Some of my favorite recurring "Saturday Night Live" bits are the focus group sketches, where a beleaguered product rep tries fruitlessly to lead a group through a product testing scenario—with great difficulty, because at least one of the testers winds up being patently bananas. (My personal favorite is this Charmin sketch, featuring James McAvoy's frankly flawless Philly accent.)

After watching a few of those sketches, you can imagine why real-life focus groups tend to be pretty small. Even without any over-the-top personalities involved, it's easy for these groups to go off the rails.

So what happens when you want to collect market research at a larger scale? That's where the market research survey comes in. Market surveys allow you to get just as much valuable information as an in-person interview, without the burden of herding hundreds of rowdy Eagles fans through a product test.

Table of contents:

What is a market research survey?

A market research survey is a questionnaire designed to collect key information about a company's target market and audience that will help guide business decisions about products and services, branding angles, and advertising campaigns.

Market surveys are what's known as "primary research"—that is, information that the researching company gathers firsthand. Secondary research consists of data that another organization gathered and published, which other researchers can then use for their own reports. Primary research is more expensive and time-intensive than secondary research, which is why you should only use market research surveys to obtain information that you can't get anywhere else.

A market research survey can collect information on your target customers':

Priorities

Beliefs

Experiences

Preferences, desires, and needs

Habits

Values and motivations

The types of information that can usually be found in a secondary source, and therefore aren't good candidates for a market survey, include your target customers':

Demographic data

Consumer spending data

Household size

Income

Education

Career

Lots of this secondary information can be found in a public database like those maintained by the Census Bureau and Bureau of Labor Statistics. There are also a few free market research tools that you can use to access more detailed data, like Think with Google, Data USA, and Statista. Or, if you're looking to learn about your existing customer base, you can also use a CRM to automatically record key information about your customers each time they make a purchase.

If you've exhausted your secondary research options and still have unanswered questions, it's time to start thinking about conducting a market research survey.

Why conduct market research?

The first thing to figure out is what you're trying to learn, and from whom. Are you beta testing a new product or feature with existing users? Or are you looking to identify new customer personas for your marketers to target? There are a number of different ways to use a marketing research survey, and your choice will impact how you set up the questionnaire.

Here are some examples of how market research surveys can be used to fill a wide range of knowledge gaps for companies:

A B2B software company asks real users in its industry about Kanban board usage to help prioritize their project view change rollout.

A B2C software company asks its target demographic about their mobile browsing habits to help them find features to incorporate into their forthcoming mobile app.

A printing company asks its target demographic about fabric preferences to gauge interest in a premium material option for their apparel lines.

A wholesale food vendor surveys regional restaurant owners to find ideas for seasonal products to offer.

Primary vs. secondary market research

Market surveys are what's known as "primary research"—that is, information that the researching company gathers firsthand. Secondary research consists of data that another organization gathered and published, which other researchers can then use for their own reports.

Primary research is more expensive and time-intensive than secondary research, which is why you should only use market research surveys to obtain information that you can't get anywhere else.

The types of information that can usually be found in a secondary source, and therefore aren't good candidates for a market survey, include your target customers':

Demographic data

Consumer spending data

Household size

Income

Education

Career

Lots of this secondary information can be found in a public database like those maintained by the Census Bureau and Bureau of Labor Statistics. There are also a few free market research tools that you can use to access more detailed data, like Think with Google, Data USA, and Statista.

Or, if you're looking to learn about your existing customer base, you can also use a CRM to automatically record key information about your customers each time they make a purchase.

If you've exhausted your secondary research options and still have unanswered questions, it's time to start thinking about conducting a market research survey.

6 types of market research survey

Depending on your goal, you'll need different types of market research. Here are six types of market research surveys.

1. Buyer persona research

A buyer persona or customer profile is a simple sketch of the types of people that you should be targeting as potential customers.

A buyer persona research survey will help you learn more about things like demographics, household makeup, income and education levels, and lifestyle markers. The more you learn about your existing customers, the more specific you can get in targeting potential customers. You may find that there are more buyer personas within your user base than the ones that you've been targeting.

2. Sales funnel research

The sales funnel is the path that potential customers take to eventually become buyers. It starts with the target's awareness of your product, then moves through stages of increasing interest until they ultimately make a purchase.

With a sales funnel research survey, you can learn about potential customers' main drivers at different stages of the sales funnel. You can also get feedback on how effective different sales strategies are. Use this survey to find out:

How close potential buyers are to making a purchase

What tools and experiences have been most effective in moving prospective customers closer to conversion

What types of lead magnets are most attractive to your target audience

3. Customer loyalty research

Whenever you take a customer experience survey after you make a purchase, you'll usually see a few questions about whether you would recommend the company or a particular product to a friend. After you've identified your biggest brand advocates, you can look for persona patterns to determine what other customers are most likely to be similarly enthusiastic about your products. Use these surveys to learn:

The demographics of your most loyal customers

What tools are most effective in turning customers into advocates

What you can do to encourage more brand loyalty

4. Branding and marketing research

The Charmin focus group featured in that SNL sketch is an example of branding and marketing research, in which a company looks for feedback on a particular advertising angle to get a sense of whether it will be effective before the company spends money on running the ad at scale. Use this type of survey to find out:

Whether a new advertising angle will do well with existing customers

Whether a campaign will do well with a new customer segment you haven't targeted yet

What types of campaign angles do well with a particular demographic

5. New products or features research

Whereas the Charmin sketch features a marketing focus group, this one features new product research for a variety of new Hidden Valley Ranch flavors. Though you can't get hands-on feedback on new products when you're conducting a survey instead of an in-person meeting, you can survey your customers to find out:

What features they wish your product currently had

What other similar or related products they shop for

What they think of a particular product or feature idea

Running a survey before investing resources into developing a new offering will save you and the company a lot of time, money, and energy.

6. Competitor research

You can get a lot of information about your own customers and users via automatic data collection, but your competitors' customer base may not be made up of the same buyer personas that yours is. Survey your competitors' users to find out:

Your competitors' customers' demographics, habits, and behaviors

Whether your competitors have found success with a buyer persona you're not targeting

Information about buyers for a product that's similar to one you're thinking about launching

Feedback on what features your competitors' customers wish their version of a product had

How to write and conduct a market research survey

Once you've narrowed down your survey's objectives, you can move forward with designing and running your survey.

Step 1: Write your survey questions

A poorly worded survey, or a survey that uses the wrong question format, can render all of your data moot. If you write a question that results in most respondents answering "none of the above," you haven't learned much.

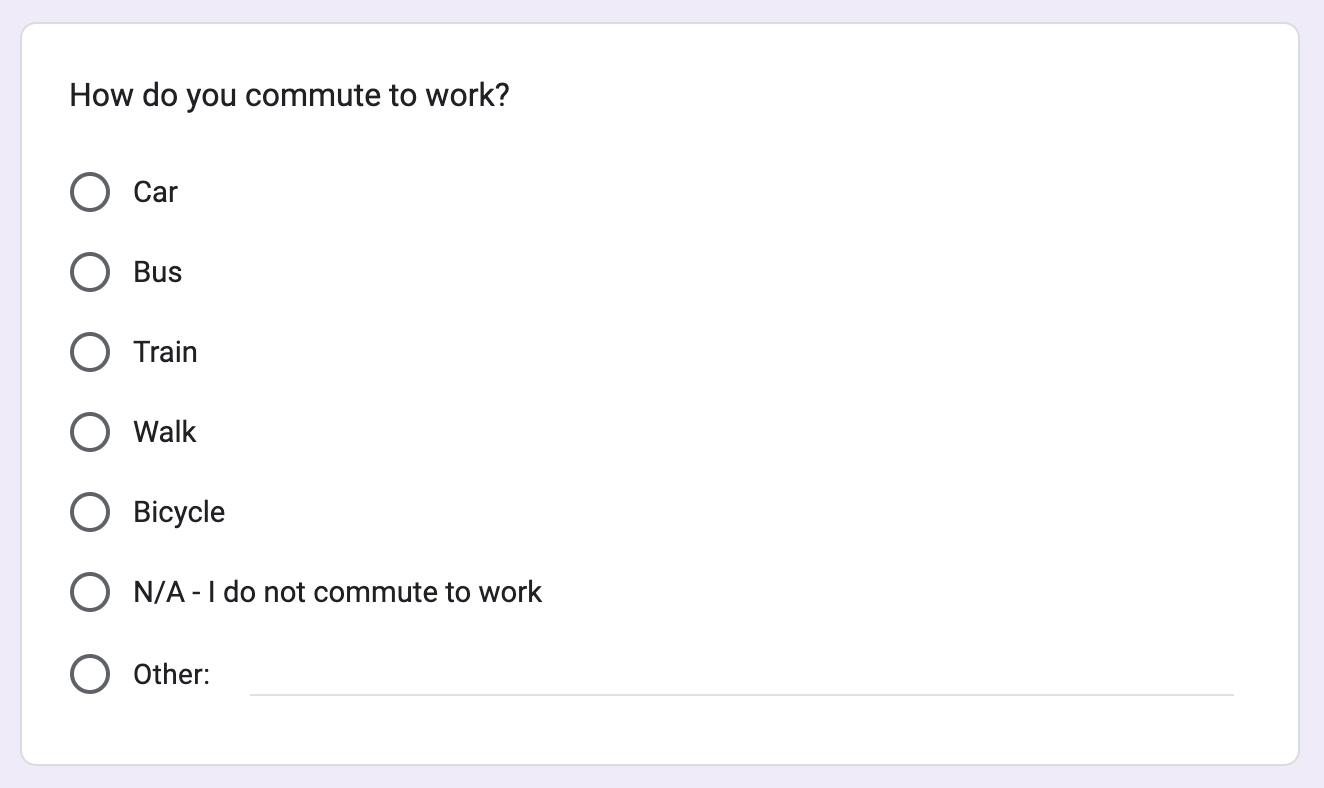

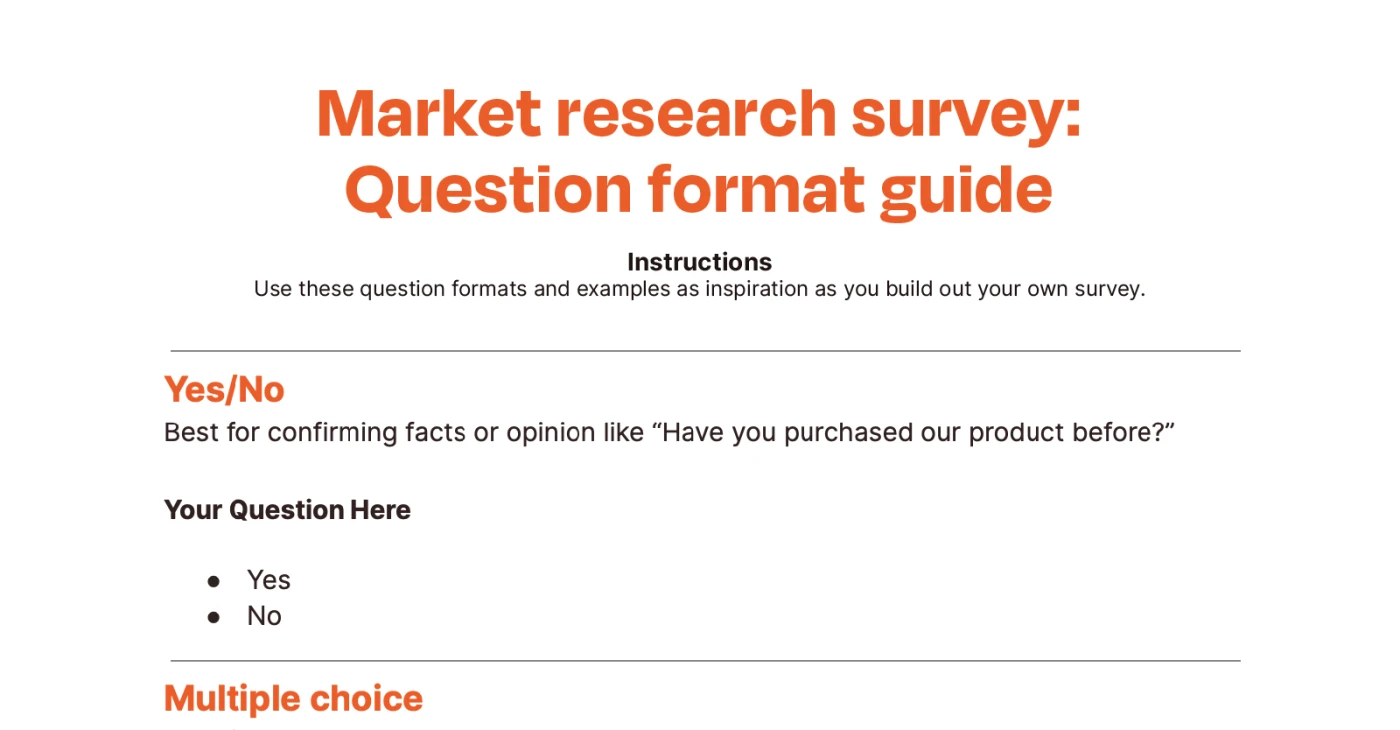

You'll find dozens of question types and even pre-written questions in most survey apps. Here are a few common question types that work well for market surveys.

Categorical questions

Also known as a nominal question, this question type provides numbers and percentages for easy visualization, like "35% said ABC." It works great for bar graphs and pie charts, but you can't take averages or test correlations with nominal-level data.

Yes/No: The most basic survey question used in polls is the Yes/No question, which can be easily created using your survey app or by adding Yes/No options to a multiple-choice question.

Multiple choice: Use this type of question if you need more nuance than a Yes/No answer gives. You can add as many answers as you want, and your respondents can pick only one answer to the question.

Checkbox: Checkbox questions add the flexibility to select all the answers that apply. Add as many answers as you want, and respondents aren't limited to just one.

Ordinal questions

This type of question requires survey-takers to pick from options presented in a specific order, like "income of $0-$25K, $26K-$40K, $41K+." Like nominal questions, ordinal questions elicit responses that allow you to analyze counts and percentages, though you can't calculate averages or assess correlations with ordinal-level data.

Dropdown: Responses to ordinal questions can be presented as a dropdown, from which survey-takers can only make one selection. You could use this question type to gather demographic data, like the respondent's country or state of residence.

Ranking: This is a unique question type that allows respondents to arrange a list of answers in their preferred order, providing feedback on each option in the process.

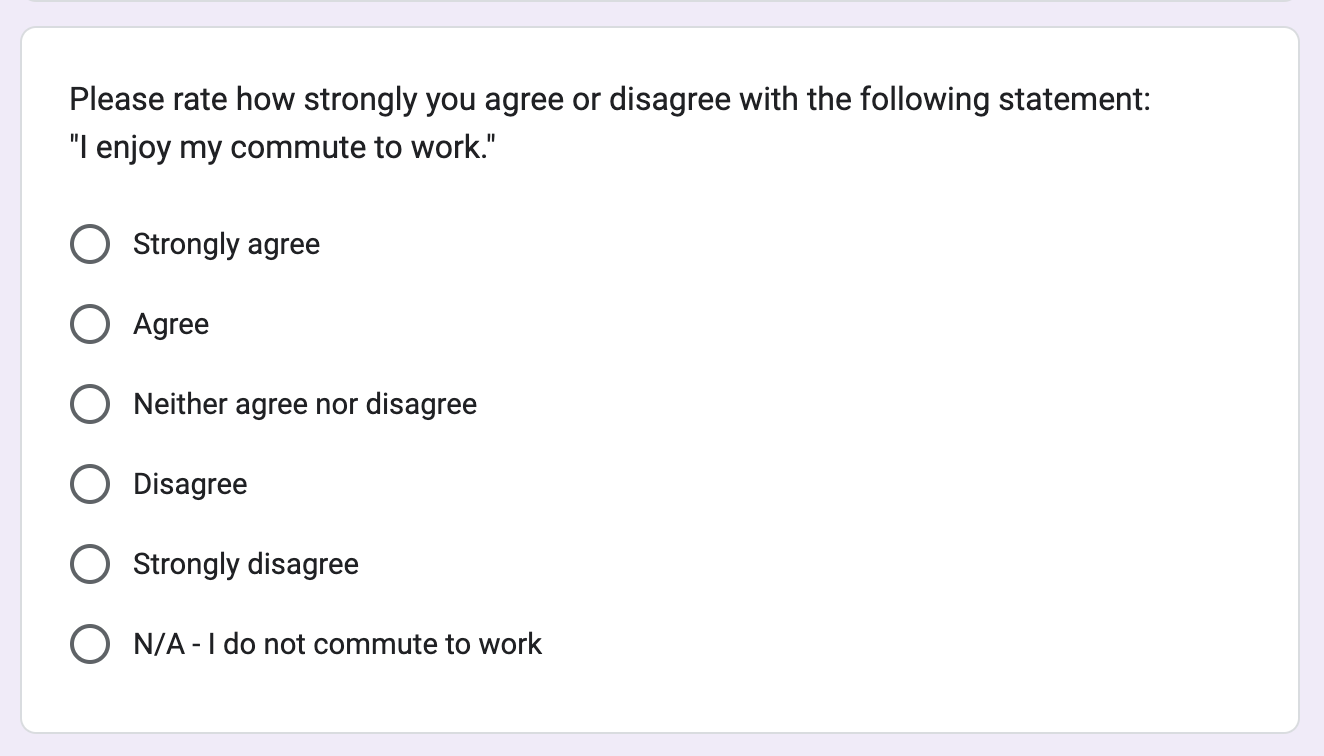

Interval/ratio questions

For precise data and advanced analysis, use interval or ratio questions. These can help you calculate more advanced analytics, like averages, test correlations, and run regression models. Interval questions commonly use scales of 1-5 or 1-7, like "Strongly disagree" to "Strongly agree." Ratio questions have a true zero and often ask for numerical inputs (like "How many cups of coffee do you drink per day? ____").

Ranking scale: A ranking scale presents answer choices along an ordered value-based sequence, either using numbers, a like/love scale, a never/always scale, or some other ratio interval. It gives more insight into people's thoughts than a Yes/No question.

Matrix: Have a lot of interval questions to ask? You can put a number of questions in a list and use the same scale for all of them. It simplifies gathering data about a lot of similar items at once.

Example: How much do you like the following: oranges, apples, grapes? Hate/Dislike/Ok/Like/Love

Textbox: A textbox question is needed for collecting direct feedback or personal data like names. There will be a blank space where the respondent can enter their answer to your question on their own.

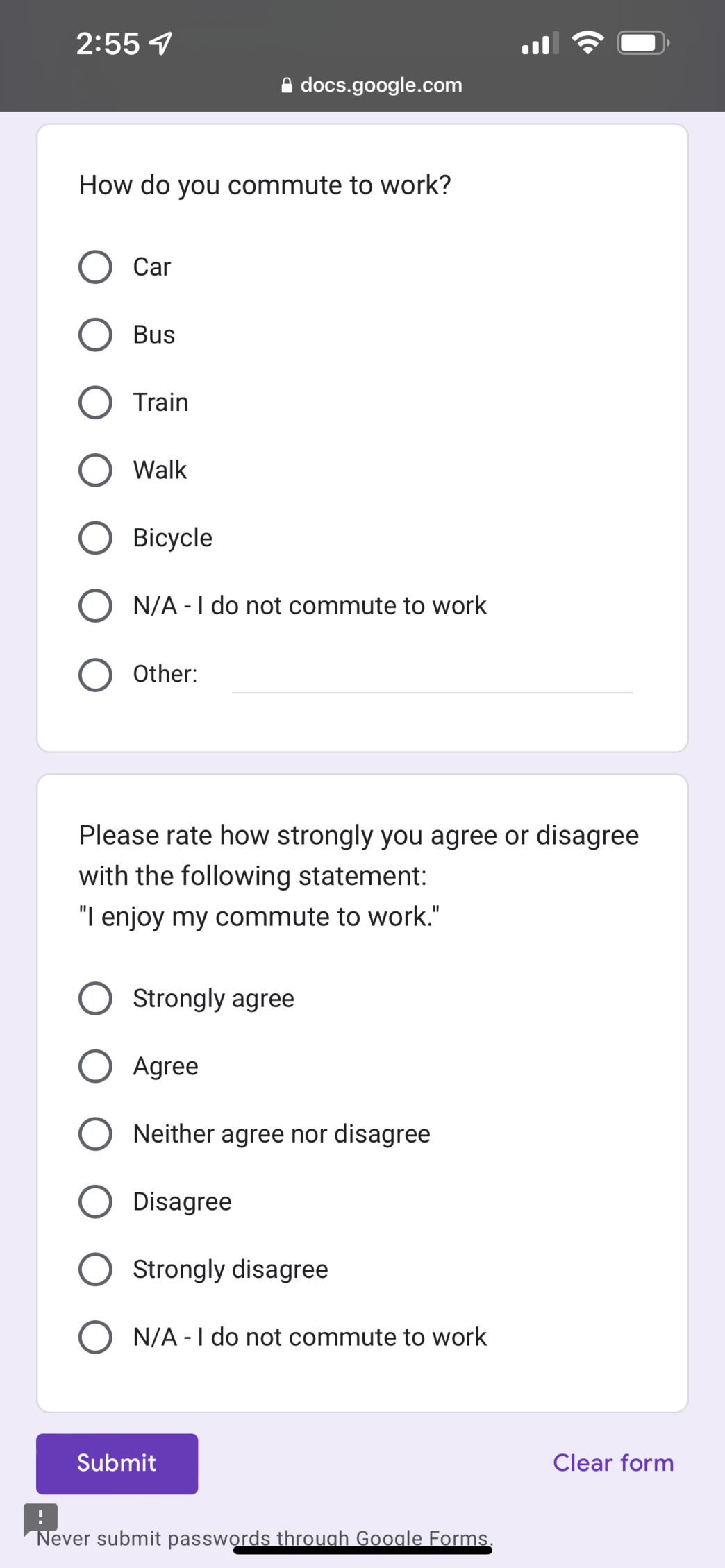

Step 2: Choose a survey platform

There are a lot of survey platforms to choose from, and they all offer different and unique features. Check out Zapier's list of the best online survey apps to help you decide.

Most survey apps today look great on mobile, but be sure to preview your survey on your phone and computer, at least, to make sure it'll look good for all of your users.

If you have the budget, you can also purchase survey services from a larger research agency.

Step 3: Run a test survey

Before you run your full survey, conduct a smaller test on 5%-10% of your target respondent pool size. This will allow you to work out any confusing wording or questions that result in unhelpful responses without spending the full cost of the survey. Look out for:

Survey rejection from the platform for prohibited topics

Joke or nonsense textbox answers that indicate the respondent didn't answer the survey in earnest

Multiple choice questions with an outsized percentage of "none of the above" or "N/A" responses

Step 4: Launch your survey

If your test survey comes back looking good, you're ready to launch the full thing! Make sure that you leave ample time for the survey to run—you'd be surprised at how long it takes to get a few thousand respondents.

Even if you've run similar surveys in the past, leave more time than you need. Some surveys take longer than others for no clear reason, and you also want to build in time to conduct a comprehensive data analysis.

Step 5: Organize and interpret the data

Unless you're a trained data analyst, you should avoid crunching all but the simplest survey data by hand. Most survey platforms include some form of reporting dashboard that will handle things like population weighting for you, but you can also connect your survey platform to other apps that make it easy to keep track of your results and turn them into actionable insights.

Tips for running a market research survey

You know the basics of how to conduct a market research survey, but here are some tips to enhance the quality of your data and the reliability of your findings.

Find the right audience: You could have meticulously crafted survey questions, but if you don't target the appropriate demographic or customer segment, it doesn't really matter. You need to collect responses from the people you're trying to understand. Targeted audiences you can send surveys to include your existing customers, current social media followers, newsletter subscribers, attendees at relevant industry events, and community members from online forums, discussion boards, or other online communities that cater to your target audience.

Take advantage of existing resources: No need to reinvent the wheel. You may be able to use common templates and online survey platforms like SurveyMonkey for both survey creation and distribution. You can also use AI tools to create better surveys. For example, generative AI tools like ChatGPT can help you generate questions, while analytical AI tools can scan survey responses to help sort, tag, and report on them. Some survey apps have AI built into them already too.

Focus questions on a desired data type: As you conceptualize your survey, consider whether a qualitative or quantitative approach will better suit your research goals. Qualitative methods are best for exploring in-depth insights and underlying motivations, while quantitative methods are better for obtaining statistical data and measurable trends. For an outcome like "optimize our ice cream shop's menu offerings," you may want to find out which flavors of ice cream are most popular with teens. This would require a quantitative approach, for which you would use categorical questions that can help you rank potential flavors numerically.

Establish a timeline: Set a realistic timeline for your survey, from creation to distribution to data collection and analysis. You'll want to balance having your survey out long enough to generate a significant amount of responses but not so long that it loses relevance. That length can vary widely based on factors like type of survey, number of questions, audience size, time sensitivity, question format, and question length.

Define a margin of error: Your margin of error shows how much the survey results might differ from the real opinions of the entire group being studied. Since you can't possibly survey every single person in your desired population, you'll have to settle on an acceptable percentage of error upfront, a percentage figure that varies by sample size, sample proportion, and confidence interval. According to University of Wisconsin-Madison's Pamela Hunter, 95% is the industry standard confidence level (though small sample sizes may get by with 90%). At the 95% level, for example, an acceptable margin of error for a survey of 500 respondents would be 3%. That means that if 80% of respondents give a positive response to a question, the data shows that between 77-83% respond positively 95 out of 100 times.

Market research survey campaign example

Let's say you own a market research company, and you want to use a survey to gain critical insights into your market. You prompt users to fill out your survey before they can access gated premium content.

Survey questions:

1. What size is your business?

<10 employees

11-50 employees

51-100 employees

101-200 employees

>200 employees

2. What industry type best describes your role?

Sales

Marketing

IT

Management

HR

Operations

Other

3. On a scale of 1-4, how important would you say access to market data is?

1 - Not important

2 - Somewhat important

3 - Very important

4 - Critically important

4. On a scale of 1 (least important) to 5 (most important), rank how important these market data access factors are.

Accuracy of data

Attractive presentation of data

Cost of data access

Range of data presentation formats

Timeliness of data

5. True or false: your job relies on access to accurate, up-to-date market data.

True

False

Survey findings:

63% of respondents represent businesses with over 100 employees, while only 8% represent businesses with under 10.

71% of respondents work in sales, marketing, or operations.

80% of respondents consider access to market data to be either very important or critically important.

"Timeliness of data" (38%) and "Accuracy of data" (32%) were most commonly ranked as the most important market data access factor.

86% of respondents claimed that their jobs rely on accessing accurate, up-to-date market data.

Insights and recommendations: Independent analysis of the survey indicates that a large percentage of users work in the sales, marketing, or operations fields of large companies, and these customers value timeliness and accuracy most. These findings can help you position future report offerings more effectively by highlighting key benefits that are important to customers that fit into related customer profiles.

Market research survey example questions

Your individual questions will vary by your industry, market, and research goals, so don't expect a cut-and-paste survey to suit your needs. To help you get started, here are market research survey example questions to give you a sense of the format.

Yes/No: Have you purchased our product before?

Yes / No

Multiple choice: How many employees work at your company?

<10 / 10-20 / 21-50 / 51-100 / 101-250 / 250+

Checkbox: Which of the following features do you use in our app?

Push notifications / Dashboard / Profile customization / In-app chat

Dropdown: What's your household income?

$0-$10K / $11-$35K / $36-$60K / $61K+

Ranking: Which social media platforms do you use the most? Rank in order, from most to least.

Facebook / Instagram / Twitter / LinkedIn / Reddit

Ranking scale: On a scale of 1-5, how would you rate our customer service?

1 / 2 / 3 / 4 / 5

Textbox: How many apps are installed on your phone? Enter a number:

________

Market research survey question types

Good survey apps typically offer pre-designed templates as a starting point. But to give you a more visual sense of what these questions might look like, we've put together a document showcasing common market research survey question types.

Use automation to put survey results into action

You're going to get a lot of responses back from your survey—why dig through them all manually if you don't have to? Automate your survey to aggregate information for you, so it's that much easier to uncover findings.

Related reading:

This article was originally published in June 2015 by Stephanie Briggs. The most recent update, with contributions from Cecilia Gillen, was in September 2023.