Launching a new business requires much more than coming up with a catchy name. You have to tackle dozens of details, including everything from writing a business plan to printing business cards.

Here, we'll walk you through all the things you need to launch a startup. And you can download our business startup checklist to keep you on track as you take your first steps as a new business owner.

Checklist for starting a business

1. Write a business plan

A business plan will help you nail down your goals and expectations and give you a roadmap for getting your company off the ground. If you plan to pitch investors or apply for a business loan, you'll need a business plan—most won't even consider a pitch unless there's a business plan attached.

Parts of a business plan

Depending on the complexity of your business idea, a business plan can be as short as a page or as big as a thick, data-packed document. No matter how simple or complex, every business plan should have at least a few key parts:

An executive summary, or a top-level outline of everything in the business plan.

A business description, including your company's structure, industry, value proposition, background information, and both short- and long-term business objectives.

A market analysis that evaluates where your business stands in relation to competitors, target customers, and industry trends.

A description of your products or services.

Financial projections like pricing and sales strategy, profit goals, and investor details.

An operational overview laying out the logistical "how"s of your business, including logistics, distribution, and production plans.

Business planning software

If you have any basic business experience or know-how, you can probably get through writing a business plan on your own, but if you're feeling totally lost or if you just want something to help move you through the steps more efficiently, business plan writing software might be the way to go.

BizPlan and Enloop are two examples of business plan platforms with reasonable monthly costs. IdeaBuddy is another platform that's meant to be used earlier in the process when you're still fleshing out ideas to help develop and refine your business concept, then guide you toward a formalized plan.

2. Estimate your startup costs

Calculating your startup costs will help you appeal to investors and estimate when your new business will start to become profitable.

Types of startup costs

To begin, you'll need to calculate your exact startup costs. These may include:

One-time startup costs: state business registration fees, lease deposits, etc.

Labor costs: your salary plus worker salaries

Overhead costs: monthly office rent, utilities, taxes, computer equipment, production costs

Spreadsheets are your friend with planning business finances—and we have a set of business budget templates to help you estimate monthly and one-time expenses for your business.

Start saving

Just like homeowners need an emergency fund for when the roof starts leaking, you also need an emergency fund for your new business. How much you need depends on the size of your operation and whether you're keeping your current job or going all-in on your new endeavor. It takes most startups at least a few months (and usually more) to become profitable, so if your startup is going to be your main source of income, you'll need at least a few months of operating expenses plus your own living expenses stashed away.

Find funding

Skip the family loan and second mortgage. Better loan options include the Small Business Association, your local bank, or new types of online lenders.

You might even start a crowdfunding campaign to generate cash—which is also a good way to test out your business idea's viability. Remember, though, that your purpose isn't to raise money. Your purpose is to create a viable business with products or services that genuinely help your customers.

3. Register your business

Before we dive into the details of business registration, a disclaimer: what we're providing here is a basic overview of the general requirements for most businesses in the United States. If you operate internationally or work in some niche industry like long-haul tobacco and airplane fuel shipping, these guidelines are one hundred percent guaranteed not to cover everything you need to know about registering your business.

Even if your company is fairly small, there may be specific requirements in your state or county that aren't covered here. No matter what, make sure you do your own research with local and state governments or consult with a lawyer to determine the legal requirements that apply to you.

Pick a business structure

Business structures boil down to four main types: sole proprietorships, partnerships, limited liability companies, and corporations. For legal and tax purposes, decide which type you'll operate under—though you can always switch to a different business type as your company grows.

Sole proprietorships: This is the simplest type of business to start and run. It means that you are the company, and all assets and debts of the company are yours too. This also means you'll be personally liable for all business obligations like lawsuits or unpaid debts, so this is the riskiest business structure.

Partnerships: These are like sole proprietorships, except there's more than one owner. Co-owners typically structure their business relationship with partnership operating agreements. Partners split the company's legal and financial obligations and also share in the profits.

Limited Liability Companies and Partnerships (LLCs and LLPs): When you form an LLC or LLP, you work as a "member" of the company, along with any company partners. If the company goes into debt or gets sued, your personal assets are protected. Compared to corporations, there's less paperwork and smaller startup costs.

Corporations: When you incorporate, you create a separate legal entity that owns all of the assets and liabilities for the company. Corporations are usually more attractive to outside investors—you can "go public" with an initial public offering (IPO) and raise money through selling stock in the company.

Choose a business name

Start by writing down every single name that pops into your head, including the ridiculous names (bad idea brainstorms work!). This will get your creativity flowing. Plus, you can pull elements that you like from the throwaway names and incorporate them into your more serious ideas.

If you plan to register a trademark on your business's name, keep in mind what can't be trademarked:

Any person's name who hasn't given expressed permission

Swears or other offensive content

Government flags and insignia

Your name also needs to meet the U.S. Trademark Office's requirements for "distinctiveness," which just means your trademark needs to be unique enough to avoid confusion between yourself and other similarly named businesses.

Register your company

All businesses except sole proprietors with no employees must register with the IRS and obtain an Employer Identification Number (EIN). This is your company's federal tax identification, which you'll use when paying taxes, opening a bank account, applying for business licenses, and hiring employees.

You may need to register your business with your state government. Use the Small Business Administration's state lookup tool to find information for your state. Similarly, contact your local government office to find out if additional registrations or permits are necessary.

4. Open accounts and obtain permits

With your business plan in hand, it's time to lay the operational and financial groundwork to get your company off the ground.

Open a company bank account

Even if you run a sole proprietorship and your business is just you, life will be easier if you have a separate bank account to manage your business finances. If you want to accept credit card payments either online or in person, look into credit card payment processing services.

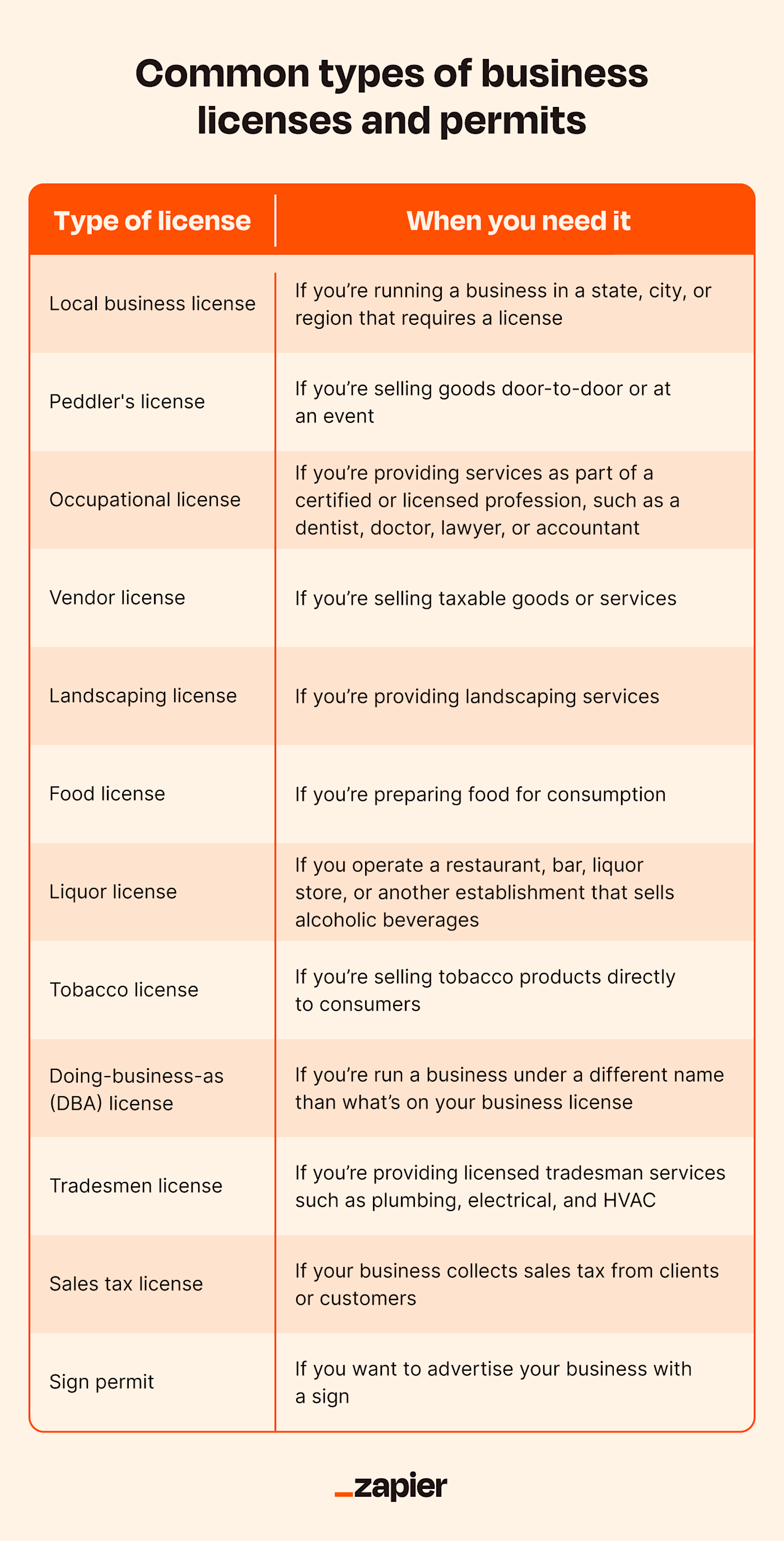

Get licenses and permits

In certain industries, you'll need licenses and permits in order to operate legally. This usually applies in industries where there's a risk of damage to the customer—think construction, hair salons, and financial consulting. Some municipalities also require home-based businesses to hold a "home occupation permit," so make sure you find out what licenses you need before you open your doors, no matter what industry you're in.

Find out if you need a Sales Tax Permit

If you sell physical products and you operate in a state that collects sales taxes, you likely need to register for a Sales Tax Permit. Most states administer these permits for free or for a nominal fee.

5. Set up a financial accounting system

Money can get complicated very quickly, so you want to have an automated system for financial accounting, budgeting, and documentation before you start making any sales.

Basic bookkeeping 101

There are a number of bookkeeping records that small business owners need to update on a regular basis to keep their business finances in order. These tasks include:

Income statements

Balance sheets

Cash flow statements

Bills and invoices

Expenses

Payroll

Quarterly financial statements

Tax returns

Unless you're very confident in your skills with an Excel spreadsheet, you should invest in accounting software or consider hiring a part-time bookkeeper. Check out Zapier's list of the best accounting software for small businesses for some apps to try out.

Understand your tax liability

Business taxes are very different from employee taxes. The biggest difference is that small businesses are required to file taxes quarterly instead of annually. You need to have enough cash on hand to remit payment to the IRS every three months, which can take some getting used to.

If you have employees, you'll also need to keep in mind that employee taxes are paid to the government by the employer. If you've ever looked at your own pay stubs, you'll know that each includes a record of what taxes were taken out of your paycheck. Those taxes aren't taken by the government directly—they're taken out by the employer, who is then responsible for sending employees' taxes to the IRS.

6. Buy business insurance

As soon as you hire employees, open a physical location, or begin to scale your business, you'll need liability insurance of some sort. General liability insurance covers you in case someone is injured on your property or as a result of your company's activities.

Additional policies that are common for new businesses include:

Professional liability: Covers you in case an error or omission on your part costs your clients money.

Workers' compensation: Covers medical expenses and lost wages for employees who are injured while working.

Business interruption insurance: Helps replace lost revenue if your business is forced to close temporarily due to a natural disaster or other event.

Property insurance: Covers your physical property, from company equipment to office or warehouse space.

7. Create a management system

For a single-person business, a management system can be as simple as a set of to-do lists for keeping track of budgets and schedules. Larger businesses will need to formalize processes for managing workflows, finances, schedules, team organization, and more.

Management setup

When getting your management system up and running, focus on the essentials. At a minimum, you'll need a structure for managing:

Calendars and scheduling

Customer communications

Budgets, invoices, and other financial documents

Industry-specific KPIs

Purchasing and order fulfillment

If you're starting with a team, you'll also want to put together an organizational chart. Determining each person's responsibilities will help eliminate confusion and oversights.

Invest in branding and marketing

The fun part, of course, comes at the very end of all the operational logistics. Take some time to think through your marketing strategy before launching your business. At a minimum, you'll need to start with a website, a logo, and social media accounts.

Establishing a brand identity

Start by thinking through how you want to come off to others as a brand. Usually, your brand voice will align closely with the industry you're in—financial and legal firms tend to be serious and authoritative, while creative agencies need to be witty and innovative.

Consistency is far more important than trying for fancy, versatile, or expensive branding. A company with a simple, casual tone and one or two brand colors and basic designs will do far better than a company that tries out a different tone with each social post.

List of things needed to start a business

Starting a business doesn't need to be an overwhelming undertaking. With a bit of organizational planning and this business startup checklist, you can get your company up and running quickly. Of course, the more tasks you automate on this list, the smoother everything will run, and the quicker you'll be able to start making sales. Learn more with this small business guide to automation.

Related reading:

This article was originally published in October 2016 by Melanie Pinola and has also had contributions from Amanda Pell. The most recent update was in May 2023.