We independently review every app we recommend in our best apps lists. When you click some of the links on this page, we may earn a commission. Learn more.

PayPal has been in the payments industry for a long, long while. In that time, it's built an experience that's really easy for first-time users, as well as a trusted reputation that makes customers more likely to hit "Buy."

What PayPal hasn't done in this time is outline its transaction fees in a way that makes a lick of sense.

Maybe PayPal's fees also sent you running for the hills. Or perhaps you're looking for a PayPal alternative that's more focused on B2B. Whatever the case, here's our roundup of the five best alternatives to PayPal based on extensive testing done by the Zapier team.

Note: This list includes payment processors and invoicing software. If you're looking for a PayPal alternative to handle payments primarily, check out the best online payment processing services.

The best alternatives to PayPal

Stripe for simple fees

Shopify Payments for an all-in-one eCommerce solution

Square for selling on social media or in person

HubSpot Payments for B2B sales

Wave for invoicing

How we evaluate and test apps

Our best apps roundups are written by humans who've spent much of their careers using, testing, and writing about software. Unless explicitly stated, we spend dozens of hours researching and testing apps, using each app as it's intended to be used and evaluating it against the criteria we set for the category. We're never paid for placement in our articles from any app or for links to any site—we value the trust readers put in us to offer authentic evaluations of the categories and apps we review. For more details on our process, read the full rundown of how we select apps to feature on the Zapier blog.

The best alternatives to Paypal at a glance

| Best for | Standout feature | Pricing |

|---|---|---|---|

Simple fees | Supports all major credit cards, 135+ currencies, crypto, and ACH transactions | 2.9% + $0.30 per online credit card transaction | |

All-in-one eCommerce solution | Supports 130+ currencies | 2.9% + $0.30 per transaction; requires an active Shopify plan (starting at $29/month, billed annually) | |

Selling on social media or in person | Integrates with Instagram and Facebook | 2.9% + $0.30 for online credit card transactions | |

B2B sales | Integrated with HubSpot CRM | 2.9% per transaction; requires a HubSpot subscription (starting at $15/month, billed annually) | |

Invoicing | User-friendly with built-in native payment processor | 2.9% + $0.60 per transaction for card payments (3.4% + $0.60 for card payments from American Express); 1% per transaction for bank payments (ACH) |

The best PayPal alternative for simple fees

Stripe

Stripe pros:

Supports all major credit cards, 135+ currencies, crypto, and ACH debit and credit transfers

Simple, low-cost added fee for international transactions and currency conversions

Stripe cons:

No native pay-later option, but integrates with third-party platforms that charge high per-transaction fees

Stripe and PayPal are two of the most popular payment processors, and they share a lot of the same features. For example, both accept all major credit cards; you can check out customers online and in person; and you'll get similar safeguards like data encryption, 2FA, and fraud detection.

But here's where they really differ: pricing.

PayPal has a seriously complicated fee schedule that adds up quickly. Basics like a virtual terminal or a recurring payment tool require a subscription plan plus an added fee. Stripe, on the other hand, doesn't require a premium subscription to access advanced features. And advanced features cost only a small additional per-transaction fee—usually a few cents or a few tenths of a percentage point.

If you want to keep fees low at scale and are comfortable with light coding or outsourcing some implementation to get set up, Stripe is hands down the way to go. But if you want more out-of-the-box simplicity—and don't mind higher fees and more complicated pricing—stick with PayPal.

Stripe has a bottomless pit of extras—but you can extend its capabilities even further by connecting Stripe with Zapier. Automatically get Slack notifications for new Stripe sales, create QuickBooks customers for new Stripe payments, and connect Stripe to your entire tech stack. Learn more about how to automate your payments with Stripe, or get started with one of these pre-built workflows.

Zapier is the most connected AI orchestration platform—integrating with thousands of apps from partners like Google, Salesforce, and Microsoft. Use interfaces, data tables, and logic to build secure, automated, AI-powered systems for your business-critical workflows across your organization's technology stack. Learn more.

Stripe pricing: Fees vary by transaction type; 2.9% + $0.30 per online credit card transaction.

Learn more: Stripe vs. PayPal

The best PayPal alternative for an all-in-one eCommerce solution

Shopify Payments

Shopify Payments pros:

Very easy to set up and use

Supports 130+ currencies

Shopify Payments cons:

Limited freedom to use another payment provider

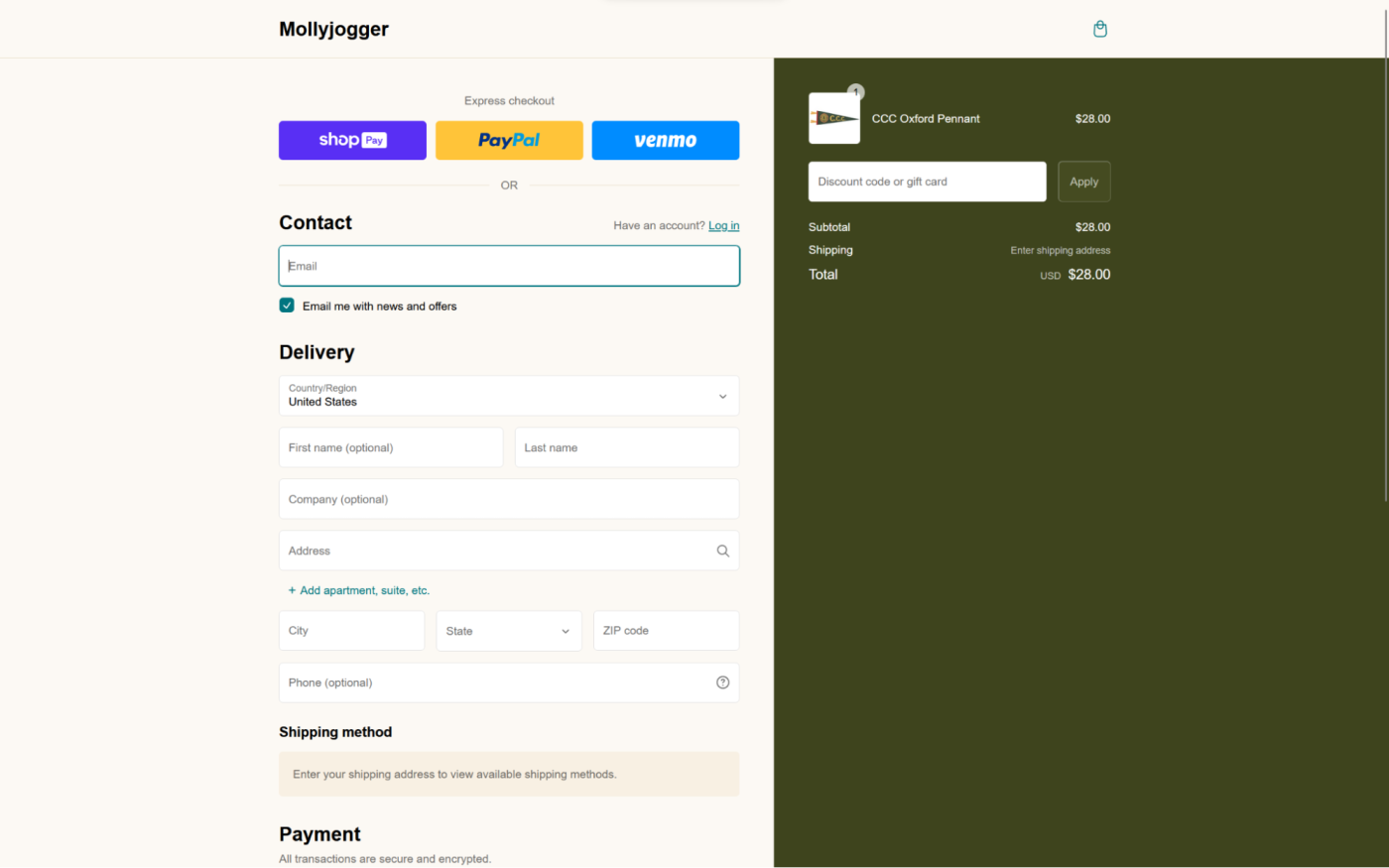

Shopify offers everything you need to sell online: website, marketing tools, and Shopify Payments. PayPal, on the other hand, doesn't give you a way to build a website and market your business—it was built as a payment processor. But that's what makes Shopify the ideal PayPal alternative for eCommerce businesses.

Using Shopify's native payment solution saves you the time—and potentially headache—of configuring and integrating a third-party platform, especially if your store's inventory rotates a lot.

And as you go up in paid tiers, you unlock more features and get slightly reduced payment processing fees (down to a minimum of 2.4% + $0.30 per transaction).

If you're new to the eCommerce space, Shopify also offers plenty of high-quality help to get you started. You don't have to be a technical expert or coding wizard—just bring time and curiosity, and you'll be able to build your store. To activate the online payments, submit your business details, wait for confirmation, and that's that.

You can also integrate Shopify with Zapier to connect your eCommerce apps and automate the boring stuff. Here's how to automate your Shopify store, or you can take a look at these workflows for some inspiration.

Add new Shopify customers to Google Ads Custom Lists

Shopify Payments pricing: Starts at 2.9% + $0.30 per transaction. Active Shopify plan required, starting at $29/month (billed annually).

The best PayPal alternative for selling on social media (or in person)

Square

Square pros:

Easy combination of in-person and online sales

Can set up a fully functional eCommerce website in a matter of minutes

Square cons:

No built-in payment method badges to give customers a sense of security

If your business sells primarily via social media apps like Instagram and Facebook, another solid PayPal alternative to consider is Square. And similar to Shopify, Square lets you build an eCommerce website and process payments.

Because Square integrates with Instagram and Facebook, you can add your products and manage your inventory, and that information syncs automatically to your profiles. You can even chat with your customers without leaving Square using the Messenger integration it offers. The setup process is a bit lengthy and requires attention to detail, but the time you'll save with it in the future pays off.

Square accepts online credit card payments, ACH bank transfers, and gift cards. But it also has a lot of extras, like buy now and pay later support. Unlike PayPal, Square doesn't offer payment method badges or a "processed securely by Square" note, so you'll want to add those to your website to give customers a sense that it's safe to shop online with you.

If you decide to sell both online and offline, Square also offers a robust hardware selection and advanced POS features.

By using Zapier's Square integration, you can do so much more than just send invoices and process payments. For example, you can automatically update your inventory tracker after a sale goes through and add new customers to your email marketing list. Here are popular ways to automate Square, plus some pre-made workflows to get you started.

Create Square customers from new Acuity Scheduling appointments

Save new Square transactions to Google Sheets rows

Square pricing: Fees vary by transaction type; 2.9% + $0.30 for online credit card transactions. Square also offers subscription plans to unlock more features, starting at $29/month.

Debating between Shopify and Square? Find out how these two apps stack up in our app showdown: Shopify vs. Square.

The best PayPal alternative for B2B sales

HubSpot Payments

HubSpot Payments pros:

Simplifies billing by turning deals into payment links

Easy to spread payment buttons anywhere you need

HubSpot Payments cons:

May lack flexibility

No one loves friction. When selling products or services to other businesses, it's best to have a payment flow that's easy to use. While you can theoretically process B2B payments with PayPal, it makes more sense to use a purpose-built payment processor instead.

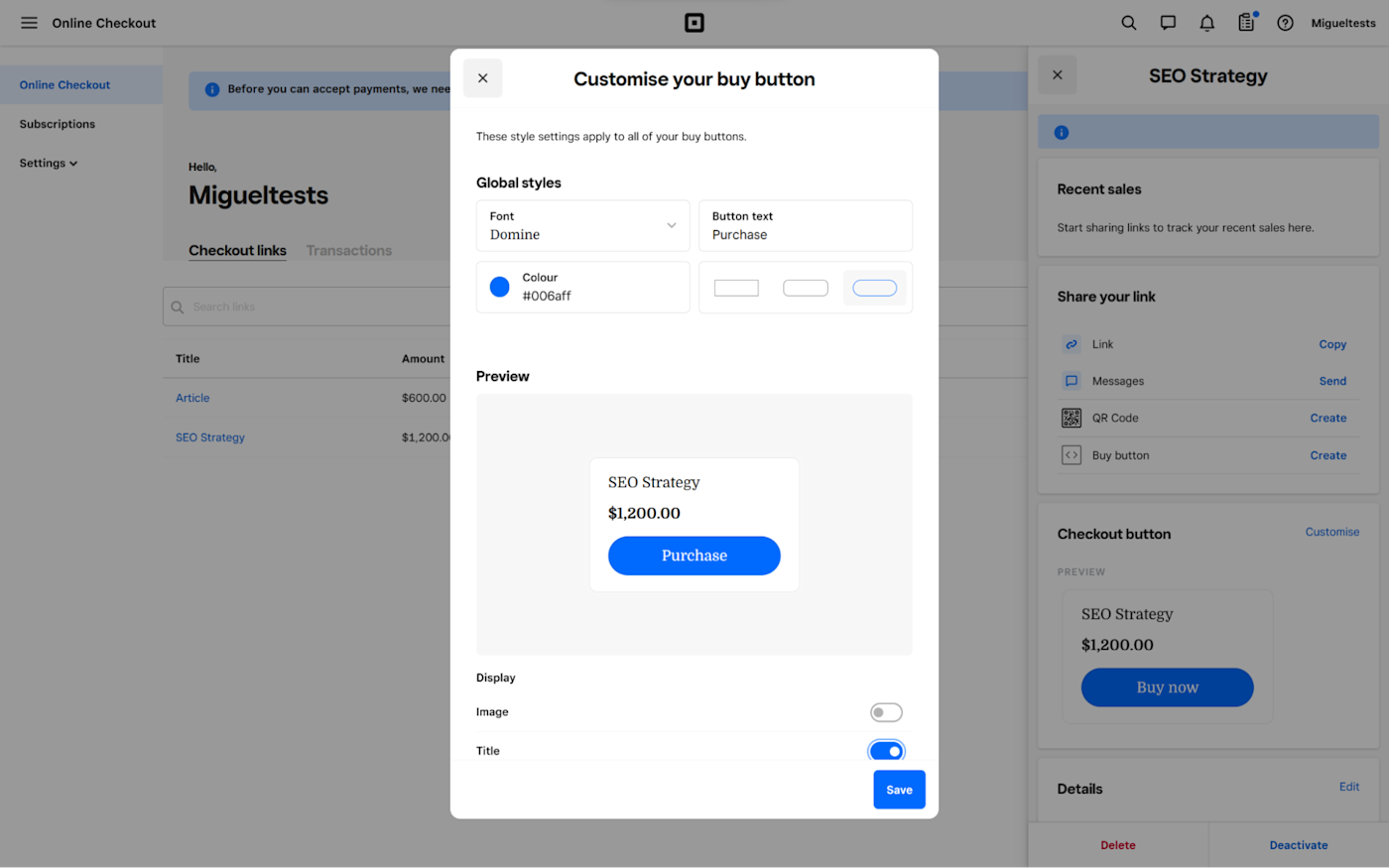

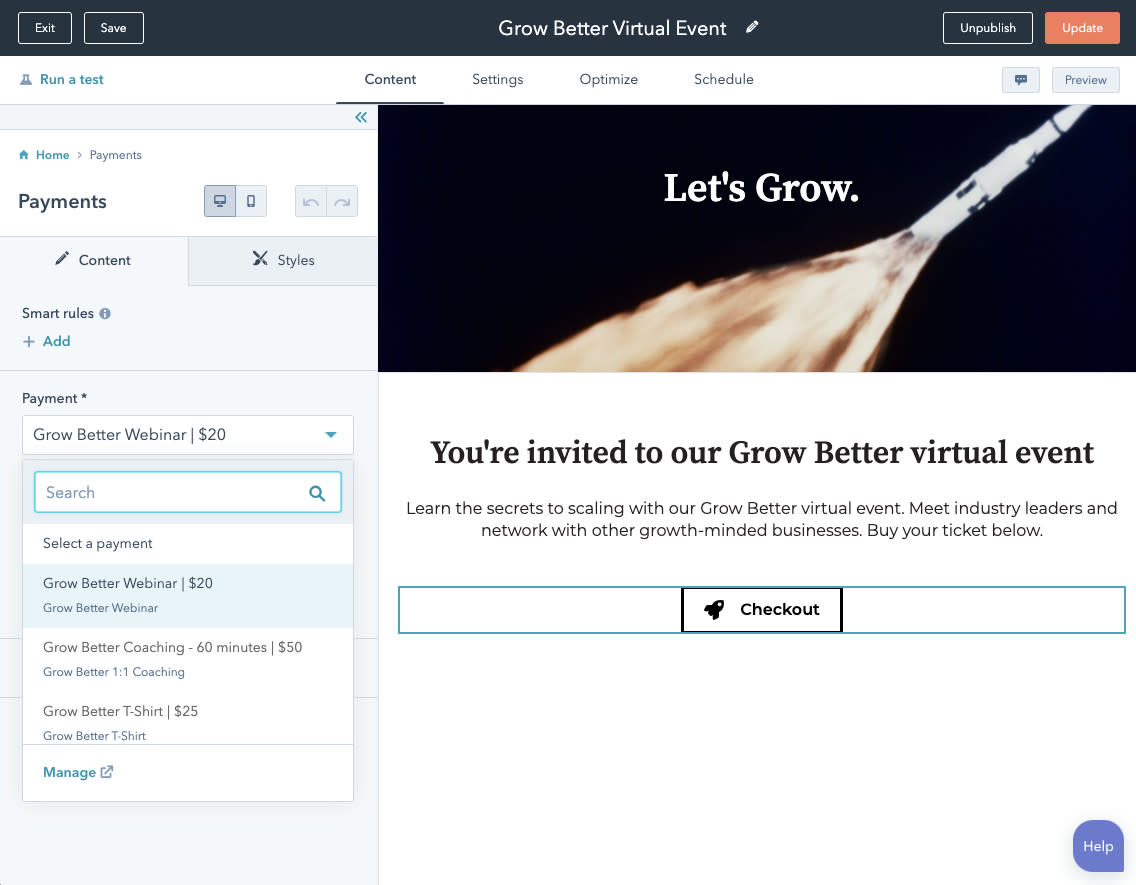

Take HubSpot Payments, for example. Part of the HubSpot Commerce Hub feature set, Payments adds payment processing on top of a mountain of possibilities. It's seamlessly connected to all other parts of this sales software, so you can manage your business relationships, marketing, website, content, and operations from the same place.

You can use it to quickly turn proposals into a payment link. And your customers can pay in a good-looking payment form, so you can lock in those dates or send those products right away. The main drawback is that Payments is available only to companies based in the United States.

The actual payment infrastructure belongs to Stripe, with HubSpot charging 2.9% (no extra fees) for each transaction. A piece of advice: don't connect your Stripe account to HubSpot for processing payments. If you do, you'll end up paying both apps' processing fees, bringing the total to 3.4% + $0.30 per transaction instead.

Since this new product is all about streamlining your work and saving time, you can keep doing that by connecting HubSpot and Zapier and making your tech stack work as one. Here are some ideas to get you started, or you can take a look at more ways to automate your business operations in HubSpot.

Create contacts in HubSpot for new leads from Google Ads

Add new HubSpot contacts to Google Ads customer lists

HubSpot Payments pricing: 2.9% per transaction. Active HubSpot Starter subscription required starting at $15/month (billed annually).

The best PayPal alternative for invoicing

Wave

Wave pros:

Super user-friendly, even on mobile

Built-in native payment processor

Wave cons:

Invoices aren't as customizable as some other options

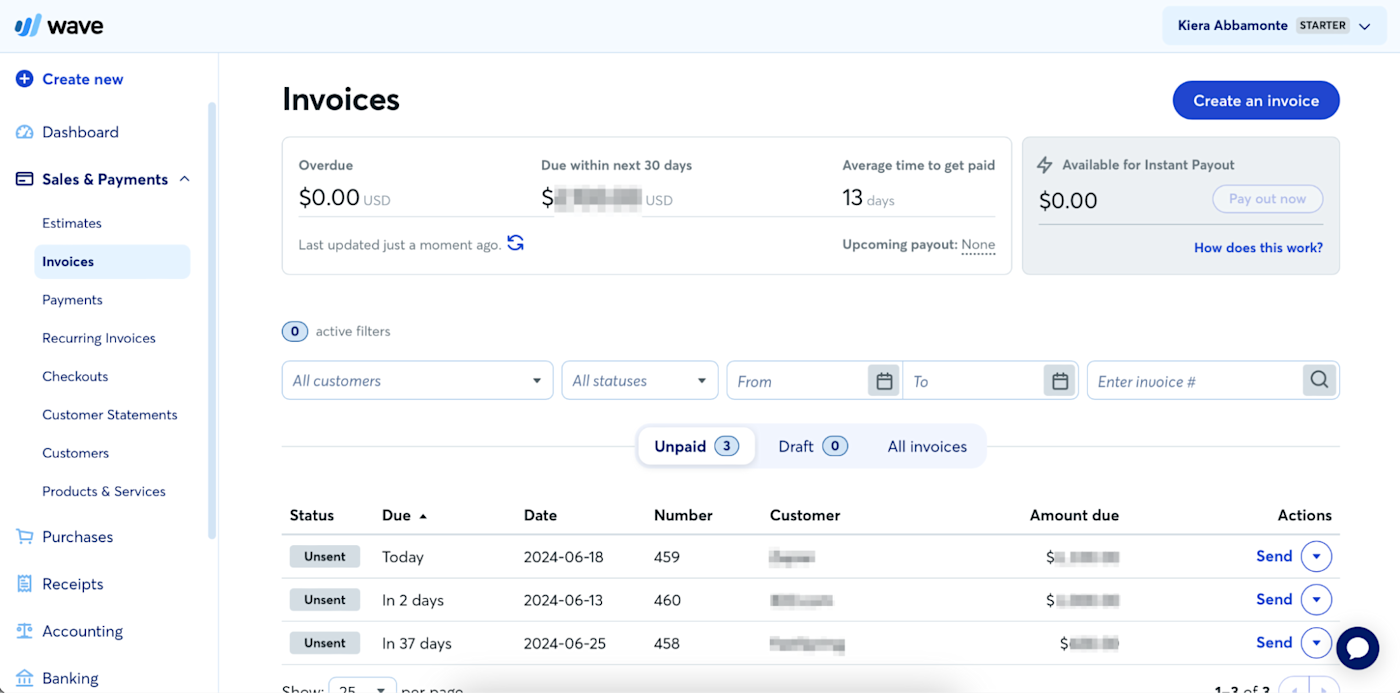

Getting paid is great, but sending invoices can be painful. If you've been using PayPal for invoicing, Wave offers free invoicing software that makes the billing process a whole lot easier. It's a full-featured business app that lets you send invoices, access detailed reports, track where your cash goes, and (if you need it) reconcile your accounts for free.

Wave's invoicing features are intuitive to navigate and include several templates, so you can customize the layout and design. And with Wave's mobile app, you can do it from anywhere.

PayPal also offers customizable invoices and a mobile app, but it's the additional features you get with Wave, like tax filing and payroll, that make it a solid PayPal alternative for growing businesses. While the upgraded features aren't free, they are affordable. Payroll, for example, starts at $20/month.

You can connect Wave to Zapier to automate even more of your invoicing workflows. Learn more about how to automate Wave, or try these pre-made workflows.

Create Mailchimp subscribers from new Wave customers

Wave payment processing fees: 2.9% + $0.60 per transaction for card payments (3.4% + $0.60 for card payments from American Express); 1% per transaction for bank payments (ACH).

Learn more: The best invoicing software

Other alternatives to PayPal

While the five apps listed above are some of the best alternatives to PayPal, there are a few other apps that are worth checking out—especially if you're looking for a PayPal alternative that's suitable for individuals and businesses.

Skrill for sending and receiving money. You can use it with individuals (for example, up-and-coming solopreneurs) and eCommerce websites.

Payoneer for money transfers and online payments. It operates in more than 190 countries, making it a solid option for international eCommerce businesses.

Mobile payment options like Google Pay (for Android devices) and Apple Pay (for Apple devices)

Peer-to-peer payment apps like Venmo (owned by PayPal). Note: Venmo is accessible only in the United States.

Which PayPal alternative should you use?

There are a lot of factors to consider when deciding which PayPal alternative you should go with (why, yes, I am sidestepping the question and not giving you the answer everyone hates, which is "it depends").

If there's an alternative on this list that piques your interest, ask yourself:

Does it integrate with your selling platform?

Does it support the transaction types you use?

Does it have the features you need, such as payment processing and invoicing?

Do the fees make sense for my volume of sales?

If the answer is "yes" to all of the above, that's a pretty good indication that you've found the right PayPal alternative for your business.

Related reading:

This article was originally published in July 2024. The most recent update was in March 2025.