We independently review every app we recommend in our best apps lists. When you click some of the links on this page, we may earn a commission. Learn more.

Laying my cards on the table: I'm not an accountant. And I said goodbye to all the bookkeeping tasks associated with my freelance career many moons ago. So what qualifies me to write this article? When I was self-employed and begrudgingly had to balance my own books (I couldn't afford an accountant), I had to go through the nightmare of trying to find the right software to help me get the job done.

Being the juggernaut that it is, QuickBooks came as one of the top recommendations. But back then, the aesthetics of the platform alone scared me off. I didn't find it user-friendly enough for an amateur like me. And the price point was far beyond what I could justify.

Whether you're self-employed and looking for a less scary option or an accountant for a business that's looking for a specific feature QuickBooks doesn't have, here are the ten best QuickBooks alternatives. I've based my picks on thorough app testing done by the Zapier team, along with my own experiences.

The best QuickBooks alternatives

Wave for free accounting software

Xero for project tracking with your accounting

FreshBooks for an easy-to-use option for freelancers

Zoho Books for an all-in-one solution

Sage 50 Accounting for in-depth reporting

QuickBooks Online for real-time collaboration and accessibility

Square for selling on social media

Oracle Netsuite for enterprise resource management

Puzzle for startups

OneUp for integrating accounting and sales

How we evaluate and test apps

Our best apps roundups are written by humans who've spent much of their careers using, testing, and writing about software. Unless explicitly stated, we spend dozens of hours researching and testing apps, using each app as it's intended to be used and evaluating it against the criteria we set for the category. We're never paid for placement in our articles from any app or for links to any site—we value the trust readers put in us to offer authentic evaluations of the categories and apps we review. For more details on our process, read the full rundown of how we select apps to feature on the Zapier blog.

The best QuickBooks alternatives at a glance

| Best for | Standout feature | Price |

|---|---|---|---|

Free accounting software | Native credit card payment processing | Free plan available; paid plans from $16/month | |

Project tracking with accounting | Intuitive user interface | From $20/month; $80/month for project tracking features | |

Easy-to-use option for freelancers | OCR data extraction from receipts | From $14/month | |

All-in-one solution | Wide feature set | Free plan available; From $15/organization/month | |

In-depth reporting | Customizable audit trails and cash flow statements | $625/year for one user; Team plans from $1,043/year | |

Real-time collaboration and accessibility | A modern, cloud-based version of QuickBooks | From $35/month | |

Selling on social media | Supports digital wallets like Apple Pay and Google Pay | Free plan available (2.9%+$0.30 fee per credit card transaction); paid plans from $29/month | |

Enterprise resource management | All-in-one software that supports multi-currency, multi-language, and tax compliance features | By custom quote | |

Startups | Highlights metrics like burn rate, cash balance, and runway | Free plan available; paid plans from $50/month | |

Integrating accounting and sales | Uses modular "apps" for a lean and focused feel | From $9/month |

The best QuickBooks alternative for free accounting software

Wave

Wave pros:

Invoicing and accounting are completely free

Native credit card payment processing

Wave cons:

Available only in the U.S. and Canada

Wave tops the list as the best QuickBooks alternative for two main reasons: (1) great features across the board and (2) a really attractive pricing model. The only snag? It's available only in the U.S. and Canada. (If you're on the other side of the ocean, skip ahead.)

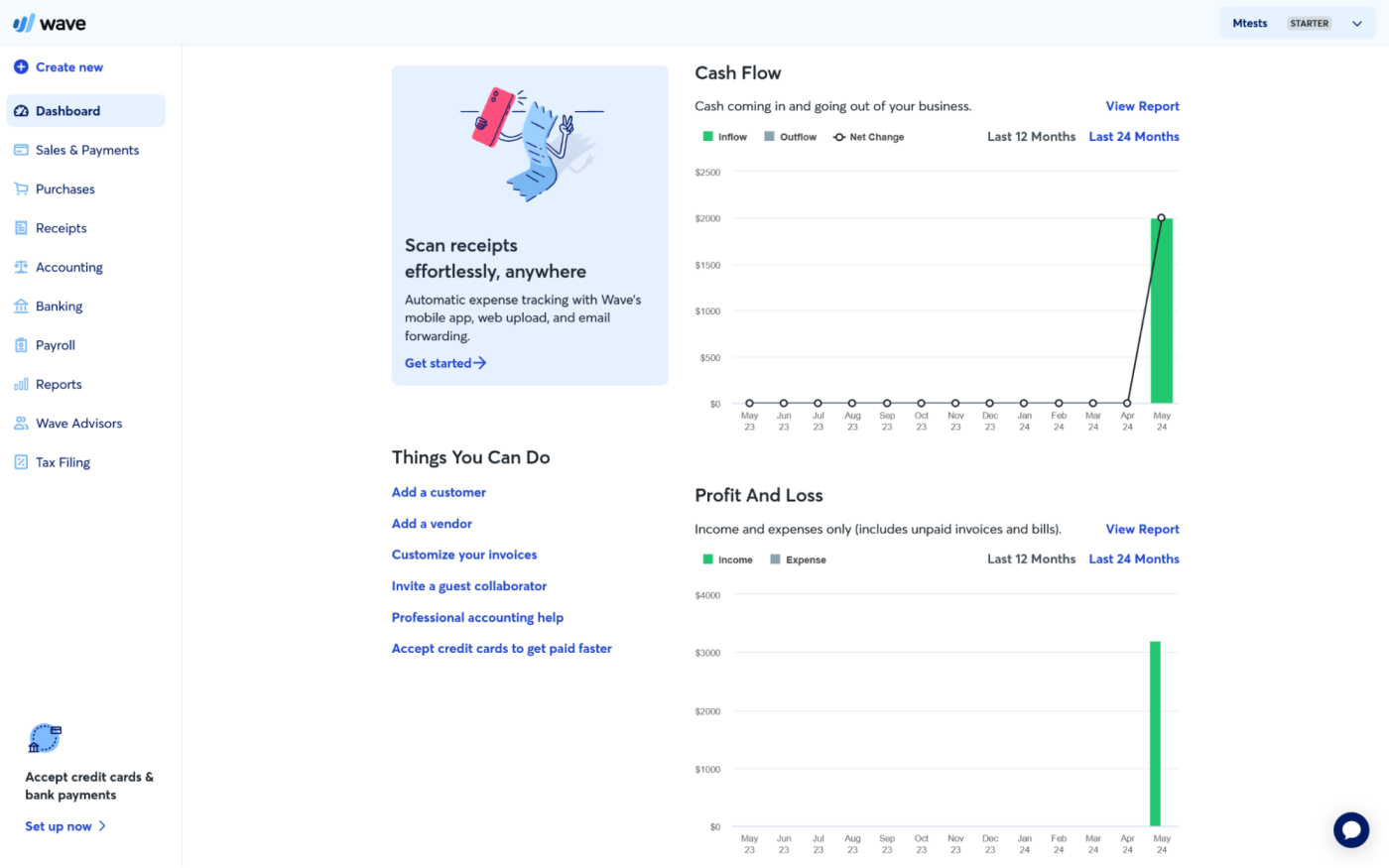

The whole app has a friendly vibe, with rounded fonts and simple icons. The dashboard shows you a cash flow graph, the balances on your bank accounts (you have to integrate them with Wave, but they'll pull only transaction data, never push data or orders to your bank account), a set of links to common actions, and a profit and loss graph.

With Wave Checkouts, you can accept payments from your website with a payment link. You can also attach your receipts to expenses, keeping everything in one place. And if you're on a paid plan, Wave uses optical character recognition (OCR) technology to extract receipt data and turn them into bookkeeping records.

Now, let's talk about pricing. While QuickBooks will almost certainly meet all of your accounting needs, it's going to cost you—even for the most basic plan. Wave, on the other hand, offers its core invoicing and accounting features for free. But we all know there's no such thing as a free lunch, so what's the catch? Wave takes a small percentage plus a fixed rate out of every online payment processed by the platform. Considering that most payment processors and accounting apps that accept payments will charge you a fee to process credit card and ACH payments, you really do get the accounting features for free.

If you're not sold on Wave by now, you might be once you connect Wave with Zapier to integrate it with the rest of the apps you use so you can automate all your accounting workflows. Learn more about how to automate Wave, or try these pre-made workflows.

Create Mailchimp subscribers from new Wave customers

Zapier is the most connected AI orchestration platform—integrating with thousands of apps from partners like Google, Salesforce, and Microsoft. Use interfaces, data tables, and logic to build secure, automated, AI-powered systems for your business-critical workflows across your organization's technology stack. Learn more.

Wave pricing: Free plan available; Pro plan for $16/month (or $170/year) includes no Wave branding and OCR data extraction for receipts. Online credit card payments charged at a percentage plus a fixed rate.

Read more: Wave vs. QuickBooks

The best QuickBooks alternative for project tracking with your accounting

Xero

Xero pros:

Intuitive user interface

Good range of reports

Xero cons:

Adding project management features costs extra

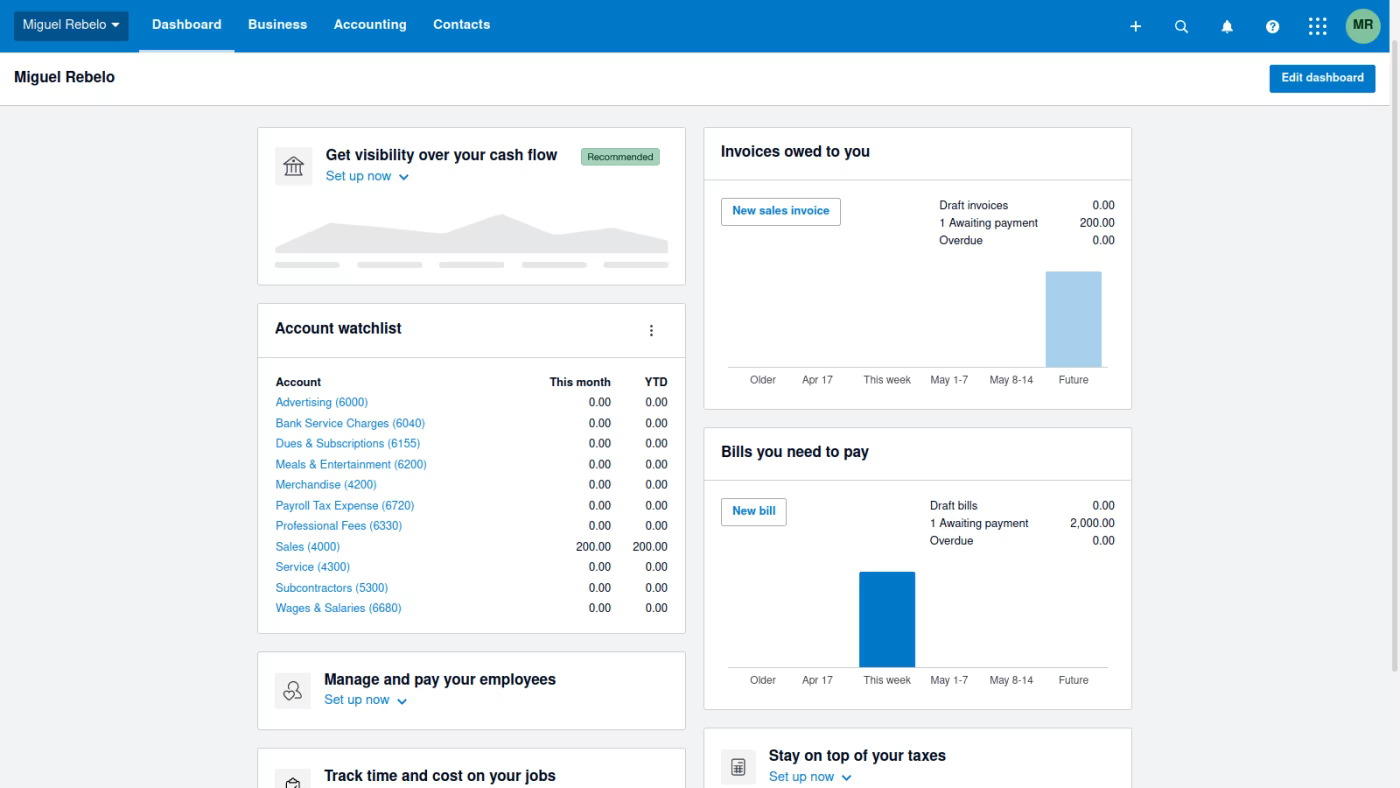

Xero's mission is to help you "do beautiful business." And with all the features it offers, you can do that and much more—especially when tackling your projects.

You can review projects in three stages: draft, in progress, and complete. Clicking on a project will take you to the project dashboard, with the estimate, the amount invoiced, time and expenses, and the deadline. A thorough approach, while at the same time helping you focus on all the relevant metrics.

Projects are the main course, but there's a lot more on offer. The bookkeeping features are top-notch. In addition to basic invoices and expenses, you can also create purchase orders, file expense claims, and print checks. All these features are peppered with reports and local dashboards to help you see what's going on with your business.

QuickBooks also offers project tracking, but it requires either a subscription to the Plus plan (at $99/month) or an additional subscription to QuickBooks Time. If you subscribe to the lowest paid tiers for QuickBooks Online and QuickBooks Time, you're looking at about $75/month, which is a few dollars cheaper than Xero. But the moment you jump to a higher paid tier for QuickBooks Online or QuickBooks Time, you're looking at a heftier overall price tag.

Xero natively integrates with hundreds of apps across many categories—from the automotive industry to tourism. If you don't find what you need, you can connect to thousands more apps with Zapier's Xero integration. Here are some examples, or you can read more about how to automate Xero.

Xero pricing: Paid plans start at $20/month. To get project tracking features, you'll need the $80/month Established plan.

Read more: The best self-employed accounting software

The best QuickBooks alternative for an easy-to-use option for freelancers

FreshBooks

FreshBooks pros:

Extracts data from receipts with OCR

Ability to invite other users with multiple roles

FreshBooks cons:

A bit expensive considering the features offered

Only 5 clients on the cheapest plan

FreshBooks is a freelancer's dream, providing inexpensive access to simple invoicing customized invoices for only $21 per month, whereas QuickBooks charges you $35 per month to do the same. If invoicing clients is the main reason you need a QuickBooks alternative, FreshBooks is hands-down the way to go.

FreshBooks is also simpler to use. It's evident as soon as you enter the platform. The dashboard is full of bright colors, relatively few navigational options, and clear breakdowns of tools. And if you stumble, there are links to the knowledge base scattered throughout, so you always have in-depth information close at hand. For more advanced stuff, you can call FreshBooks, hop on a chat session, or send a support ticket.

QuickBooks also does a good job of walking you through its interface and features. But considering its "business professional" dashboard filled with charts and graphs summarizing business metrics, it's more overwhelming to navigate than FreshBooks.

If you love how easy FreshBooks is, you'll love how much easier it is when you connect FreshBooks to Zapier. You'll be able to do things like automatically subscribe new FreshBooks clients to your email list and receive notifications when new invoices are created, for example. Here are a few more workflows to get you started.

Subscribe new Freshbooks clients to a Mailchimp list

Add or update Mailchimp subscribers for new clients in FreshBooks New

Add new Freshbooks clients to Google Contacts as new contacts

FreshBooks pricing: Free 30-day trial available; paid plans start at $14/month (billed annually) and include unlimited invoices for up to 5 clients and online payments. Add team members for $11/user/month.

Read more: FreshBooks vs. QuickBooks and FreshBooks vs. Xero

The best QuickBooks alternatives for an all-in-one solution

Zoho Books

Zoho Books pros:

Wide feature set

Good platform and account customization

Zoho Books cons:

Cluttered interface can be overwhelming and tricky to navigate

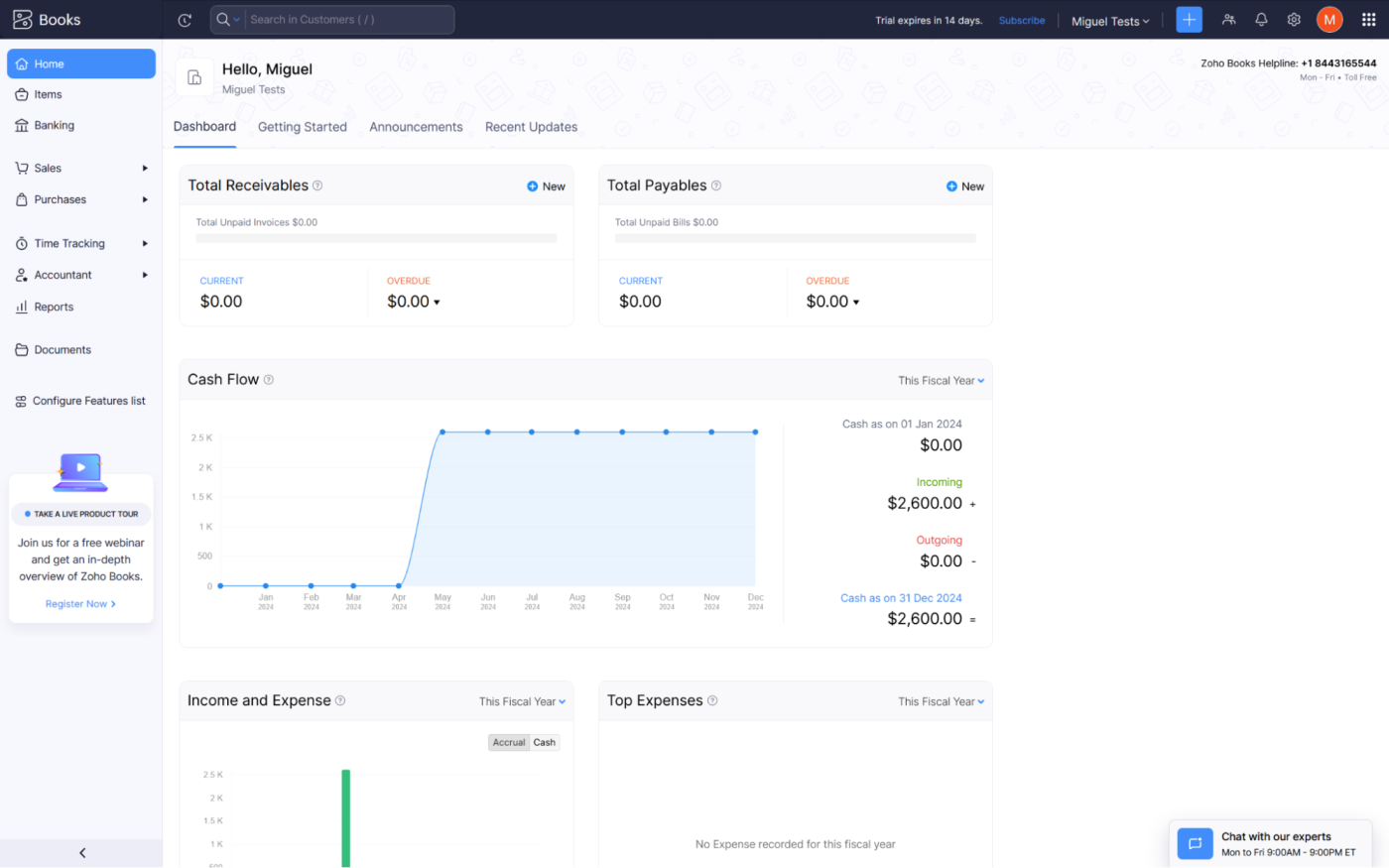

QuickBooks offers a handful of well-integrated accounting and invoicing products. But this pales in comparison to the approximately one zillion apps on offer from Zoho. With Zoho, there's an app for everything—a CRM, a project management tool, an accounting solution. You name it, Zoho's got it.

But we're here to talk about QuickBooks alternatives, so let's focus on Zoho Books.

All the core bookkeeping features are there, including projects, time, and inventory tracking. These are easy to use once you get used to the amount of information and input fields on each page. There's a budgeting feature where you can set limits for the accounts you choose, and even include asset, liability, and equity accounts in the mix. It's not the intuitive personal finance approach, but it makes sense for business budgets. The reports section has a lot of variety, and you can mark your favorites and even configure report layouts.

The accounting features are great, both for your accountant (who you can invite) and for you. There's a whole section dedicated to tracking tax payments and tax adjustments over time and a journal section to record all other accounting events.

Bigger picture: if you're looking for a robust software suite that goes beyond accounting and invoicing, go with Zoho.

Zoho also integrates with eight different payment portals to let your customers pay invoices online. If you use Stripe, it separates Stripe transaction costs as its own expense category, so you can see how much you're spending on fees. If Zoho doesn't natively integrate with your payment gateway, use Zapier's Zoho Books integration to connect it with other options—and thousands more apps. Here are some ideas to get you started, or you can learn more about how to automate Zoho Books.

Subscribe new Zoho Books customers to a list on Mailchimp

Create invoices in Zoho Books from new WooCommerce orders

Add Contact to Customer List With Email in Google Ads for New Customer in Zoho Books

Zoho Books pricing: Free plan includes 1 user, 1 accountant, and 1,000 invoices/year; Standard plan for $15/organization/month includes 3 users, 5,000 invoices/year, and no Zoho Books branding.

Read more: The best accounting software for small businesses

The best QuickBooks alternatives for in-depth reporting

Sage 50 Accounting

Sage 50 Accounting pros:

Plenty of add-ons and tools available when you grow

Bigger-business feel and functionality

Sage 50 Accounting cons:

Pricing packages are confusing

Like Intuit (the parent company behind QuickBooks), Sage has been around since the '80s. It offers a no-nonsense approach to accounting for every type of business—from small operations to corporate behemoths.

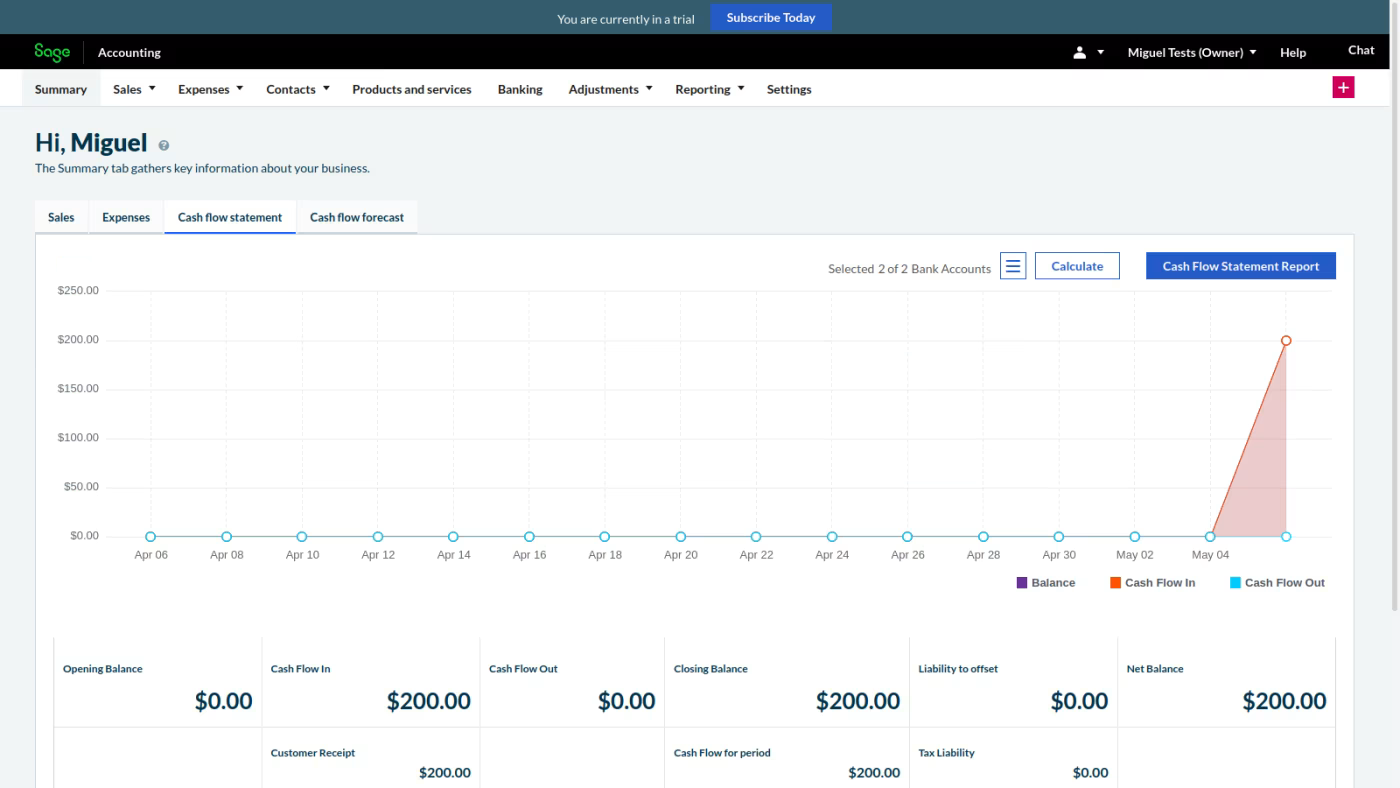

The reports are the best part about Sage. Audit trails and cash flow statements, two examples from the over 20 available, can be customized to your liking by applying filters or date ranges. But if you want even more insight into your data, you can send it to Sage Business Cloud Intelligence, a report-building platform that will give you lots of new angles to play around with.

From the Sage dashboard, you'll get an overview of everything you need to know about your business, including cash flow statements, forecasting, and your bank account balances. Speaking of bank accounts, integrating them is easy. And you can set up workflows to automatically categorize your transactions.

Access to Sage's receipt capture functionality costs almost twice as much as QuickBooks', but with Sage, you get more than just receipt capture. Once you set up rules to import data, you can upload any relevant documents, and Sage will take care of sorting it out, extracting data, and having it available for you when you need it. It's definitely a step up from the classic capture receipts feature, so if you're handling a lot of paperwork, this could cut the sweat from the blood and tears equation.

Sage offers a decent library of app integrations—over 100 of them. But a word of caution: some of them may come at an extra cost. To integrate Sage with even more of your tech stack, connect Sage to Zapier. Here are a few examples to get you started.

Create Sage Accounting sales Invoices for new WooCommerce orders

Update WooCommerce product stock quantities when new Sage Accounting stock items are updated

Sage 50 Accounting pricing: $625/year for one user, invoices, and basic accounting features. The Pro plan starts at $1,043/year for advanced budgeting and inventory, multiple companies, and audit trails.

The best QuickBooks alternative for real-time collaboration and accessibility

QuickBooks Online

QuickBooks pros:

Plenty of help and setup support

Lots of extras to scale your app, if you need them

QuickBooks cons:

It becomes more difficult to use as you activate more features

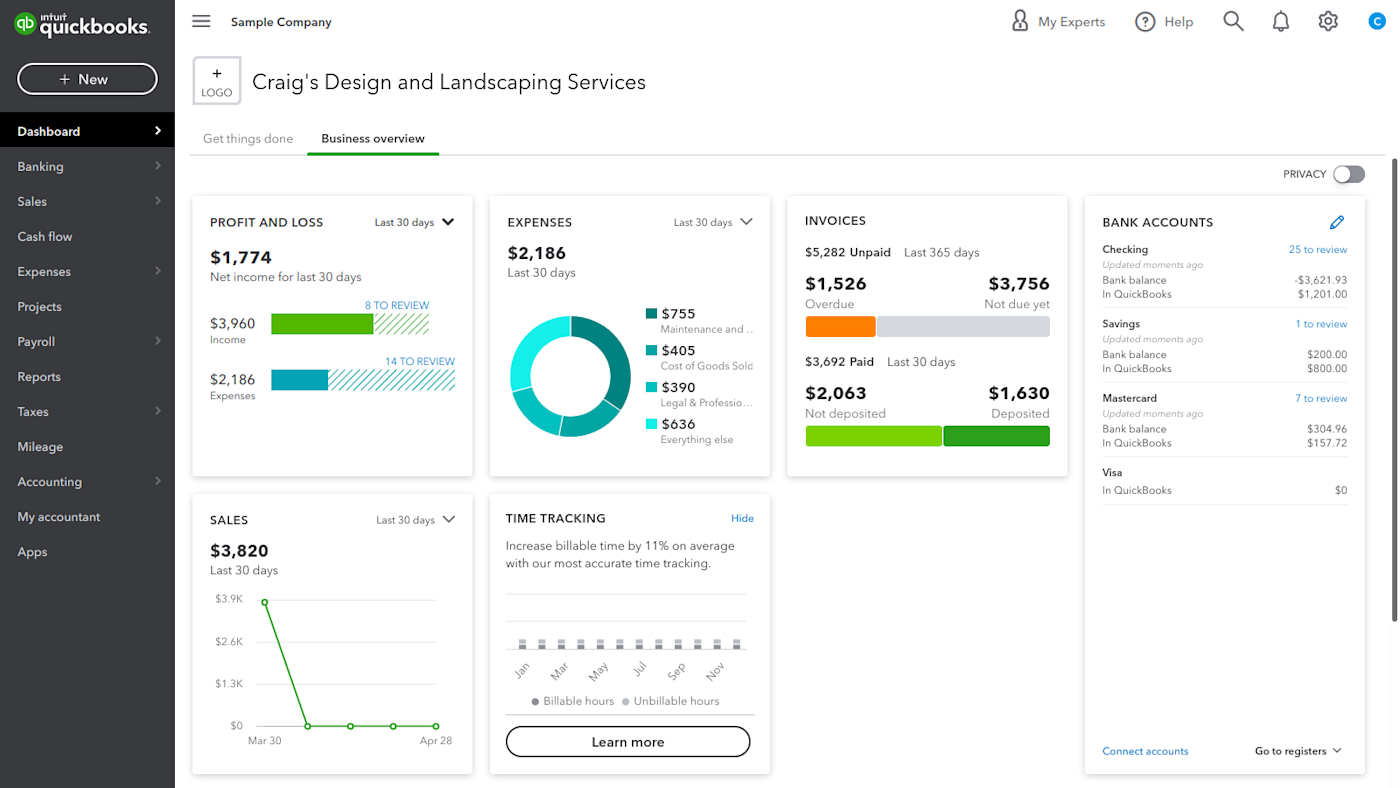

If you love the feel of QuickBooks but want something that doesn't scream "floppy disc," give QuickBooks Online a try. It's faster, sleeker, and built for the way businesses operate today (read: collaborating remotely and accessing essential business data from anywhere).

Unlike Desktop, QuickBooks Online doesn't require a local install. As long as you've got an internet connection, you can log in from any device—laptop, tablet, phone—and pick up right where you left off. That makes it perfect for remote teams or businesses with multiple people managing finances. Everyone gets their own login, you can set custom permissions, and even invite your accountant. No saving files to share later, no waiting for someone else to log off—just real-time updates. QuickBooks Online also includes Intuit Assist, an AI assistant that helps you auto-generate invoices, payment reminders, and estimates.

Sure, QuickBooks Desktop still has its strengths, especially for businesses that want more control over data and don't need constant online access. But when it comes to speed, collaboration, and ease of use, QuickBooks Online is the clear winner.

And if you ever need to connect your accounting with the rest of your workflow, QuickBooks Online integrates with over 650 apps—including Zapier, so you can automate tasks like adding customers, sending receipts, or tracking invoices across your other tools. Learn how to automate QuickBooks, or get started from one of these workflows.

Create QuickBooks Online customers with sales receipts for new Stripe payments

Add new ZenMaid contacts as QuickBooks Online customers

QuickBooks Online pricing: Plans start at $35/month for basic accounting, sales, and reporting features. Upgrade to the Essentials plan for more sales channels, additional currencies, time tracking, and up to 3 users.

Read more: QuickBooks Online vs. Desktop

The best QuickBooks alternative for selling on social media

Square

Square pros:

Supports digital wallets like Apple Pay and Google Pay

Real-time inventory tracking available

Square cons:

Not very customizable overall

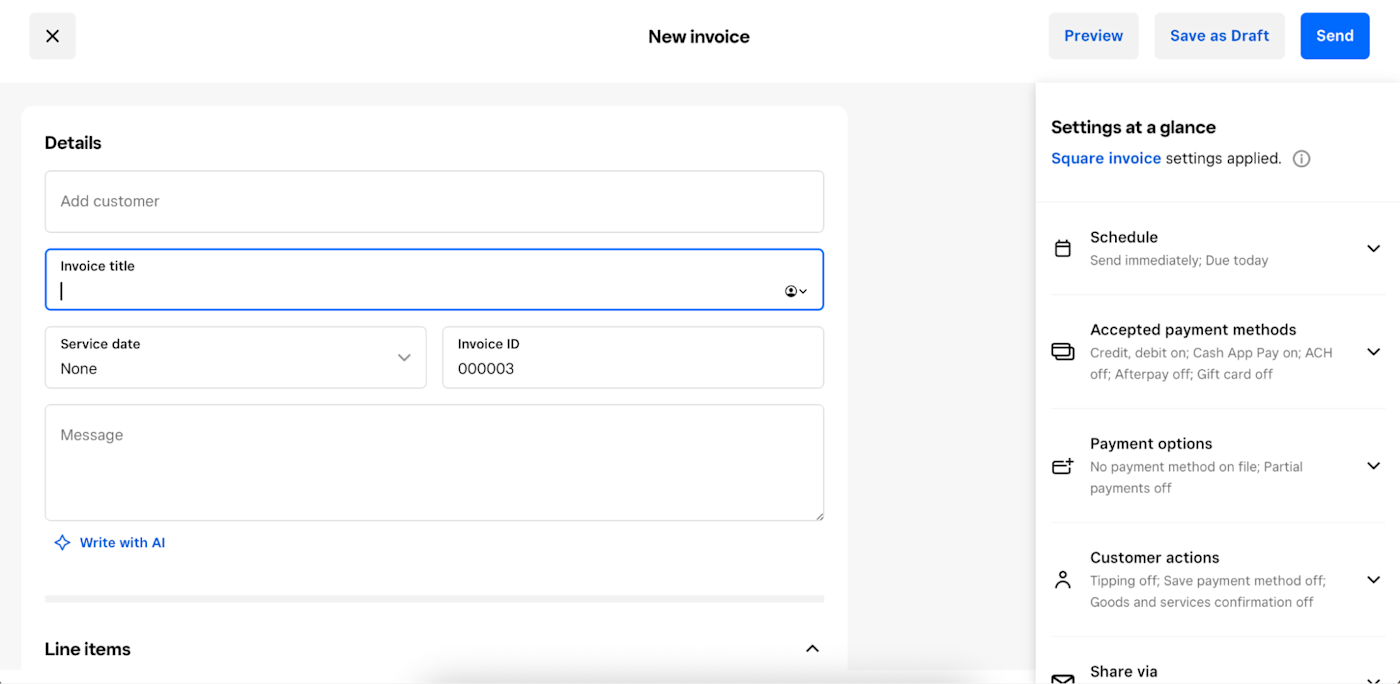

Sure, Square isn't dedicated accounting software—but it's also more than the swiveling tablet you've used to pay at your local coffee shop. What started as a simple payment platform has evolved into a powerful multi-faceted tool for managing online sales. If your product-based business does a lot of selling on social media, you can get away with swapping from QuickBooks to Square for your accounting.

Square lets you manage your inventory and product listings in one place, then sync that info directly to your social media profiles. You can even chat with customers through the built-in Facebook Messenger integration so you're not constantly hopping between apps to close a sale. The initial setup takes a bit of time and attention, but once it's in place, your workflow becomes much smoother.

Beyond social selling, Square offers a great invoicing experience. The interface is fast, intuitive, and doesn't bury features behind dropdown menus. You can set up one-time or recurring invoices, choose your payment methods, schedule when they go out, and tweak the design to match your brand.

And because it's built as a payment platform first and foremost, Square gives you plenty of extras: support for credit cards, bank transfers, gift cards, "buy now, pay later" options, contracts, tipping, and even milestone-based payment schedules. You can even go in-person with Square's point-of-sale hardware if you want to expand into pop-ups or retail.

Connect Square with Zapier to automate all your admin tasks, like syncing sales data, triggering follow-up emails, or tracking invoices in your CRM. It's a great all-in-one system for product-based businesses, especially if social selling is part of your strategy. Here are popular ways to automate Square, plus some pre-made workflows to get you started.

Save new Square transactions to Google Sheets rows

Create Square customers from new Acuity Scheduling appointments

Square price: Commission-based; online card payments at 2.9% + $0.30 per transaction. The Plus plan unlocks more invoicing features for $29/month.

The best QuickBooks alternative for enterprise resource planning

Oracle NetSuite ERP

Oracle NetSuite pros:

Extensive resources, including user groups, forums, and support from Oracle

Supports multi-currency, multi-language, and tax compliance features

Oracle NetSuite cons:

Implementation can be resource-intensive

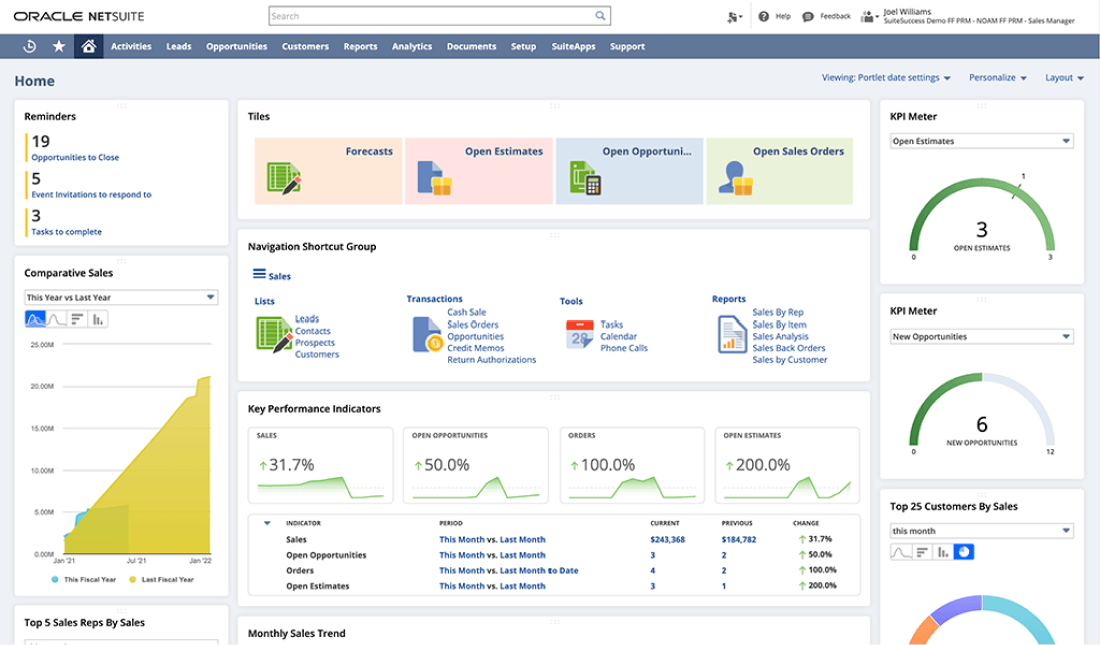

If your business has outgrown QuickBooks and you're ready for an all-in-one business management solution, you might be ready for an enterprise resource planning (ERP) platform.

ERP software is a comprehensive platform that helps manage and connect multiple teams across an organization. NetSuite's features cover everything from finance and procurement to supply chain, HR, and beyond. Whether you're in tech, retail, healthcare, or even something niche like campus bookstores, NetSuite can adapt to your workflows.

The tool's sophisticated financial tools include multi-currency support, revenue recognition management, and comprehensive financial planning and analysis. And the custom dashboards strike a nice balance between being user-friendly and deeply powerful—which isn't easy to pull off.

NetSuite's pricing is custom, and you'll need resources to focus on implementation. If you don't have an internal IT team or you're working with a smaller budget, it could be too much. But for larger or fast-scaling businesses that need serious infrastructure, it's absolutely worth the investment.

Plus, you can plug NetSuite into the rest of your tech stack with Zapier, so you can automate routine tasks, sync data across platforms, and keep your team focused on high-impact work. Learn more about how to automate NetSuite, or get started with one of these pre-made workflows.

Create items in monday.com from new records in NetSuite

Create new posts in Webhooks by Zapier from new records in NetSuite

Update records in NetSuite and simultaneously create or update users in Intercom

NetSuite pricing: By custom quote

Read more: The best ERP software

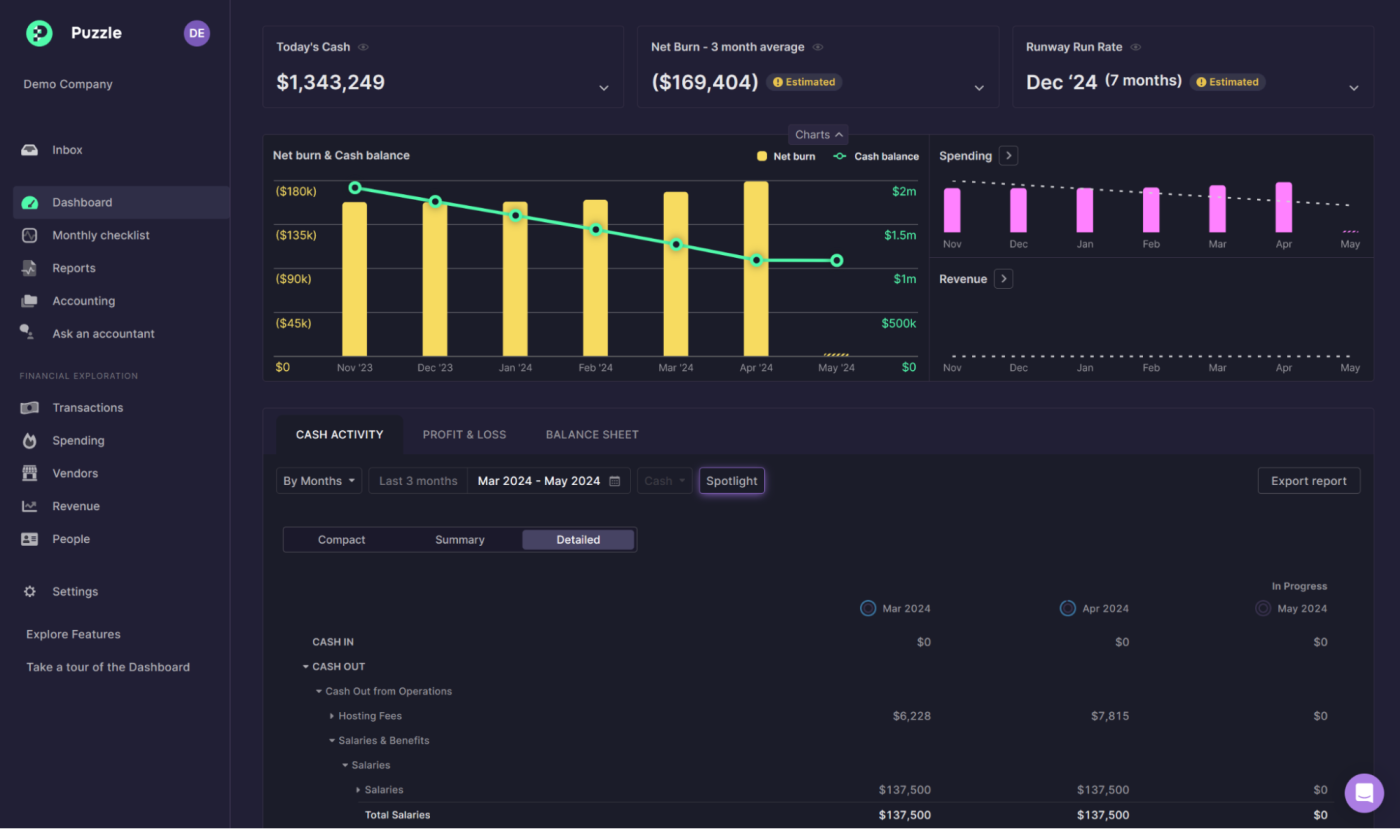

The best QuickBooks alternative for startups

Puzzle

Puzzle pros:

Purpose-built for startups

Accountants available via chat

Puzzle cons:

A little too niche for many businesses

Startups are a different kind of small business—they're fast-moving, resource-stretched, and hyper-focused on growth. So when it comes to accounting, you need more than just income and expense tracking: you need financial insights that help you make real-time decisions.

Puzzle was designed with startups in mind, and it shows. Instead of generic reports, it zeroes in on the metrics that matter most—like burn rate, cash balance, and runway. You'll know exactly how long you've got before you need to raise more funding or shift your focus to revenue.

It's not just about high-level metrics, either. Puzzle helps you get into the details without the usual accounting headaches. The Monthly Checklist walks you through bank reconciliations, credit card reviews, and uncategorized transactions—making it easier to stay organized and compliant. And the Financial Exploration tools let you dig into your income, expenses, and payroll from every angle, so you can quickly spot areas to optimize.

Compared with QuickBooks's traditional and broad feel, Puzzle's focus on automation, targeted analytics, and real-time data access makes it perfect for startups.

Puzzle price: Free for businesses spending less than $5,000 in monthly expenses. Paid plans start at $50 for advanced insights and chat support.

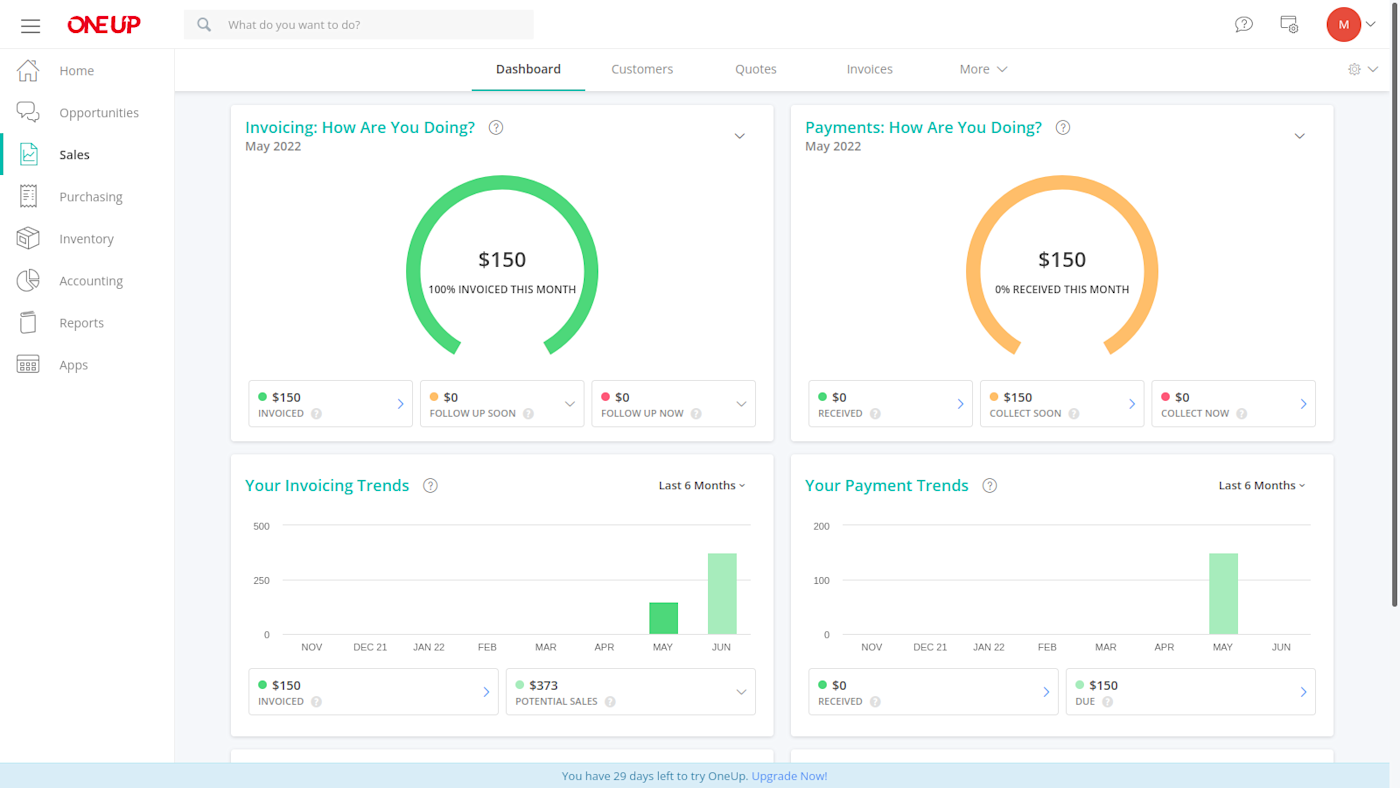

The best QuickBooks alternative for integrating accounting and sales

OneUp

OneUp pros:

Wide, well-integrated feature set

Good value for available features

OneUp cons:

Limited payment gateway integrations

If your sales and accounting teams are constantly passing spreadsheets back and forth—or worse, living in totally separate apps—there's a solution to the chaos. OneUp is a clean, modern alternative to QuickBooks that brings everything together into one smooth system, blending your CRM and accounting workflows in a way that actually makes sense.

One of the first things you'll notice is how tidy and easy to navigate OneUp feels. It uses modular "apps," including CRM, accounting, invoicing, and inventory. Just activate the features you need so the platform stays lean and focused. And there's a handy search bar where you can type what you want to do—like create an invoice or view a project—and jump straight there. No digging through menus.

Where OneUp really shines is in how well the accounting features tie in with your CRM. You can track leads, client interactions, and deals right alongside estimates, invoices, and project timelines. It's perfect for keeping your sales and finance teams on the same page, especially if you want visibility into how every conversation or quote connects to revenue.

There's also support for time tracking, basic tax prep tools, and even a clever inventory management system. OneUp can automate inventory restocking based on sales activity, which is a huge bonus if you're managing physical products.

OneUp Accounting pricing: Plans start at $9/month; you'll need at least the $19/month plan to invite your business partner or accountant and have access to support. Prices increase based on the number of users.

Other QuickBooks alternatives

If none of these options work for you, or you're looking for an app that's more in the neighborhood of accounting software, here are some ideas.

Before you can reconcile your books, you need to get paid. That's where dedicated invoicing software comes in. PayPal is a popular app that allows you to send invoices and process payments. For more options, check out our list of the best invoicing software and the best online payment processing services.

Payroll processing apps like Employment Hero and Deel manage direct deposit onboarding, pay grade changes, and payment processing.

Freelance-specific software like FreeAgent and Fiverr Workspace offer helpful features for solopreneurs, like tax prep help and contract signing. For more options, check out our list of the best booking software for freelancers.

If your business uses vehicles for service or delivery, LessAccounting has a user-friendly interface that prominently displays mileage and vehicle tracking on the dashboard.

Open-source accounting software like Manager can be a great choice if you're not ready to commit to a monthly subscription and don't need lots of advanced features.

Want to keep things simple for your small business? You can always use a spreadsheet to track your budget.

QuickBooks alternatives FAQ

Is there a free alternative to QuickBooks?

If your budget is zero, I'd recommend Wave. It's what I used when I was freelancing, because it has a robust free plan that offers everything you need—from invoicing to accounting reports—completely free, for unlimited clients and products.

Is there a Google alternative to QuickBooks?

Google doesn't offer a dedicated accounting software product, but if you're a Google Sheets fan, you can track your expenses and budget in a spreadsheet. Go forth and create as many charts and pivot tables as your heart desires.

Is there a better alternative than QuickBooks?

QuickBooks is a juggernaut for a reason: what it does, it does well. But you might not have the budget for the software—in which case, more affordable options like Wave and Zoho Books are the way to go.

Or, if you're not an accountant at heart and need a more user-friendly option, FreshBooks is a better alternative. For businesses that need more in-depth reporting or enterprise-level infrastructure, try Sage 50 or Oracle NetSuite. And if you like QuickBooks but want a cloud-based solution, QuickBooks Online is what you're looking for.

Related reading:

Simple ways to automate bookkeeping Popular ways to automate QuickBooks

How to conduct a business cost savings audit (with checklist)

This article was originally published in August 2024. The most recent update was in April 2025.