When someone applies for a mortgage, they're making one of the biggest financial decisions of their life. Benchmark Mortgage, a nationwide lender with over 300 loan officers and 244 active branch websites, understands the importance of guiding customers through this process seamlessly. But with so many moving parts—lead generation, compliance, customer communication—the company faced challenges in maintaining efficiency while providing a personalized experience.

"Managing the mortgage process requires balancing speed with personalization," says Jason Haeger, Digital Marketing Manager at Benchmark Mortgage. "We needed a way to streamline operations without sacrificing the human touch our customers expect."

That's where automation made all the difference. Using Zapier, Benchmark Mortgage reduced manual work, ensuring leads, compliance processes, and marketing workflows run efficiently.

Results at a glance

100% of leads are now routed instantly, eliminating manual email forwarding.

Compliance approval time was reduced from days to minutes with AI-powered review.

Real-time FEMA alerts ensure timely communication with affected homeowners.

Trade show lead processing was reduced from weeks to real-time capture.

Marketing compliance automation ensures regulatory adherence with minimal manual effort.

About Benchmark Mortgage

Company size: 500-1,000 employees

Industry: Mortgage

Location: Plano, Texas

Automating lead management for faster customer connections

Before implementing automation, managing new mortgage leads was a fragmented process. Benchmark's contact form on its homepage allowed potential borrowers to express interest, but ensuring each lead reached the right loan officer in a timely manner was a challenge.

Here's how Benchmark Mortgage's lead routing Zap works:

A potential borrower submits a form on the company website.

Zapier captures the data via a webhook, formats the data using Zapier Formatter, and stores the borrower's contact details in Zapier Tables.

That information is sent to a Google Sheet via Zapier.

From there, the workflow is split into two paths based on whether the customer already has an assigned loan officer.

If they don't have an assigned loan offer, the lead is automatically sent an SMS message via Podium, sent to the consumer direct team, and added to their CRM.

If they do have an assigned loan offer, an email is drafted with important information.

I'm always looking to add more convenience to make it easier to do our jobs.

Jason

"It's a seamless handoff now. Before, loan officers were manually forwarding emails. This ensures no lead slips through the cracks," he says.

Simplifying marketing compliance with AI and automation

Marketing in the mortgage industry isn't just about creativity—it's about compliance. Every piece of content must be reviewed to meet strict regulations. Before automation, Benchmark Mortgage's compliance team spent hours manually sifting through Zendesk tickets, which led to delays, frustration, and bottlenecks. Jason saw an opportunity to streamline the process with automation.

Using Zapier, Benchmark Mortgage connected Jotform, monday.com, Dropbox, and an AI-powered compliance review tool called PerformLine. Now, compliance reviews happen seamlessly without manual intervention.

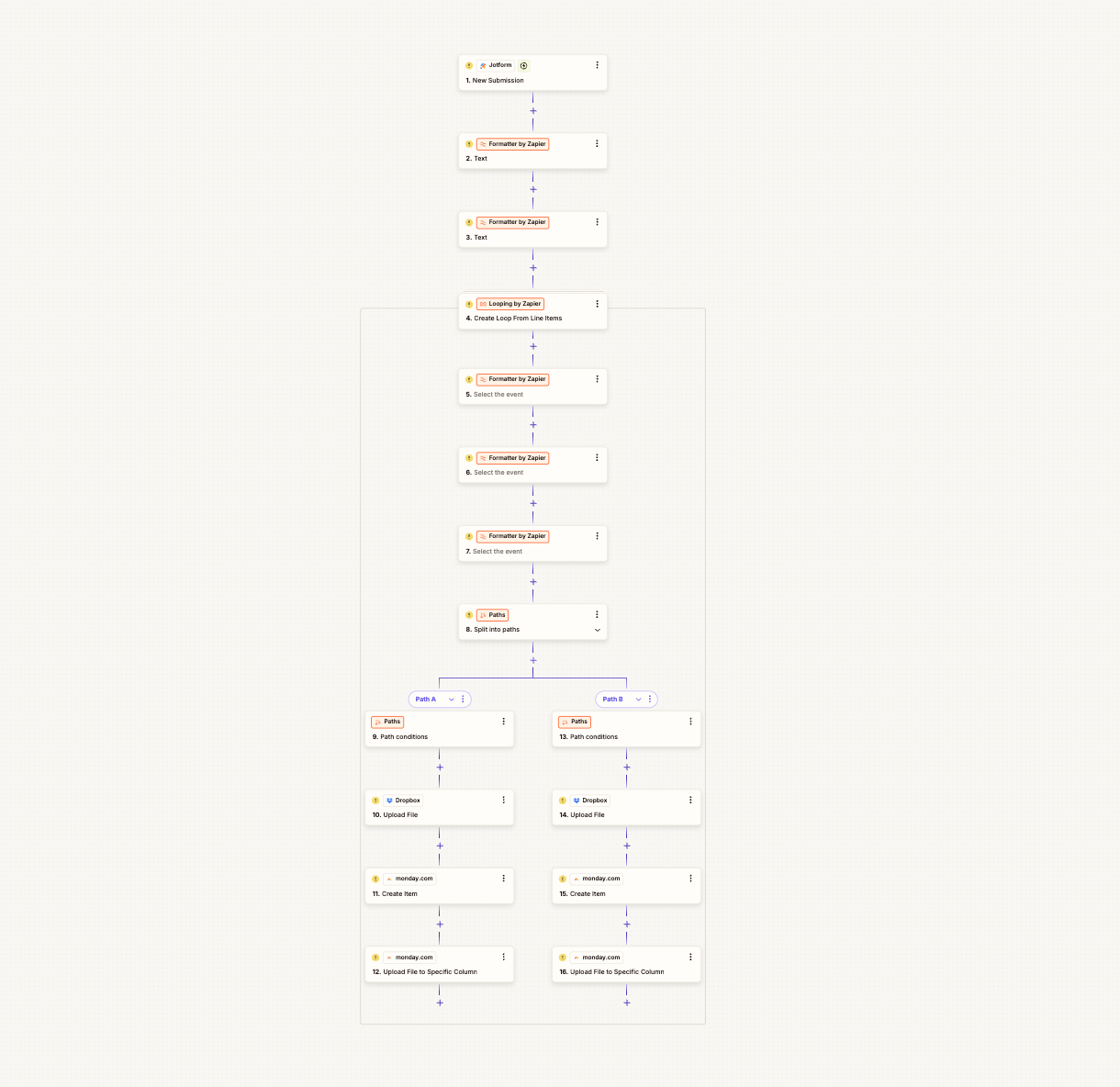

How it works:

Loan officers submit marketing materials through Jotform, answering compliance-related questions and uploading files.

Zapier formats the submission using multiple Formatter steps, ensuring file names, extensions, and URLs are structured correctly.

If multiple files are uploaded, Zapier loops through each one using Looping by Zapier, creating separate items for tracking.

Files are uploaded to Dropbox for storage, and Zapier creates corresponding records in monday.com, ensuring every submission is properly logged.

With the submission processed and stored, monday.com then triggers the compliance review by logging the results from PerformLine, which scans content for compliance based on predefined rules.

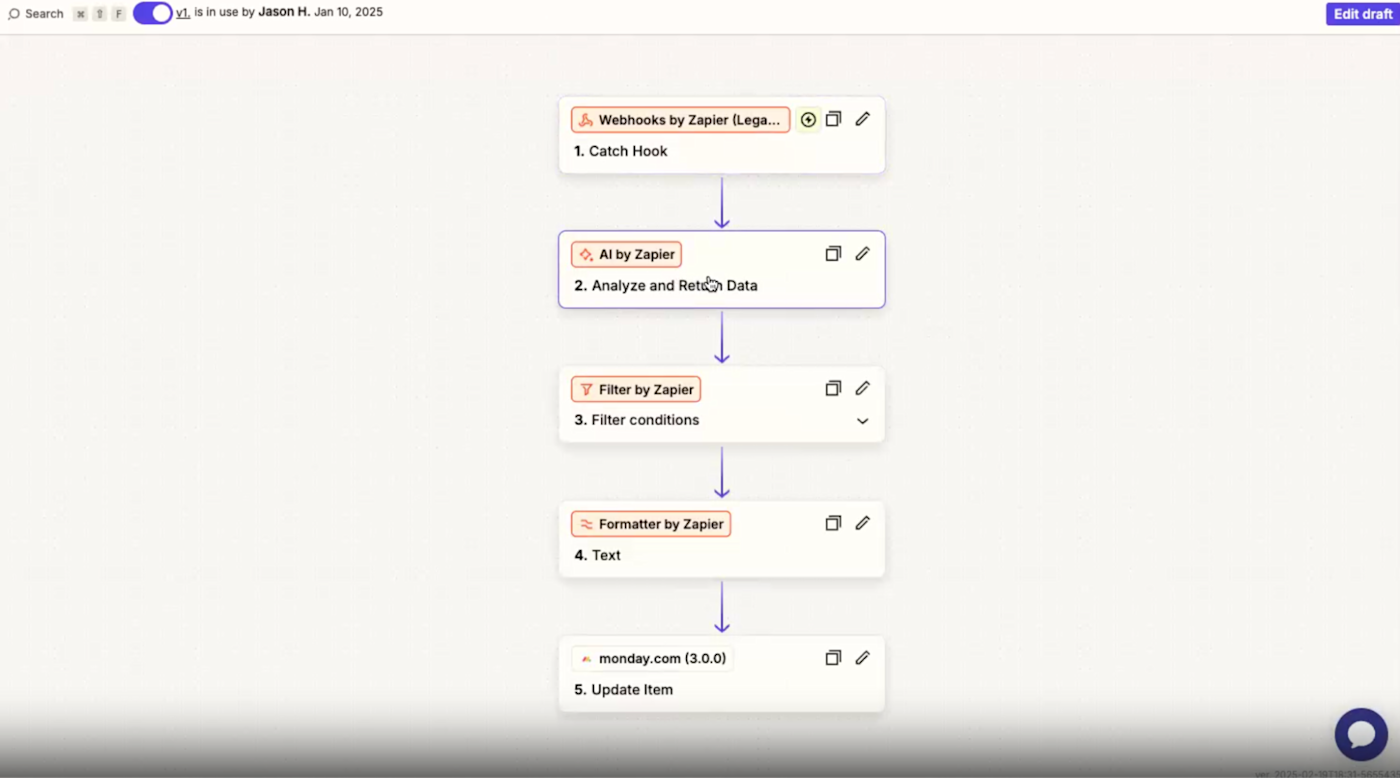

Once the marketing content is processed and organized, the second automation handles compliance review.

A webhook catches the update from monday.com with the important text.

AI by Zapier analyzes the compliance score and extracts key details.

A Zapier filter ensures that only relevant updates are processed.

Then that information is sent to monday.com.

Before this, compliance was a back-and-forth nightmare. It's practically hands-free, and this system has blown away our legal team.

Jason

Keeping teams informed with real-time FEMA alerts

When natural disasters strike, mortgage companies need to act fast to support affected homeowners with specialized loan options. Benchmark's communications team needed a way to stay informed about new FEMA disaster declarations without manually checking the FEMA website every day.

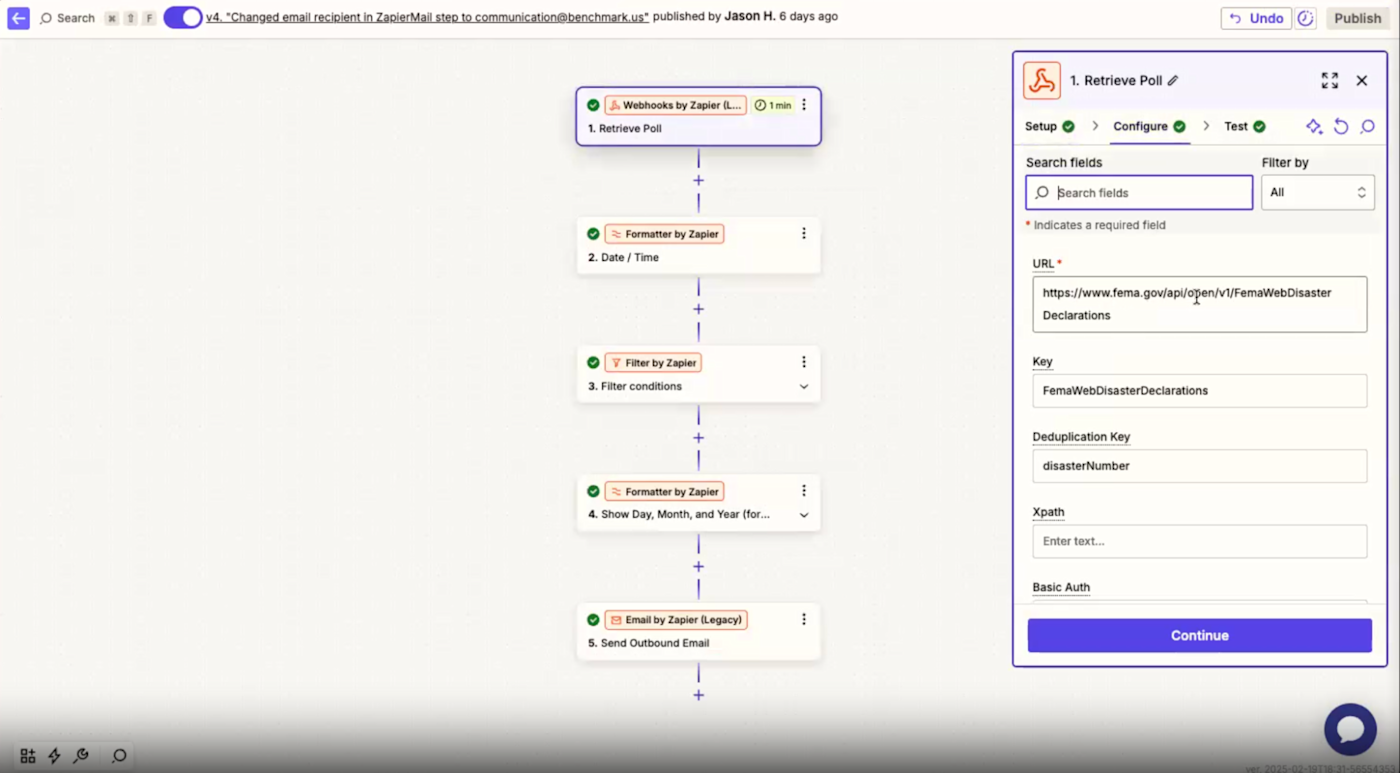

Jason built a Zap to tackle the issue. Here's how it works:

Zapier pulls real-time FEMA disaster declarations via a webhook from FEMA's API.

Results are filtered and formatted based on the declaration date to verify only new events are processed.

Email by Zapier sends an email notification to the Benchmark Mortgage communications team, including a direct link to the FEMA announcement.

"This took a tedious, manual task off our team's plate," Jason says. "Now, they're instantly notified when a new disaster zone is declared, allowing us to act faster."

Automating trade show lead capture with HubSpot

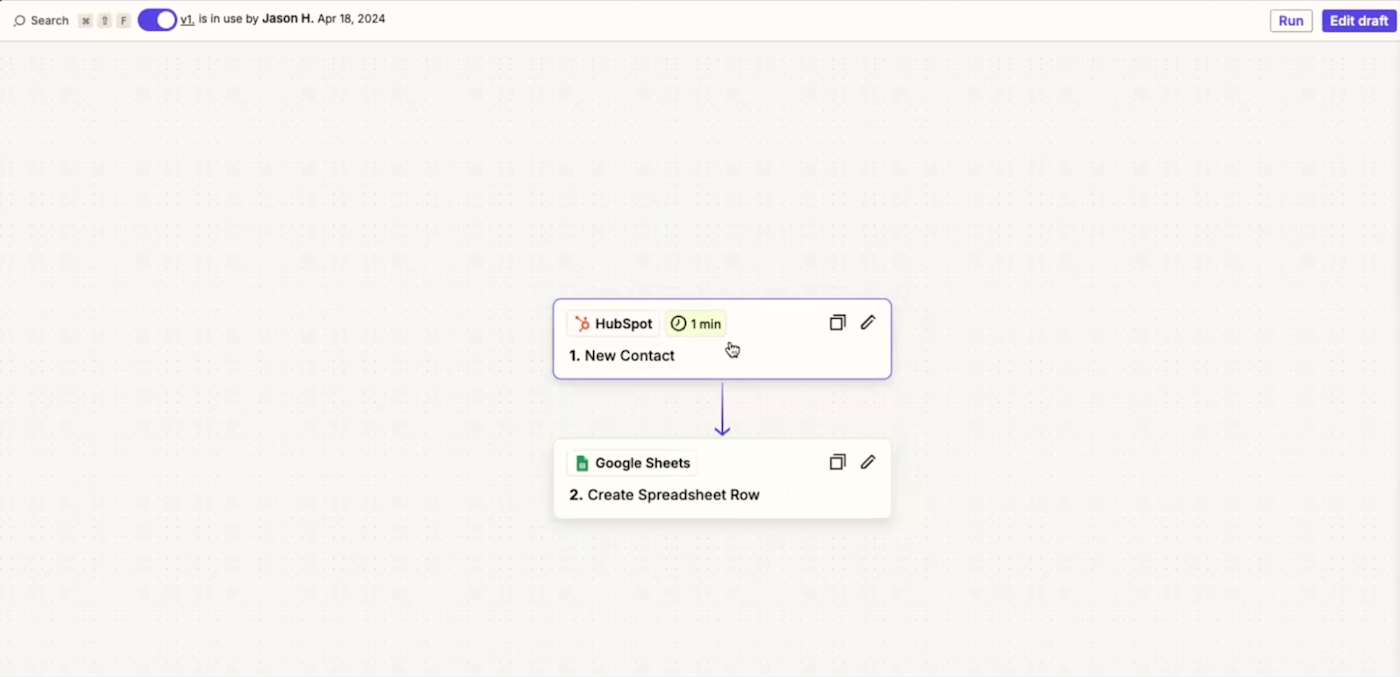

Benchmark's wholesale lending team regularly attends industry trade shows, but collecting and organizing business cards from potential partners was a hassle. Jason found a cost-effective solution using Zapier and HubSpot's free business card scanner.

Now, Account Executives at trade shows scan business cards using the HubSpot mobile app, and the info is sent to Google Sheets via Zapier.

What used to take weeks of data entry now happens instantly. It ensures follow-ups happen while the lead is still warm.

Jason

The impact of automation at Benchmark Mortgage

For Benchmark Mortgage, Zapier isn't just about saving time—it's about making things possible that wouldn't be otherwise.

Many of our workflows wouldn't even be possible without Zapier—we simply don't have the bandwidth to handle them manually. While most people use automation to save time, for us, it's about scalability.

Jason

Through automation, Benchmark Mortgage has built a scalable, efficient, and compliant mortgage lending process that delivers a superior experience for both customers and loan officers. And as the team continues to explore new ways to integrate AI and automation, they're paving the way for an even more seamless customer experience in the mortgage industry.