank that issued the card to you.

When you use your card, the card network contacts the issuing bank to check if the details are correct (card number, CVV, PIN) and if you have enough funds to cover the transaction. It also initiates the process of moving the money from your account to each business you purchase from.

What's involved in processing a credit card transaction?

Processing a transaction is complex, often involving multiple parties and a range of networks. Here are the pieces involved in running a transaction:

The cardholder, which is your customer. They want to get your product or service. They use their credit/debit card on a physical terminal or enter the card's details into the payment form on your website.

The merchant, which is you/your business.

A payment gateway, software that enables online transactions. These handle the payment form, security, and contacting the payment processor.

A payment processor, which processes the actual credit or debit card transactions. These take care of connecting banks, your merchant account, and card networks, ensuring that all of the pieces are moving as they should.

Card networks and payment systems, which handle the process of actually moving money between banks.

Some platforms may combine some of these. For example, there are payment processors that offer their gateways; others combine a gateway with a merchant account, but don't do the actual processing.

How does credit card processing work?

There are two phases involved in credit card processing: authorization and settlement.

The first one is authorization. When the cardholder taps their card to pay (or clicks the Pay button on your website):

You (the merchant) send the payment authorization to the payment processor connected to your payment gateway.

The payment processor uses the card number to contact the card network (Visa, Mastercard, etc.) to figure out which bank issued the card.

Once contacted, the issuing bank confirms that the card's details are correct and that the account has sufficient funds to greenlight the transaction.

The bank then approves or denies the transaction.

Fun fact: all of this happens right after you tap your card to pay for anything and get the "authorized" message at the payment terminal, in seconds. Be sure to look out for it the next time you're shopping.

Another thing you might've noticed if you do mobile banking is that some transactions show an "unclaimed" tag right after you pay for something—the balance was subtracted from your account, but the merchant hasn't received the money yet. This is because the transactions are only authorized when you buy; the money isn't actually moved until later on in the day or week.

This leads to the second phase: settlement.

Businesses batch all the authorized transactions of the day from all their clients and send them to their payment processor.

The payment processor talks to the card networks (Visa, Mastercard, etc.) to notify them that funds will move now.

The card network communicates with each issuing bank. Each bank subtracts the balance from each cardholder's account and sends them over via the card network.

The funds land in the merchant's account, minus the interchange fees.

The money is held in the merchant's account until the payout date. This is when it moves into your business's bank account and you can use it freely.

What's the best online payment gateway for eCommerce?

All these payment processing companies are solid choices to let your customers pay you securely. Take your time to explore their entire feature sets, as not all of them offer the same possibilities or have the same pricing model. It's also wise to try out the support team and ask some questions—I mostly interacted via chat and phone, but your experience may vary depending on your needs.

Once you're locked in on your favorite online credit card processing system, register for an account and familiarize yourself with the way payments are processed, the fees applicable to your business, and how chargebacks are handled. Happy selling!

Related reading:

This article was originally published in September 2016 by Matthew Guay, and has also had contributions from Hannah Herman. The most recent update was in January 2024.