Self-employment gives you the freedom to set your schedule and choose your own projects—but it doesn't come with a benefits package. As freelancers and small business owners, we don't get employer-provided PTO, retirement savings matches, or health insurance. The good news is: we can create our own.

In this guide, I'll walk you through each major employment benefit, how it works as a business owner in the US, and how to find the option that works best for you. Along the way, I'll share which options I've chosen, so you can get a sense of what it might actually look like in action.

Health insurance for self-employed individuals

Before we go any further, take some time to think about what you're looking for in health insurance. Here are some questions to ask yourself:

How many people need to be covered by my policy, and how old are they?

How much coverage do I need? Am I looking for something basic for emergencies or comprehensive care?

What add-ons do I want, like vision and dental?

Do I need to factor in any chronic or pre-existing conditions?

When do I need coverage to begin?

Next, tally up your current resources. Note down anything you can think of, whether it's emergency savings, a healthcare fund, or any coverage from a family member or spouse's job. Also, calculate how much you can afford to spend on monthly premiums and what sort of deductible you'd be comfortable with.

There are three main ways to access health insurance when you're self-employed and plenty of alternatives beyond that, depending on your income level.

Insurance type | Description | Considerations |

|---|---|---|

Healthcare Insurance Marketplace plans | Standard plans available through the Health Insurance Marketplace®; includes HMO, PPO, and HDHP options | Tax-deductible; eligibility for tax credits based on income |

Employer-provided insurance (for corporations) | If set up as a corporation, you can treat yourself as a W-2 worker and pay for your own insurance | Depends on business structure; tax credit eligibility for small businesses |

Medicaid or government-provided insurance | For those with lower income; eligibility varies by state | Tax paperwork provided for coverage period |

Fixed indemnity insurance | Reimburses medical expenses up to a fixed amount | Premiums are tax-deductible under qualified medical expenses |

Short-term coverage | Insurance plans covering short periods, usually less than 12 months | Varies by state and coverage amount |

Direct primary care (DPC) | Monthly membership for a range of specified services with a specific doctor or clinic group | Find providers through Direct Primary Care Coalition database or primary care memberships |

Health shares | Sharing medical costs within a community; members pay a flat fee | Based on age, dependents, health condition, and preferred deductible |

International plans | For international freelancers; includes companies like SafetyWing and CignaGlobal | Ensure it's international health insurance, not travel medical insurance |

Healthcare marketplace

If you're looking for your standard health insurance plan, self-employed workers can buy plans through the Health Insurance Marketplace®.

The most common types of health insurance plans include:

Health Maintenance Organization (HMO) plans: HMOs offer discounted care within a network of healthcare providers and often don't cover out-of-network costs. If you want to see a specialist, you'll need a referral from your primary care provider. HMOs generally have lower premiums and deductibles as well as fixed co-pays.

Preferred Provider Organization (PPO): PPOs offer the most flexibility in terms of care and cover both in-network and many out-of-network costs. You also don't need a referral to see a specialist. However, this freedom does mean paying higher premiums than HMOs.

High-Deductible Health Plan (HDHP): These plans have very low premiums and high out-of-pocket costs. They're designed to help you keep care costs low unless you have a medical emergency. HDHPs can be HMOs or PPOs and have a huge tax advantage: health savings accounts (HSAs). HSAs allow you to set aside pre-tax income to pay medical expenses and invest the rest in a tax-advantaged account.

Healthcare Marketplace plans are generally tax-deductible, though they actually just lower your taxable income. Depending on your income level, you may also be eligible for a tax credit that allows you to pay a lower premium.

Pay your own employer-provided insurance

If you're set up as a corporation, you have the option to treat yourself as a W-2 worker and pay yourself a salary. As a W-2 worker of your own company, you may also be able to pay for your own employer-provided insurance.

Your limitations and tax advantages depend heavily on your status as an LLC, S Corp, or C Corp, so consider this option carefully if you're your company's only W-2 worker.

The Health Insurance Marketplace® has options for small businesses with employees. You also may be eligible for a tax credit on a portion of premiums if you have more employees than just yourself and your family members.

If you're part of a professional association, check and see if they offer introductions to insurance brokers.

Alternative health insurance options

Whether you have a lower income, less-than-ideal local coverage, or don't have the business structure to pay your own insurance, there are plenty of other options.

Medicaid or other government-provided health insurance

This option is generally for those with lower income, and your eligibility will vary from state to state. I found this option helpful when I first started freelancing and during slow seasons. For tax purposes, you should receive paperwork before April to show that you were covered for part or all of the year, but it won't affect what you pay or owe.

Fixed indemnity insurance

This is a type of insurance that reimburses you for medical-related expenses up to a fixed amount per year (e.g., $1,000 for ER visits). The good news is that you can often keep the difference if your care costs are less than the fixed amount.

These plans are considered supplemental, not full insurance, so while you can deduct premiums, they fall under qualified medical expenses. Also, fixed indemnity payments may be taxable if your reimbursement is larger than the original medical expense.

Short-term coverage

This covers a range of insurance plans that will cover you and other family members for a short period, usually less than 12 months. These plans differ by the amount of coverage, and most states limit use to prevent people from buying multiple short-term policies back-to-back.

Direct Primary Care (DPC)

With DPCs, you sign on with a specific doctor's office or group of clinics for a monthly membership or subscription fee. The fee covers a range of specified services, like checkups, basic tests, and bloodwork. If you need additional medical care, your general practitioner will refer you out to a specialist.

To find a DPC provider, try the Direct Primary Care Coalition database or primary care memberships like Forward or OneMedical.

Health shares

Health shares help you pay for healthcare by sharing medical costs. Members pay a flat fee based on their age, number of dependents, health condition, and preferred "deductible" or unshareable amount. Then, when medical costs arise, you can submit eligible expenses to be paid by the community once your portion has been covered.

While many medical cost-sharing memberships are based around religious communities, there are agnostic groups out there as well.

Important note: Most of these alternatives are tax-deductible if you plan to itemize your qualified medical expenses.

Global insurance plans

Finally, for my international freelancers, there are global insurance plans through companies like SafetyWing, CignaGlobal, GeoBlue, Aetna—the list goes on. Just make sure you're buying international health insurance, not travel medical insurance.

My healthcare plan

While I've been self-employed for over a decade, I currently freelance on top of full-time work and have an HDHP through my employer with an HSA, which is an exciting first for me. Fun fact: an HSA can also double as an investment account, which I'll discuss in more detail in the retirement savings section.

Retirement savings for self-employed individuals

We all need to retire sometime, but the freelance retirement plan is usually "I'll work until I can't." But we can do a bit better than that for our self-employed benefits package. If you don't already have a retirement plan in mind, now is a good time to make one.

How much are you looking to save, or what percent of your income? Have an overall retirement savings number, as well as your ideal monthly and annual contribution ready before you start looking at savings options. You can always adjust based on what you find.

Like health insurance, you've got a lot of options, such as Traditional IRAs, Roth IRAs, SEP IRAs, and Solo 401(k)s.

Savings option | Description | Contribution limits |

|---|---|---|

Traditional IRA | Contribute pre-tax dollars; tax-deferred growth; taxes paid on withdrawal | $6,500 (2023), $7,000 (2024); $7,500/$8,000 for 50+ |

Roth IRA | Contribute after-tax dollars; tax-free growth and withdrawal | Combined limit with Traditional IRA |

SEP IRA | Designed for self-employed; tax-deductible, tax-deferred contributions | Up to $66,000 (2023), $69,000 (2024) or 25% of net income |

Solo 401(k) | For self-employed with no employees; high contribution limits | $66,000 (2023), $69,000 (2024); plus $7,500 catch-up for 50+ |

Traditional and Roth Individual Retirement Accounts (IRAs)

Traditional and Roth IRAs are tax-advantaged accounts that help you save by growing your savings over time tax-free or only paying taxes when you withdraw funds. Every IRA account comes with a range of investment options, including stocks, bonds, and funds, which will vary depending on the account provider.

Traditional IRA

A Traditional IRA is an IRA you contribute to with pre-tax dollars, meaning that your contribution will lower your taxable income. Your savings grow tax-deferred, which means you get the tax deduction upfront and only pay tax when you withdraw from the account.

Roth IRA

Roth IRAs work opposite to Traditional IRAs. Instead of getting a tax deduction right away, you contribute with after-tax dollars. All savings grow tax-free and any amount you withdraw will be tax-free as well.

The annual maximum you can contribute to Traditional and Roth IRAs combined is $6,500 or $7,500 for those 50+ for the 2023 tax year and $7,000 ($8,000 for 50+ contributors) for the 2024 tax year. Tax deductions and contribution limits also depend on your Modified Adjusted Gross Income (MAGI).

Simplified Employee Pension (SEP) IRA

SEPs were created especially for self-employed folks and are tax-deductible with tax-deferred contributions, similar to Traditional IRAs. When you withdraw from your account, those funds will be taxed as income.

These accounts can also be used as basic retirement savings plans for small businesses with employees. Employer contributions have their own set of rules, so please do your due diligence before committing.

SEPs have a much higher contribution limit than other IRAs. For the 2023 tax year, you can contribute up to $66,000 or 25% of your or your employee's annual net income up to a certain limit. For 2024, the maximum contribution increases to $69,000. SEPs also don't have catch-up contributions for those over 50.

You must be 59 ½ to withdraw from any IRA without paying penalties. Both Traditional and SEP IRAs require you to begin withdrawing from your account at either age 72 or 73 depending on your birth year.

Solo 401(k)

If you want your very own 401(k), here's an option for you. Solo 401(k)s were created for self-employed folks and business owners with no employees. But there is an exception: your spouse can be added to the account and contribute as well if they earn income from your business. Solo 401(k)s have no income or age restrictions.

Like the SEP IRA, Solo 401(k)s have a higher contribution rate: $66,000 in 2023 and $69,000 in 2024. But Solo 401(k)s also allow for catch-up contributions for 50+ freelancers: an additional $7,500 for both the 2023 and 2024 tax years.

The most popular IRA and 401(k) account providers include household names like Fidelity, Vanguard, Charles Schwab, and most major banks. Check with your bank first to see what their retirement account options are, their minimum deposit requirements, and investment options.

My retirement plan

My partner and I were a little late to the retirement game, so we only opened our first IRA in the last few years. Since then, I've become employed full-time at a company that offers a 401(k), which we're adding to our rotation of retirement accounts.

And as I mentioned in the health insurance section, I also have an HDHP with an HSA for medical costs. An HSA is very similar to a traditional IRA because it allows you to save and invest a fixed amount of pre-tax dollars. And while your contributions are limited, the amount rolls over each year, giving you a potential extra retirement account option.

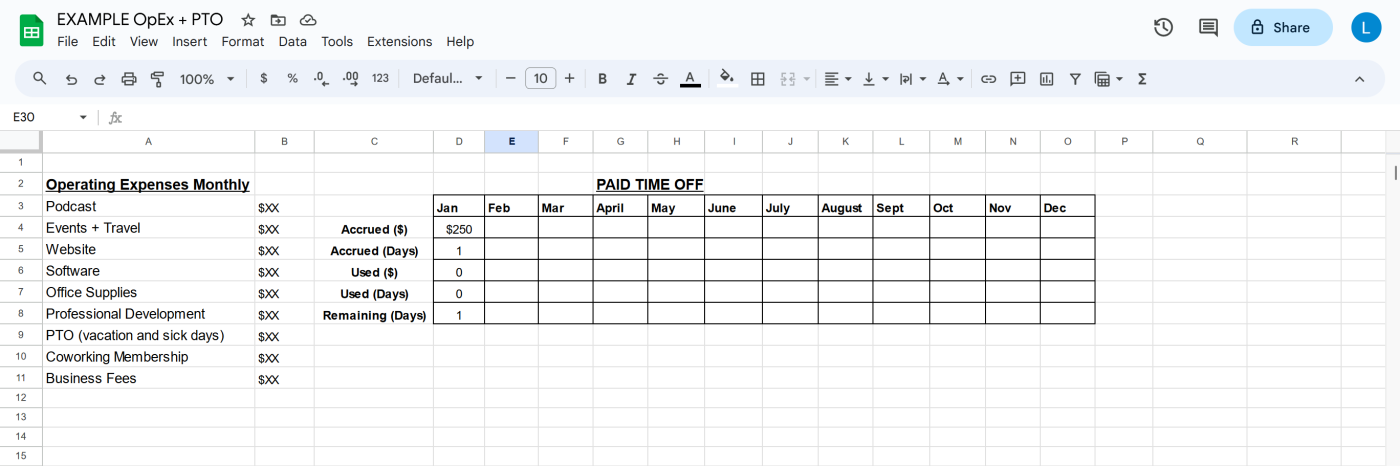

Paid time off (PTO) for self-employed individuals

There's no magic formula for getting PTO while self-employed. We don't have tax-advantaged accounts, employer matches, or government resources to fall back on for vacation, sick, and personal days. In all fairness, though, plenty of full-timers don't get great PTO either.

So, ready to DIY your PTO? First, the basics:

Add up your ideal vacation days. How many days do you want to (or need to) take off this year to work at your best that aren't weekends or non-work days? And don't forget about holidays. Do you want to factor these into your PTO or not count them at all because your clients won't be working either?

Now do the same for sick days. It's hard to predict how often you'll be sick in a year, especially if you have kids. But to give you a place to start, paid sick leave maximums across the U.S. range from 5-10 business days or 40-80 working hours.

Think about your PTO approach. Some companies offer separate PTO days for vacation and sick leave; others lump it all together. Which would you prefer?

Finding your PTO fund total

Once you know how many days you want, you can calculate the total based on your average annual income, or your income goal for the year—whichever is higher.

If you've historically made or plan to make $60,000, for example, that's $5,000 a month or roughly $1,150 a week. If you want to get a bit more specific, take that weekly number and divide it by the number of days a week you work:

4-day work week = $287.50 per day ($143.75 half day)

5-day work week = $230 per day ($115 half day)

6-day work week = $191.67 per day ($95.83 half day)

Say you want two weeks of PTO total (vacation and sick leave) this year and you work five days a week. That's $2,300.00 ($230 x 10 business days), or half a month's income.

Saving for your PTO fund

Now you can find your PTO number, cost, and the cost of each day and half day. Let's get to the good part—where is all the money for this PTO going to come from? Once again, you have options.

PTO type | Calculation method | Funding options |

|---|---|---|

Active PTO fund | Based on annual income goal; set aside a portion for PTO | Add PTO cost to income goal; save in a separate account or as a budget line item |

Passive PTO fund | Build fund without additional earnings; use creative methods | Micro-savings, interest income, credit card points, investments |

Active PTO fund

If your annual income goal is $60,000 and you want to factor in two weeks of vacation and sick leave ($2,300), your new income goal is $62,300 or $191.67 extra a month.

Then you can choose how and when to spend it. One way is to simply use the time and reimburse yourself when you make that "extra" income. You could also set that monthly PTO fund ($191.67) aside in a separate savings account to use or grow. This is similar to how full-timers accrue hours of sick leave as they work.

A great way to keep extra funds organized is by adding them as line items to your operating expenses budget. That way you can track how much you're "earning" toward PTO, what you've spent, and how much you can roll over at the end of the year.

If setting up a separate account seems like a lot, some banks like Ally, SoFi, Bank of America, and Revolut offer savings "vaults" or "buckets" that help you divide out your savings by category.

Passive PTO fund

Why not build your PTO fund passively without having to earn more money? To me, this is the more fun option because it costs the least and forces you to get creative. Unfortunately, it also usually takes longer because you have to wait for the fund to grow.

There's no one way to build a passive income fund, but here are a few methods you can try separately or together:

Micro-savings: Apps like Acorns and Chime help you save more by "rounding up" your purchases to the nearest dollar. Over time, that can add up pretty quickly, especially if you make a lot of purchases or connect multiple bank accounts.

Interest income: Earn money with money you already have. Switching to a HYSA can earn you hundreds of dollars a year. Check out sites like Doctor of Credit to find super high-yield savings opportunities.

Credit card points: Plenty of business and personal credit cards offer points for spending on certain categories, big sign-up or anniversary bonuses, and "pay yourself" cash options. With a little research and some strategic spending, you can easily start adding to that PTO fund.

Investments: Micro-investment apps, brokerage accounts, and peer-to-peer (P2P) lending are just a few ways to make your money work for you. Just be careful with this option when you're trying to build a fund you aren't willing to lose, as many investments come with risks attached.

Unfortunately, many of these saving methods don't come with tax advantages. However, micro-savings like "roundups" typically come from post-tax dollars, and the IRS doesn't usually doesn't count credit card points as taxable income.

One more thing to remember when it comes to PTO: self-employed income potential is flexible.

If you freelance full-time, you often have the freedom to take extra time off and then earn additional income to pay for it later. Freelance income is also irregular, so you'll likely not make the exact same amount each month. You might meet or exceed your PTO goal some months or come in under on others—that's just how it works.

This is just a way to help you stay organized and see where your savings are going. Don't forget to actually take that time off when you start earning it.

What about slow seasons?

If there's one thing you can always count on, it's that you'll eventually have a slow season. Many of us are probably used to falling back on part-time jobs or supplementary skills during slow seasons, but it can't hurt to have a little cushion, just in case.

You could theoretically combine slow season savings with your PTO fund. After all, it can be a great time to rest and recharge on holiday. But I personally advocate for a separate fund—because you just never know.

There's no real formula for a fund like this. Slow seasons can depend on your industry, your clients' fiscal year, the economy, even the weather. It's hard to say when they'll happen or how long they'll last. Think of slow season savings as a freelancer emergency fund, one that you'll likely use up every year or two.

According to a recent Bankrate report, 57% of U.S. adults can't afford to pay for a $1,000 emergency expense. And a $1,000 slow season fund might be a good place to start. Any of the methods I've mentioned for building your PTO savings can help.

My PTO and slow season plan

I have multiple sources of income: a full-time job and freelancing. Since I need both to meet expenses, I theoretically need two PTO funds.

As a full-timer, I get PTO days through my employer, but that PTO only covers my travel or sick days at my full-time job. For my freelance work, I have a "sick and slow season" fund, which is part of my operating expenses budget.

I live with several disabilities, including depression. That means that for several months a year, I'm not getting a lot done, so having that extra savings just makes a lot of sense.

I save a set amount of my freelance income each month, which then goes into a separate savings bucket. I've used micro-savings, interest income, and credit card points mostly for personal savings, but one of my goals this year is to start applying some of these ideas for business savings as well.

Other self-employed benefits to consider

You probably have a lot to think about so far, but stay with me.

Health insurance, retirement savings, and PTO are definitely the "big three" when it comes to employee benefits. But full-timers also often have access to other benefits that you might need for one reason or another. Here are some examples.

Disability insurance: Short- or long-term coverage that protects you if you're disabled by a serious illness or injury. For self-employed workers, most providers offer personal or individual income and business overhead expense policies. Most personal or individual disability insurance premiums aren't tax-deductible (though that may depend on your business structure), but insurance payouts are usually tax-free. In many cases, you can also deduct business overhead expense policy premiums as a business expense.

Critical illness insurance: While disability insurance focuses on covering income and business expenses, critical illness insurance pays a benefit when you're diagnosed with certain serious conditions. This lump sum is typically meant to help offset big medical bills and even everyday expenses. Critical illness insurance, another type of supplemental insurance, can be tax-deductible as a qualified medical expense if you itemize your deductions.

Life insurance: Life insurance helps fill the financial gap you leave behind if you die unexpectedly. These policies can pay for your funeral, any remaining debts, and your family's living expenses. Life insurance policies usually fall into three categories: temporary (term life), long-term (universal life), and permanent (whole life). Each has different benefits and coverage options.

In general, you can't deduct life insurance premiums on your taxes, though payouts should be tax-free if you're not subject to estate tax.

Benefits package for one

As self-employed workers, we may not get all the same perks at the same price. And creating a benefits package can be exhausting, especially when it's not tied up in a neat bow for you.

But what we can do is pick and choose what works for us, our lives, businesses, budgets—and of course, our taxes. Now go and start building the work benefits package that works for you.

Related reading:

Disclaimer: You understand and agree that this post is intended to provide general information and education, which in some cases may be outdated, and that the information provided is not intended to be interpreted as specific business, financial, or legal advice for your business and financial situation. You should consult with an attorney, accountant, and/or financial advisor in your area who understands your particular business and financial situation so that you can take the right steps for you and your business.