We independently review every app we recommend in our best apps lists. When you click some of the links on this page, we may earn a commission. Learn more.

Payroll isn't exactly a glamorous topic. Nobody wakes up jazzed to calculate deductions or make sure your employees get their direct deposit on time. But if you're in HR, finance, or run a business, you have to deal with payroll.

Luckily, payroll systems offer a solution that doesn't involve screaming into a calculator. I scoured the depths of the internet, sifted through reviews and Reddit rants, analyzed features and pricing, and consulted payroll experts to bring you this list of the best payroll systems.

The 6 best payroll tools

Gusto for a user-friendly solution

OnPay for niche industries

ADP RUN for scalability

Patriot Payroll for businesses on a budget

Remote for a global workforce

Rippling for tech companies

What makes the best payroll software?

I've spent more time than I care to admit researching payroll software. (Seriously, my browser history looks like I'm plotting the most boring cybercrime in history.) To whittle down the list, I evaluated each option based on the following criteria:

Pricing and value: Nobody wants a system that costs more than the paychecks it's cutting. I prioritized tools that offer competitive pricing without sacrificing features.

Compliance and support: Top-tier payroll software provides robust compliance support, including automatic tax updates, filing assistance, and dedicated help when you need it. Bonus points to platforms that also offer proactive compliance alerts to help you stay ahead of changing regulations. Because nothing says "I need help" quite like getting a letter from the IRS.

Tax help: Payroll taxes are complicated enough without having to worry about filing them yourself. The best systems take care of tax calculations, payments, and filings automatically across multiple jurisdictions.

Breadth of capabilities: From benefits administration to contractor payments, today's payroll systems go beyond paychecks. The more they can do, the better.

A quick disclaimer before we dive in: while I'd love to tell you I personally processed payroll for an entire company in each of these systems, that's not quite the case. For those I couldn't test directly, I pulled from reviews, product demos, and real-world insights from payroll experts who use these tools daily—since those are the folks who really understand the pain points.

The best payroll systems at a glance

| Best for | Standout feature | Pricing |

|---|---|---|---|

A user-friendly solution | Intuitive interface and automated onboarding | From $40/month + $6/employee/month | |

Niche industries | Specialized support for unique industries | $40/month + $6/employee/month | |

Scalability | Feature-rich platform from a reliable and well-established provider | Custom | |

Businesses on a budget | Cost-effective solution that doesn't forfeit essential features | From $17/month + $4/employee/month | |

A global workforce | Simplifies the complexity of international employment and payments | $29/employee/month | |

Tech companies | Highly automated platform that streamlines HR, IT, and finance | Custom |

Best payroll system for a user-friendly solution

Gusto

Gusto pros:

Built-in employee management

Automatic tax calculations and filings

Feature-packed mobile app

Gusto cons:

Pricing can be higher than some competitors for larger teams

Advanced payroll functionality requires an upgraded plan

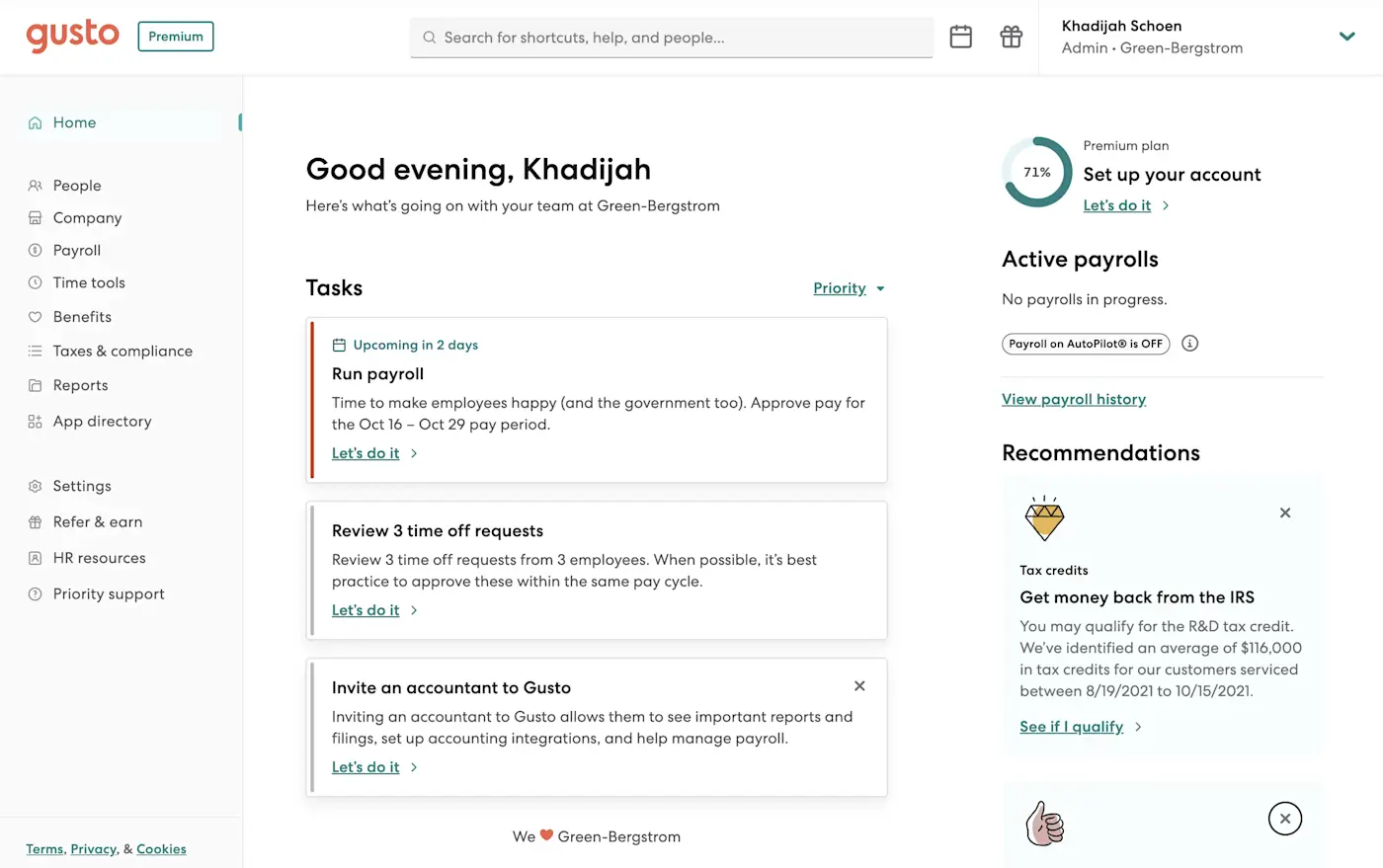

Gusto is the go-to for businesses that need a payroll system with just the right blend of features and simplicity. It's like the Apple of payroll—sleek, intuitive, and a bit more expensive than you'd like.

Gusto offers the most intuitive payroll experience I've encountered. The dashboard organizes information in a logical, easy-to-follow manner, providing a clear overview of upcoming payroll tasks, time-off requests, and important deadlines.

The clean interface guides you through payroll, making complex processes feel simple without sacrificing functionality. Even for payroll newbies, it's stupidly easy to use. Madan Chaolla Park, CEO of EUjobs.co, loves Gusto's flexibility. They told me that when an employee needed their paycheck a bit early, they were able to do it in a few clicks.

A favorite feature among users is the employee self-onboarding system. New hires receive an email invitation to set up their own accounts, complete tax forms, and enroll in benefits—all without HR intervention. And the employee self-service portal lets employees check their own pay stubs without bothering you. This is great because, historically, employees asking about their pay has led to revolutions. Just ask Marie Antoinette.

That said, Gusto's tiered pricing can be a drawback. While the base plan is affordable, you'll need to upgrade to higher-tier plans for premium features. Multi-state payroll, for example, is only available on higher-priced plans. It's like Paramount+, but instead of ad-free content, you get the privilege of legally compensating your workers.

Gusto pricing: Simple ($40/month plus $6/employee/month); Plus ($80/month plus $12/employee/month); Premium ($180/month plus $22/employee/month)

Best payroll system for niche industries

OnPay

OnPay pros:

Flat-rate pricing includes all features

Easy-to-use interface

Well-regarded customer support

OnPay cons:

Limited integrations

Not ideal for large-scale growth

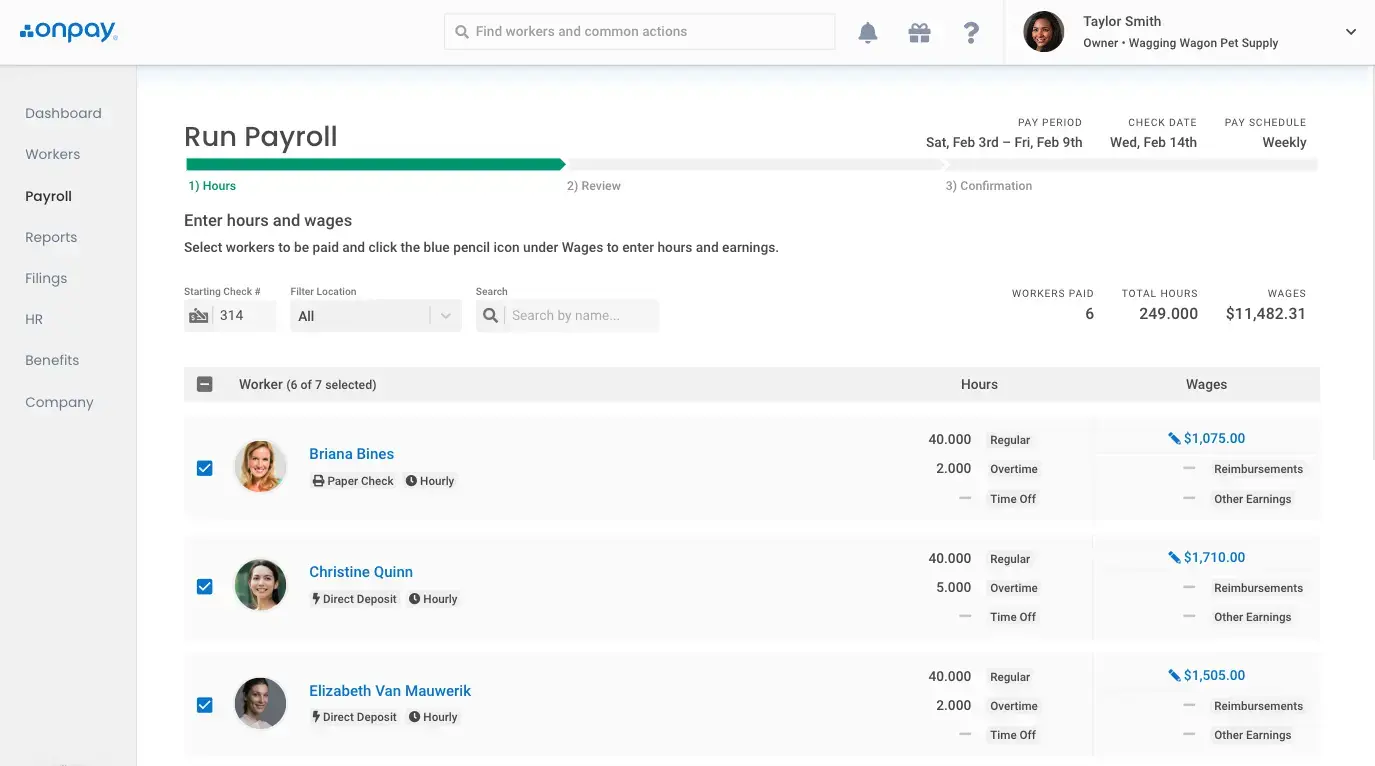

You run a farm. Or a church. Or a small brewery where half the workforce is your cousin and the other half is a dude named Ricky who may or may not be getting paid in beer. Normal payroll solutions assume your workforce is made up of buttoned-up, salaried office drones with 401(k)s—not part-time farmhands or clergy who technically took a vow of poverty. OnPay, however, actually understands that your business doesn't fit into a neat little corporate box.

OnPay offers specialized support for industries with unique payroll requirements, such as:

Agricultural businesses (Form 943 processing)

Restaurants (tip reporting and allocation)

Houses of worship (minister housing allowances)

Nonprofits (FUTA exemptions)

Medical practices (healthcare-specific compliance)

Eli Itzhaki, CEO and founder of KeyZoo Locksmiths, thinks OnPay works well for companies that need flexibility in how they pay their workers. "Many payroll systems are built for standard 9-to-5 employees, but OnPay actually works for businesses like mine, where people are out in the field, getting paid based on completed work, and sometimes taking cash payments that need to be accounted for properly."

Similarly, the owner of Property Home Buyers CA, Justin Azarias, finds OnPay particularly beneficial for his real estate-specific needs. He said it simplifies commissions and makes managing back-office tasks less daunting.

At $40 per month plus $6 per person, it's priced similarly to Gusto's basic plan but includes features you'd typically have to pay extra for elsewhere, like multi-state payroll, tax filings, and basic HR tools. Dominick Tomanelli, co-founder and CEO of Promobile Marketing, told me that an agency he worked with saved $5,000 annually on administrative costs by switching to OnPay.

If you're a small business with straightforward payroll needs, OnPay is a fantastic option. But if you're planning to scale quickly, you might outgrow its capabilities.

OnPay pricing: $40/month plus $6/employee/month

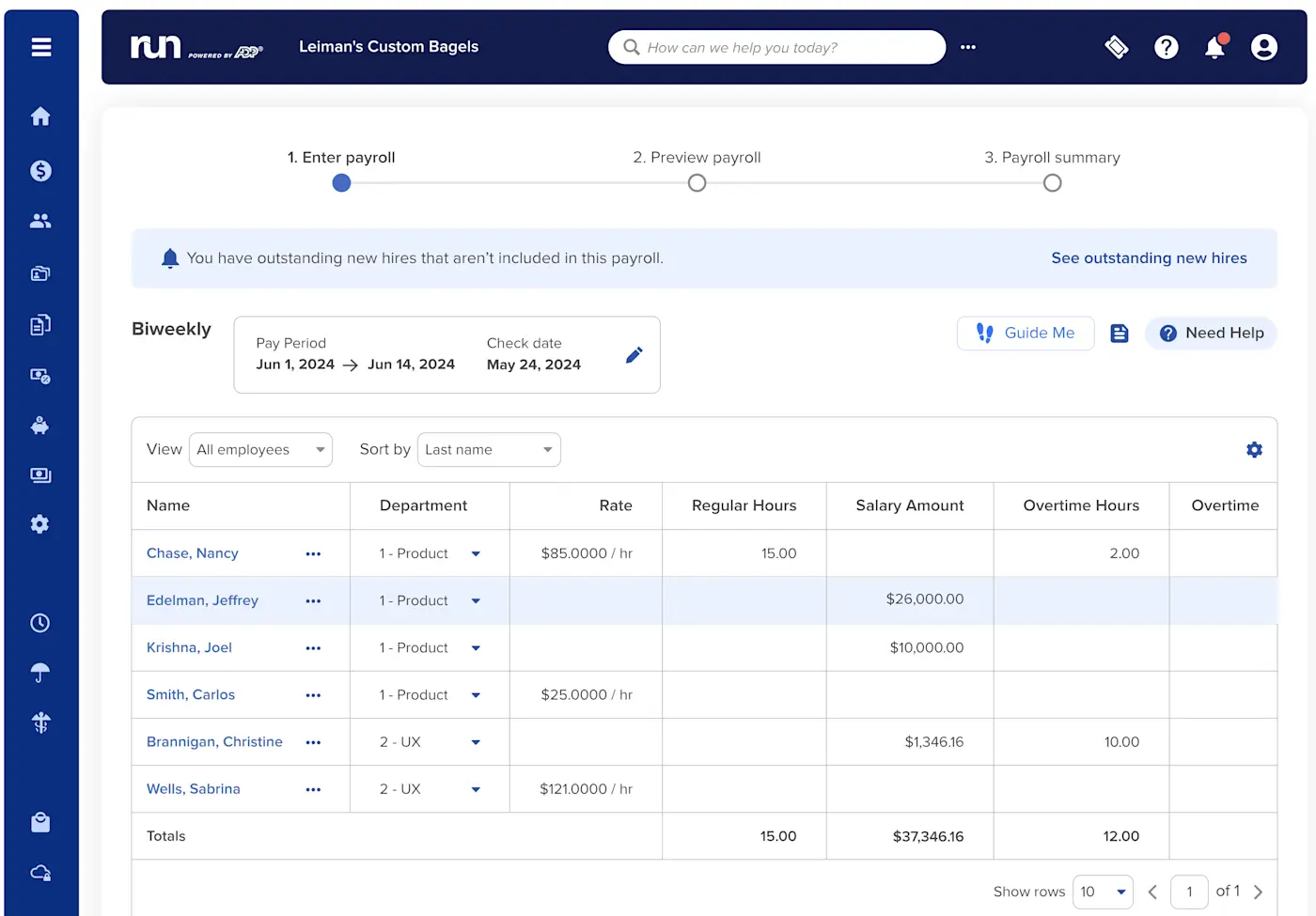

Best payroll system for scalability

ADP RUN

ADP RUN pros:

Built-in multi-state tax compliance

Exceptional mobile apps for both admins and employees

24/7 customer support

ADP RUN cons:

Limited to businesses with under 49 employees

Benefits administration only available as a paid add-on

Remember when your parents told you to dress for the job you want, not the job you have? That's basically ADP RUN's approach to payroll software. It's built for small businesses but dresses like an enterprise solution.

ADP has been in the payroll game longer than most of us have been alive. But much like Paul Rudd, who hasn't aged a day since "Clueless," ADP RUN pairs timeless reliability with modern features, like automated payroll and AI-powered error detection.

Plus, it comes with built-in scalability. The platform offers four different plans, each adding more functionality as your business grows:

Essential: Basic payroll processing and tax filing

Enhanced: Adds wage garnishment services, check signing/stuffing, and unemployment insurance management

Complete: Includes live HR support, document management, and HR training and toolkits

HR Pro: Adds an applicant tracking system, legal services, marketing tools, and a learning management system

Additionally, ADP RUN offers flexibility through its add-ons. You can start simple and layer in tools like time tracking or benefits administration as your needs expand.

The biggest drawback with ADP RUN is its pricing transparency—or lack thereof. To get exact costs, you'll have to jump through the hoop of speaking with a sales rep on the phone. And from what I've seen online, the base cost is typically higher than competitors like Gusto or OnPay, making it less appealing for cost-conscious small businesses.

But if you're planning for growth, the investment might be worth it to avoid switching systems later—you can stick with ADP for the long run.

ADP RUN pricing: Custom

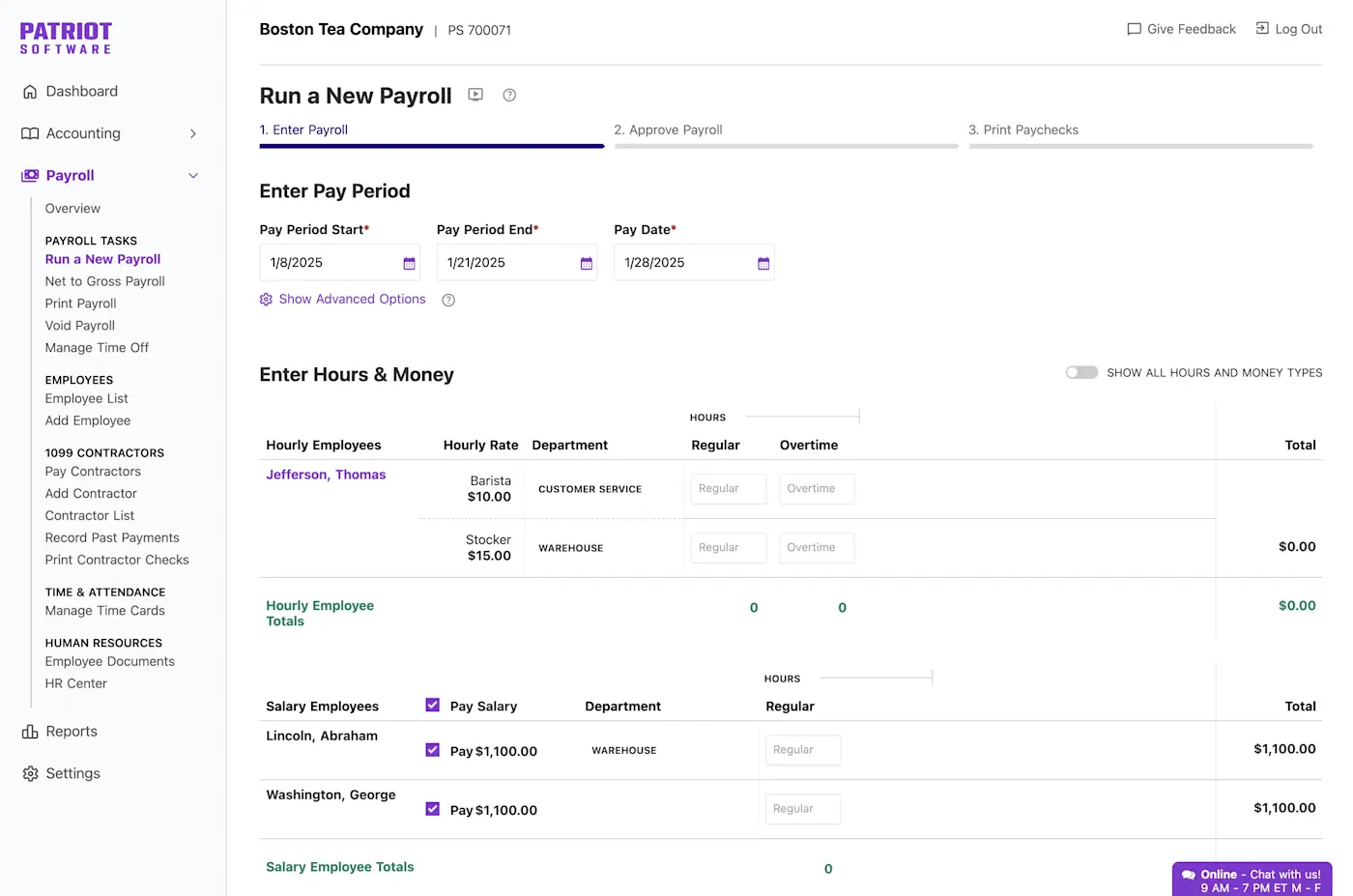

Best payroll system for businesses on a budget

Patriot Payroll

Patriot Payroll pros:

Extremely affordable starting price

Simple, straightforward interface

Free expert setup and U.S.-based customer support

Patriot Payroll cons:

Limited integrations

No international payroll support

If you're a small business owner trying to keep costs down without sacrificing essential features, Patriot Payroll deserves your attention. It's a super affordable payroll solution, offering basic functionality at a fraction of the cost of many competitors. Sure, it's not flashy, but neither is your accountant.

The Basic plan is only $17 per month (plus $4 per employee), making it the most budget-friendly option on this list. It includes unlimited payroll runs, direct deposit, an employee portal, and the ability to pay contractors alongside employees. Its clean, intuitive interface is easy to navigate, even if you're new to payroll.

While Patriot excels at delivering value, it does have some limitations. For starters, the Basic plan requires users to file their own taxes, which, like doing your own oil changes, is annoying but not impossible. You'll have to upgrade to the Full Service plan to make tax filings someone else's problem.

Patriot also lacks some of the more sophisticated capabilities found in pricier competitors, like extensive benefits administration or global payroll options. If you're scaling your business internationally or need advanced HR features, this may not be the right fit. Additionally, features like multi-state payroll filings and time tracking are only available as paid add-ons. But for businesses with simple payroll needs, Patriot is a fantastic value.

Patriot Payroll pricing: Basic Payroll ($17/month plus $4/employee/month); Full Service Payroll ($37/month plus $5/employee/month)

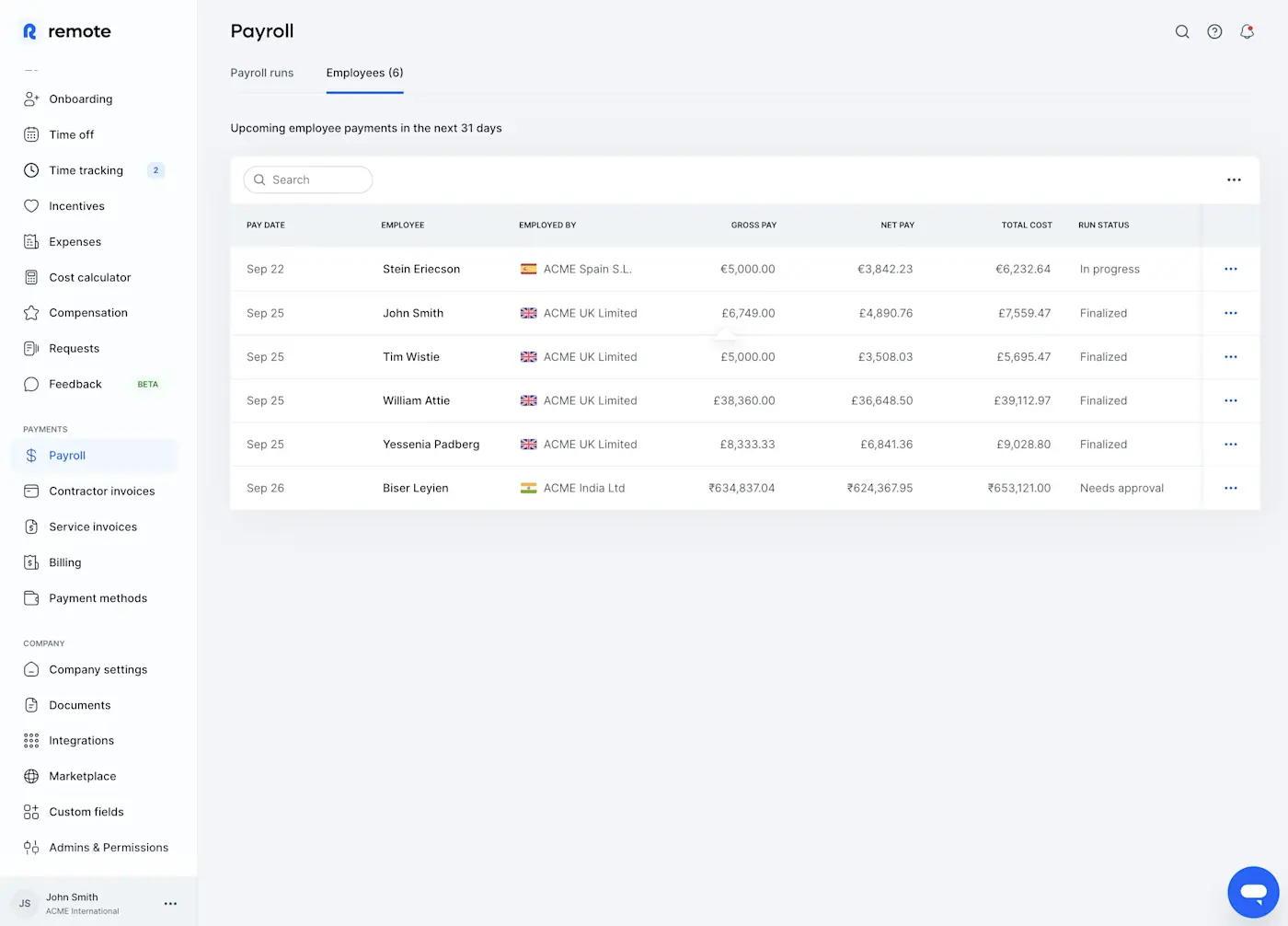

Best payroll system for a global workforce

Remote

Remote pros:

Simplifies international hiring and compliance

Comprehensive global payroll support

Employer of record (EOR) services in 95+ countries

Remote cons:

Limited features may vary by country

EOR services may not be suitable for all businesses

If you're hiring employees across multiple countries, you need a payroll system that can handle the legal headaches of international payments. Remote takes the complexity out of global payroll, saving you from the logistical nightmare of setting up shop abroad.

Through its EOR services, Remote acts as the legal employer for international workers. That means Remote handles all the complicated stuff about paying people in different countries, so you don't have to become an expert in Bulgarian tax codes or Indonesian compliance laws.

Remote handles multi-currency payments, automatically calculates payroll taxes, and files necessary paperwork to keep your business compliant. It even offers benefits administration, so you can provide international employees with access to health insurance, retirement plans, and other benefits in line with their local laws and expectations.

At $699 per month for its Employer of Record service, Remote isn't cheap. But neither is accidentally violating international labor laws because you thought you could figure it out yourself with Google Translate.

Remote integrates with Zapier, allowing you to automate tasks like adding time-off requests to your calendar or new hires from your HRIS. Here are some pre-made workflows to get started.

More details

More details

Remote pricing: Payroll ($29/employee/month); Employer of Record ($699/month)

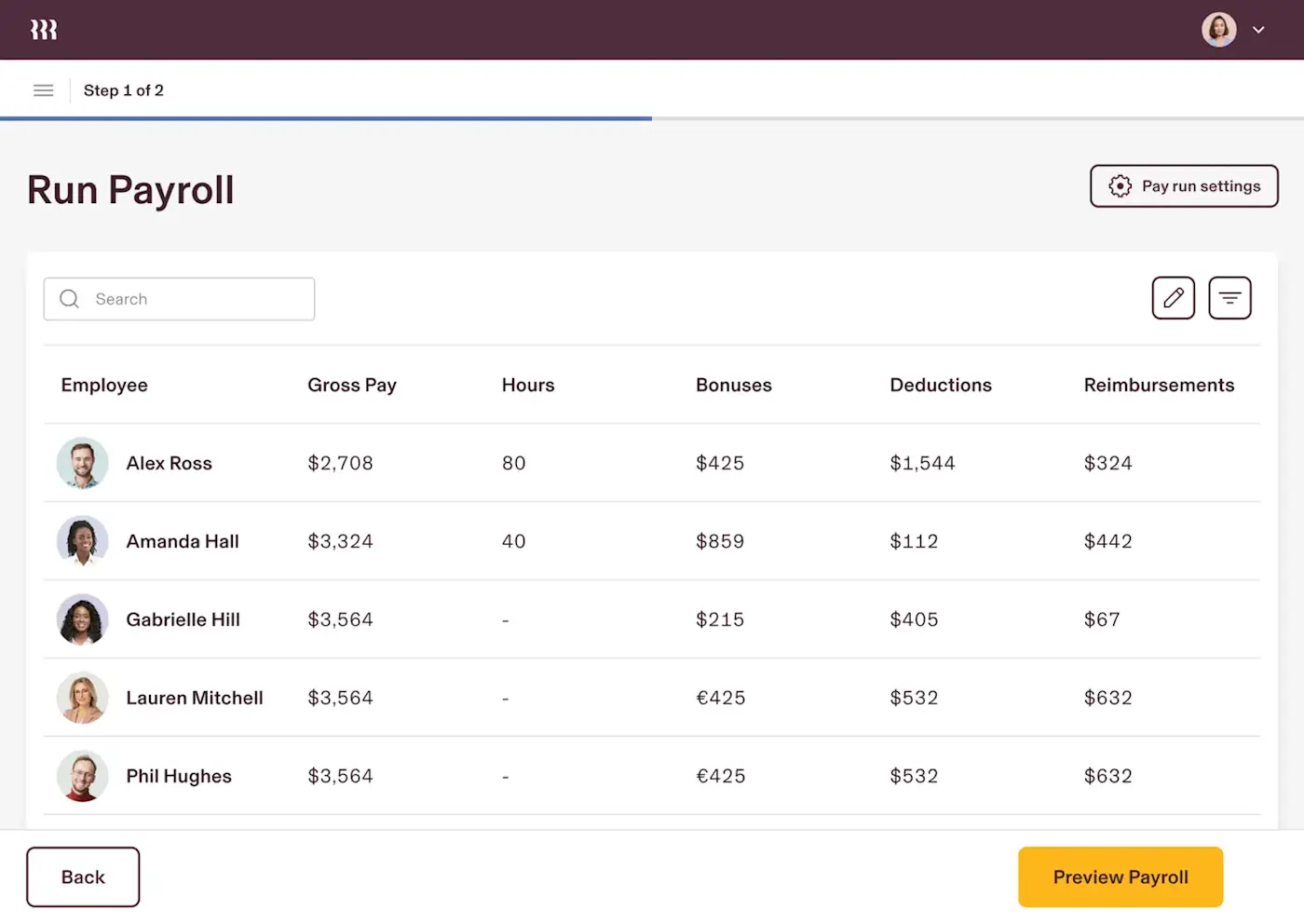

Best payroll system for tech companies

Rippling

Rippling pros:

Streamlines HR, IT, and finance into a single system

Strong automation capabilities

600+ integrations

Rippling cons:

Pricing reportedly higher than traditional payroll services

May be overkill for businesses that only need basic payroll

Rippling is what happens when Silicon Valley decides to solve payroll—more features than you probably need, but dang if it isn't impressive.

Payroll-wise, Rippling handles all the basics like automated tax filings, direct deposits, and compliance. But unlike the other apps on this list, Rippling combines payroll, HR, and IT management into one platform, making it a fantastic choice for tech-savvy companies seeking to streamline operations.

One notable feature is Rippling's Workflow Studio, an automation engine that allows you to create and customize workflows for nearly any task across payroll, HR, and IT.

Gal Cohen, field area manager of JDM Sliding Doors, raved about how it makes onboarding and payroll much easier. "[Rippling] can automate local tax adjustments, track work hours from multiple locations, and even ship out company laptops to new hires while syncing that expense with payroll."

Rippling isn't without its flaws. Pricing isn't the most transparent—you'll need to request a quote based on your business size and needs. And while it's packed with features, some users have noted a learning curve, particularly for businesses not steeped in tech culture. Plus, if all you need is basic payroll, Rippling may feel overwhelming.

Rippling pricing: Custom

Payroll system automation with Zapier

After exploring these top payroll systems, you might be wondering how to make them work even better for your business. Zapier can automate many manual processes and create seamless workflows between your payroll system and other applications.

Whether you're looking to automatically update your accounting software when payroll runs, notify managers when timesheets need approval, or sync employee data between systems, Zapier can help streamline your payroll processes and create fully automated payroll systems. Learn more about how to automate your HR processes.

Related reading: