As a small business owner, you're likely balling with a lot more than your personal checking account. If you don't properly manage your business finances, there's more on the line than an overdraft fee—you now have an entire organization to account for.

Small business budgets are necessary to balance revenue, estimate how much you'll spend, and project financial forecasts, so you can stay out of the red and keep your business afloat.

But creating a small business budget template isn't a small task. Since I don't have a business to run, I did the heavy lifting for you—check out these free, downloadable templates for your small business budgeting.

Table of contents:

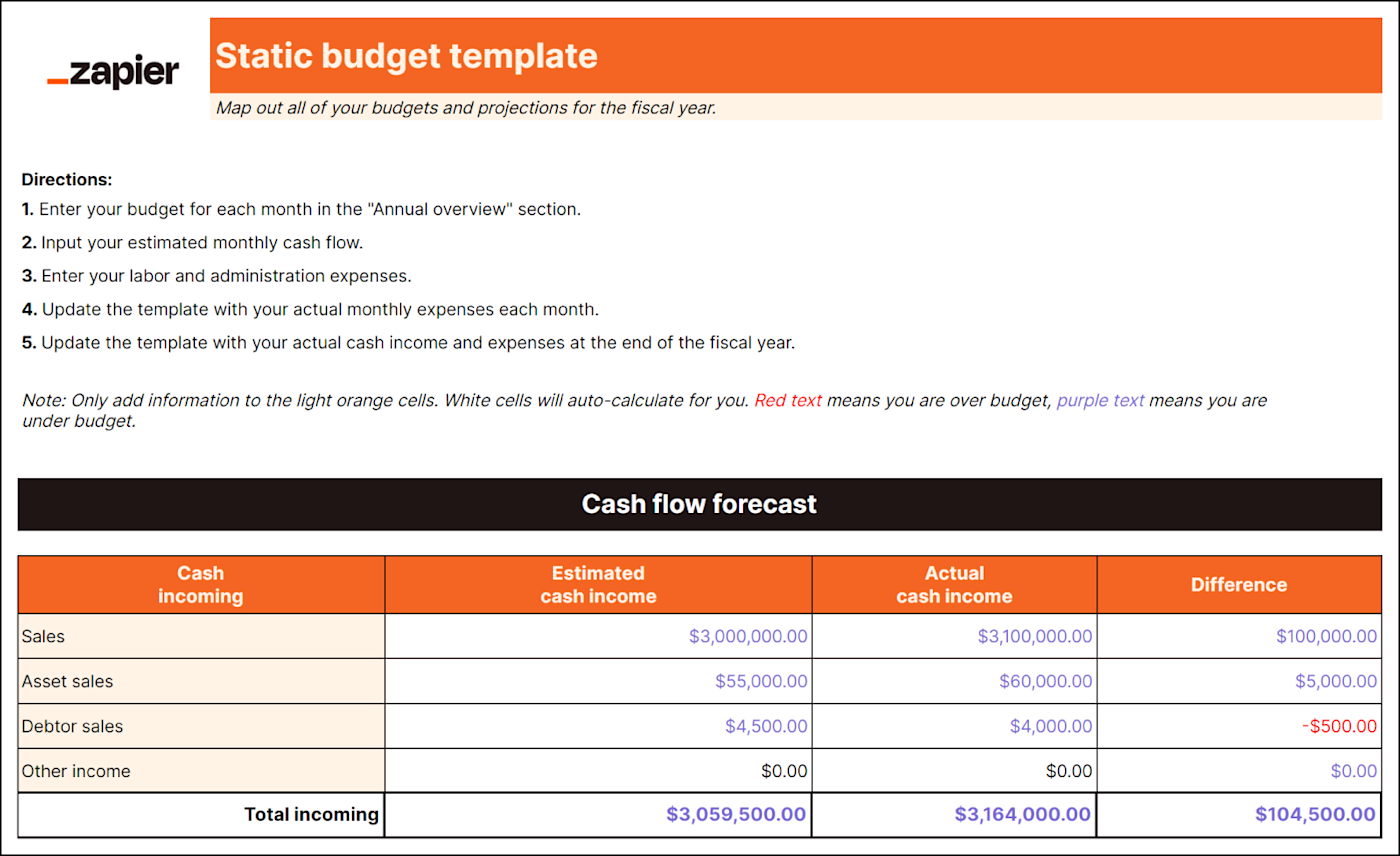

1. Static budget template

Best for: Multiple departments or revenue streams; Industries with complex operations

A static budget combines all the function-specific budgets a business uses into one. Typically, a static budget includes the following items (plus any other budgets your business might use):

Cash flow projections: Estimations of how much money will flow into and out of your business. They also help you decide when, how, and what you should spend money on.

Total expected spending: All estimated expenses, including labor and administrative costs.

By integrating all of your budgets and projections, the static budget provides a full picture of your business's estimated expenses and financial strategy for the upcoming fiscal year.

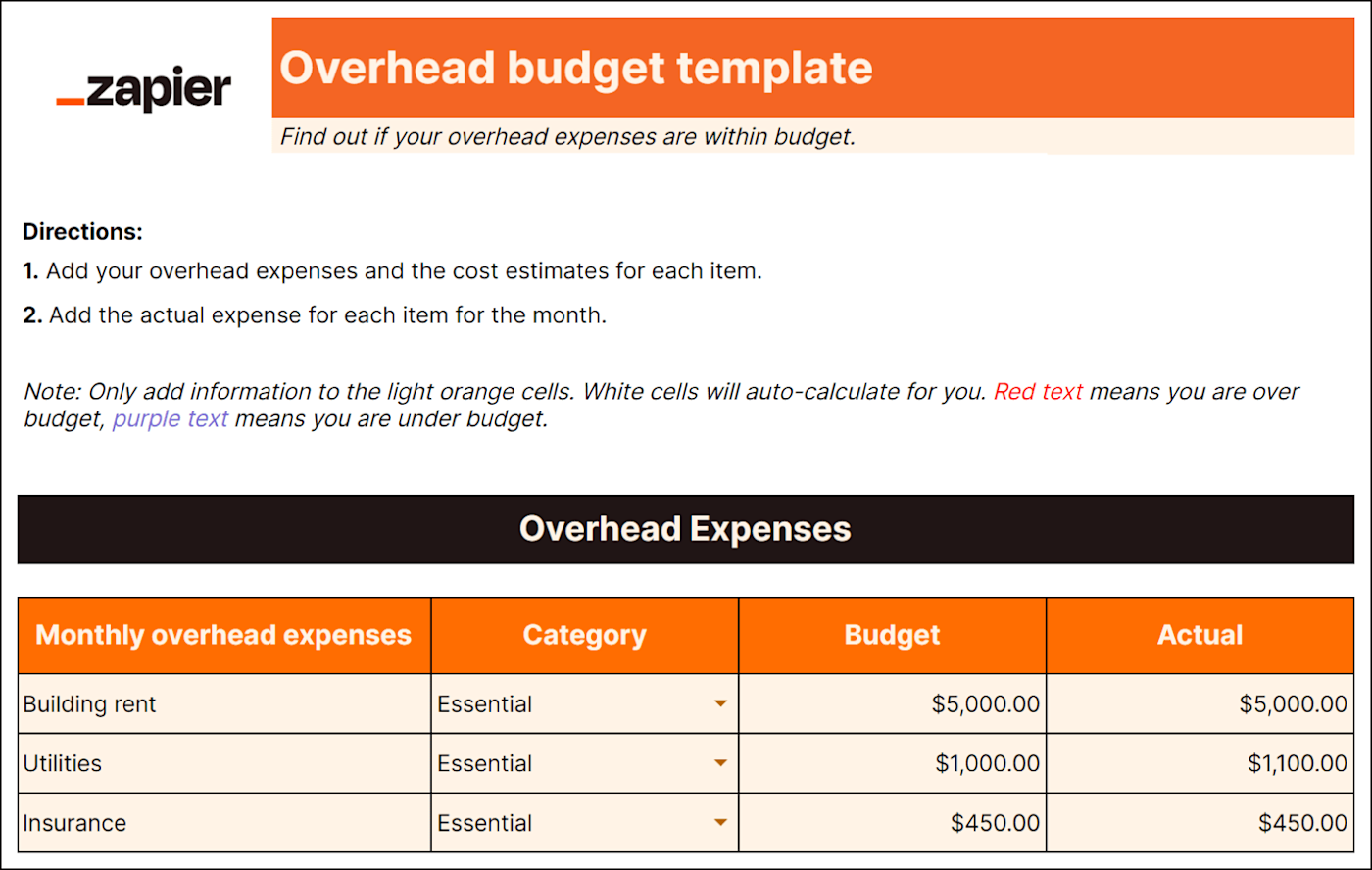

2. Overhead budget template

Best for: Service-based businesses

It's easy to forget about expenses that aren't directly tied to production, like delivery charges or utilities. But these costs exist (and can add up quickly), so you need an overhead budget. A detailed overhead budget template will include:

Administration expenses

Taxes

Rent

Utilities

Insurance

It compares your budgeted amount to actual figures (warning: it may be a rude awakening) and can help improve accuracy for future financial planning.

Predicting overhead spending helps you plan how to use other funds more practically too—if you know how much you'll spend on overhead, you can make better business decisions. For example, you'd know whether you can afford to invest money into other initiatives like adding a delivery service or upgrading equipment.

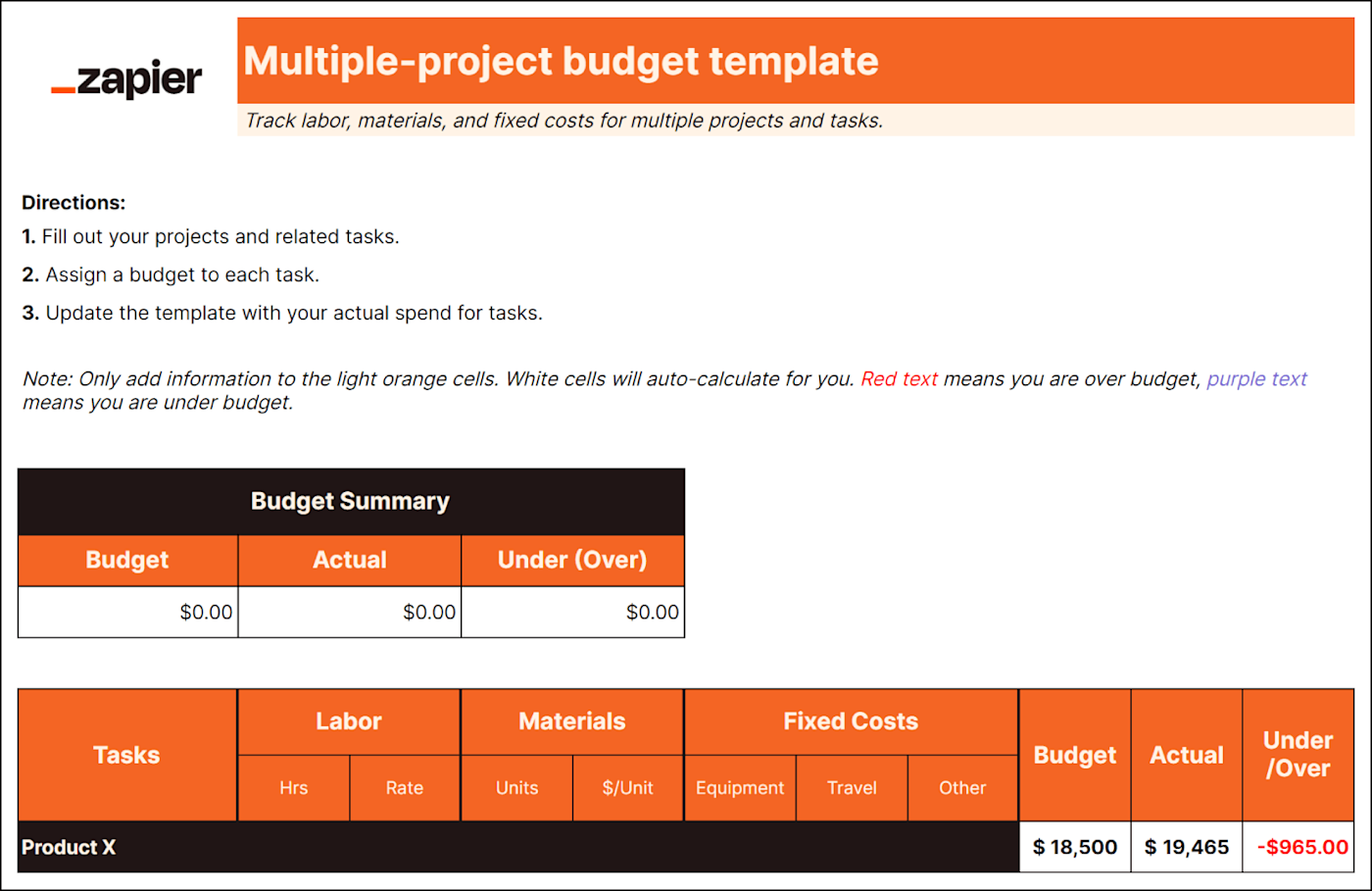

3. Multiple-project budget template

Best for: Project-based industries

If you're managing multiple projects like website development or event planning, each with its own budget and expenses, you need a multiple-project budget to help keep your head on straight. This type of budget will help you track the following items per project:

Product-by-product COGS (cost of goods sold)

Labor costs

Equipment and resource costs

Indirect project expenses like travel

A multiple-projects budget establishes estimates for everything you need to get projects across the finish line. It also lets you track costs to ensure you're not spending more than you accounted for in the budget.

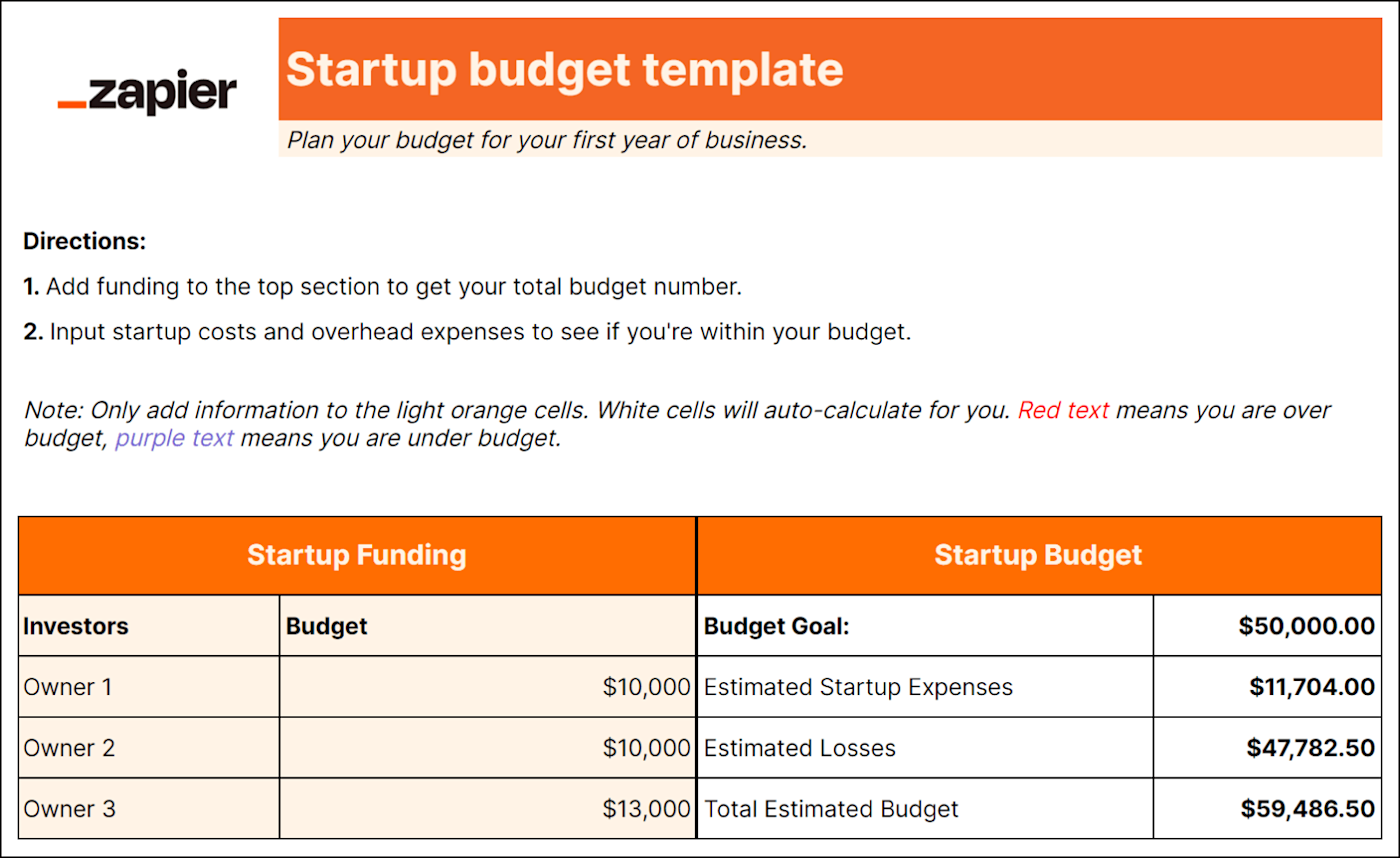

4. Startup budget template

Best for: New small businesses and startups

Startups need to ensure financial success from the get-go, so they can reinvest profit into the business and potentially attract more investors.

But unlike established small businesses, you don't have past financial data to base expenses on. That's why you need a startup budget to focus on expenses for your first year of business, including items like:

Funding from investors and loans

Licensing and permits

Logo and website design

Website domain

Business software

Security installation

Overhead expenses

Capital expenses

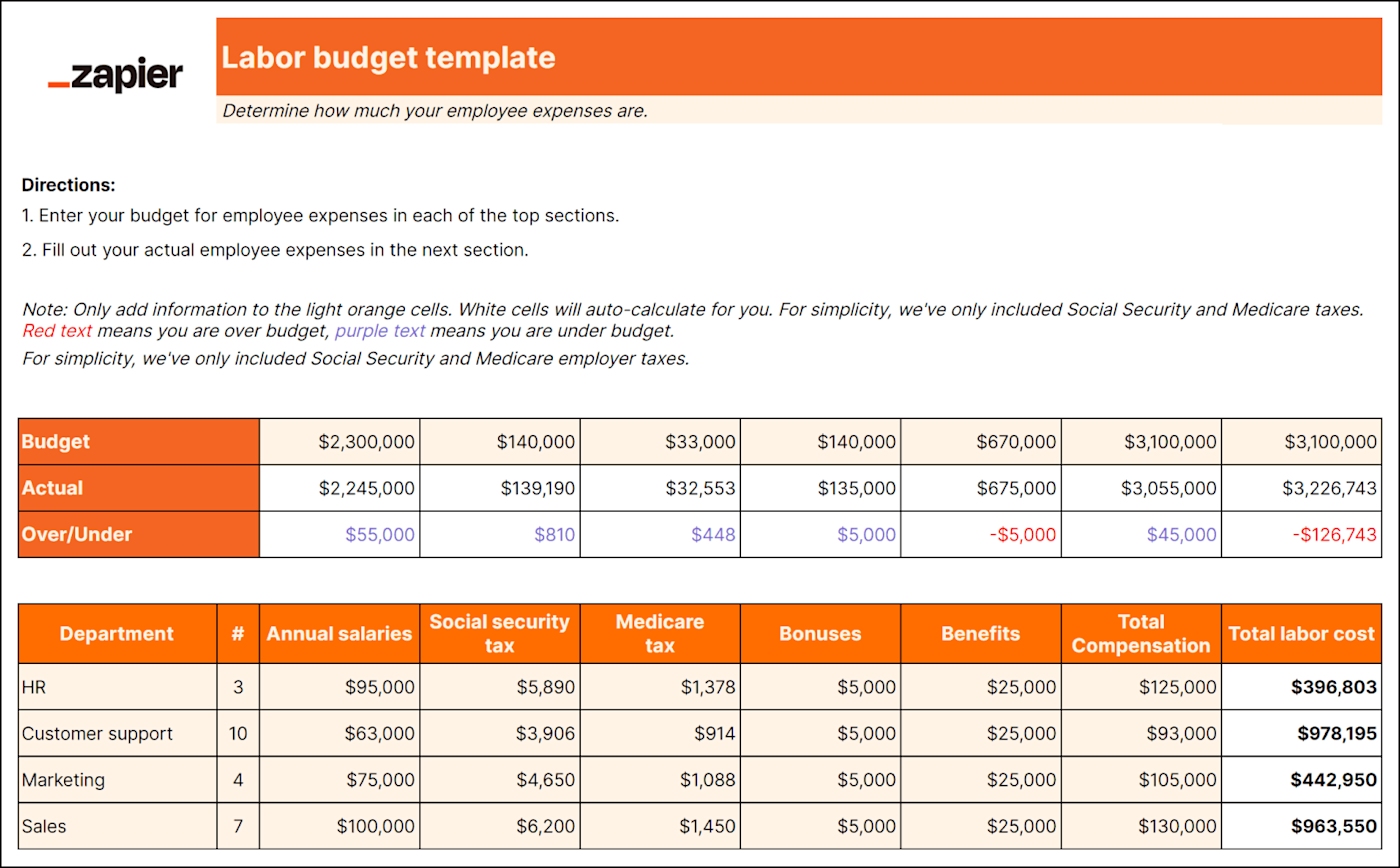

5. Labor budget template

Best for: Larger businesses with lots of employees

Unless you're a one-person show, you'll need a labor budget. And even if you are a one-person show, it's good to know if you can afford to pay yourself. A labor budget breaks down all employee-related costs like:

Wages

Bonuses

Payroll taxes

Contract labor

Break down employee costs into direct, indirect, fixed, and variable categories to clarify how your company allocates its resources. You can also consider different scenarios more easily when you understand the breakdown of labor costs.

For example, you can simulate the impact of adding or reducing staff in specific departments or assess the effects of different compensation structures on different teams.

An accurate forecast of labor costs ensures you can sustainably meet your staffing needs and can help you make informed hiring decisions. Down the road, it can also help you determine if you can afford to give your staff raises, bonuses, or additional benefits.

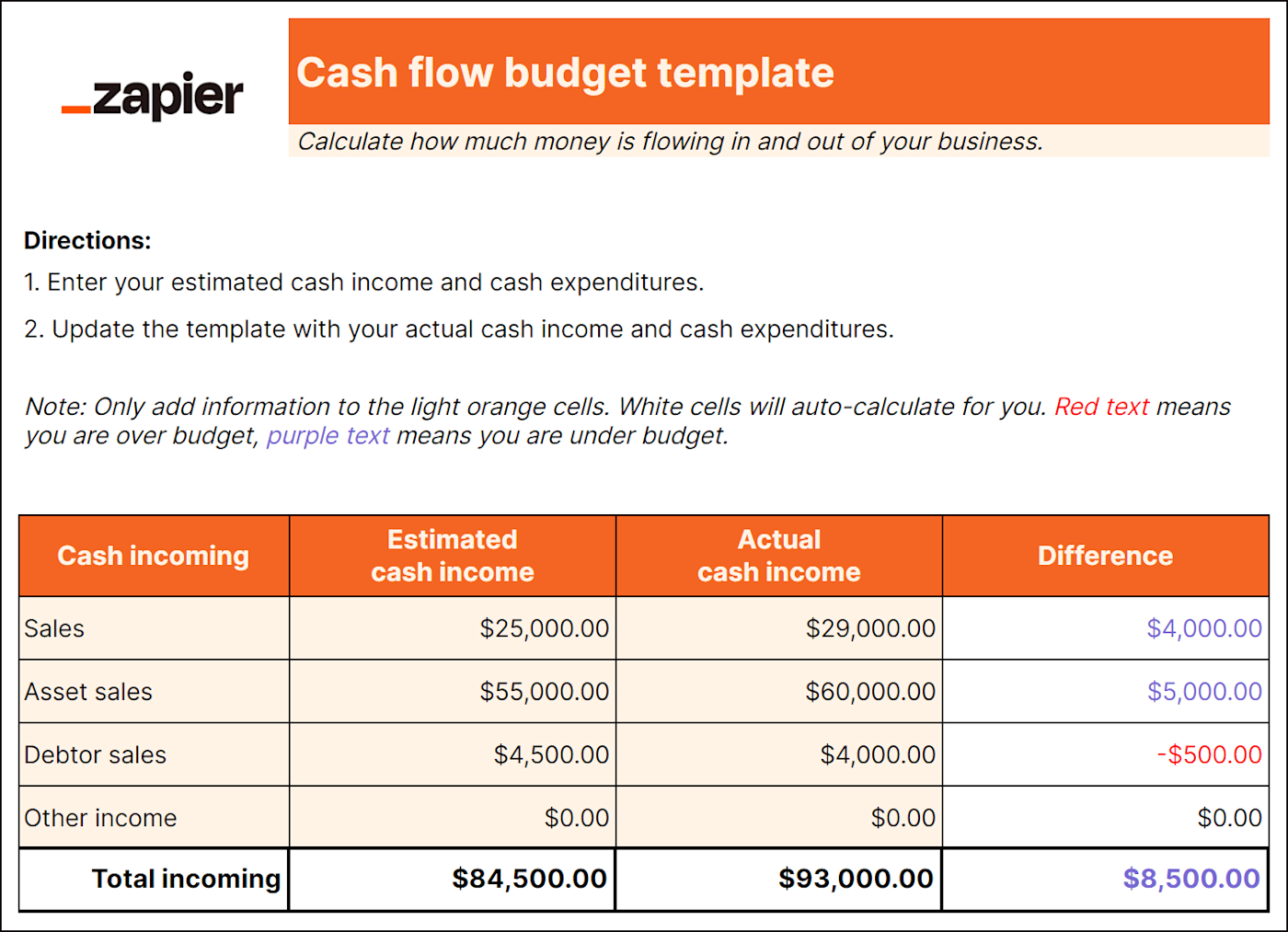

6. Cash flow budget template

Best for: Businesses with fluctuating income and expenses; Seasonal businesses; Retail

As important as it is to be mindful of how much money you're spending, you should also track how much money you're making. A cash flow budget helps estimate how money is flowing in and out of your business. It includes:

Starting balance (set at the beginning of the month, quarter, or year)

Projected cash inflow from all revenue streams

Estimated cash expenditures

Ending balance (calculated at the end of the month, quarter, or year)

This type of budget lets you proactively manage your resources, anticipate potential cash shortages, and strategize for growth. For instance, if you know you're only going to break even this year, you may wait on expanding or making a large investment.

7. Administrative budget template

Best for: Businesses focused on streamlining operations

An administrative budget includes all those general expenses that the company as a whole needs to function. This type of budget accounts for:

Depreciation expenses

Insurance

Training and development

Communication expenses

Marketing

Accounting fees

While you could technically include administrative expenses in an overhead budget and call it a day, a separate administrative budget gives more of an eagle-eye view of how well your business is operating.

Without an eye on administrative costs, you may be spending unnecessarily or lose focus on areas where it'd be wiser to invest your money. In other words, you could be spending way too much on fancy pens when you should be saving up to upgrade your cash register.

Periodic budget reviews

A budget isn't a "set it and forget it" deal. Regular budget reviews can help you stay on track with your financial goals and respond proactively to changing market conditions.

You should compare your estimated budget to actual spending. Then you can see where you went over and where you can splurge more. Try to review your budget monthly, quarterly, and yearly.

Monthly: Compare actual performance against your budgeted figures for the month. Identify any deviations and look for insights into cash flow, sales trends, and expense management.

Quarterly: Dive deeper into performance over the last three months. Use trends to project revenue and expenses for the upcoming quarter and identify areas for improvement.

Yearly: Reflect on your long-term financial objectives for the fiscal year. Assess the effectiveness of your budgeting strategies, and set new budget targets for the upcoming year.

How to design your small business budget plan

It's cliched but true: you gotta spend money to make money. But that's no excuse to start throwing cash at your business willy-nilly.

Budgeting forces you to prioritize your objectives, so you spend money on the things that matter most. Here's how to create a small business budget in four steps:

Identify your working capital for the budgeting period. Add up your current assets like cash, accounts receivable, and inventory. Then subtract current liabilities like accounts payable and short-term debt. The remaining amount is what you have left to cover your operational expenses during the budgeting period.

Separate business and personal expenses. If you haven't already, open a dedicated business bank account. This makes it easier to track, categorize, and analyze your finances.

Determine your fixed and variable costs. Make a list of costs that stay the same every month (fixed costs) and what changes (variable costs). These will change based on the purpose of the budget. For instance, a labor budget will only consider employee-related costs.

Calculate your total expenses. Add up all the costs for your business, including fixed costs, variable costs, labor, and any other applicable expenses. This total is how much your business needs to run. Any leftover money from your working capital can be allocated toward other business investments.

Budgeting methods

If you've budgeted before and hated it, you may just have been using an ineffective budgeting method for your preferences. Here are a few budgeting methods to try instead:

Traditional: This budget is set for a determined amount of time and uses last year's numbers as a benchmark. Once you set your budget, you don't change it unless you get approval for an adjustment.

Rolling: This dynamic approach spans a continuous time frame instead of a fixed time period. As each month or quarter passes, you add a new budget period and drop the oldest period. This lets businesses adjust projections based on real-time performance and market conditions.

Flexible: This budget changes along with your sales forecast. As real-time sales activity deviates from budgeted amounts, you recalculate the budget to reflect the new data.

Small business budget FAQ

Still don't know where to start with your small business budget? Check out the answers to these common questions before you open a new Google Sheet.

What should a business budget include?

A business budget should include all income sources and expenses. Income sources could include projected revenue from sales, loans, or potential investor funding. Expenses may include items like office space rent, employee salaries, insurance, and marketing. Add anything that helps paint a full picture of your finances.

How much does the average small business startup cost?

The average small business startup costs $40,000 in its first year of business. But this will absolutely vary depending on your type of business, unique expenses, and cash income. For instance, there are multiple types of businesses you can start with $10,000 or less.

What is the best free business budgeting software?

The best free budgeting business software will depend on what your business needs, but you can try apps like Mint or Wave. Or you can use a spreadsheet—scroll up for some free small business budget templates.

Automate your small business

Knowing when or where to invest money into your business is just one of the many tasks you have on your plate as a small business owner. Learn how automation for small businesses can help take some of those recurring tasks off your hands, so you can focus on growing your business.

Related reading: