Are we making money?

What's our monthly burn?

How many people should we hire?

What can we afford?

Can we order pizza for lunch?

These are some of the questions and discussions happening among finance teams and scaling companies every day. And they're not easy questions to answer—except for maybe the last one (the answer to that one should always be yes).

Early on in their journey, companies and founders might have a good handle on their financial position—either because they're involved in all aspects of the company or by closely tracking their bank accounts. But as a company starts to grow, and tasks and roles are bestowed on other team members, it gets tougher. Sometimes the finance and accounting components of the business get deprioritized. Other times, business owners neglect them because they may just not be a numbers person.

That's ok. But it means you need sound financial processes, so that everyone has important financial and non-financial metrics at their fingertips whenever they need it.

As co-founder of ConnectCPA, a virtual accounting and bookkeeping service, I run into these situations and challenges with many new clients we bring on board. Once in a while, we'll work with a new client that has their stuff together—and our team does a virtual high-five—but in many cases, there's a lot of historical data to pore over, catch up on, and clean up.

Once the foundation is set, the real work can begin.

One of the best ways to keep up with your accounting and avoid human error is through automation. Streamline your accounting with these 5 automation tips.

Bookkeeping basics

The foundation of sound financial processes starts with bookkeeping. (Not all bookkeeping is the same—there's cash-basis and accrual-basis—but that's a conversation for another day.) The more your company grows, the more complex your bookkeeping will become—and that's when it's time to get someone with some experience on board. We've taken over the accounting books from many companies, and their bookkeepers have been on both ends of the spectrum: some amazing recordkeeping and coding all the way to "I can't believe they left you with books in this shape."

It's not something to take lightly.

What is bookkeeping?

Before we jump into the details of bookkeeping, it's important to understand the chart of accounts. The chart of accounts is the list of every expense, revenue, asset, liability, and equity account where individual transactions can be classified to. It's essentially the index for all your accounts. Every company's chart of accounts will look a little different, but the important thing is that all financial transactions are recorded.

And that's bookkeeping.

When someone is bookkeeping, they're categorizing every single financial transaction that shows up on the company bank and credit card statements to a chart of accounts.

Our team constantly monitors our clients' charts of accounts and has discussions with them about it. Why discuss so regularly? It's not uncommon to add new accounts as companies scale and new types of financial transactions appear. The reverse can also happen: accounts aren't used anymore, and they're removed.

You want to keep your chart of accounts as relevant and streamlined as possible. Nobody needs to have four different accounts for office supplies. We get it—everyone loves new supplies—but recording it all in one place is just fine.

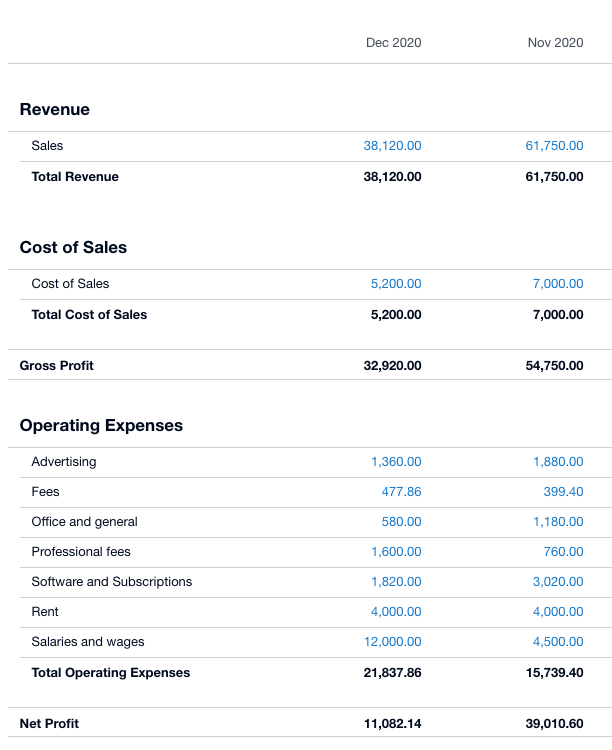

After a period of time, as individual transactions are being recorded into their individual accounts, we sum up the accounts for the month/quarter/year and report the totals. Reporting on the sum of these accounts (i.e., just the total of each account) is a financial statement: it should provide a clear picture of financial performance for a company. Here's an example.

How bookkeeping helps provide real-time financials

With the introduction of cloud accounting software, user-friendly payment gateways, and other automation tools, companies have the ability to automate lots of bookkeeping tasks, leading to faster turnaround times, increased efficiency, and real-time financial visibility.

At ConnectCPA, we live and breathe automation. Here are a few examples:

You can create "rules" in your accounting system for recurring transactions, so that when bank or credit card transactions are imported or downloaded, they can be auto-categorized to specific accounts, saving loads of time on the bookkeeping and data entry front.

You can integrate an expense capturing app with your accounting system. When you come across an expense, whether a physical receipt or one in your inbox, you can have the expense app digitize it and publish it to your accounting system, creating a record of that expense with minimal effort.

You can also use a tool like Zapier to integrate your accounting and bookkeeping software with any of the other apps you use to run your business.

This kind of automation increases accuracy (in addition to eliminating repetitive tasks). And with accurate financial statements at your fingertips, company management has the ability to make decisions based on real-time data, rather than on historical information. The ability to pull up metrics on a whim and make a decision? Magical.

Plus, if a company is looking to build relationships with external stakeholders such as investors, shareholders, or banks, accurate reporting is a necessity. Whether it's an investment, loan, or acquisition, you'll need to portray your operations from a financial point of view through financial statements. You want those ready when you need them—not scrambling to get them together.

Transparent KPIs and other benefits of real-time financials

Your business likely has key performance indicators (KPIs), important and unique metrics that can be tracked and measured to determine company performance. For example:

Revenue growth

Monthly sales bookings

Net promoter score (NPS)

Lifetime value of a customer

Customer acquisition cost

Measuring KPIs often falls by the wayside simply because businesses don't have the foundation to track the data in order to provide meaningful information.

You guessed it: real-time financial information to the rescue.

By keeping up with the real-time financial information of your company, you can create a process by which you're measuring KPIs and comparing to previous months and quarters—all as part of the financial tracking process. By keeping track of financial data, you're keyed into a wide variety of metrics, allowing you to pull different financial levers within the company and determine their impact.

We were recently working with a company that was in the process of being acquired. The acquirer was really impressed with their organized financial information and thorough understanding of their own business during the due diligence stage. They were able to highlight the change in their KPIs as the business evolved and were also able to forecast certain metrics. In part because of this, the acquirer felt confident and closed the deal quickly. We've seen the opposite happen, too, and it's unfortunate because of how easily it can be prevented.

Real-time financials are an evolution

"Start with the basics, and evolve from there."

That's the advice we typically provide businesses that aren't organized from a financial perspective. Yes, you can be easily overwhelmed by thinking about all the months or years of bookkeeping that's required to get caught up, let alone setting up processes to ensure things are running smoothly on a go-forward basis.

Get some help to get organized and into a monthly cadence of up-to-date books. Once that's set up, dig into the monthly numbers and try to obtain a better understanding of your business financials. Through this, you'll naturally come up with specific KPIs that should be measured to understand whether you're achieving objectives.

This information can then drive budgets and forecasts—data that every scaling company needs as it makes its mark on the world.

This was a guest post from Lior Zehtser, co-founder of ConnectCPA. ConnectCPA focuses on streamlining the accounting, bookkeeping, and back-office functions for scaling companies. They work with companies in Canada and the U.S. to assist with setting up or improving their financial infrastructure through automation and implementing key processes to ensure financial information is accurate and accessible in real-time. Want to see your work on the Zapier blog? Check out our guidelines, and get in touch.